Let me tell you a story. I entered the training program with a large, reputable and very "blue-blood" Canadian investment firm in 1977 and spent the better part of one full year moving through the various departments for stays that varied between 30 and 90 days. Aside from learning a gargantuan amount of superfluous information about government bonds and money markets, it was like five years at the Harvard Business School when it came to understanding the two main drivers of stocks — fear and greed.

At the tail end of the 1970's bull market in commodities, there was one final gasp of inflation-hedge positioning when the Hunt Brothers out of Texas cornered the silver market, removing every available coin, bar, wafer, and candlestick from every shelf in every antique shop, coin dealer, and commodity exchange the world over.

By the time the heavily-short bullion banks woke up and realized they were in trouble, the price had risen from its lowly nadir of $1.25 per ounce in 1970, it had established its apex in early 1980, punctuating the Stagflation Seventies with a run to $50 per ounce. As many were the fortunes made during the ten-year advance, the old adage that says "stocks take the escalator up but the elevator down" was never truer than it was for silver.

During the final orgasmic gasps of the silver bulls in 1980, 2011, and this week, silver's trajectory metamorphosed from a "gradual" angle of ascent to a "vertical" one that ended in ab abrupt reversal and crash, at least in 1980 and 2011. The drawdowns off those two tops were 93% from 1980 to 1993 and 76.1% from 2011 to 2015 (although the actual nadir came at the end of the COVID crash in March 2020).

By Thursday afternoon, I had received no fewer than 30 emails from angry, agitated silver bulls with the vast majority under the age of 40 all explaining to me with varying degrees of condescension and arrogance the 20-odd reasons that "it's different this time."

As if they were reciting verses from "Casey at the Bat" or "Dr. Seuss' Cat in the Hat," they all sounded like Rick Rule in full regatta format echoing reason after reason that gold is going to double from here and why silver belongs at its inflation-adjusted price of $192.10 "where it will still be cheap!"

Meanwhile, the week that just passed saw gold and silver hit historic all-time highs taking short sellers out behind the woodshed with unbridled ferocity. The manner in which both metals gapped higher through Friday morning reeked of the burning flesh of a seriously-singed short seller being chased down by his broker's credit clerk, an experience I endured only a few times in my time as a commodities broker after which I discovered Zen Buddhism and Thai bath houses both instrumental in deterring my addiction to risk.

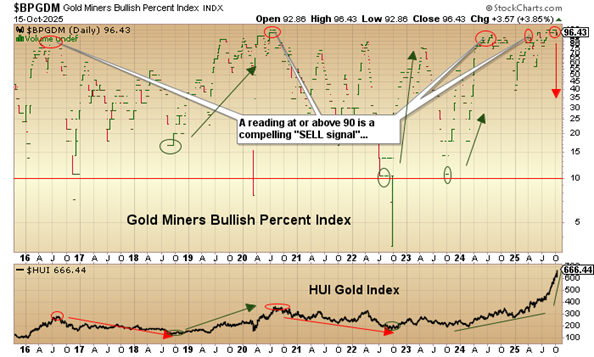

One of the best tools for identifying tops for the precious metals is the Gold Miners Bullish Percent Index (BPGDM:US). A couple of times since the bottom at $1,045 in late November 2015 the index has been clocked above 90. In late summer 2016 after a blistering move off the January 2016 low for the HUI under 100, the BPI printed 92.86 after which the HUI:US (ARCA Gold Bugs Index) fell from 286 to 133 inside of 25 months.

Then in August 2020, after the Treasury and the Fed flooded the financial system and households with $7 trillion worth of liquidity, the BPI hit 96.55 after which the HUI:US fell from 373 to 172. This week, the BPI went out at 100, the maximum reading for that index and at a level which has never been seen before.

The late-coming newbies that have preferred crypto and AI to the PM's for most of the past six years tend to move in packs. A perfect analogy is a swarm of birds at dusk in the marsh, where entire flocks of ravenous birds move as one organism descending upon the insects in perfectly choreographed swoops. One tweet from a popular "influencer" at the right time can trigger millions upon millions of shares of buying in anything and when they move in sequence, the results can be mind-boggling.

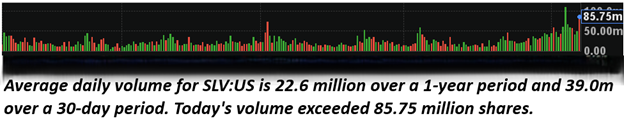

Look at the volume surge this week for SLV:US with particularly focus on Friday's reversal day.

There is an old saw that governs trading and that is that "volume precedes price" at both tops and bottoms but it is particularly relevant on key reversal days like Friday where volume exceeded 85.75 million shares. This silver ETF traded at a record high of $49.25 shortly after the opening but then reversed, closing below the prior session's low ($48.00) going out for the week at $46.71, constituting a true outside key reversal, a powerfully-bearish technical pattern.

Key characteristics and significance

- Confirmation with volume: The reversal signal is more reliable when it occurs on higher-than-average volume, as this indicates strong selling or buying pressure.

- Context matters: The pattern is most significant when it appears after a strong, extended move or near a key support or resistance level.

- Psychological shift: It reflects a change in market sentiment, where the prevailing side (e.g., bulls in an uptrend) loses control and the opposite side takes over.

