Argentina's mining industry has flourished under President Javier Milei, who, since being elected in late 2023, has been working to capitalize on the abundant mineral resources of the country by making it a more competitive, attractive destination for large-scale mining investment, wrote The Chronicle Journal, a newspaper covering Canada's Northwest, on October 14. Milei and his administration's efforts led to record-high exports of lithium, gold, and silver from Argentina this year and miners' improved sentiment toward the jurisdiction's investment attractiveness. Some impediments to mining progress remain, and more improvement could be made, but overall, the near- and longer-term outlook for the industry is positive.

"Argentina's mining surge in 2025 presents a mixed bag of opportunities and challenges for public companies," the newspaper added.

During the first eight months of 2025, Argentina's mining exports totaled US$4.21 billion (US$4.21B), representing a 32.9% year-over-year (YOY) increase. Gold accounted for about 80%, lithium about 14% and silver about 12%. Drivers of this exceptional performance were a material boost in gold, lithium, and silver production, favorable market conditions, strategic investments resulting from recently enacted policy, including the Regime for the Incentivization of Large Investments (RIGI), and a concerted push to leverage the country's extensive mineral endowment.

Today, Argentina's mining portfolio is worth US$30B and contains 100-plus projects, more than half of which are copper-focused, according to the International Trade Administration (ITA). Along with gold, silver, copper, and lithium, the country boasts deposits of aluminum, boron, iron, molybdenum, potash, uranium, vanadium, and zinc. For full-year 2025 (FY25), minerals exports are projected to reach US$5–5.2B, "setting a new historical benchmark for the country," reported The Chronicle Journal, and in the next decade, they could increase fivefold, the ITA noted.

Argentina's Standout Provinces

In Argentina, where mining is regulated at the provincial level, the highest-ranked jurisdiction is San Juan, the province with the most projects, according to the Fraser Institute's latest Annual Survey of Mining Companies, 2024. With respect to its Investment Attractiveness, San Juan's rank improved to No. 14 out of 82 from No. 21 out of 86 in 2023. Miners said they were less concerned about the province's quality of its geological database (this scored 46 points lower than in the previous year), labor regulations (44 points lower), and the availability of skilled labor (24 points lower).

La Rioja province's ranking shot up YOY in terms of Investment Attractiveness, to No. 44 out of 82 versus No. 83 of 86 in 2023. Investors indicated they had fewer concerns about labor laws (their score on this issue was 75 points lower than in the year before), the taxation regime (44 points lower), and socioeconomic agreements (40 points lower).

Good News for RIGI

In Argentina's congressional midterm elections last month, Milei's party, La Libertad Avanza, more than doubled its seats in Congress, The Wall Street Journal (WSJ) reported on November 11. This bodes well for the continuity and consistency of mining-related reforms implemented during his presidency so far, intended to deregulate the industry, promote fiscal incentives and remove currency controls, noted The Chronicle Journal. RIGI, specifically, introduced last year for mining projects over US$200 million (US$200M) in value, provides companies with 30-year tax stability, lower corporate income tax, exemptions on import duties, eventual elimination of export duties, and the ability to arbitrate disputes abroad at independent tribunals.

"For foreign investors, the election is great news. Dollarization would dispel any lingering exchange rate/currency/capital movement fears," Hallgarten & Co. Editor Christopher Eccleston wrote in an October 28 report. "The prospect of Milei surviving full term is now guaranteed, which comforts those dependent upon the RIGI regime in the mining, oil, and gas sectors. Should Milei feel confident about a second term (and no reason not to), then RIGI might be opened up for a second life after the first deadline passes."

Economy Needs Revitalization

Argentina's economy needs jump-starting, according to the WSJ, after the effects of Milei's severe fiscal austerity measures, including major cuts to government spending through subsidy elimination, public sector workforce reductions, and capital expenditure deferrals. Ultimately, the monthly inflation rate plummeted to 2.1% in September 2025 from a peak of 25.5% in December 2023, Vizion, a provider of trade intelligence, explained in an October 28 article.

Yet unemployment remains elevated at 6.3%, and many Argentines have not experienced meaningful improvements in living standards. To tackle this, Milei must attract private investments, wrote the WSJ. For instance, eight mining projects being developed in Argentina and forecasted to produce 1,000,000-plus tons of copper per year by 2035, need about US$26B in new investments, Nicolás Muñoz, a mining expert at consulting firm CRU Group, told the WSJ. Initial production is slated to begin in about three years.

The short-term outlook for Argentina's mining industry suggests ongoing robust performance, driven by strong commodity prices and increasing production volumes, particularly in lithium, wrote The Chronicle Journal.

