Applying my old training in financial analysis (at least what I can recall of it) to the existing resource at Fitzroy Minerals Inc.'s (FTZ:TSX.V; FTZFF:OTCQB) Buen Retiro project, it is important to remember that the drilling to date has been confined to the old pit structure, where open pit operations were carried out in past cycles.

The drilling to date has been focused on the northern area, where there exists a 1,200m strike length, and to the south and southwest portion, which carries 2,700m of strike length.

Neither the north nor the south-southwest areas have been drilled off yet. In fact, there is a 10 kilometers (10,000 meters) of total strike length from north to south to be investigated, leaving the potential for substantial increases to the existing volume of ore estimated to be around 30 million tonnes of oxide copper grading around 0.6% with 96.67% recoverable.

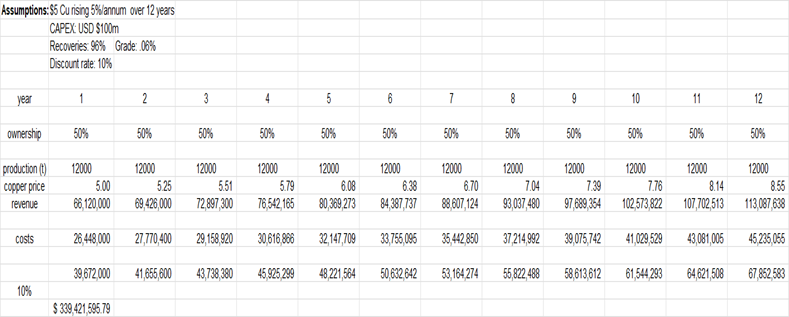

The figure at the bottom of the spreadsheet shown here of US$339,421,565.70 is the discounted net present value of the annual free cash flows that accrue to FTZ/FTZFF, assuming the following:

- Copper price: US$5/lb. escalating at 5% p.a. for 12 years US$8.98/lb.

- CAPEX: US$100,000,000

- Grade: 0.06%

- Recovery: 96.67%

- Discount rate: 10%

If I convert the DNPV of US$339,421,565 to Canadian (at 1.3797), I arrive at US$468,299,933. To determine the value per share of those payments, I divide by the fully-diluted share capital of approximately 320,000,000 to arrive a CA$1.46 (US$1.05) per share, which is 5.21 times the current price of CA$0.28 (US$0.2055).

It is important to recognize that the 30 million tonnes is by no means a 43101-compliant figure, nor is it coming from the company in any official capacity. I simply ask those who understand the deposit to give me a number that would stand up under the scrutiny of a maiden resource estimate, which I think will be forthcoming after this Phase II drill program has been completed by year-end. The grade at 0.6% is based upon historical numbers and will, in my view, be corroborated when the drill holes are released in the next few weeks, while the recovery rate at 96.67% is based upon past metallurgical work that is in the public record.

The significance of this lies in the fact that Chilean copper miner Pucobre SA has a 30% clawback provision in place whereby they must pay Fitzroy three times whatever has been spent to date on Buen Retiro (estimated to be US$20 million) totaling approximately US$60 million in order to exercise that right.

They can earn another 20% by funding the construction of the mine (estimated at US$100 million). At that point, Fitzroy earns a free-carried 50% of the free cash flow generation which totals US$339,421,565 over 12 years of mine life.

With over 35 million "in-the-money" warrants out there, the exercising of said warrants puts another CA$26 million into the corporate treasury so this little junior could conceivably be sitting on a cash reserve of in excess of CA$86 million or nearly CA$0.27 per share between now and the end of next year — with the stock price at CA$0.275 bid!

Now, this is where it gets exciting.

The Buen Retiro asset allows FTZ/FTZFF to explore both Buen Retiro and Caballos with no further need for financing, probably until well into 2026, but perhaps never again, especially if Pucobre SA exercises its clawback. Most importantly, shareholders of FTZ/FTZFF can expect a significant "lift" from Buen Retiro alone, which means that they get a world-class exploration play at Caballos essentially for free.

