Honey Badger Silver Inc. (TUF:TSXV; HBEIF:OTCQB) is a Canadian junior advancing a portfolio of 100%-owned silver assets across the Yukon, Northwest Territories, and Nunavut. The company's strategy is clear: acquire ounces in the ground at low cost, consolidate overlooked historic districts, add value through quality work on the ground, and position itself for maximum leverage to a rising silver price.

Its core assets include the Plata Project in the Yukon, just 30 km from Snowline Gold's Rogue discovery, alongside the Sunrise Lake deposit in the NWT (12.6 Moz Indicated, 14.1 Moz Inferred historic resources) and the Nanisivik Mine in Nunavut, a past producer of more than 20 Moz of silver.

The Clear Lake (5.5 Moz Inferred) and Yava deposits add further optionality. Together, these projects represent over 40 Moz of historic silver resources, with additional exploration upside. In addition, other contained metals, such as zinc and lead, contribute to a roughly 150 million ounces of silver-equivalent total inventory.

Why Silver? Why Honey Badger?

Silver has a history of explosive moves once multi-year bases resolve, and the current setup suggests that another major leg higher may be underway. My ongoing chart, which has accurately mapped previous cycles, is pointing to much higher prices ahead. This can only reinforce the Honey Badger story.

If silver simply repeats the average of its last two major rallies off the COVID lows, the projected price could well exceed US$100 per ounce, the number the Chairman Chad Williams likes to use. Key interim resistance levels remain at US$38, US$50, and potentially US$72–78, but the long-term symmetry of the pattern argues that silver's upside potential is far from exhausted.

With industrial demand from energy transition metals, AI/data center infrastructure, and defense applications converging with renewed investor interest, the technicals align with fundamentals to paint a bullish picture. This is exactly the type of backdrop in which quality junior silver names, like Honey Badger, can deliver outsized returns.

Silver remains firmly on the global critical metals stage, with demand surging in photovoltaics, electronics, and investment. Honey Badger recently expanded its land package at Plata by 26%, adding 1,338 hectares over new geophysical anomalies and uncovering sheeted quartz veins across an 18 km trend, a possible signature of a reduced intrusion-related gold system (RIRGS). Early mapping and sampling are pointing toward multiple untested drill targets.

The company is also reviewing Nanisivik's unmined zones, where historic data indicates the potential for 100 Moz silver at 30–50 g/t Ag, alongside critical metals like germanium and gallium. This combination of growing silver ounces, new discoveries, and critical metal credits creates fresh momentum at a time when silver sentiment is improving, and leverage-rich juniors are beginning to move.

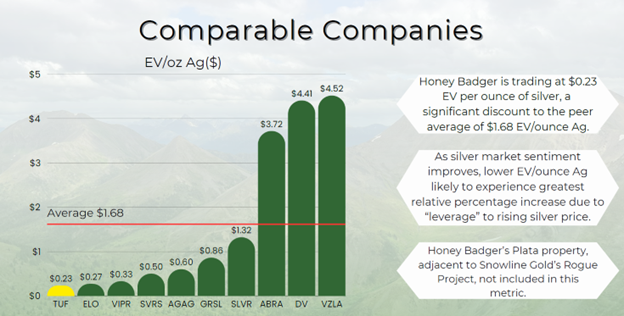

Honey Badger Silver is currently trading at just US$0.23 EV per ounce of silver, a steep discount compared to the peer group average of US$1.68 EV/oz Ag. This relative undervaluation positions the company with significant upside potential as silver market sentiment improves. Historically, companies with the lowest EV/oz multiples often experience the strongest percentage re-ratings when the silver price strengthens, given their built-in leverage. Importantly, this calculation does not even factor in Honey Badger's Plata property in the Yukon, which sits adjacent to Snowline Gold Corp.'s (SGD:TSX.V; SNWGF:OTCQB) Rogue discovery and adds further optionality to the story.

Management

The team is led by Chad Williams, Executive Chairman and Interim CEO, founder of Red Cloud Mining Capital, and former CEO of Victoria Gold Corp. (VGCX:TSX; VITFF:OTCMKTS). Williams is also a director of New Found Gold Corp. (NFG:TSX.V; NFGC:NYSE.American), and Abcourt Mines Inc. (ABI:TSX.V; ABMBF:OTCPK), bringing deep capital markets and operational expertise.

Supporting him are seasoned directors and advisors:

- John Hill – Principal of Rexerro Capital; former partner at Cambrian Capital.

- Koby Kushner, P.Eng., CFA – Mining engineer and CEO of Libra Lithium.

- George Topping – 30 years in mining finance and engineering.

- Dorian Nicol (Advisor) – MIT graduate, 49 years of global experience; managed Nevada and Mexico mines.

- Paolo Cattelan – 30 year engineering career occupying a number of senior executive roles and leadership positions.

- Michael Jalonen (Advisor) – Former world top-ranked precious metals analyst at Bank of America.

This leadership group blends capital markets strength with technical depth, positioning Honey Badger to both unlock resources and transact smartly in a consolidating silver market.