Developing copper mining is a way for the Latin American country to diversify its exports and address its scarcity of U.S. dollars. Because the country has a dual currency system, this is "a major economic challenge that has for decades fueled catastrophic runs on the country's currency, the peso," wrote the WSJ.

To help stabilize the currency and economy of Argentina, according to the U.S. government, President Donald Trump's administration made a US$20B currency swap agreement with that country's central bank last month, The New York Times reported on October 17.

This was a loan from the U.S. using the Treasury's Exchange Stabilization Fund, not a direct cash handout. Monica de Bolle, economist at the Peterson Institute for International Economics, told PBS the move, instead, was entirely political and geopolitical. Trump meant to prop up Milei, whom he sees as a political ally, and to send a message to China, given its extensive involvement in Argentina, de Bolle said.

What to Expect, Watch For

The short-term outlook for Argentina's mining industry suggests ongoing robust performance, driven by strong commodity prices and increasing production volumes, particularly in lithium, wrote The Chronicle Journal. Even though the outlook for lithium generally is favorable, some mining companies in the space, ones with higher operating costs or slower project ramp-ups, for example, could face difficulties due to the global oversupply and related price fluctuations.

Similarly, while the outlook for gold and silver is strong, Argentina's domestic production volumes for these metals are projected to decline in 2025 due to maturing mines and lower-grade ores. Producers of these metals that heavily rely on specific mines face substantial output decreases and mining of lower grades, which could lower profits.

"The key for all players will be efficient operations, strategic expansions, and a keen eye on global commodity markets," the Canadian newspaper added.

Further out, Argentina could become a major player in critical minerals. This is especially the case because copper, essential for the clean energy transition, provides a huge long-term opportunity.

"Potential strategic pivots for the government include refining the RIGI framework to address any investor concerns and streamlining environmental permitting processes while ensuring sustainable practices," wrote The Chronicle Journal.

For investors, the newspaper highlighted, mining companies with established operations and ones actively developing new projects in Argentina warrant close attention. Here are three that qualify:

Argenta Silver

Based in Vancouver, British Columbia, Argenta Silver Corp. (AGAG:TSX.V; AGAGF:OTCQB) is a silver-focused explorer whose flagship project is El Quevar in Argentina's Salta province. El Quevar currently hosts about 50,000,000 ounces (50 Moz) of silver in the Yaxtché deposit, and mineralization remains open in multiple directions across a 1.5-kilometer trend, President and Chief Executive Officer (CEO) Joaquín Marias told Kitco Mining Investment Trends on November 11. Marias would like to grow El Quevar into a 250-Moz silver district.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Argenta Silver Corp. (AGAG:TSX.V; AGAGF:OTCQB)

Argenta recently completed a 16-hole, 4,244-meter (4,244m) winter diamond drill program at the project, and the final results of two holes testing the newly discovered Andrea target just came in. They showed multiple wide and continuous intercepts of silver mineralization. These results mark the discovery of a promising new silver-bearing zone, worthy of further exploration, about 950m northeast of Yaxtché, wrote Peter Krauth of Silver Stock Investor on November 14.

Earlier this month, the explorer began another exploration program at El Quevar, this one to encompass 12,000–15,000m of new drilling, geological mapping, surface sampling, geophysical surveys, and detailed alteration and metallurgical analyses. It is expected to end in June 2026.

"Argenta's 2025–2026 campaign now stands as one of the most dynamic exploration efforts in Argentina, blending strategic focus, cutting-edge scienc,e and a clear drive to unlock the full silver potential of El Quevar," Krauth added. "I am happy to hold my full weighting in the stock and consider weaknesses as buying opportunities."

Red Cloud Securities Analyst Taylor Combaluzier wrote in a November 14 research report that Argenta's 2025 winter drill program was successful. Drilling confirmed and extended mineralization at Yaxtché and indicated potential for further extension. Combaluzier wrote this about Argenta and El Quevar: "With year-round and relatively low-cost drilling, an unconstrained high-grade silver deposit with multiple proximal exploration targets, a healthy cash balance and support from investors such as Frank Giustra and Eduardo Elsztain, Argenta could quickly grow El Quevar into a formidable project."

1Regarding Argenta's ownership and share structure, eight strategic entities own 30.03% of the company, including the Top 3 shareholders overall. They are Canadian businessman and mining financier Frank Giustra with 11.57%, Argentine businessman Eduardo Eisztain with 11.65% and Thomas Humphreys with 2.1%. A total of four institutions hold 1.34%, and retail investors own the rest.

Argenta has 254.3 million shares outstanding. Its market cap is CA$180M. Its 52-week range is CA$0.175–1.175 per share.

