It is all over now for gold. Never-ending sell stops hit down to US$2500.

Parabolas do what parabolas do. Classic parabola breach, parabola backtest, then fall

Gold can step back now after its wonderful leadership.

Let the real world go forward.

Industrial metals.

Exploration.

Growth companies are growing.

Next leg in the U.S. stocks bull market.

U.S. Treasuries are now real assets, not liabilities.

It was always going to end like this.

Parabolas do what parabolas do.

The ever-increasing rate of change leads to exhaustion.

This is just another form of a Goodbye Kiss.

Breach, back test, then just falls away!

Elegance!

Parabolas aren't rare and, no, its not different this time!

Support now at:

- US$3500, not much

- US$3400, a bit

- US$3300, almost nothing

- US$2700

- US$2500

So is this a major long-term high?

Possibly.

But if Gold is the Metal of Prosperity, then probably not.

Let's wait and see.

This massive new overhang might take years to clear, though. Bureaucrats are buying at the top after selling at the bottom. The massive volume on Friday tipped us off that the Golden Fleece Sting was underway. Some big investment banks will be reporting some massive earnings gains for the Dec Qtr.

US$12 trillion is just laying on the table at US$4,400. Still US$10 trillion at US$4,100. Gold off US$250 sort of overshadows Monday's US$104 gain that took gold up just US$0.87 to make a new high over Friday.

Silver was hit and is lost down there in the volume section of the chart.

Last week at the Australian Gold Conference in Sydney, we saw and heard Eternal Optimism based on 'the Vibe'.

It was now OK for gold to rise with a rising US$, so the de-dollarisation thingy wasn't important. Falling interest rates just meant real interest rates were falling faster, so just sell the US$, which we just decided was going up!

The Fed was cutting interest rates, which would cause an explosion of inflation because M2 just made a new high.

It was still printing money!

(In reality, the Fed is still running down its overall Balance Sheet of T Bonds and those previously toxic mortgages, so it is actually withdrawing funds from the market.)

No mention of the U.S. Fiscal Repair that saw the U.S. Budget Deficit reduced by US$200 billion after US$198 billion monthly surplus in September.

No mention of the Big Beautiful Bond Rally underway.

No mention of falling energy prices that would follow the US PPI's -0.1% change for August to something even lower in September.

No.

It was just looking skyward with whoever had the highest target.

And of course, 'It REALLY is different THIS time'!

Well, it clearly isn't.

And to think that so many of the 'Free Market/ Let gold show the way' crowd have been relying on the cretinous CCP to create their Nirvana by buying up all the gold.

Some people thought it was really cool that China wasn't really telling the world how much gold it actually had!

So it is OK for the CCP to lie to the World.

And impoverish its citizens at the same time by buying up all that shiny yellow rock.

Wouldn't it be funny if Russia were part of the Golden Fleece to take down China?

Keep watching the Yuan.

China might get a margin call!

Gold Stocks

Wow. What a performance.

Who was fooling whom?

Sell-offs, non-confirmations, new highs, 'painting' the charts.

Overall, you knew price action was phony.

No prisoners in GDX.

Gapped down.

And likewise here in the big stocks.

These are oversold, of course, but these are up substantially in 2025, so lots of gain to sell down to.

Latecomers might be tempted, but you wouldn't, would you?

Gaps.

Look at Newmont Corp. (NEM:NYSE; NGT:TSX; NEM:ASX).

Look at Barrick Mining Corp. (ABX:TSX; B:NYSE).

Look at Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE).

Look at Kinross Gold Corp. (K:TSX; KGC:NYSE).