Check marks on all three characteristics of Friday's action in the silver pit convinced me to hold fast to my bearish stance for both gold and silver. We added the SLVD:US (the inverse bear ETF for the SLV:US) at $2.19 ($.01 off the daily and 52-week low after adding puts on the GLD:US and ample allocation to JDST:US (Inverse Bear ETF for Junior Gold Miners ETF (GDXJ:US) on Wednesday and Thursday under $3.50. Closing out the week at $3.80, it has a 52-week high print of $32.14 making our entry points at around 11% of the yearly apex.

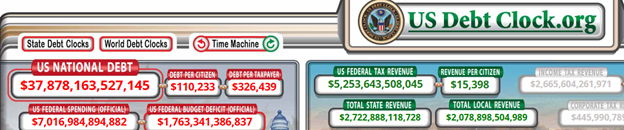

For the record, I am a long-term gold bull and hold to the view that the U.S. Treasury will eventually need to collateralize their bond market with the 8,311 metric tonnes of gold alleged to be residing in Fort Knox. However, at $4,200 per ounce, the gold in Fort Knox covers a mere 3.24% of National Debt. At $129,000 per ounce, the bond market is fully collateralized but that excludes the entitlements such as Medicare and Social Security.

I first wrote about this in 2020 when I launched the GGM Advisory but everyone was so obsessed with ratting out those who forgot their masks or stood within six feet of you that they paid little or no heed when the COVID crash took the HUI:US down to 154.60 and the GDX:US to $15.00. People are only now revisiting that four-letter word describing the iceberg that is headed for the bow of the USS America and that word is D-E-B-T. Norm Franz tells us that "gold is the money of KINGS" while "debt is the money of SLAVES."

There would be no greater irony anywhere in the history of mankind if it was the American gold reserves that rescued its citizenry from a legacy of entrapment leading to chaos and slavery.

Over the near-term, I think there is a realistic chance for gold to correct back to its 100-dma at around $3,500 while silver could trade below $40 again in its retest. The good news is that even with sell-offs like these, both metals will remain well-insulated and still in secular bull markets.

Debt

Stocks are acting miserably but have the benefit of three of the best promoters (verging upon snake-oil salesmen) in the forms of Donald Trump, Scott Bessent, and Elon Musk. You can take it to the bank that on any given day that stock market is selling off, one of or all three of these pro-market personalities will be on Fox News or CNN or CNBC chirping up the outlook for the stock market, the economy, motherhood, and apple pie.

However, as much as they tried, the S&P 500 failed to make new highs and went out a full 100 points off its record from October 8. The tech-heavy NASDAQ went out around 600 points below its 52-week high but what I see is a market quickly losing leadership and in search of a desperately-needed narrative to offset the problems creeping into the daily media scrum that include REPO issues (like Q4/2019), and private equity debt defaults (like Tricolor and First Brands) referred to as "cockroaches" by JPM CEO Jamie Dimon this week, as in, "there is never only one cockroach."

Fighting the Fed and fighting the tape are two practices commonly associated with " a mug's game" and notwithstanding the fact that at my advancing age there is little I can do to repair the lost brain cells from seven decades filled with debauchery and excess during at least the last five of them, I know that I should hop on board, grab the cymbals and pompoms and call for "Dow 100,000!!!" at each and every turn — but I just cannot.

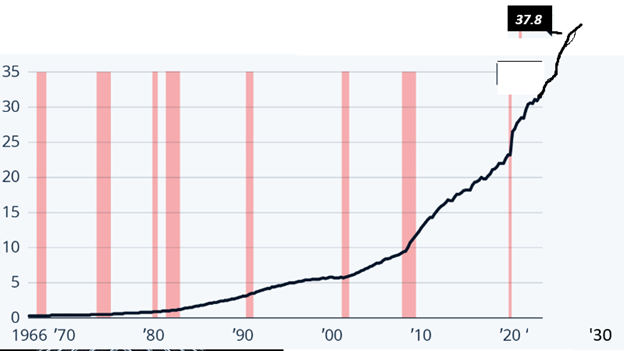

I keep seeing the U.S. Debt Clock continuing to roll forward standing at $37.8 trillion. It feels to me like it was just yesterday that I was writing the GGMA 2020 Forecast Issue using the figure of $25 trillion as the value of the bonds that needed collateralization.

It took from 1980 to 2010 to grow from $870 billion to $10 trillion but then only 15 more years to triple it again.

"Debt is the money of slaves," wrote Mr. Franz a great many years ago but in today's enlightened world of self-destructing electric vehicles and artificial intelligence, the advances in the human condition would be hard to grasp with all the death and destruction going on in Eastern Europe and the Middle East. Even the canyons of urban America are now sprawling fields of homeless humanity without dignity and devoid of hope. Nobody can tell me that the national debt couldn't have been created with far better results than propping up the S&P 500 through uncontested currency debasement and money printing. Had the leaders focused on the "greater good" rather than the net worth statements of the minority elite, conditions for the average citizen would be vastly improved.

As it stands today, economic growth cannot maintain itself without a healthy middle class within a society that rewards achievement and fosters a clear path to advancement via hard work and dedication.

That is precisely why I find it difficult to get blindly bullish on the western stock markets and especially the overvalued, overpromoted and overprotected American market.

That said, I shall now descend from my soap box and pour a well-deserved glass of Chablis. . .

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.