With all major U.S. stock market averages closing out the week at record, nosebleed highs amidst unprecedented levels of retail speculation and P/E multiple expansion, old-timers like this author can simply look down from their rocking chairs perched precariously on the porch overlooking a veritable ocean of celebration as the CNBC commentators laugh and joke and exchange all-too-knowing winks and nods at the parade of new highs literally everywhere.

They call it "money-flow" and the eggheads chortle out a constant torrent of "blah-blah-blah" about "positioning" and "complexity" with all of the other buzzwords designed to impress that are hell bent to convince the investing public that this mountain of debt that has grown from US$25 trillion in 2020 to US$37 trillion in just five short years (a 48% increase) has nothing to do with record stock market highs, housing unaffordability, cost-of-living stress or widening the gap between the "haves" and the "have-nots."

In the 1921-1923 period, in what was once a thriving, educated, and prosperous society, the citizens of the German Weimar Republic that were raised to believe that savings and "Reich bonds" were a safe place to store one's wealth and that stocks were for "irresponsible gamblers" were soon to learn a painful lesson. By 1923, the inflation rate was at the 1,000% level, and savings and bonds were vaporized under the debasement of the Reichsmark currency unit, leaving once-prosperous families destitute and on the street. It also set the stage for civil dysfunction that metamorphosed into blind adoration of Adolph Hitler in the Depression-era 1930s. We all know too well what happened after that.

The irony of the 1921-1923 hyperinflation was that the few speculators that were holding large amounts of foreign stocks and/or gold were absolutely and totally enriched in terms of the German currency as their ownership of "assets" allowed them to avoid the debilitating loss of purchasing power in the value of their domestic currency. There was a generational transfer of wealth that favoured the speculator over the saver.

Ditto the events in Zimbabwe after British colonial rule ended in 1965, then later was abolished under Robert Mugabe in 1980, after which many of the same economic policies of Weimar Germany were put into place, resulting in massive money-printing and currency debasement.

Citizens who used bank savings to store wealth were completely impoverished over a 40-year period, resulting in widespread poverty and human rights abuses.

Again, citizens that amassed wealth stored in foreign or hard assets like gold, silver, and diamonds survived the devastation of the hyperinflation but the notable similarity to the Weimar event was that stocks soared as defined in local currency units.

For those of you who are inclined to dismiss these irrelevant pieces of historical trivia as "outdated" because they occurred in the last century, look no further than Turkey, the heart of the former Ottoman Empire and a relatively modern country by European standards. The average rate of inflation in 2024 was 75% and just as happened in Weimar and Zimbabwe, savers and bondholders were destroyed by serial currency debasement resulting in a soaring stock market that actually resembles the Western market averages with particular emphasis to the NASDAQ.

So, you think that perhaps modern-day Turkey is a "one-off" that should be ignored due to its proximity to the Middle East battlegrounds in Iraq and Afghanistan?

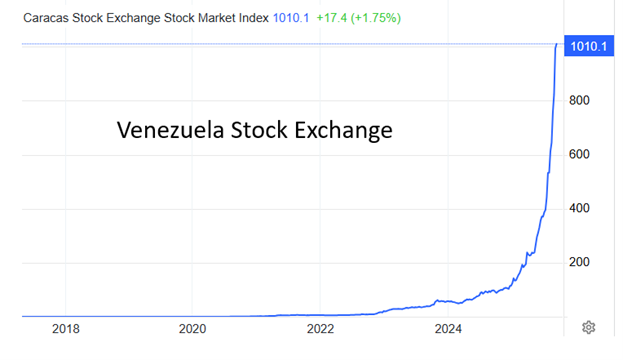

Take a short flight across the pond to South America, where the former "Jewel of South America" — Venezuela — suffers a similar and oh-so-familiar plight. Once a burgeoning society, the formerly rich petro-state has seen GDP fall by 80% in less than a decade, driving some seven million of its citizens to flee. Most Venezuelans live on just a few dollars a month, with the health care and education systems in total disrepair and biting shortages of electricity and fuel, as of 2024, according to VOA (report from AFP). An OPEC member, Venezuela holds the world's largest proven oil reserves, estimated at around 303 billion barrels in 2023, primarily located in the Orinoco Belt. Yet, despite such unfathomable wealth, almost 82 per cent of Venezuelans live in poverty, with 53 per cent in extreme poverty, unable to buy even basic foodstuffs.

This, my friends, is what happens when the ruling elite refuse to protect the purchasing power of the domestic currency.

