Gold isn't the only precious metal experiencing a remarkable rally this year. Silver prices have soared approximately 75%, driven by investors seeking safe havens, robust industrial demand, and ongoing supply shortages.

Spot silver prices reached a record high of US$51 per troy ounce on Thursday, surpassing the US$50 mark for the first time since 1980. This year, traders have gravitated towards tangible assets like gold and silver as secure investments and hedges against geopolitical instability and economic uncertainty, including concerns about tariffs, inflation, Federal Reserve independence, and government debt burdens, CNN's John Towfighi reported on October 10.

Silver has been on a significant upswing, buoyed by the momentum from gold. The metal is seen as a more affordable alternative to gold, which recently reached US$4,000 per troy ounce for the first time.

"There's just a lot of concern about the global economy, and when that happens, people turn to hard assets like silver," Michael DiRienzo, chief executive officer of the Silver Institute, previously told CNN. "Silver tends to follow gold upwards."

While investor demand pushed prices higher, silver also plays a crucial role in various industrial applications, such as constructing data centers, solar panels, and smartphones.

"Its dual role as an industrial metal and safe-haven asset has amplified the rally, making 2025 a historic year for silver," said Ewa Manthey, a commodities strategist at ING, according to CNN.

Finding factors that could drive silver prices down is challenging because the world appears increasingly fragmented, reported Karishma Vanjani for Barron's on October 9.

"Silver could go further up if the dollar falls further in value since it spurs more international buying," Vanjani wrote. "Silver is globally priced and traded in dollars. The market for silver is significantly smaller than the over US$25 trillion gold market, which means a move in the dollar has a bigger impact on silver on a percentage basis than gold. Rising inflation can also support demand for real assets like silver."

Supply concerns are also contributing to the potential for higher prices. The silver market is experiencing its fifth consecutive year of a structural supply deficit due to "stagnant mining output" failing to keep pace with demand, according to Peter Grant, vice president and senior metals strategist at Zaner Metals, the piece reported.

"Strong and growing demand for silver, combined with a persistent supply deficit, is a recipe for higher prices," Grant told CNN.

Gold prices have surged over the past two years, fueled by investors seeking safe havens. Central banks reducing their reliance on the dollar and increasing their gold reserves have also driven prices up. This safe-haven rally has extended to other precious metals like silver and platinum, which have risen approximately 75% and 80% this year, respectively. Both are both outpacing gold, which has increased by about 51%.

Silver's Role in Electronics

Many people recognize silver's role as an investment, but its numerous industrial uses often go unnoticed, according to a page titled "Why Silver Is One of the Most Important Elements on Earth" on the GoldSilver.com website.

In reality, nearly half of the annual silver supply is dedicated to industrial applications and manufacturing. This industrial silver is truly essential in modern society.

You might not realize it, but silver is used in nearly all of your electronic devices. If you’re using a gadget with an on/off button, it’s highly probable that silver is a crucial component, GoldSilver.com said.

Renowned for its unmatched electrical conductivity, silver is the ideal material for a wide range of applications. It is present in everything from printed circuit boards and switches to TV screens, telephones, microwave ovens, children’s toys, and even the keys beneath our computer fingertips.

According to the Silver Institute’s World Silver Survey 2023, industrial demand for silver reached a new record high of 539.6 million ounces (Moz) in 2022, with the electrical and electronics sector being a major contributor. This sector experienced a 7% increase in silver demand compared to the previous year.

"The ongoing expansion of 5G technology, the Internet of Things (IoT), and the push towards renewable energy sources are expected to further drive silver demand in the coming years. With over 15 billion devices currently connected to the internet worldwide and projections suggesting this number could double by 2030, the outlook for silver in the electronics industry remains strong," the article on GoldSilver.com noted.

Investors can gain exposure to silver by purchasing bars or coins or by investing in exchange-traded funds (ETFs) backed by silver, the CNN report by Towfighi noted. The iShares Silver Trust ETF has climbed approximately 68% this year. Inflows into silver ETFs are at their highest level since 2020, according to Marina Smirnova, chief investment officer at Sprott Asset Management.

"Silver's steady climb is turning into a breakout," Smirnova said, according to CNN. "Supply is thinning, and investors are taking notice."

HSBC, in a note this week, said it expects prices to reach as high as US$53 this year and US$55 next year, but to decline in the latter half of 2026, the CNN article said. "Part of the rise will come from gold, which often exerts a 'strong gravitational pull on silver,' possibly due to buying by 'investors who have not taken full advantage of the gold rally,'" wrote James Steel, HSBC’s chief precious metals analyst, according to Towfighi.

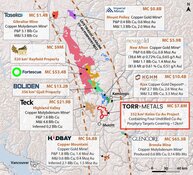

If you don't want to buy physical silver or invest in an ETF, you could look at the many silver explorers and producers around the world, including the following public companies.

Irving Resources Inc.

