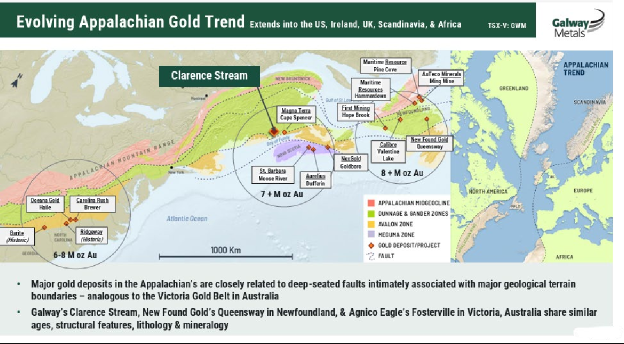

Galway Metals Ltd. (GWM:TSXV; GAYMF:OTCQB) is an advanced-stage Canadian gold and antimony explorer with one of the more compelling district-scale portfolios in Eastern Canada. With 2.25 million ounces of high-grade gold already defined at Clarence Stream, a past- producing polymetallic VMS project at Estrades, and a CEO with a track record of building and selling resource companies, Galway offers investors exposure to two overlooked assets in proven jurisdictions, and a stock that looks primed for a move.

The current market cap is just $47 million, with no debt, over $5 million in cash, and a tightly held structure — 20% is owned by management, insiders, and institutions who know the business. After a pullback from $0.80 to around $0.36, Galway's chart suggests the setup for a technical breakout, with upside targets pointing toward $1.05.

Jurisdiction Advantage: New Brunswick

Galway's flagship Clarence Stream project sits in the heart of southern New Brunswick, a mining- friendly province with competitive tax rates, efficient permitting, and some of the lowest drilling and operating costs in Canada. The project is exceptionally well-serviced, with paved roads

throughout, rail within 100 km, and grid power ranked the 4th cheapest in the country. It's also within reach of a tidal deep-water port and two airports, including one international.

Nearby population centers like Fredericton (63,000) and Saint John (130,000) provide access to a skilled workforce and essential services. The project benefits from proximity to the Mount Pleasant mill and permitted tailings facility, further enhancing its development potential.

The Flagship: Clarence Stream: A Gold-Antimony Dual Asset

Clarence Stream hosts a growing gold system with 2.25 million ounces of gold in open-pit and underground resources, averaging 2.3 g/t and 4.5 g/t, respectively. But perhaps the most overlooked element is the 25 million pounds of antimony, a critical mineral now trading at significantly higher prices due to export restrictions from China.

Recent drill results confirm the potential to grow the resource. Galway's latest hit, 26.9 g/t gold over 8.6 meters (230 g-meters) — was encountered at the margin of the current pit model.

According to CEO Robert Hinchcliffe, the deposit remains open in all directions, with three drill rigs now turning. What's even more compelling: Galway estimates current defined ounces represent less than 7% of the overall 65-km gold corridor, underscoring the scale and upside still ahead.

Management: Proven Builder with Skin in the Game

Galway is led by CEO Robert Hinchcliffe, who previously sold Galway Resources for $340 million, creating two spinouts in the process. He also served as CFO at Kirkland Lake Gold and worked as a mining analyst on Wall Street. His alignment is clear: he's purchased 2.7 million shares on the open market in the past two years.

Management, board, and insiders own 20% of the company, capital that's committed, not promotional. Top institutional shareholders include Van Eck, Caisse de dépôt (CDPQ), Mackenzie Investments, and Schroders, alongside the Extract Exploration Fund.

Capital Structure Snapshot Market Cap: $47 million Cash: >$5 million

Debt: None

Shares Outstanding: ~107 million

Options/Warrants: ~15 million combined

Ownership: ~20% management/insiders/family

Top Holders: Extract, Van Eck, CDPQ, Mackenzie, Schroders

With two 100%-owned flagship projects, no debt, and institutional backing, Galway's valuation appears disconnected from what's in the ground, and what's still to be discovered.

Technical Analysis: See the Fractal

Galway's chart is showing signs of life again. After a steep pullback from $0.80, the stock has started carving higher lows forming a familiar fractal base that closely resembles the 2024 pattern which preceded a rally to $0.90.

