First, a quick note on gold. On the chart, it made an important reversal, a morning doji star pattern. That is one of the most reliable reversal patterns I know of. I will have more in tomorrow's update, but see the chart here at Playstocks Chart of the Day.

Love him or hate him, but direct actions from the Trump Administration have caused two of our stocks to pop very recently. It is important to keep track of what is going on with politics because it can have a big impact on economies and investing. I am not very fond of some of Trump's personality traits, behavior, and actions, but it is what it is, and no sense getting upset with it. Simply know who he is. He often exaggerates and sometimes outright lies. I think he mostly does this to create controversy and attention for himself. He is the President of the strongest country in the free world and throws around that strength at will. There are constant attacks and criticism of him because he is enemies with legacy media, and the far left is out to try and stop him at all costs. The far left has gotten favorable federal judges to use temporary restraining orders to slow down nearly everything he tries to do. Their latest tactic is to try to stop him with a government shutdown, although some politicians on both sides.

And on a related topic, I think that is another reason Trump was upset with Ontario Premier Ford's ad against tariffs, because the Supreme Court will soon be ruling on his authority to enact tariffs. With all these federal judge restraining orders, most are appealed in the District Courts and thrown out, but a few make it up to the Supreme Court, Trump's tariffs being one. I think they will rule in Trump's favor. If you listened to Reagan's Speech about Japan tariffs in 1987, it was also done by executive order, not through Congress. In some ways, Trump is taking some pages from Reagan's book. Reagan's policies were also very controversial at first, but he turned out to be right and a hero. With Trump, it is a big question mark.

I happened to walk into my living room yesterday, and the show 'The View' was on. I don't watch the show, but they had a guest on describing Trump's policies, so I watched for a bit. The guest highlighted Trump's foreign policy and that Trump wants to be remembered as a peacemaker. Next, Whoopi Goldberg asked a question, and as a Trump hater, I thought — How will she hit back?

Whoopi commented — So he has been a failure at home for the people, why can't he get things done at home? I was waiting to see if the guest responded to all the federal judge restraining orders, but he went into the government shutdown issue. That is certainly a factor slowing progress down.

I agree with some of the things that Trump is trying to do, like removing illegal immigrants, fighting drugs, and crime. You would think this would be straightforward and welcome, but the far left is fighting Trump on this, too. It seems it does not matter if something is good or bad, but whatever it is, they fight and try to stop Trump's policy. Crazy times to say the least! I am not so sure about his trade and tariff policy, but I understand what he is trying to do. Enough political rhetoric, how has Trump helped our investments?

Yesterday, our Millennium stock, Cameco, popped in price on news that the U.S. government announced a strategic partnership with Westinghouse Electric Company, which Cameco co-owns with Brookfield Asset Management. I wonder if this is what Trump and Carney were really talking about for the last several weeks. Brookfield is Carney's baby; he was the chairman before PM of Canada, but still has his financial fortune in Brookfield. These politicians always look after themselves first.

The plan is to accelerate the development of America's nuclear power. Washington envisions that at least $80 billion of new nuclear reactors will be constructed across the country.

Cameco Corp.

Recent Price - $148

Entry Price - $3.25

Opinion – Hold

Cameco Corp.'s (CCO:TSX; CCJ:NYSE) stock jumped almost $28 on Tuesday to close about $149 and is still around $148 this morning. We have been in the stock for a long time, and it is a huge winner for us. This year alone, it is now up about 100% which will help bolster the Millennium Index return. Joe, last updated Cameco on September 18, and we reiterated with a Buy rating of around $114. With comments, "Cameco is no longer just a uranium producer; it has become a global nuclear leader."

The government will be using Westinghouse nuclear reactor technology. Once constructed, the reactors are expected to generate reliable and secure power. The move, the companies say, aligns with President Trump's executive order signed in May aimed at advancing the nation's nuclear technology development, which he sees as vital to its energy security and AI ambitions.

Bloomberg estimates that power consumption from U.S. data centers is expected to double by 2035, reaching almost 9% of total demand. The anticipated demand has created a nationwide rush to build new infrastructure, with nuclear reactors being at the forefront of this energy revolution.