Mind you, if you elected to store whatever wealth you could save in Venezuelan stocks, you did just fine in domestic currency measurements although you would be unable to avoid either airfare or accommodation anywhere else in the Western world.

I go apoplectic every time I pick up the Wall Street Journal or Barron's and read about some "analyst" explaining with great humility why he/she was able to stay fully-invested in technology stocks right through the pandemic and the subsequent five years of wars, famines, global trade friction, and rising inflation while pointing to "American Exceptionalism" or "corporate productivity" or "unparalleled innovation" all the while choosing to ignore the one dominant driver of stock values since the lows of the GFC in 2008. That driver is referred to by the CNBC crowd as "liquidity."

How many times have I heard the expression "cash on the sidelines"? How often do the quantitative analysts refer to "ample liquidity levels" as an excuse for buying any and all dips in stock prices?

My question to the might be "From where, pray tell, did all this precious 'liquidity' come?" Is it an abundance of retained earnings from outsized sales and profit margins? Did it come in the form of the discovery of massive oil and gas or mineral fields in the Continental United States since 2008? Was it the invention of a new technology enhancing corporate productivity?

The answer is "No, no, and no" to those being possible sources of "liquidity," whereas the answer lies in the national debt clock and the 48% increase in national debt since 2020.

Here is an analogy: you are about to enter a room along with nine other people that is filled with 10 baskets of corn. In each basket, there are 10 cobs of corn, which means that there are 100 cobs of corn in the room. Before entering, each person is given exactly 10 dollars with which to buy corn. Since there are 10 people spending a total of $100 to purchase 10 baskets containing 100 cobs of corn, the maximum price per cob of corn would be 100 cobs ÷ $100 = $1.00 per cob. Then everyone is asked to put the corn back in the baskets and exit the room. This time, prior to re-entry, each person is given $100 for a total of $1,000 now in the market to buy corn. Since there are still only 100 cobs in total, but now 10 times more money, the new price that may be charged is $10 per cob, $1,000 ÷ 100 cobs of corn.

Was the corn more valuable because of "enhanced productivity"? Did the quality of the corn increase as the people left the room? Why were providers of corn able to increase prices with little or no enhancement to the satisfaction level of the product?

It was purely and simply because the number of currency units was increased without an increase in the amount of cobs to be sold. Inflation, pure and simple.

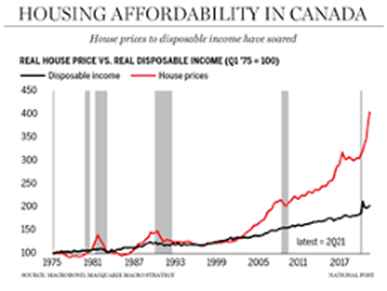

Why is there a housing crisis in North America? Is it because the quality of homes has been increased to reflect better insulation, safer plumbing systems, solar heating, and/or better structural design?

The answer is "not bloody likely." It is because between 2008 and 2025, the latent value of a Canadian loonie or an American greenback has been diluted by the creation of trillions of the same currency units, flooding the domestic markets and chasing the same amount of wood and cement and copper and tile that were required to build a house in 2000, back when the average price of a home was, even back then, barely affordable.

From the chart shown here, one can see the exact point where house prices decoupled from increases in disposable income. It was 2008, when central banks, including the Bank of Canada and the U.S. Federal Reserve Board, opened up the spigots to protect their precious banking brethren and flooded their housing markets with unlimited "liquidity" as well as coercing their government vassals to open up the borders to foreign buyers in order to protect the shaky mortgage portfolios of the member banks. You see, central banks work with governments, and governments are largely owned by the banks, so policy, both monetary, fiscal, and immigration, are all aligned to keep housing from crashing at the expense of wages and salaries, which by lagging behind so badly, force citizens to become indentured servants of the banks.

Will you ever read of this in the Globe & Mail, Toronto Star, Barron's, or the WSJ?

Answer: NEVER. And the U.S. Bureau of Labor Statistics will spew out volume after volume of purposely contrived garbage on employment, wages, savings rates, and inflation, so far from reality that even grade school students can see that the statistics are all designed and presented with a carefully orchestrated agenda, which is to keep the investing masses complacent and the voting public content.