Key upside targets:

Target 1: $0.50: Breakout above current resistance

Target 2: $0.70: Mid-channel resistance

Target 3: $0.90: Prior high

Big Picture Target: $1.05: Full extension

Volume is increasing, MACD is curling upward, and price is testing the downtrend line. It's the kind of setup traders wait for.

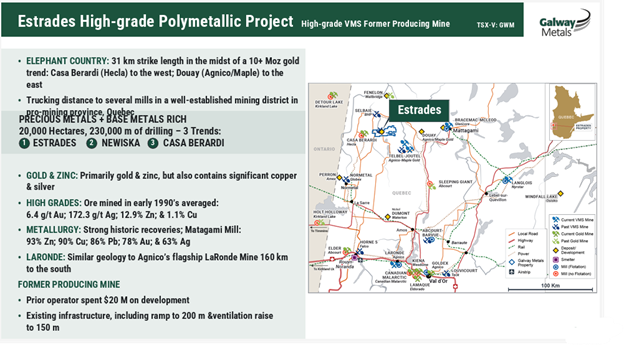

Estrades: A Second Flagship with VMS Upside

Galway also owns the Estrades Project in Quebec, a former-producing, high-grade VMS deposit that remains wide open.

The company controls a 31-km land package encompassing the Estrades mine, Newiska concessions, and Casa Berardi claims, all located within one of Canada's most productive gold-zinc belts.

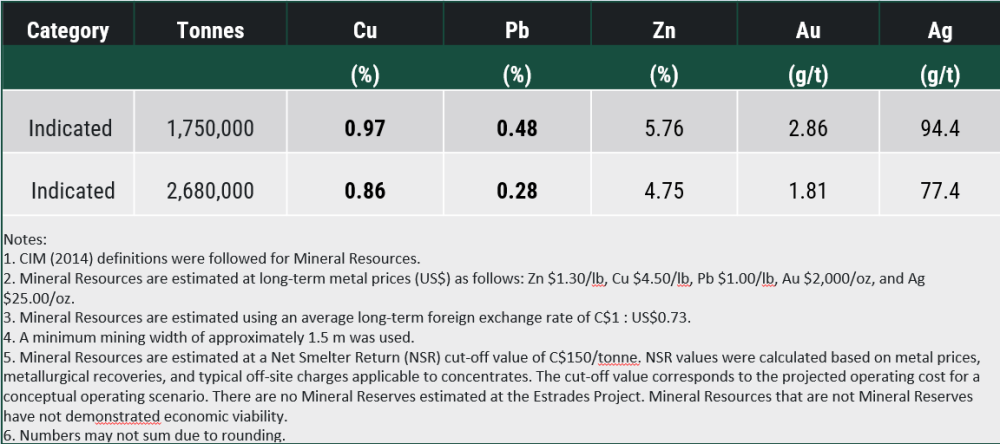

The project hosts:

Historical mined grades averaged 6.4 g/t Au, 172 g/t Ag, and 12.9% Zn. With over 230,000 meters drilled and $20 million in development already sunk into the project, Estrades is now undergoing metallurgical optimization and a scoping study — with the goal of identifying deep VMS feeder systems.

For investors seeking optionality to rising gold, zinc, copper, and silver prices, Estrades offers significant upside potential, often overlooked in current valuations.

Upcoming Catalysts

- Ongoing drill results from Clarence Stream (gold and antimony)

- Resource expansion at Southwest and North deposits

- Metallurgical testing to optimize gold/antimony recoveries

- Estrades scoping study underway

- Potential resource update at Clarence Stream in early 2026

Final Thoughts

Galway Metals isn't getting credit for the ounces it already has — or the ones it's likely about to define. Between a proven management team, strong insider ownership, district-scale upside at Clarence Stream, and a high-grade VMS asset at Estrades, this is a classic case of undervalued optionality at a time when developers are coming back into favor.

The recent pullback has created a buying opportunity. If the technical breakout materializes and drill results keep hitting, GWM.V may not remain a sub-$0.40 stock for long.

With both fundamentals and technicals pointing to a disconnect in valuation, Galway Metals is a Speculative Buy at current levels.

Learn more at: www.galwaymetalsinc.com.

Galway Metals Ltd. (GWM:TSXV; GAYMF:OTCQB) closed for trading at CA$0.455, US$0.325 on August 5, 2025.

| Want to be the first to know about interesting Gold and Antimony investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.