After intersecting multiple mineralized vein zones at the East Yamagano Joint Venture (JV) in Japan, Irving Resources Inc.'s (IRV:CSE; IRVRF:OTCQX) Director and Technical Advisor Dr. Quinton Hennigh said the company was "eagerly" awaiting results from a new hole in which it observed silicification, silica breccias, and stockwork vein zones at depth.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Irving Resources Inc. (IRV:CSE; IRVRF:OTCQX)

Hole 25SY-001 encountered high-grade gold values, including 5 meters grading 2.9 grams per tonne gold (g/t Au), with 1 meter grading 8.3 g/t Au, starting at a downhole depth of 444 meters; 1.2 meters grading 4.14 g/t Au, with 0.5 meters grading 8.38 g/t Au, starting at a downhole depth of 490.8 meters; and 2 meters grading 2.48 g/t Au, with 1 meter grading 4.53 g/t Au, starting at a downhole depth of 678 meters.

"Hole 25SY-001 gives us confidence that we have a vein system emerging at depth in this area," Hennigh said at the time. "We now see a vector pointing to potentially higher gold grades and wider vein zones associated with the deeper core of the AMT resistor."

Hennigh said the company was "eagerly" awaiting results from its newest hole, 25SY-002A, in which it observed silicification, silica breccias, and stockwork vein zones at depth.

The veining in the new hole, 25SY-002A, "coupled with results from holes further north indicates we may have found extensions of the Yamagano vein system tending through East Yamagano," Hennigh said.

The Canadian exploration company has garnered support from several major players pursuing gold and silver in Japan, including Newmont, which owns nearly 20% of the company. Japan is renowned for its high-grade gold mines, with numerous past-producing epithermal sites.

Brian Leni of Junior Stock Review described the stock as an "opportunity." "In my view, Irving is selling for less than it's worth, considering the potential upside of discovery at its Yamagano project. Not only that, but this junior company is exploring Yamagano" with Newmont Corp. and Sumitomo Corp. (8053:TKY; SSUMF:OTCPK), Leni wrote for Streetwise Reports in November. "When it comes to Irving, I have long seen the potential of their project portfolio," Leni wrote. "Visiting Yamagano and Omu in person and meeting the technical team that is executing the exploration work has only further solidified that potential in my mind. To me, Yamagano holds the key to garnering frothy market attention once again . . . I clearly see that there will be a steady stream of project development across Japan moving out into the future."

On July 14, Chen Lin, author of the What Is Chen Buying? What Is Chen Selling? newsletter, noted that "Hennigh just visited Irving Resources Inc., and he came back quite excited. We will watch the drilling results in the coming weeks."

In a post on his website in March, Analyst Jayant Bhandari mentioned that he and his clients have been long-term investors in the company. "The designated areas within this agreement are progressing toward becoming mines, primarily for silica with gold credits," he said of Omu. "High-grade silica from Omu is expected to be in strong demand." Bhandari continued, "IRV has stagnated for several months while similar companies have moved up," he said. "I prefer to invest when others aren't paying attention."

The company said management and directors own about 9.3%, and strategic investors Newmont and Sumitomo own 19.2% and 5.2%, respectively.

Yahoo! Finance said about 1% is owned by institutions. The rest is retail.

According to Refinitiv, top insiders include President and Chief Executive Officer Akiko Levinson with 4.88% and Hennigh with 3.1%.

Irving Resources has a market cap of CA$21.78 million with 83.36 million shares outstanding. It trades in a 52-week range of CA$0.15 and CA$0.42.

Silver North Resources Ltd.

Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) is a Canadian junior exploration company dedicated to advancing silver projects in the Yukon. The company recently wrapped up its 2025 field program at the Veronica property, part of its GDR project in southern Yukon Territory.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB)

The Veronica claims are located adjacent to the Tim Property, which is under separate option to Coeur Mining Inc. (CDE:NYSE), one of the largest U.S.-based silver producers, the company said.

This work was partially funded by the Yukon Mineral Exploration Program, which offers grants of up to US$30,000 for eligible expenditures.

The Veronica property is situated in the Silvertip district, an area known for carbonate replacement deposit (CRD) style mineralization containing silver, lead, and zinc. The project is located 16 kilometers northeast of the Silvertip mine and adjacent to the Silver North Tim property, which is under option to another operator. Silver North's eight-day program at Veronica included prospecting, mapping, soil geochemical sampling, and hand trenching. Crews collected 453 soil samples, 26 rock samples, and conducted two trenches and eight additional pits.

The program as "an important first step in assessing the property's potential to host carbonate replacement deposit style mineralization," said President and Chief Executive Officer Jason Weber. He noted that the discovery of galena mineralization "in what appears to be a prospective stratigraphic position" was a positive indicator for further exploration.

The results build on a 2016 soil anomaly measuring 450 by 450 meters that returned values up to 31.1 ppm silver, 3,100 ppm lead, and 612 ppm zinc. Silver North's 2025 work marked the first trenching and testing of this anomaly.

On July 25, Rick Mills of Ahead of the Herd called the company "an excellent silver investment opportunity in Canada's most productive silver region, Keno Hill," and emphasized his long familiarity with its management team. He noted that Silver North "controls excellent land positions within the Keno Hill district, conducting substantial drilling. They understand their assets and potential."