So, I do not wish to hear of an "analyst's forecast" on the "AI group" or for "Mag Seven" or for stocks as an 'asset class' unless they can give me an accurate average inflation rate since 2000. According to StatsCan, the average Canadian house was priced at $163,951 in 2020, a mere five years ago. A dinner for two was priced at $30. Here in 2025, the average home price in Canada is priced at around $700,000. A meal is now $60. The average annual increase for a home since 2020 has been 27.68% while the average annual increase to dine out was 12.35%.

Now get this: The Bank of Canada number for the average annual rate of inflation was an astonishing 4.7%. If anyone out there believes that the true annual increase in consumer prices was 4.7%, then I have some of the Scugog swamp you can have, real cheap! The U.S. numbers are not a lot different, nor are the numbers provided by central banks or government agencies around the globe.

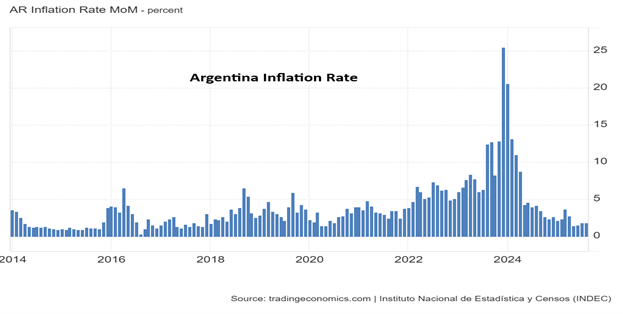

I am of the belief that we in North America are witnessing the very early stages of the same malady that affected our global neighbors in Germany, Hungary, Zimbabwe, Venezuela, Turkey, and more recently Argentina, at least until austerity measures were implemented by recently-elected President Milei.

The government-run news agencies are all preaching from the same hymn sheet about the "moderate inflation" and "strong labor markets" but the reality is that the everyday cost of living has been escalating exponentially since 2008 and is now in vertical ascent since the pandemic in 2020.

The bull market in "everything" from stocks to housing to gold and food has been accompanied by a bear market in the purchasing power of the currency unit, be that Reichsmarks in 1921-1923 Germany, lira in Turkey in 2015, or dollars in North America 2008-2025. Remember the old adage about the dilution factor that crushes the junior mining sector. Most investors hate dilution because it minimizes the replacement value on a per-share basis by way of a deluge of new paper.

Well, that is precisely what we have experienced in the past 16 years, as the chosen response to any crisis that could negatively affect the asymmetrical wealth effect of rising stock values was to print money. When the 2007-2008 banking crisis threatened to derail stocks, they printed currency to paper over the deflationary effects of debt liquidation and equity vaporization by the banks. When an Asian flu bug threatened to scupper the lofty stock market in 2020, they fired up the monetary printing press and dropped bundles of cash from helicopters directly into household bank accounts, and that led to record highs in stocks by the summer of that year, as well as the highest inflation rates in decades a few short months later.

We are in the early throes of a hyperinflationary melt-up that will, with the certainty of a rising sun in the morning, not end well.

Stocks

As the week ended with the NASDAQ at yet another record high, it is fair to assume that the final melt-up has now descended upon the U.S. equity markets with all eyes on next Wednesday's FOMC meeting where the oddsmakers have placed a 10% probability of a 50-bps. cut in the Fed Funds rate.

The only chart I include is the chart of Tesla Inc. (TSLA:NASDAQ) closing tonight up 86.4% off the April 7 lows while sporting a relative strength index of 74.72 (overbought). The last time RSI moved above 70 was in late May, just prior to a 25.5% drop that rattled the back teeth and front orbital lobes of the Elon Musk and Cathy Wood disciples, unconcerned with class action suits, a hostile White House, and eroding market share in EV sales thanks to Chinese (BYD) competition.

However, like the rest of the technology sector, price action and money flow are everything, as operating performance fundamentals mean nothing. I own a few small bearish bets on TSLA, and am being beaten like a rented mule.

The one late-week loser was Oracle Corp. (ORCL:NYSE) that hit a jaw-dropping 52-week high on Wednesday at $345.72 only to close out the week at $292.18, some 5.49% off the Wednesday peak. It was however up from its close a week ago at $232.80 so all-in-all, not too shabby on the week.

