StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) may be one of the most overlooked gold exploration stories in Nevada's Walker Lane. In a move that stunned insiders familiar with the asset, the company acquired the Hercules Gold Project, a large, fully permitted oxide gold system, for just US$250,000.00 after the asset had previously sold for US$25 million.

Now, with fresh capital, a tight structure, and a new drill plan built around a structural model that flips past assumptions on their head, StrikePoint is beginning to confirm a million-ounce exploration target.

And the market hasn't caught on.

Yet.

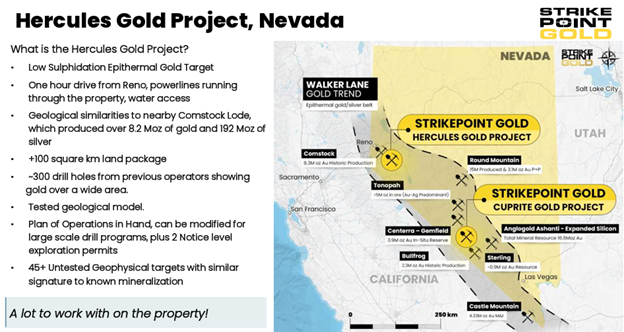

StrikePoint is a Canadian junior focused on high-grade, near-surface gold discoveries in tier-one jurisdictions. Its flagship Hercules Project is located just one hour from Reno and 20 kilometers east of the historic Comstock Mine, which produced over 14 million ounces of gold. The company controls a vast land package, over 1,323 unpatented and four patented claims, covering 100 square kilometers, making it the fourth-largest landholder in Walker Lane, behind only AngloGold, Kinross, and Centerra.

While many juniors were on life support during the recent bear market in gold, StrikePoint used that time to quietly acquire a portfolio of highly prospective assets. That included the Porter and Willoughby properties in British Columbia's Golden Triangle, of which, Porter was later monetized. The company's strategic pivot to Nevada is timely. The Walker Lane is not only one of the world's top-ranked mining jurisdictions, it's also where consolidation, capital, and exploration success are all converging.

CEO Mike Allen is no stranger to value creation. He was behind the acquisition and sale of the Sterling Project in Nevada to Coeur Mining for US$120 million, a 12x return. In 2020, he led the Hercules Project under Eclipse Gold and sold it for US$25 million in a merger. Four years later, StrikePoint reacquired the same project for US$250,000 after the buyer went bankrupt on another asset. With Hercules back in hand, Allen returned with a drill plan and a structural reinterpretation of the system that's already proving out.

Investor relations is led by Knox Henderson, known for his tremendous work with Great Bear Resources during the difficult early days, and Kodiak Copper. At the board level, StrikePoint is chaired by Sean Khunkhun a consistent champion of junior exploration companies and a capital raiser, he is President of Dolly Varden Silver, reinforcing its alignment with Discovery Group alumni and strategic capital. This is a team that's been around gold markets long enough to know how to build, communicate, and execute.

The capital structure remains tightly held. With a sub-CA$10 million market cap and roughly 40 million shares outstanding post-consolidation, StrikePoint is funded for its next phase of drilling thanks to a CA$3 million financing completed in 2024. The company also retains equity in Dolly Varden Silver, having sold its Porter project for CA$1.2 million in Dolly stock, giving StrikePoint added leverage to success in BC's silver district. Insiders hold a meaningful position, and there's very little overhang on the cap table.

The Walker Lane is becoming ground zero for gold exploration and consolidation in the U.S. AngloGold has spent over US$600 million consolidating the Beatty District surrounding its 3.4-million-ounce Silicon discovery.

Centerra Gold paid US$200 million to acquire the Gemfield Project in 2022. Kinross continues to operate the 28-million-ounce Round Mountain Complex in the trend, and Equinox Gold's Castle Mountain is in production nearby. In this context, StrikePoint's land position, exploration target, and location could not be better timed.