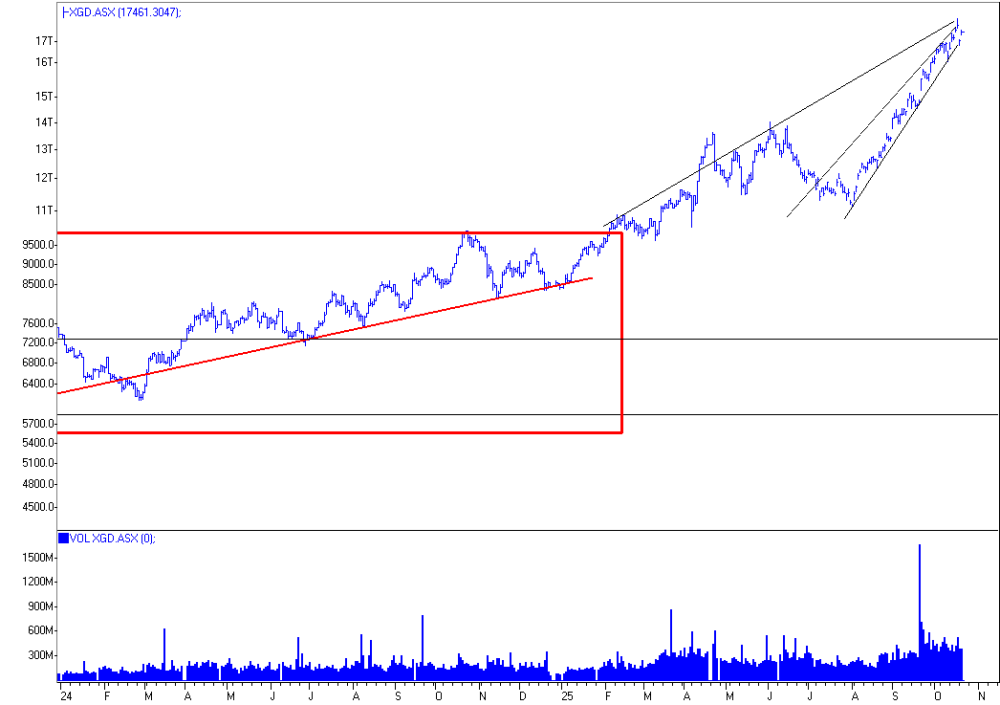

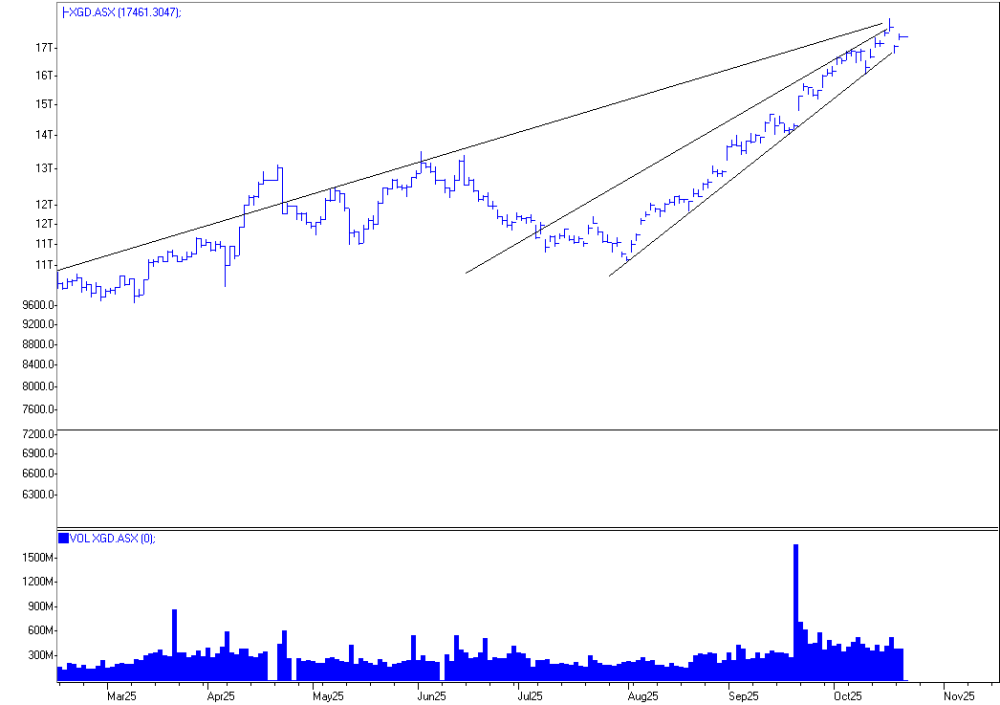

ASX Gold Stocks

You could see that wobbly, wonky, gap-ridden ''B' Wave ' was going to end in tears.

