Gold is breaking out, but the most valuable signal for equity investors is not the headline price. It is how leadership changes after a long base.

In both prior up-legs in gold, the heavy lifting in equities came from mid-cap producers and credible explorers. The publicly tracked model portfolio was built to capture that shift.

The record speaks for itself, and the same setup is forming again.

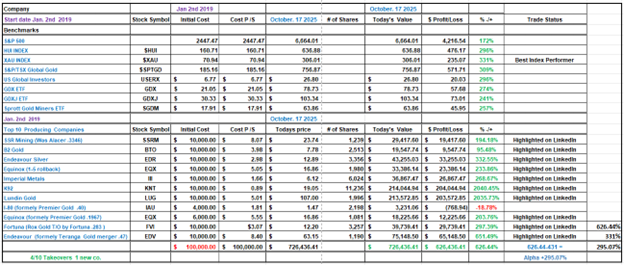

Back in early 2019, optimism for gold and silver equities was scarce, especially following the late 2018 market lows. Yet, the LinkedIn Producer Model Portfolio, launched on January 2, 2019, proved a bold bet.

Updated regularly on LinkedIn and X, this portfolio has showcased remarkable growth, outperforming the S&P 500 and all precious metal indices and ETFs over the past five-plus years.

As of October 17, 2025, its total return stands at an impressive +626.44%, turning a $100,000 investment into $726,436.41 with a compound annual growth rate (CAGR) of 33.92%, far surpassing the XAU Index's +331.36%.

Originally crafted for a large investor seeking 10 precious metal companies capable of doubling in a year (a goal they exceeded), this portfolio has weathered significant volatility, including a 65% Covid-era drop and multiple interest rate shocks. Four of the original 10 companies have been acquired, with one spin-out adding a new company, bringing the total to 11. Despite four corrections exceeding 30% and two surges over 160%, patience has paid off handsomely.

However, the story doesn't end here. While this portfolio has delivered extraordinary returns, the next wave of wealth creation in the gold sector over the next five to six years is likely to come from a different group: developers, mid-cap producers, and the gutsy exploration companies. These entities are the backbone of the industry, driving new supply to offset the declining reserve life of existing mines. History supports this shift; legendary firms like Barrick Mining Corp. (ABX:TSX; B:NYSE) emerged from a series of takeovers and discoveries, starting with Pan Cana Resources in the early 1980s, an overlooked Nevada gold property, and evolving through mergers with Homestake Mining, Rand Gold, and Placer Dome.

Today, B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX) mirrors an early Placer Development, steadily building a robust company with a strong dividend.

Yet, the real potential lies with explorers and developers who uncover the next big deposits.

This is a risky business, built on the thrill of discovery, but it's where future giants are born.

For Streetwise readers, the focus should shift toward emerging players in exploration, development stories, and mid-tier production. All these types of companies could benefit from mergers of equals, takeovers, better earnings and stock buy-backs, and higher dividends, and the most rewarding of all, discovery. While the current portfolio could see further gains, the next +600% returns will likely stem from these innovative companies fueling the gold market's future. Keep an eye on the horizon, great wealth awaits those who back the next wave of gold pioneers.

In the next five to six years, it probably won't be this portfolio that will go up +600%, (although it could). Instead, more than likely, it will be the developers, the mid-cap producers, and the exploration companies that are the real driver and backbone of this business as they are the companies that are looking for the new supply to fill the ever-declining reserve life of the mines in production.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fortuna Mining Corp., Equinox Gold Corp., Barrick Mng Corp., and B2gold Corp.

- John Newell: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.