You get the low-risk predictability of the Buen Retiro asset operated and funded by a large and very successful Chilean miner (Pucobre SA) and the wild west, gunslinger excitement of the copper-molybdenum discovery on the Chincolco anomaly at Caballos and where a second anomaly 7 km. to the north (Cerro los Mulas or "Mule Hill") awaits exploration when the weather clears in September.

When I think about Caballos and its potential, I look 45 km. to the north, where Antofagasta's flagship Los Pelambres copper-molybdenum Mine is in full production with estimated reserves of 4.9 billion tonnes of ore, grading 0.65% copper. Then I look to the south of Caballos, where Anglo-American's Los Bronces copper-molybdenum Mine is also in full production with estimated reserves of 3.13 billion tonnes of ore grading 0.32% copper.

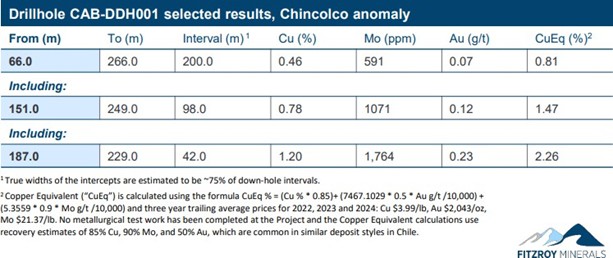

In sum, Caballos is perfectly located in the cradle between two world-class copper-moly mines, and it has graduated from being simply "prospective" because they actually have a new copper-molybdenum discovery — with an initial discovery hole running 200m of .81% Cu-Eq grade within which was a high-grade section of 42m of 2.26% Cu- Eq mineralization.

In my 47 years of speculating on mining companies with a particular passion for exploration plays, I have had an equal number of "misses" as I have had "hits" but because my entry level for these companies is usually both "early" and "cheap," I have minimal downside risk as measured against the upside potential.

In all of those plays, including Hemlo in 1981, Eskay Creek in 1988, Dia Met in 1991, Diamondfields in 1993, and Mountain Province in 1995, on no occasion was I ever protected by having a core asset like Buen Retiro, not only limiting my downside risk but also providing significant upside on its own. I was normally forced to speculate in an "all-or-none" manner without the safety of a core asset. As such, with FTZ/FTZFF, I am now afforded a risk-free "shot" at another potential Los Pelambres or Los Bronces where the company has already established a discovery.

Ladies and gentlemen, it does not get any better than this if you are in the habit of speculating on junior resource companies. Whenever you find a little jewel like this one with all of the attributes kicking in on all cylinders, you are forced to go "ALL-IN."

The advantage we all have is that we know that there is still a lot of the 10-cent and 15-cent paper in circulation, albeit funded primarily by GGMA subscribers and followers, and that no matter what I say or write, some shareholders will have a need to sell. I am not a seller, and I still hold the 350,000 shares I bought literally accidentally back in September 2023 at CA$0.035, when the old Norseman Silver was getting trashed by the vendor of those B.C. properties. The reason I "hang on for dear life (or "HODL" as the Bitcoin kiddies would say) is that you need a 10-20-bagger to offset the ones you buy that "miss."

We should get an update from FTZ/FTZFF between now and month-end, so I want you all to remember — and this is important — that any grade north of 0.5% copper when situated in an oxide host is considered "high-grade ore." Remember that the model shown above uses a grade of 0.6% with a 96.67% recovery rate. As has been the case in every barnburner release made by the company thus far in 2025, these drill reports are used by traders as liquidity events, and they sell. I throw my hands in the air, but the Pavlovian response to positive drill results is due to the dreadful environment we have been forced to endure in the junior miners, largely since late 2021. That is all about to change as the tech stocks and crypto deals fall by the wayside and the commodities trade takes over all to happen by the end of October.

You want to build a large and bullet-proof position in FTZ/FTZFF between now and the time they move the three drill rigs to Caballos between now and the end of September, because the Q4/2025 and 2026 drilling seasons are going to be epic.

| Want to be the first to know about interesting Copper and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.