Orestone Mining

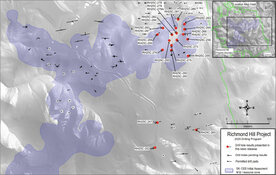

Also headquartered in Vancouver, Orestone Mining Corp. (ORS:TSX.V) is a mineral explorer advancing the earn-in Francisca project in Argentina's Salta province and the 100%-owned, permitted, and drill-ready Captain gold-copper project in B.C.

With Francisca, Orestone has the option of earning up to 85% ownership of it after spending US$4.2M on exploration at the property over seven years, according to the agreement signed in Q1/25. The company's near-term goal with the project is to define an oxide gold deposit mineable by open-pit methods using low-cost, heap-leach gold recovery. Orestone is preparing to start a phase one exploration program consisting of detailed mapping and up to 600 rock and trench samples to better delineate, before drilling, the surface extent of widespread oxide gold-silver mineralization.

In recent news, Orestone's CA$2.2M private placement, upsized from CA$2M originally, closed on November 7. Major shareholder Crescat Capital LLC contributed CA$232,000.

Richard Mills of Ahead of the Herd wrote in a November 4 edition that Francisca is a pure precious metals play, a gold project "with a silver kicker."

"The reason I like Francisca is because it looks like it could have some serious size to it," Mills wrote. "The management has been involved in the development of 10 or 12 of these oxide heap-leach deposits, so I'm looking at this as a unicorn, which is basically a junior run by management that has built companies into cash flow. I think this is a project they can do that with."

Orestone CEO David Hottman told Mills in a recent interview that at 1–2 g/t gold, even at 30,000–40,000 ounces of production a year, Francisca would generate a lot of cash at today's gold prices.

1As for ownership and share structure, four insiders own 9.85% of Orestone, including Hottman with 2.97%. One institution and the largest shareholder overall, Crescat Capital, holds 11.05%. Retail investors have the rest.

Orestone has 78.99M shares outstanding, a market cap of CA$4.5M and a 52-week range of CA$0.02–0.11 per share.

McEwen Inc.

McEwen Inc. (MUX:TSX; MUX:NYSE ), headquartered in Toronto, Ontario, engages in the exploration, development, production and sale of gold and silver assets in Argentina, Mexico, Canada and the U.S. Its two projects in Argentina are the large copper porphyry deposit Los Azules in San Juan province and the gold- and silver-producing San Jose in Santa Cruz province, of which it owns 49%.

McEwen Inc. private subsidiary, McEwen Copper Inc., is developing Los Azules, a US$3.2B copper deposit discovered almost three decades ago, noted the WSJ. During Q3/25, the company achieved two major derisking milestones for the project, as announced in a November 6 news release. McEwen secured approval to receive RIGI benefits for Los Azules and completed a feasibility study of it. The study outlined an operation with a 21-year life of mine and the potential to extend it another 30 years by using Nuton leaching technology or a conventional concentrator.

Detailed engineering is about to start for the project. McEwen is targeting early 2027 for a construction start, subject to project financing. Future progress, however, could be impeded by Argentina's glacier protections because the area around Los Azules contains 150-plus rock glaciers. Already, one of these glaciers limits the size of the planned open pit, and a preliminary assessment indicated that glaciers could frustrate project expansion plans, reported Bloomberg News.

As for San Jose, which has been producing for 17 years, The Chronicle Journal pointed out that McEwen Inc. is now processing lower-grade ore.

Joe Reagor, managing director and senior research analyst at ROTH Capital Partners, lowered his target price on McEwen Inc. by 9% for two reasons, he noted in his Nov. 7 research report. The miner's Q3/25 production came in lower than expected, resulting in revenue and earnings per share misses, and the company lowered its full-year 2025 production guidance.

That said, Reagor added, "Ultimately, MUX's future production growth potential and asset base should outweigh near-term quarterly performance, in our view. As such, we are maintaining our Buy rating."

Reagor's new target price on McEwen Inc. implies 22% upside from its November 14 closing price.

1In terms of ownership and share structure of McEwen Inc., 14 strategic entities own 15.61%. Of these, Rob McEwen's company, 2190303 Ontario Inc., is the largest insider shareholder with 15.02%. More than 100 institutions hold 45.13%. The Top 3 are Mirae Asset Global Investments (USA) LLC with 3.6%, State Street Investment Management US with 3.23% and Van Eck Associates Corp. with 3.04%. The rest is with retail investors.

McEwen Inc. has 54.8M shares outstanding and a market cap of US$939.79M. Its 52-week range is US$6.38–24.88/share.

| Want to be the first to know about interesting Gold, Silver, Copper and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Argenta Silver and McEwen Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.