I may not be reading this one correctly, but my best guess after this extraordinary rise is that the coming 'C' wave will go back to the 9888 breakout level and below the August low of around 10,800.

C waves can be nasty.

Note there are 44 gold stocks in the XGD today.

Under the S& P index boffins' procedures you can expect this index to lose ten stocks by mid 2026. Gold producers with big recent gains are very vulnerable to big falls.

Stick with our explorers and developers.

\

\

T Bonds

I think I am going to win this!

Best market call of the decade!

Whoda thunk it!

Bonds that everyone hates and no one owns, even though there are US$30tn of them out there!

If you listened to the rabid calls of 'de dollarization' and hyperinflation and runaway deficits and Orange Man bad this outcome would be incomprehensible to most.

But not you!

Peaked!

Just love the sight of collapsing bond yields in the morning!

Brings joy to my heart when I wake up!

Even if it is only 4 am.

Means a better world is coming.

Bond prices are up, up, and away!

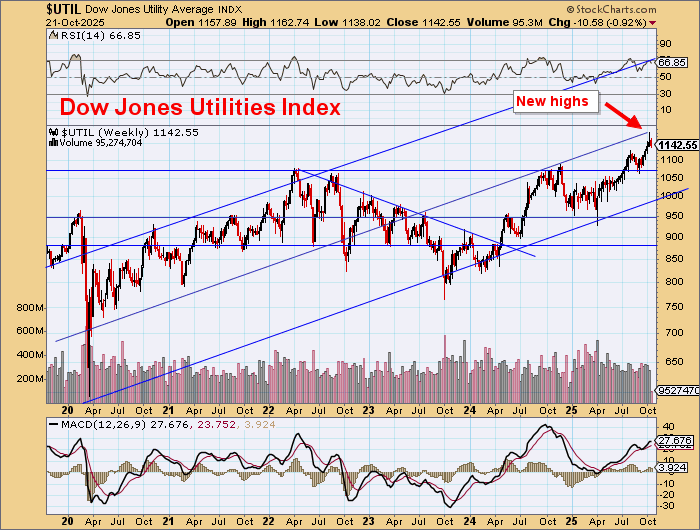

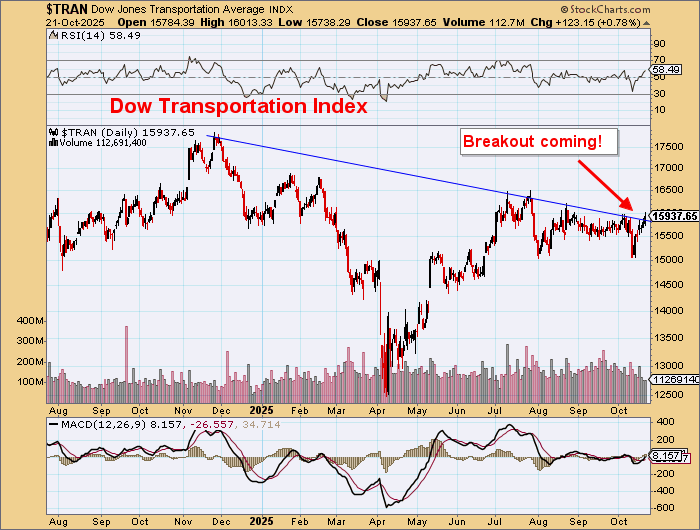

US Stocks

Dow Theory Confirmation is coming up!

Transports are about to break out and head to new highs to confirm a new U.S. stocks bull market! WTIC is down below US58/bbl. Gasoline is still falling.

No inflation.

Yippee!

Currencies

Many out there must be having heart attacks now with their 'de-dollarization' strategies.

Gold down, U.S. stocks at record high, T Bonds roaring, and Ray Dalio's 'hard currencies' are collapsing.

US Dollar

It is a big beautiful bull market for the U.S. dollar.

Big Beautiful Bond Bull Market.

Big Beautiful US$ Bull Market.

Big Beautiful U.S. Stocks Bull Market.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Mining Corp. and Agnico Eagle Mines Ltd.

- Barry Dawes: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.