Concerned you've "missed the boat" on the gold upswing — or perhaps the initial phase of silver's surge — have no fear.

Within the realm of precious metals, both gold AND silver are just getting started. And the genuine potential isn't found in collecting coins or acquiring bars . . . it's in possessing shares of mining operations extracting silver from beneath the earth and transforming gold into an innovative asset category.

But not just any mining operations. The small, overlooked producers that haven't crossed your radar are delivering the most substantial returns — and they're only at the starting line.

Let's examine this opportunity. . .

Silver's Positioning Appears More Promising Than Before

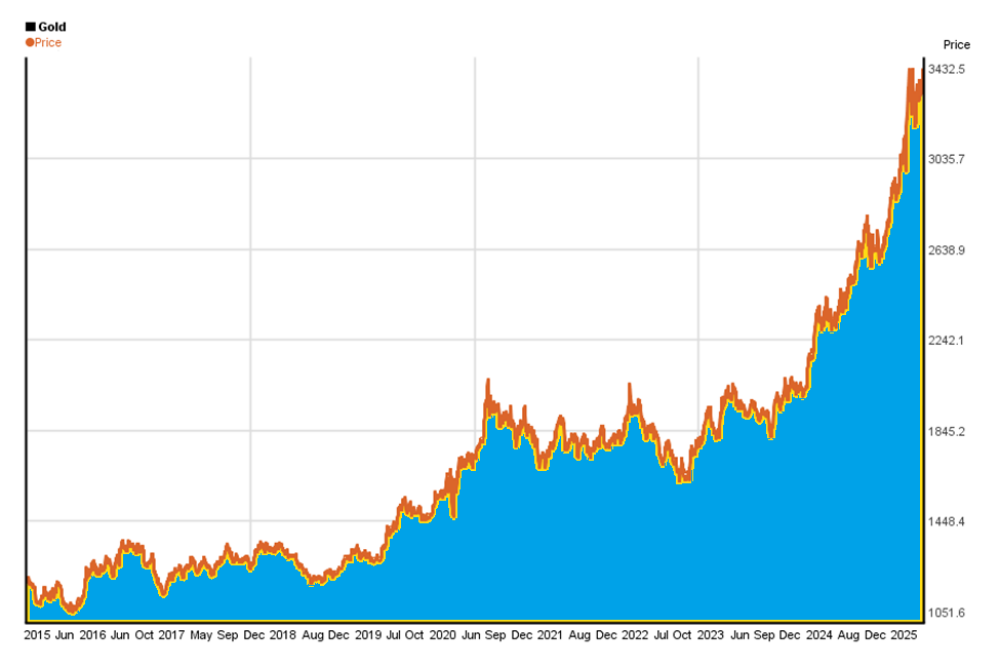

Gold captured headlines throughout 2024 when it surged to unprecedented peaks.

Central Banks were relentlessly accumulating gold. Investors sought refuge from inflationary pressures, national debt burdens, armed conflicts, and market turbulence.

Yet while gold commanded attention, silver quietly began establishing its own bullish foundation.

Now, in 2025, silver is genuinely breaking barriers and exhibiting its typical behavior: climbing higher and quicker than gold.

Here's why this momentum is authentic:

- Manufacturing Demand is Escalating: Silver represents a crucial component for photovoltaic panels, electric vehicles, advanced telecommunications, and microchips. As artificial intelligence and electrification expand globally, silver requirements are intensifying.

- Resources are Constrained: Decades of inadequate investment mean insufficient new silver extraction. When consumption explodes while supply remains unresponsive, valuations skyrocket.

- Gold Advances First, Silver Trails — Then Accelerates: Gold initiates the movement, then silver catches up... frequently overtaking it. This delayed-reversal pattern is what we're witnessing currently.

- Silver Remains Undervalued: The comparative ratio between gold and silver significantly exceeds historical averages. Should this relationship normalize, silver prices must increase substantially.

Every indicator suggests silver isn't merely ascending, but launching upward. However, The Substantial Earnings Aren't Found in the Metal — They're Within the Mining Companies

Here's the undisclosed reality of precious metals investing: possessing physical silver or exchange-traded funds might safeguard wealth . . . but they don't expand it rapidly.

If you're seeking genuine appreciation potential, you must own enterprises that extract silver from underground. When silver prices shift, the financial dynamics of silver production transform dramatically — potentially supercharging mining company stocks.

For instance, if silver advances from $25 to $30 per ounce, representing a 20% increase.

But for an extraction company producing silver at $20/oz, its profitability doubles.

And we're not discussing sluggish established producers. The actual excitement surrounds junior mining operations.

Small-Scale Miners = Exceptional Returns

Let's review the performance metrics.