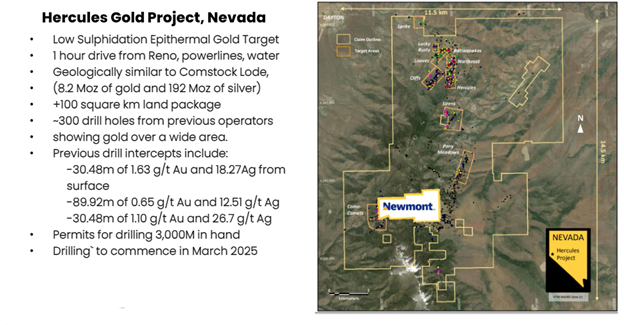

The Hercules Project comes with over 300 historic drill holes, a large geophysical and geological dataset, and alteration zones that span 6 by 13 kilometers. When Allen returned to the project, he brought back the knowledge of why previous drilling lacked predictability: the orientation was wrong.

Veins that appeared to pinch out were actually listric, flipping direction at depth. The 2024 drill campaign flipped the drill direction, testing the model, and confirmed both continuity and grade.

Early results include 117 meters of 0.45 g/t gold, with a high-grade section of 12 meters grading 2.0 g/t. Historic results include 89 meters of 0.65 g/t gold with silver credits and 30 meters of 1.65 g/t gold plus 18 g/t silver.

These are compelling numbers for an oxide heap-leach system in Nevada. The project currently carries an exploration target between 800,000 and 1 million ounces, and numerous targets remain untested, including the Loaves zone, a geochemical anomaly with gold-bearing sagebrush and no prior drilling.

Technical Picture: When You Hit Rock Bottom, the Only Path Is Up

StrikePoint Gold is trading at levels where most have already walked away. At CA$0.075 the stock sits near multi-year lows. From a technical standpoint, this is often the zone where risk and reward begin to shift, not because the trend has reversed, but because the selling has finally exhausted itself.

The chart shows a long and grinding downtrend with both the 50-day and 200-day moving averages still sloping downward. The 50-day has consistently acted as resistance since early 2024, and the 200-day remains far overhead. However, price has begun to stabilize above key support at CA$0.07, forming what could be the early stages of a base.

Momentum indicators paint a familiar picture for a stock that's hit rock bottom. The MACD remains below zero, showing no crossover yet, and the RSI sits around 35, oversold, but not diverging. However, recent volume spikes in July 2028 are worth watching. For the first time in months, buying interest has returned in size, and price has held firm in response. That's not yet confirmation of a reversal, but it's a sign of accumulation beginning to stir.

From a chartist's perspective, the roadmap from here is clear:

Target 1: A breakout above CA$0.10, the psychological line in the sand. A decisive move through this level, with volume, would set the stage for a test of the 50-day moving average near CA$0.13.

Target 2: CA$0.22, the 200-day MA and a gap-fill zone from late 2023.

Target 3: CA$0.31, a retracement level with historical consolidation.

Big Picture Target: CA$0.50, the 2023 high and pre-breakdown resistance. Reaching this would require a fundamental re-rating, but technically, it remains within reach should a sustained trend emerge.

Now, SKP.V remains speculative. But as the saying goes: "When you hit rock bottom, the only path is up." From this zone of maximum pessimism, even a modest bit of news, volume, or reversal confirmation could ignite a climb back toward more meaningful territory.

Final Thoughts

StrikePoint Gold at its current price of CA$0.08 cents per share, SKP.V is a rare combination: deep-value optionality, a fully permitted oxide gold asset in one of the world's best mining jurisdictions, a proven technical and capital markets team, and a meaningful exploration target on a district-scale land package.

Add in a tight share structure, current drilling, and the possibility of news flow in the coming months, and you have the ingredients for a speculative turnaround. Therefore, we view StrikePoint as a Speculative Buy at the current price of CA$0.08 cents. In a market that's rewarding companies with scale, jurisdictional safety, and near-surface oxide gold systems, StrikePoint could go from forgotten to front-page fast.

You can find more information by going to their website here.

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) closed for trading at CA$0.08, US$0.5605 on August 8, 2025

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- StrikePoint Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of StrikePoint Gold Inc.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.