Secretary of Commerce Howard Lutnick said the $80 billion pact with Westinghouse "embodies the bold vision of President Trump — to rebuild our energy sovereignty, create high-paying jobs and drive America to the forefront of the nuclear renaissance . . . Our administration is focused on ensuring the rapid development, deployment, and use of advanced nuclear technologies," he stressed.

Westinghouse AP1000 Reactor

Under the partnership, Westinghouse will deploy its AP1000 reactor, which it hails as the most advanced commercially available, with fully passive safety systems, modular construction design, and the smallest footprint per MWe on the market.

Each two-unit AP1000 site would create or sustain 45,000 manufacturing and engineering jobs in 43 states, and a national deployment will create more than 100,000 construction jobs, the companies said.

This is a prime example and part of Trump's plan to bolster U.S. manufacturing and jobs, but with the fast track, it is still 1 to 2 years out before construction starts.

Currently, there are six AP1000 reactors setting operational performance and availability records worldwide, with 14 additional reactors under construction and five more under contract, they added. To date, the AP1000 technology has been selected for nuclear energy programs in Poland, Ukraine, and Bulgaria. This reactor growth rate bodes well for Cameco stock.

On the chart, you can see the steady rise of the last three years, and with a big jump this year. I believe with the revival of nuclear power, we will see Cameco shares at $400 or $500 in a few years. When we first bought Cameco, it was the world's leading uranium producer; now it is also benefiting from nuclear power generation with its ownership of Westinghouse. Simply hold the stock and enjoy the ride. I expect they will soon raise dividends as well.

Intel Corp.

Recent Price - $42

Entry Price - $22.60

Opinion - Hold

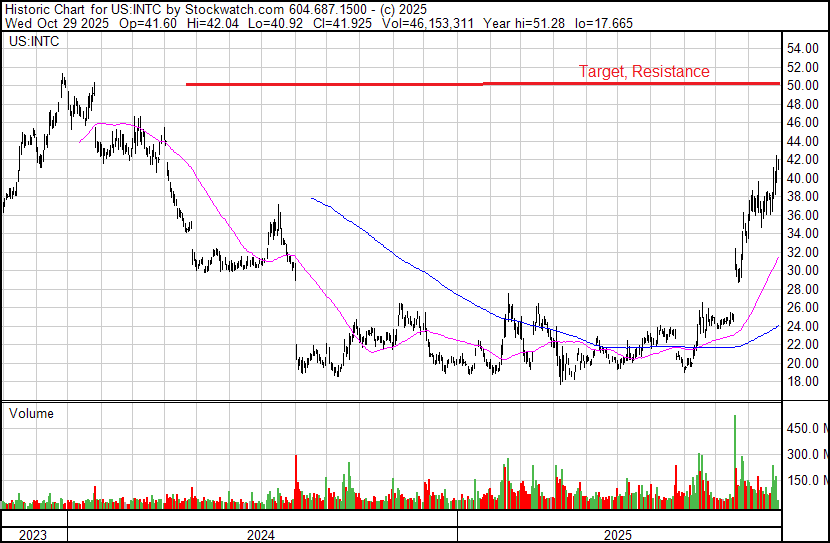

Intel Corp.'s (INTC:NASDAQ) stock took another jump this week after Q3 financial results, and is another one of our stocks where the Trump Administration is directly involved by buying a 9.9% stake in the stock.

Intel reported better-than-expected revenue last Thursday, signaling that demand for its core x86 processors for PCs has recovered. The stock jumped 6% in extended trading.

