Arguably, one of the most humbling experiences of the past 47 years spent circumnavigating the global financial world was trying to apply conventional fundamental analysis to markets being driven by unconventional emotional stimuli, such as the one in which I have found myself since April 7. That was the day when markets discovered that the austerity measures being trumpeted by the Trump White House were being thrown into the trash bin in favor of a policy that would allow the U.S. to "grow its way out of debt" by way of the "Big Beautiful Bill" that served to increase the twin deficits while offering $2,000 rebates from tariff savings to each individual citizen.

This governmental largesse has created sufficient liquidity to fuel the weighted S&P 500 to a year-to-date gain of 14.4% while its distant cousin, the unweighted S&P 500, has advanced only 8.2% in the same time period. All of this has been happening while the University of Michigan sentiment numbers came in at the lowest point in years. Why is that?

From Bianco Research: "The short answer is inflation ("affordability") and not jobs. — The University of Michigan Sentiment Survey (blue) was 50.3, the second-lowest reading shown ever, behind only June 2022. This survey started in 1952, and consumer sentiment is currently lower than during the 1962 Cuban Missile Crisis, 1969 recession (and protests), 1970s inflation, the 1987 crash, the 1998 financial crisis, September 11, the Great Recession in 2008, and COVID. This is happening when the unemployment rate is 4.3%, well below its 73-year average of 5.7%, and the stock market (red) is at a new all-time high after two consecutive 20% annual gains. So why are consumers so negative? The simple answer is inflation, or "affordability" as it is now being called. From the cumulative rise in CPI over the last five years (prices are now 26% higher) to record home and beef prices, consumers feel everything is too expensive and are upset about it. Add to this that wages (average hourly earnings) have increased by 21% over the last five years, behind the 26% increase in CPI, and they are also falling further behind."

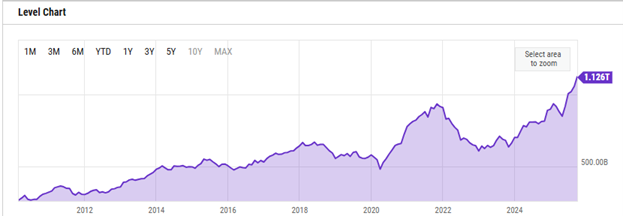

Obviously, the citizens whose noses are the most out of joint are those without either a house or a stock portfolio because the Wall Street crowd is about as giddy as they have been in ages. In fact, the chart shown below demonstrates how investors have been using leverage — and absolute mountains of it — to play the U.S. equity markets to the point where it now exceeds a trillion dollars of margin debt.

Alas, and here I sit, loaded to the back teeth with hedges of all shapes and sizes, with some favouring volatility and others just outright shorts, all used as a way of insulating my junior mining portfolio from a 2008-style or 2020-style drawdown that takes everything down with it, regardless of race, colour, or creed. As the old saying goes, "when they raid the brothel, they take away all the ladies, including the hat check girl and the piano player."

That is how it is supposed to happen when markets rise to unsustainably overpriced levels, such as those "magnificent seven" companies that are leading the S&P to the "promised land" of record high forward P/E's and babelicious market caps. None of the traditional methods of analysis has been effective in timing anything vaguely resembling a correction. In fact, the last time there was so much as a 3% correction day was back on August 5, 2024.

Over the years, one develops tools for staying alive during periods of extreme stock market volatility, and since surviving (and learning from) crashes in October 1987, 1998, 2008, and 2020, I developed what I thought was a foolproof system of identifying bubble-like behaviours. Back in the day, I used to attend luncheons put on by the Investment Dealers Association, where the public could come and hobnob with the professional money people. Back in the day, you were referred to not as a "wealth manager" or "financial advisor" but more often as a "registered rep" or, as I used to have encrypted on my card, "customer's man." The industry could not survive back in the pre-internet period without stock salesmen (and saleswomen) moving their client capital in and out of industry "product" while the research analysts were busy tearing apart balance sheets and income statements at a furious pace.

During these IDA luncheons, the professionals who focused on bonds and bills, with never a mention of stocks, used to look down disparagingly upon the "retail honkies" who concentrated on stocks only. I noticed that at or near market tops, the bond boys would be alone on the far side of the room, discussing the yield curve with one another while the public guests would be on the other side of the room, bombarding the stock jockeys for their latest "hot tips" until all the refreshments and egg salad sandwiches had been consumed. Of course, at market bottoms, it was the reverse, with the groups completely reversed. It functioned like clockwork, pretty much up until the advent of the internet, when financial information and market-impacting news would be spread instantaneously, after which the "IDA Luncheon Indicator" had less effectiveness.

Even the gold market was sent for a loop this week after every armchair technician with a laptop called the bottom in gold on October 28, at $3,900 basis December futures.

They were ridiculing the bears and taunting even the cautious "correction callers" despite the fact that a few of the perennial gold bulls had called for a correction.

