Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA; DVQ:FSE), halfway through its current 35,000-meter (35,000m) drill program at its Kitsault Valley project in British Columbia's Golden Triangle, increased the scope by 20,000m, taking the total to 55,000m, and added a fifth drill rig, according to a news release. The remainder of drilling will prioritize the Wolf vein extension and test multiple silver, gold and copper exploration targets elsewhere at the project, including the Big Bulk porphyry system.

"Dolly Varden Silver isn't just dipping a toe into British Columbia's mineral-rich terrain this summer — they're diving in head first," Jeff Valks, senior analyst for The Gold Advisor, wrote in the July 24 edition. "With more drills spinning, new zones lighting up, and strategy guiding the targets, Dolly Varden is clearly eyeing a bigger prize in the Kitsault Valley."

The Canadian explorer expanded the in-progress drill campaign following its strong start and following the company's CA$29 million (CA$29M) financing, including participation by Eric Sprott, noted Dolly Varden President and Chief Executive Officer Shawn Khunkhun in the release. With the added meters, Dolly Varden may drill test further key exploration targets and keep growing the high-grade silver zone at the Wolf vein.

Already, the company drilled systematic stepout holes at Wolf where mineralization is becoming increasingly robust, according to alteration and structural studies, noted the release. This is where Wolf approaches the projection of the Central Valley/Moose Lamb fault system, connecting from the Torbrit silver deposit about 1 kilometer away.

The two rigs thus far drilling at Wolf will stay there for directional drilling, testing downplunge and stepping out in search of the mid-valley structural intercept. Directional drilling, the release explained, is a more precise, sustainable method that involves focusing on strategically placed intercepts instead of total meters. This more precise, sustainable method allows Dolly Varden to decrease total meters drilled by employing the same mother hole many times.

The two other rigs of the four were used to test priority exploration targets at the Moose, Chance and Red Point prospects and were moved to the Homestake Ridge silver deposit.

The just-added fifth rig, already mobilized to the site, will be used to drill Dolly Varden's 26.54-square-kilometer (26.54-sq-km) Big Bulk copper-gold porphyry system 10 km east of Torbrit. Big Bulk is similar to other such deposits in the region, including Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) KSM and Ascot Resources Ltd.'s (AOT:TSX.V) Red Mountain.

Also of note, Dolly Varden's geological team has ramped up geological field work, including mapping and sampling of underexplored areas on the recently consolidated claim packages.

Also of note, Dolly Varden's geological team has ramped up geological field work, including mapping and sampling of underexplored areas on the recently consolidated claim packages.

With this, the objective is to develop drill targets for the company's late 2025 and 2026 exploration programs.

Aggressively Exploring, Expanding

Headquartered in Vancouver, Dolly Varden Silver is a mineral explorer advancing Kitsault Valley, one of the largest, high-grade undeveloped precious metals assets in the Golden Triangle, a safe, tier 1 jurisdiction.

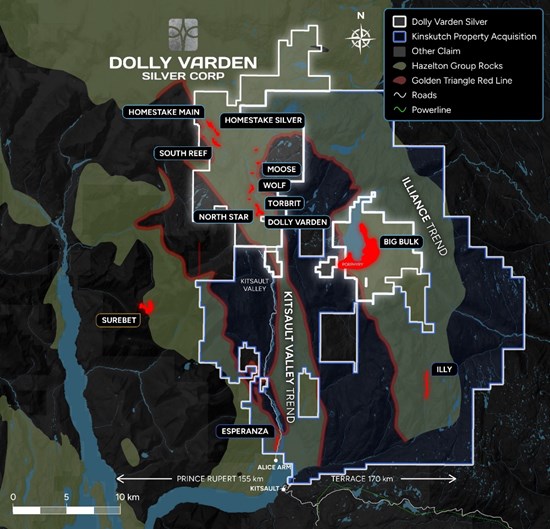

Kitsault Valley encompasses the 88-sq-km Dolly Varden silver project, the 75-sq-km Homestake Ridge high-grade gold and silver project, the Big Bulk system, and the past-producing Dolly Varden and Torbrit silver mines. Kitsault Valley is at the southern tip of the prolific Golden Triangle, just south of Newmont Corp.'s (NEM:NYSE) Brucejack mine and Skeena Resources Ltd.'s (SKE:TSX.V) Eskay Creek mines.

