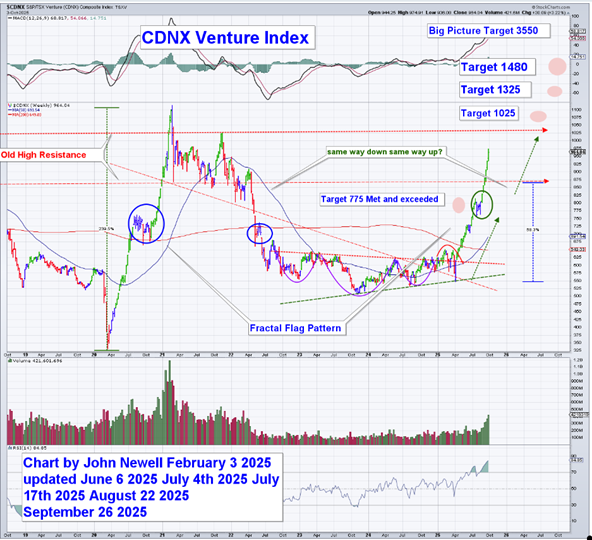

The long-awaited breakout in both the CDNX Venture Index and select U.S.-based explorers appears to be underway. The early signals I highlighted back in February 2025, when the TSX Venture was quietly carving a massive base pattern, have now been confirmed. The question investors should ask today isn't if this is the breakout, but how far it might run.

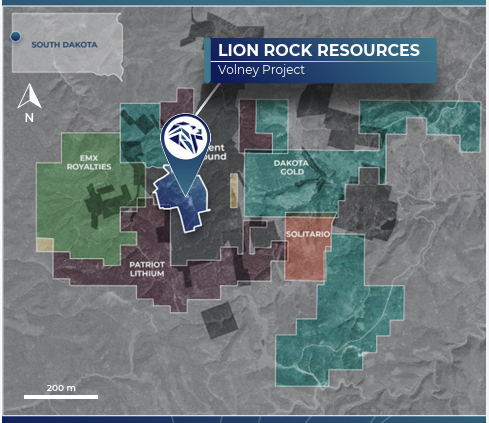

And few stories illustrate this shift better than Lion Rock Resources (ROAR:TSX; LRRIF:OTC), a made-in-America exploration company sitting on a dual commodity opportunity, gold and lithium in South Dakota's historic Black Hills.

The Bigger Picture: The Venture Awakens

In my earlier article, I argued that the TSX Venture Index (CDNX) was forming a mirror-image reversal "the same way down, the same way up." That pattern has now broken out decisively, clearing the 775 level and validating the first target. The next upside objectives are 1,325 and 1,480, levels that align with the 2021 peak.

Volume expansion, improving breadth, and a return of risk appetite in the resource sector all support the idea that we are entering the next leg of the junior mining bull market. Historically, these moves unfold over several years, not months, and they often begin when skepticism is still high, exactly where we are now.

Lion Rock Resources: Breaking Above Invisible Resistance

While the index confirms the broader trend, Lion Rock Resources is a textbook example of what happens when technicals, fundamentals, and timing align.

After exceeding its first target at CA$0.26, the stock pulled back naturally to the 0.618 Fibonacci retracement level, forming a higher low, a critical sign of underlying accumulation. From there, the shares began to coil within a declining wedge pattern, often a precursor to powerful upside moves once broken.

In early October, Lion Rock Resources pushed decisively through its Point of Resistance (POR), what I call "invisible resistance," the level where quiet accumulation gives way to market recognition. This marks the Point of Recognition phase, where the broader market begins to revalue a stock based on new information.

Next technical objectives:

- Short term: CA$0.40

- Intermediate: CA$0.65

- Big picture: CA$1.50

Momentum indicators confirm the move. RSI has turned higher from mid-range, and MACD has crossed upward, both supporting the breakout. The stock continues to form higher lows, a classic sign of a developing uptrend.

The Catalyst Behind the Chart

Technicals tell you when; fundamentals tell you why.

Lion Rock Resources recently closed an oversubscribed $5 million financing, ensuring it is fully funded for its 2025 drill program, which is targeting both lithium and gold zones.

Read: Lion Rock Closes $5M Financing →

Follow-up sampling and drilling have already produced strong results, including high-grade lithium up to 5.4% Li₂O at surface and gold values up to 18.2 g/t Au — confirmation that the Black Hills district still holds untapped high-grade potential.

Read: Lion Rock Reports Lithium Results →

Read: Lion Rock Reports Gold Results →

What makes this particularly significant is the location. The project sits entirely on private land, meaning no federal permitting delays, and lies within a proven mining jurisdiction alongside Coeur Mining and Dakota Gold. That private land advantage could fast-track development by years compared to other federally regulated areas.

The Macro Tailwind: Made in America

We are witnessing a strategic shift in global supply chains. The U.S. government is pouring billions into infrastructure renewal, electric vehicle manufacturing, and clean energy, and every one of those initiatives depends on reliable, domestic sources of critical minerals.

Lion Rock Resources fits that narrative perfectly. It's not just another exploration story; it's part of a broader American resource independence movement gold as a store of value, lithium as the backbone of electrification, and tin, a silver substitute, among things, adding an important third leg of strategic potential.

No federal red tape, no offshore dependence, 100% American soil.

Conclusion

The technical breakouts we are seeing, from the CDNX Venture Index to individual names like Lion Rock Resources, suggest the tide may finally be turning for junior explorers.

This is the phase in the cycle where the market begins to recognize value, not create it from hype. As capital returns to the sector and liquidity improves, companies with the right combination of assets, funding, and technical structure are often the first to re-rate.

Lion Rock Resources just broke through invisible resistance. And for investors looking for early-stage exposure to America's next critical mineral discovery, that signal couldn't be clearer.

For the reasons listed above, I view Lion Rock Resources (ROAR:TSX; LRRIF:OTC) as a Speculative Buy at approximately CA$0.33.

The first article on Lion Rock can be found here.

For more information on the company, investors can visit the website here

| Want to be the first to know about interesting Gold and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Lion Rock Resources.

- John Newell: I, or members of my immediate household or family, own securities of: Lion Rock Resources. My company has a financial relationship with Lion Rock Resources. My company has purchased stocks mentioned in this article for my management clients: Lion Rock Resources. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.