During the week of October 13-20, I sent out a series of email alerts to my subscribers, drawing comparisons to the summer of 2020 when December gold futures spent nineteen days in overbought territory before topping out and heading down for the better part of three long and very painful years. I pointed out that by October 13 of this year, gold had spent fifty-one consecutive days in the overbought camp, but by Friday of that week, it had completed 56 days in overbought status.

I put on a number of hedges that week, intending to serve as insurance against a market meltdown the likes of which we saw in 2008 and 2020, that ignored the bullish price action in gold and instead opted to take the TSX Venture Exchange out behind a woodshed and pummel it into a barely recognizable quivering mass. The rally off the lows in late October caught me a bit off guard, so I lifted a couple of hedges on Tuesday that were sporting profits a good deal smaller than where they were a week earlier.

As is prone to happen when you are licking your wounds on equity market hedges, by the time Friday morning arrived, I was wishing that I had those hedges back. Nevertheless, the JDST:US went out for the week a penny lower than where I sold it, while the GLL:US closed $0.30 higher than my exit level, but both ETFs were well off their respective highs for the day.

Gold and silver are being whipped around like kites in a hurricane largely because of the amount of leveraged speculation that has entered the fray, particularly since August, when Fed Chairman Powell signalled new interest rate cuts for September and December. While there was a quarter-point cut in September, the probability of a December cut, considered a virtual certainty a week ago, fell to less than 45% this week as the economic data was somewhat stronger than expected.

I am of the belief that gold is headed down to the 100-dma at $3,653, but by the time it reaches there, the 100-dma could be at $3,700 or higher, as its angle of ascent remains at a solidly bullish 45° angle. Silver executed a troubling "double top formation" this week, which was one of the reasons I exited two of my hedge positions as the action on Thursday was riveting, although the late downward reversal from record intra-day highs on Thursday turned into a complete rout on Friday, dropping over 5% on the day. December silver still looks poised for a test of its 100-dma at $42.74, but by the time it gets there, the 100-dma could be $43.50-44.00.

The TSX Venture Exchange peaked in mid-October at 1,037 and has since given back 17.36%, declining tick-for-tick with gold prices. Despite that, my two top picks and largest personal holdings — Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) and Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) both had terrific weeks, with the former closing at $0.42, its highest level since June 2.

The latter was up 21.88% on a week where the TSXV lost 6 points.

Considering that GTCH/GGLDF has the support of newsletter writers Jeff Clark and Brien Lundin and fund managers EMA's Lawrence Lepard and Myrmikan's Dan Oliver, it was only a matter of time before the investing public woke up.

Atrium Research has a target of $1.10 on the stock, and that seems to be the number most of the analysts are assigning to it.

Followers of this publication have been familiar with the company since 2020, during which it has had a range of between $0.08 (during the Covid Crash) and $0.74 (after the North Fork Zone was discovered).

My top pick and largest holding (FTZ/FTZFF) has the support of two newsletter writers and the analysts at Sydney-based Tribeca Asset Management. Largely off the radar screens of the more popular influencers, this little jewel of a company has raised over CA$20m in the past 18 months for copper exploration in Chile and while the companies that get the most attention are the ones that are either exploring for or developing sexier metals like gold and silver or to a lesser degree lithium and uranium, I like the companies exploring for or developing the more boring metals like copper that actually boast fundamentals far more compelling than any of the others. The red metal continues to be my preferred metal in which to invest here in the twilight hours of 2025 and well into the balance of the decade as the dual knockout punches of dwindling supply and escalating demand come to bear on pricing.

Kamoa-Kakula (DNC copper mine)

It has been said that the strain on the electrical grid will be insane with the arrival of these gargantuan data farms being constructed by Microsoft and Meta et al, which becomes a mind-boggling boost in demand for copper wiring and other electrical components.

It has been said that the strain on the electrical grid will be insane with the arrival of these gargantuan data farms being constructed by Microsoft and Meta et al, which becomes a mind-boggling boost in demand for copper wiring and other electrical components.

It has also been said "on the record" by more than one CEO of major copper producers that no new mines can pass feasibility testing at prices less than US$15,000 per metric tonne, which translates to $6.80 per pound, up from the Friday close of $5.05/lb.

This is the "stuff" upon which bull markets are born and thrive because while everyone is focused on silver as the next wealth-creating moonshot, copper quietly gathers momentum from a massively bullish fundamental backdrop.

Copper, at the end of the day, carries no degree of marginal usage or even selective usage. Copper has universal usage and is found everywhere from plumbing to electronics to communications. It is at all times mined as a primary metal as opposed to serving as a co-product or a by-product of any other extraction metal.

For these and other reasons anchored completely in fundamental analysis, I am "ALL-IN" copper with the usual caveat that major market turmoil caused by unsustainable debt levels around the globe has the potential to derail even the purest and clutter-free trades in the blink of an eye and the passage of a New York nanosecond.

| Want to be the first to know about interesting Copper, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc. and Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. and Getchell Gold Corp. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.