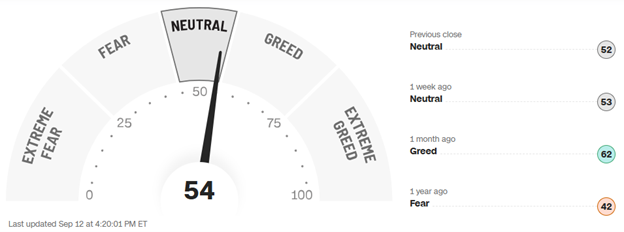

I remain a skeptic on the near-term outlook for stocks, as many others out there are, as the CNBC Fear-and-Greed Index indicates. To have a reading of <NEUTRAL> as all markets power to new highs is not only a positive for the bulls, but it is highly unusual.

Gold and Silver

When applying technical analysis to the world of the precious metals, it is important to note that a) there ain't no bull market like a gold bull market and b) silver bulls are like gold bulls on steroids, methamphetamines, Red Bull, and Mad Dog 20/20.

The market we witnessed this week is the market we were all dreaming about from 2021 to 2023, when rampaging inflation, serial money printing, geopolitical strife, and social discord should have had gold at $5,000 per ounce. Unfortunately, it has taken an additional three years to trigger a buying stampede into the precious metals, with silver finally taking the lead from gold; the Senior Gold Miners outperforming gold and silver metal; and the junior miners led by developers and explorers now finally catching a much-deserved bid.

My own portfolio of juniors and physical metal is having a stellar month thus far and I am sure that without the scars of experience adorning my septuagenarian backside, I would be popping champagne corks with celebratory delight this weekend while writing about how absolutely brilliant I have been to have loaded up with so many lovely little 10-cent juniors while being laughed at by the world of cryptojunkies and tech fanatics. However, I do have bear-inflicted scar tissue and a long memory of past disappointments and failed campaigns, not to mention domestic ridicule, chasing Rover the wonder dog from room to room with a wine bottle in one hand and a Manchurian bull whip in the other because the bullion banks had intervened to thwart my dreams of unlimited wealth and self-imagined sex appeal.

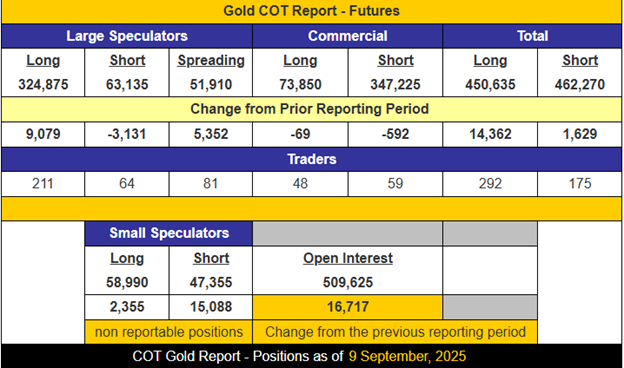

In the cold, cruel light of day, I can honestly say that were this any other point in history, I would be raising cash like a nagging little fishwife while looking over my shoulder for the arm of the bullion bank behemoth standing at the ready to relieve me of my net worth. I would be looking at all of the usual technical indicators like the COT Report, fully expecting a reading of 350,000 net shorts from the Commercials and a weekly increase of several thousand. Instead, an amazingly subdued COT came out tonight with a manageable 273,375 contracts held "net-short" by the "bad guys." Considering the lofty close in gold at an all-time, inflation-adjusted high of $3,683 after hitting $3,715.20 earlier in the week, that behavior by the Commercials was mindboggling.

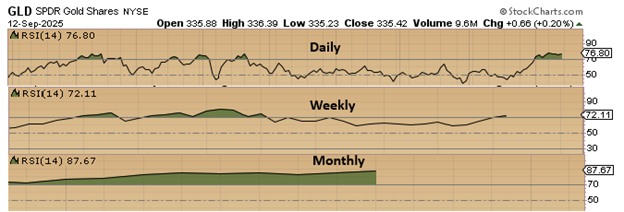

Nevertheless, as the chart below illustrates, gold is overbought on all fronts.

Running RSI readings of 72.11 (weekly), 76.80 (daily), and 87.67 (monthly), this is the same degree of stretched momentum as we saw back in April when gold first approached $3,500. It corrected but it was more of a sideways correction failing at its worst to even approach the $3,000 barrier that was formerly resistance for so long.

Just as stocks were overbought in July and were a virtual certainty to correct in the seasonally weak August-September period, gold might easily trade sideways and form another perfect flag formation, just as it did this past summer. If there is one thing that a hyperinflationary spiral is teaching me, it is that "overbought" is merely the monetary excesses being redeployed.

