Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ) reported its unaudited condensed consolidated financial results for the quarter ended September 30, 2025, alongside a series of project and financing developments related to its Stibnite Gold Project in Idaho. The company stated that it broke ground on the project on October 21, 2025, following receipt of a signed Plan of Operations and a Conditional Notice to Proceed from the United States Forest Service (USFS). This milestone was described by President and CEO Jon Cherry as a "historical milestone" for stakeholders and the nation.

During the quarter and through October, Perpetua secured a combined US$382 million in gross equity proceeds. This included a fully exercised underwriter option in July for US$49 million and additional funding from a strategic investment closed on October 28, 2025, involving Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) and JPMorgan, which contributed US$255 million. A subsequent registered equity offering and private placement yielded an additional US$78 million by the end of October.

The company is also pursuing US$2 billion in debt financing through the Export-Import Bank of the United States (EXIM). It received a Preliminary Project Letter and an Indicative Term Sheet from EXIM on September 8, 2025, and expects EXIM board-level consideration in spring 2026. According to Perpetua, the funding request is intended to support construction, permitting, and development costs for the Stibnite Gold Project.

Operationally, the company reported no lost-time incidents or environmental spills during the quarter. Other key developments included the issuance of a request for proposals to third parties regarding off-site antimony processing opportunities and the appointment of Mark Murchison as Chief Financial Officer effective October 1, 2025. Joe Fazzini was named Vice President of Investor Relations in November.

Gold Holds Ground After Three-Week High as Experts Reaffirm Long-Term Appeal

On November 11, Kitco News reported that gold prices eased slightly after reaching a three-week high, with December futures closing at US$4,113.10 per ounce. The modest pullback was attributed to profit-taking by short-term traders, although analysts pointed out that gold remained on track for its best annual performance since 1979.

The article cited increased expectations of a U.S. Federal Reserve rate cut as a key factor supporting gold prices. The return of government operations was seen as a potential signal of weaker economic data ahead, creating a favorable backdrop for precious metals, which often serve as a hedge during uncertain macroeconomic periods.

The following day, analyst Matthew Piepenburg emphasized gold's enduring role as a store of value. He noted the metal's effectiveness in preserving purchasing power during extended periods of currency debasement and financial volatility. Referring to the long-term decline of the U.S. dollar since the Federal Reserve's inception, Piepenburg positioned gold as a safeguard against inflation and monetary instability.

On November 17, Couloir Capital wrote, "Gold prices ended higher by 2.0% during the week, its first weekly gain in four weeks, led by safe haven demand amid growing uncertainty over the U.S. economic outlook. However, the advance was partially restrained as hawkish commentary from several Federal Reserve officials tempered expectations for a potential December rate cut."

Commentary Highlights Strong Institutional Support and Derisking Progress

Mike Niehuser of ROTH Capital Partners first commented on October 22 that the company's move into early construction represented a major step in derisking the Stibnite project. He highlighted the US$139 million construction bond as a means to begin development immediately before winter. Niehuser also emphasized elevated gold prices and strong exploration potential beyond the current mine plan, suggesting these could enhance project economics over time.

In a follow-up on October 29, Niehuser stated the new US$255 million investment "corroborates the project's world-class potential and importance to re-establishing domestic manufacturing supply chains and national defense." He reiterated a Buy rating, maintained a US$32 target price, and listed Perpetua as a Top Pick for 2025. Niehuser added that Agnico Eagle's participation validates the project's geology and operational profile, while JPMorganChase's involvement underscores its national strategic value.

Rabi Nizami of National Bank of Canada described Perpetua's October 24 launch of early construction as a "prudent move" that keeps the project on schedule while larger financing is still in progress. He maintained an Outperform rating with a CA$50 target price and noted the milestone as a clear sign of reduced project risk.

On October 27, following the Agnico Eagle & JP Morgan startegic investment announcement, Nizami described the transaction structure as a "vote of confidence" announcement, Nizami described the transaction structure as a "vote of confidence" and a better alternative to royalty or stream arrangements. He wrote that the deal preserves long-term shareholder value and supports progress toward export credit financing. Nizami also cited potential offtake agreements and further U.S. government-backed initiatives as upcoming catalysts.

Brian Quast reaffirmed an Outperform rating and maintained a CA$44.00 target price on Perpetua Resources.

Brian Quast of BMO Capital Markets raised his target price to CA$44 from CA$41 on October 27 while maintaining an Outperform rating. He noted that replacing royalty or streaming arrangements with equity improves financial flexibility.

Quast also highlighted the formation of a joint technical and exploration advisory committee with Agnico Eagle, providing Perpetua access to engineering and operational expertise. He pointed to early works, future drill results, and government collaboration as potential share price drivers.

Mike Kozak of Cantor Fitzgerald echoed these sentiments, writing on October 27 that the equity investment removed the need to monetize future production. He raised his target price to US$27 per share while maintaining a Buy rating. Kozak described the structure of the investment, including warrants, as a sign of long-term investor commitment. He added that the deal meaningfully reduces capital risk and strengthens Perpetua's ability to enter full construction once approvals are secured.

Rebuilding a Strategic Asset for U.S. Gold and Antimony Supply

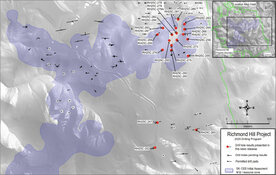

Perpetua Resources is advancing what it describes as one of the largest and highest-grade open-pit gold and antimony projects in the United States. The Stibnite Gold Project hosts 4.8 million ounces of proven and probable gold reserves and 148 million pounds of antimony, a critical mineral with no current domestic mined production in the U.S. The project's dual focus on gold and antimony positions it uniquely as both a mining asset and a strategic supplier to the U.S. industrial and defense sectors.

The company has already received over US$80 million in critical mineral funding from the U.S. Department of Defense since 2022 and has been designated a priority project by the White House. A full construction decision is anticipated in spring 2026, pending completion of the EXIM financing process and further development milestones.

In October 2025, Perpetua commenced early works construction, including engineering, procurement, and infrastructure preparation. With basic engineering nearly 50% complete and permitting milestones achieved earlier in the year, the project is advancing on multiple fronts. Recent additions to the management and development teams also reflect a growing focus on execution readiness.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Perpetua Resources Corp. (PPTA:TSX; PPTA:NASDAQ)

Located in Idaho, a well-regarded mining jurisdiction with low geopolitical risk and strong infrastructure, the Stibnite Gold Project benefits from local and federal support, including long-term environmental rehabilitation plans designed to restore legacy mining impacts.

Perpetua's financing structure includes both equity and potential debt capital of up to US$2.9 billion, combining public offerings, strategic investments, and the pending EXIM facility. The company continues to evaluate off-site processing options for antimony to ensure secure domestic supply chains and maximize project flexibility.

Ownership and Share Structure1

Following the closing of the private placement with Agnico Eagle and JPMorganChase, the company has 122.9 million shares issued and outstanding. On an undiluted basis, Paulson & Co. owns 26.3%, Agnico Eagle owns 6.5%, and JPMorganChase holds 2.6%. Approximately 64.6% is owned by other institutional and retail investors.

Its market cap is CA$3.56B. Its 52-week range is CA$7.60–CA$24.38 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Perpetua Resources Corp is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Perpetua Resources Corp. and Agnico Eagle Mines Ltd.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.