Thus far in 2025, several of the smallest silver mining enterprises have dramatically outperformed their larger counterparts:

- Argenta Silver Corp. (AGAG:TSX.V; AGAGF:OTCQB) – increased 54.35%

- Silver Storm Mining Ltd (SVRSF:OTCMKTS) – increased 57.83%

- Klondike Silver Corp (KS:TSXV; KLSVF:OTCMKTS) – increased 80%

- Silver Hammer Mining Corp. (HAMR:CSE; HAMRF:OTCQB) – increased 102.7%

- Apollo Silver Corp. (APGO:TSX.V; APGOF:OTCQB) – increased 122.55%

- Avino Silver & Gold Mines Ltd. (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE) – increased 263.4%

- Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA; DVQ:FSE) – increased an astonishing 402.24%

Compare these results against the "industry leaders":

- Endeavour Silver Corp. (EDR:TSX; EXK:NYSE; EJD:FSE) – increased 30.74%

- Silvercorp Metals Inc. (SVM:TSX; SVM:NYSE) – increased 41.92%

- Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) – increased 46.99%

- First Majestic Silver Corp. (AG:TSX; AG:NYSE; FMV:FSE) – increased 52.04%

This isn't an error. The top-performing large-capitalization company barely matched the least-performing junior enterprise. And the leading junior operations? They're vastly outpacing the major corporations.

This explains why smaller mining ventures matter. They're adaptable. They're financially leveraged. And they surge dramatically when silver prices advance.

Why This Pattern Will Likely Persist

This isn't an anomaly. It's a predictable sequence — and it's merely commencing.

- Smaller Enterprises Possess Greater Leverage: A single high-concentration discovery, or simply rising silver valuations, can triple a small-capitalization company overnight.

- Merger Activity Provides Momentum: Major mining corporations are searching for additional reserves. They're issuing payments to junior operations with promising assets — and those acquisitions can yield substantial rewards.

- Market Participation Shifts: Gold has already advanced. Silver is advancing now. And the smallest mining enterprises are typically the last to ignite — but burn most intensely.

- The Broader Context Remains Favorable: Electrical transformation, artificial intelligence infrastructure, and sustainable technologies all require substantial silver. Combined with limited availability? It creates exponential growth conditions.

An Alternative Strategy to Participate: Digital Gold from NatBridge Resources

Now, if you overlooked the early segment of the supercycle in gold and silver — and even if junior mining ventures seem excessively volatile — another participation strategy exists.

Digital gold. But not ordinary digital gold.

We're describing a revolutionary gold-backed digital asset: one that's completely secured on a one-to-one basis by verified underground gold deposits — not a speculative token or empty commitment.

And the industry pioneer in this domain is NatBridge Resources Ltd. (NATB:CSE; NATBF:OTC; GI80:FSE).

Here's their operational approach: NatBridge has acquired extensive, high-concentration gold reserves within American territory, authenticated under NI 43-101 protocols.

Rather than extracting and marketing it, they'll digitize it — establishing virtual assets secured 1:1 by gold remaining underground.

No extraction necessary. No ecological disruption. No warehousing expenses.

Simply legitimate, verified gold — digitally accessible and exchangeable instantaneously via distributed ledger technology.

For participants who missed the preliminary escalation in physical gold, NatBridge's framework introduces an entirely fresh investment category positioned to expand alongside the continuing precious metals bull market.

It represents a streamlined, protected, economical method to participate in gold's appreciation without depending on exchange-traded funds, derivatives, or governmental storage facilities. And similar to junior silver ventures, it remains undiscovered . . . temporarily.

Don't Remain Sidelined

Silver is gaining momentum.

Industrial requirements, geopolitical uncertainty, currency devaluation, and an eager marketplace are collectively driving valuations upward. And historical patterns indicate that silver doesn't merely follow gold — it surpasses it.

But the most significant returns won't derive from numismatic items or bullion.

They'll emerge from modest silver extraction enterprises with the financial leverage to convert moderate price movements into triple-digit yields...

And from groundbreaking ventures like NatBridge, which are reimagining precious metals investment through digital instruments backed by authentic, underground gold.

| Want to be the first to know about interesting Special Situations, Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dolly Varden Silver Corp. and NatBridge Resources Ltd. billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Argenta Silver Corp., Dolly Varden Silver Corp., Pan American Silver Corp., and NatBridge Resources Ltd.

- Jason Williams: I, or members of my immediate household or family, own securities of: Apollo Silver Corp., Avino Silver & Gold Mines Ltd., Silvercorp Metals Inc., and NatBridge Resources. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector. Pan American Silver is a recommendation in my newsletter, The Wealth Advisory.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.