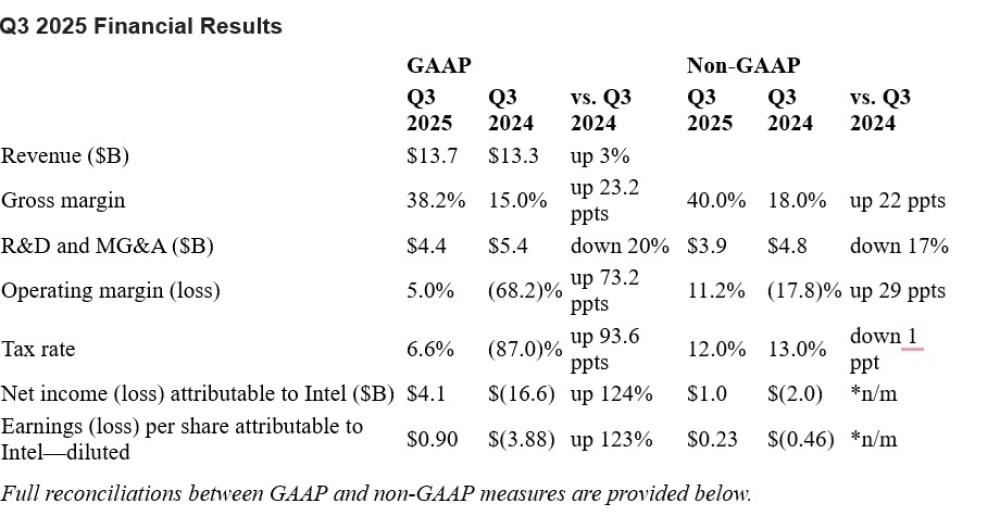

Revenue: $13.65 billion versus $13.14 billion estimated. For the third quarter, Intel reported net income of $4.1 billion, or 90 cents per share, versus a net loss in the year-ago quarter of $16.6 billion. Intel said it received $5.7 billion from the U.S. government during the quarter.

"We took meaningful steps this quarter to strengthen our balance sheet, including accelerated funding from the U.S. Government and investments by Nvidia Corp. (NVDA:NASDAQ) and SoftBank Group that increase our operational flexibility and demonstrate the critical role we play in the ecosystem," said David Zinsner, Intel CFO. "Our stronger-than-expected Q3 results mark our fourth consecutive quarter of improved execution and reflect the underlying strength of our core markets. Current demand is outpacing supply, a trend we expect will persist into 2026."

Q3 2025 Financial Results

While Nvidia gets a lot of attention and hype, our turnaround chip play, Intel, has far outperformed it this year, up about 80% vs. Nvidia 54%.

Intel said it expects revenue in the fourth quarter of $13.3 billion at the midpoint, with adjusted earnings per share of 8 cents. Analysts expected $13.37 billion in revenue and earnings of 8 cents per share. Intel said its outlook excludes the impact from a recent sale of its Altera subsidiary.

We also have Intel January 2026 Calls we bought at $2.90, so we are up huge. We have some more time, and I think Intel will soon test the late 2023 highs around $50. I would be a seller of the Calls then.

I believe the greatest risk to the stock is the popping of the AI bubble. Intel would not be affected as much but would fall some in sympathy.

Seven tech companies now account for more than a third of the value of the S&P 500 and trade at prices 70 times higher than their earnings, on average. These companies, and some other AI companies, are spending hundreds of billions of dollars. Investors are betting this tech is the future, so they're snapping up shares. By one estimate, 80% of U.S. stock gains this year came from AI companies.

I am no longer alone with my bubble fears. Big names like Jeff Bezos (Amazon), Sam Altman (OpenAI), Jamie Dimon (JPMorgan), and David Solomon (Goldman Sachs) worry we're on the cusp of a correction. They warn that valuations are getting too high and that eventually, reality may bite. And if those companies plunge, they'll take the economy with them.

I don't believe that AI will quickly transform the economy, and probably won't be that profitable. It will eventually be seen as the latest technical tool to analyze data. Remember, as I have commented a number of times, AI has been around for decades. It has just lately become more popular because it is widely available to everyday people.

At one time, you had to purchase expensive charting software to create and analyze stock charts. It was worth a lot and a big advantage, not it is free on the internet and worth little. Could AI be on the same path?

| Want to be the first to know about interesting Gold and Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp.

- Ron Struthers: I, or members of my immediate household or family, own securities of: Intel. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.