He added that Silver North represented "a pure silver opportunity where the team has already made several discoveries, documented substantial silver ounces, and I believe is progressing toward defining another Keno silver deposit."

On August 11, Michael Ballanger of GGM Advisory Inc. reaffirmed his confidence, writing that he continued to hold shares in the company.

By completing its first program at Veronica, Silver North advanced exploration in one of Yukon's most promising silver-lead-zinc districts, as noted in its investor presentation. The work provided initial trenching and sampling on a promising anomaly, while also strengthening the company's regional presence in the Silvertip area. Combined with the support of the Yukon Mineral Exploration Program and ongoing analyst commentary, the results position the company to continue refining targets and planning additional work within the district.

According to the company, ownership is distributed as follows: private individuals own 19%, management owns 16%, funds own 12%, and the rest is retail.

The company has a market cap of CA$22.18 million and a 52-week range of CA$0.07–CA$0.43 per share.

Dolly Varden Silver Corp.

Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA; DVQ:FSE) this month reported a significant gold intercept from a 2025 step-out drill hole at its Homestake Silver deposit.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA;DVQ:FSE)

In an October 1 release, the company stated that Hole HR25-456 intersected 3.34 g/t Au over 120 meters, including 216 g/t Au over 0.52 meters and 166 g/t Au over 1.3 meters. This hole is a 45-meter step-out along strike from hole HR24-433 and 30 meters up dip from hole HR24-451, confirming both continuity and growth potential beyond the current Mineral Resources.

Approximately 40% of the 2025 drill program, which covers 55,000 meters at the Company's fully owned Kitsault Valley Silver and Gold Project, focused on the Homestake Silver Deposit to expand and infill zones of high-grade gold mineralization. The deposit remains open for expansion, with gold mineralization extending towards the Homestake Main Deposit, along strike to the north of the Homestake Silver Deposit.

"These gold results from a step-out hole at the Homestake Silver Deposit confirm that the deposit continues to grow beyond the current mineral resource estimate," Chief Executive Officer Shawn Khunkhun said. "These results demonstrate the strength of the high-grade gold system, potentially a separate and overlapping event from high-grade silver mineralization at the deposit; this deposit is potentially a key driver of future project development."

Five diamond drills are nearing completion of the 2025 drill program across the Kitsault Valley and Big Bulk projects, the company reported. At Homestake Silver, drilling has concentrated on expanding and infilling areas of high-grade gold mineralization. Additional drilling is testing areas outside the current resource. Further results from the Homestake Silver gold zone, Wolf Vein silver mineralization extension, Big Bulk copper-gold porphyry system, and other exploration targets will be reported as assays are received, the company said.

On October 1, Jeff Valks, a senior analyst at The Gold Advisor, highlighted the importance of Dolly Varden Silver's recent gold discovery in its step-out drilling at the Homestake deposit. "It’s the kind of grade profile that gets investors leaning forward, not just because of the length of the intercept, but the spikes of ultra-high grade within it," Valks wrote about the intercepts.

The drill hole is situated approximately 45 meters along strike from a previous intercept (HR24-433) and 30 meters up dip from another (HR24-451), confirming that mineralization extends beyond the current resource model, Valks noted.

While Homestake has traditionally been considered silver-rich, recent work indicates a distinct shift northward into a gold-rich system. This is supported by the data: HR25-456 also returned 22 g/t gold over 0.65 meters and a one-meter interval of 3.11 g/t gold. Base metals like copper, lead, and zinc were also present in smaller quantities, adding to the deposit's metal content.

The company was also discussed by Peter Krauth in the Silver Stock Investor newsletter on October 1. Krauth called the gold intercepts "impressive."

"This new hole sits 45 meters along strike and 30 meters above earlier high-grade hits, confirming both continuity and strong growth potential well beyond the current resource model," wrote Krauth. "The results point to a wide, high-grade plunging zone that remains open to the north and at depth, suggesting exciting expansion potential."

Overall, the findings highlight Homestake Silver's transition toward a more gold-focused system, injecting new excitement into what was already regarded as a silver-rich deposit, Krauth said. The deposit's open-ended potential positions it as one of Dolly Varden's most promising avenues for growth.

Also on October 1, Stephanie Baufeld issued a brief update by email on the stock following the release, noting that it confirmed "continuity of a developing high-grade gold trend." The continued drilling positions the project "for potential resource growth and bulk-tonnage optionality," she wrote.

According to Dolly Varden's Corporate Presentation, institutional investors own 50% of the company. Along with Hecla with 13.7%, other strategic investors include Fury Gold Mines Ltd. (FURY:TSX) with 13.5% and Eric Sprott with 9.5%. The rest is in retail.

Dolly Varden has 85.43 million outstanding shares and 90.5 million fully diluted shares. Its market cap is CA$535 million. Its 52-week range, according to Refinitiv, is CA$3.21–CA$7.46 per share.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Irving Resources Inc., Silver North Resources Ltd., and Dolly Varden Silver Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Irving Resources Inc., Silver North Resources Ltd., and Dolly Varden Silver Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.