As for silver, my thoughts are of a nebulous nature; there is nothing technical nor anything fundamental I need to report. This is what I refer to as an "ad hoc" analysis of the silver market. For the first time in a very, very long time (as in decades), I am having déja vu premonitions of the 1978-1980 period when I knew nothing about silver and even less about stocks.

There was an entirely new demographic ("boomers") that had never heard of silver and who had suddenly discovered it as a solution to the gas lines, embargoes, and wars in Vietnam, resulting in a surge of epic proportions into the silver market. By way of their sheer numbers, they steamrolled the offering side of the silver market, inhaling every crumb and heel of supply, taking the market to what would be in today's currency-debased environment US$192.10 per ounce.

They were lined up for entire city blocks to own it with little regard for parental scoffing, economic fundamentals, or price. They overran everyone that tried to stop the train until at long last the regulators, margin clerks, and government conspired to save the bullion banks teetering on insolvency due to unhedged short positions that were rotting their very foundations.

Here in the fading summer of 2025, I see a number of new and much more powerful generations already well-schooled in the evils of central bank and fiscal currency debasement, moving to rotate out of crypto, tiptoeing around gold because it is boring and loved by parents and grandparents, and into silver, the safe haven of choice for the ever-expanding legions of Gen-Z, Gen-X, and Millennial warriors all well cashed up after fifteen years of Bitcoin cultivation and Blockchain enrichment. They have "anointed" silver with the title of "metal of choice" and in their sheer numbers, they are replicating the mania of the late 1970s but with far greater wisdom, infinitely more confidence, and substantially more numbers. Scary . . .

You know that when the Secretary of State of the most powerful country on the planet seriously discusses "Stablecoins" when addressing the nation's balance of payments shortfall, that the world as we used to know it has changed, and it has changed forever. If that generation has adopted silver as the "safe haven of choice", it then explains the countless emails from followers and subscribers a third to a half my age seeking guidance on a metal I have studied and owned for the better part of fifty years, but one that I have never loved, rarely traded, and never trusted. To coin a well-used phrase from the 1980s, "there has been a huge shift in the Force, Luke" . . .

The silver market was one to be faded until the Fed tightening cycle ended in late 2023. Until then, it was drifting aimlessly with little fanfare after one ill-fated attempt by the "SilverSqueeze" cheerleaders, drunk with the success of their Gamestop short squeeze, tried to corner the silver market, breaking the bullion banks in late February 2022. They learned a valuable and very costly lesson back then and have been taking a very measured and guarded approach since. I told subscribers that we needed a two-day close above the $35-36 resistance before taking the silver plunge, only to get it "good and hard" in spades with a classic silver false break-out in April that resulted in a triggered stop-loss a mere week and a half later.

I finally decided in June to simply trust the inevitability of eventual record highs in silver (based purely upon the strength of gold) and bought into Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) via two placements at $0.10 and $0.15 and then followed with a $0.09 placement in Marc Henderson's Carlton Precious Inc (CPI:TSXV; NBRFF:OTCMKTS).

Both were in possession of highly-prospective silver projects with SNAG drilling next to the mighty Keno Hill Mine in Canada's Yukon and CPI awaiting permits to drill the Esquilache silver project in the southern Peruvian Silver Belt, a project operated in the 1950s by the Hochschild mining group.

I am actively pursuing other projects in jurisdictions amenable to the commencement of silver exploration and development, but I fear that the bulk of the low-hanging fruit has already been picked clean. Alas, if I am relegated to the two names I own, I can take solace in the fact that I bought them before silver ascended to mainstream popularity at prices they will never see again.

Applying silver's sudden resurgence to the bigger picture for the metals as a group, it is instructive that we all remember that silver is always a late-stage leader in all precious metals bull markets. Gold, by contrast, has been the leader since the lows in November 2015, while silver has traded in a somewhat moribund manner until the Fed easing cycle began a mere two years ago. Now that silver has caught the attention (and bids) of a new generation of well-heeled traders and investors, it is literally frightening to think of the upside potential for pure silver plays that can actually develop a mineable resource through drilling in the next year or so. The 1978-1980 silver bull took a long time to mature, but when it finally achieved escape velocity, it was majesty at its absolute finest.

At the risk of giving silver the Ballanger-ian "Kiss of Death," everyone should own silver right now with the knowledge and caveat that it is the ultimate "widow-maker" with a long history of turning billionaires into millionaires in a New York nanosecond.

It'll be a fun ride, though. . .

| Want to be the first to know about interesting Gold, Silver and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources, Tesla Inc., and Carlton Precious Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.