Share Structure & Market Capitalization

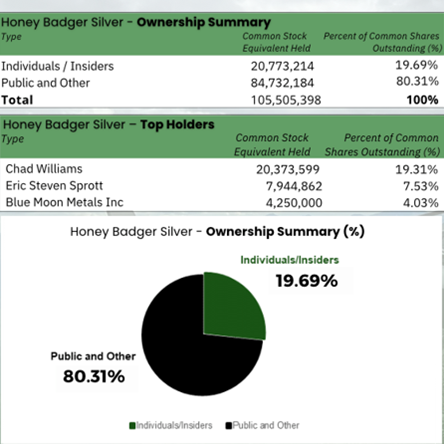

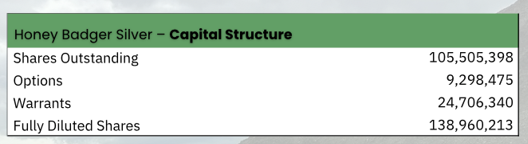

As of September 2025, Honey Badger reports:

- Shares Outstanding: 105.5M

- Options: 9.3M

- Warrants: 24.7M

- Fully Diluted: 139.0M

At CA$0.20/share, this equates to a market capitalization of roughly CA$21 million.

Notably, insiders own nearly 20% of the float, with Executive Chairman Chad Williams the largest holder at over 19M shares. Eric Sprott and Blue Moon Metals are also significant shareholders.

The Projects

- Plata Project (Yukon): High-grade past producer (>3,000 g/t Ag), expanded land package, new sheeted vein system, multiple new targets.

- Sunrise Lake (NWT): Historic Indicated 12.6 Moz Ag + Inferred 14.1 Moz Ag, with gold and base-metal credits.

- Clear Lake (Yukon): Historic 5.5 Moz Ag resource within a SEDEX system.

- Nanisivik (Nunavut): Past production >20 Moz Ag, 100 Moz silver target potential in unmined zones.

- Yava (Nunavut): Acquired 2024; historic 4.5 Moz Ag resource plus zinc-lead credits.

Each asset is 100% owned and carries minimal holding costs — effectively giving shareholders "free options on silver price" with district-scale upside.

Technical Analysis

Price Structure:

Honey Badger has emerged from a multi-year base following a steep decline in 2022–2023. Since mid-2023, the stock has been carving out a broad bottoming pattern, marked by a series of higher lows through 2024–2025. That type of long base often precedes significant trend reversals in junior mining equities.

The breakout attempts in early and mid-2025 show that buyers are beginning to regain control. The most recent move above CA$0.20 suggests the formation of a new bullish leg, although resistance at CA$0.25 (back price resistance) remains a key hurdle.

The symmetry of the pattern is worth noting: "the same way down, the same way up." This reflects how sharp declines, once stabilized, can often produce equally sharp rebounds when accumulation returns.

Moving Averages:

The 50-day moving average (MA) has crossed above the 200-day MA, forming a golden cross — a widely watched bullish signal.

Price is consolidating above both moving averages, with the 50-day rising and acting as short-term support.

The 200-day at ~CA$0.17 provides a secondary support zone.

Volume and Accumulation:

Volume analysis confirms the technical picture. Breakouts have occurred on strong upside volume, while pullbacks have been on lighter trading.

This pattern is consistent with institutional accumulation. The chart also shows a steady increase in volume since late 2024, signaling broad market interest returning to the name.

Momentum Indicators:

RSI is sitting in the mid-50s range, a neutral level that leaves ample room for further upside before reaching overbought conditions.

MACD remains positive, though slightly flattening, consistent with a consolidation phase after the recent breakout.

Price Targets:

Upside objectives, based on historic resistance zones and the measured move potential, are as follows:

- 1st Target: CA$0.25 (back price resistance, first key breakout level)

- 2nd Target: CA$0.45 (multi-year resistance, prior support zone)

- 3rd Target: CA$0.75 (major resistance from 2021 levels)

- Big Picture Target: CA$1.25 (measured move from multi-year base; would complete a full recovery cycle from the 2022 decline)

Risk Levels:

Key supports to monitor. . .

- CA$0.18 (short-term support; near rising 50-day MA)

- CA$0.17 (200-day MA, critical longer-term base support)

- A breakdown below CA$0.15 would weaken the bullish case and delay the upside targets.

Honey Badger Silver is showing classic signs of a major base breakout. With higher lows, a golden cross, increasing volume on rallies, and defined resistance levels ahead, the stock appears positioned for a sustained move higher. Confirmation comes with a decisive close above CA$0.25, which would open the path toward the CA$0.45–CA$0.75 range.

Conclusion

Honey Badger Silver brings together a tight share structure, strong insider ownership, and a diversified portfolio of silver-rich assets across Canada's north. With fresh catalysts at Plata and Nanisivik, a foundation of historic resources across multiple projects, and additional upside through royalty structures, the company is well-positioned as silver regains investor attention.

For speculative investors seeking low-cost leverage to silver in a technically strengthening junior, Honey Badger offers one of the strongest setups among Canadian-listed silver explorers. At the August 29, 2025, closing price of CA$0.205, I view the shares as a Speculative Buy.

For more information, visit the company's website: honeybadgersilver.com.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Snowline Gold Corp.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.