The explorer's series of property acquisitions in May has closed, Peter Krauth highlighted in a July 5 Silver Stock Investor edition. The properties are Kinskuch, Porter Idaho, the American Creek (consisting of Mountain Boy, Silver Crown and Dorothy), Theia, BA and Red Cliff.

"The combined land package offers strong silver, gold, and base metal potential across multiple underexplored targets hosted in favorable stratigraphy, with proximity to infrastructure and historic high-grade production," Krauth added. "The American Creek property in particular looks very exciting, with wide intercepts of bonanza-grade silver and production spanning decades."

With these new assets, Dolly Varden's entire land package in the Golden Triangle now spans 100,000 hectares of prospective Hazelton formation rocks and, in addition to Torbrit and Dolly Varden, includes the Porter Idaho, Mountain Boy and Esperanza historical mines as well.

Positive Short, Long-Term Outlook

There is more price upside in silver in the near term, purported Columnist Jim Wyckoff in a July 23 Barchart article, as indicated by the metal's recent rally coinciding with major U.S. stock indices hitting record highs and with risk appetite in the general market rising. Accordingly, it is "highly possible," he added, silver could set new record highs before Labor Day.

He cited three key factors likely to benefit silver in the near-term. They are geopolitics, including the Aug. 1 U.S. copper tariff effective date, strained U.S.-Russia relations, volatility in the Middle East. Wyckoff noted the technical charts for silver remain bullish overall for short and the longer terms, which will keep "chart-based traders and investors playing the long side of the metals." Encouraging economic data out of the U.S. and China likely translates into improved consumer and commercial demand for silver, especially from China.

A July 21 Sprott article asserted that strong fundamentals should keep silver's bull market going. Silver has been in a structural deficit since 2021, and global silver supply has failed to keep up with demand for seven straight years. The growing undersupply has intensified upward price pressure. On the other hand, demand, particularly from industry for electric vehicles, consumer electronics, and solar panels, for instance, remains a major market driver.

The article also raised the specter of an imminent silver squeeze, which happens when demand for physical silver surges suddenly, straining the available supply of freely traded or deliverable silver and causing a sharp spike in silver prices. The writers explained what appears to be a pre-squeeze setup now. Silver is undervalued relative to gold and is trading at a strong discount to its safe haven partner. Available inventories of freely traded silver have been drawn down materially. Against this backdrop, even small increases in demand could lead to disproportionately large silver price jumps.

"With supply deficits deepening and demand intensifying across both industrial and investment channels, silver's bull market appears well supported," the article read. "We believe silver offers an attractive opportunity for investors seeking exposure to a hard asset with both growth and defensive qualities."

Increasingly, silver is becoming a more affordable, alternative safe haven investment to gold, reported Reuters on July 23. This momentum could be enough to push its price above US$40/oz in the short term, Nitesh Shah, commodity strategist at WisdomTree, told the news agency. However, he added, due to stretched positioning, it is more likely the price will retreat to about US$35/oz before climbing higher, to US$45/oz, next year.

CoinPriceForecast.com, however, sees the silver price reaching US$47.97/oz by year-end 2025 and climbing steadily to beyond 2030. Prices along the way include US$54.25 by the end of 2026, continue to rise to US$63.99 by year-end 2028, and hitting US$91.34 by year-end 2030.

The Catalyst: More Drilling Data

Upcoming catalysts for Dolly Varden pertain to achievements related to its advancement of Kitsault Valley. This year, investors can expect drill results from the current 55,000m program.

Subsequently, in early 2026, an updated mineral resource estimate for the project is due out, the company said.

Bullish on the Junior

The Gold Advisor's Valks, with a long position, and Jeff Clark, with a full weighting, in Dolly Varden, consider it a core silver holding, Valks wrote on July 24. About the explorer's latest development, Valks added, "We're watching how all this bold movement translates into the kinds of grades and widths that can shift a stock — and the story."

Silver Stock Investor's Krauth also remains bullish on Dolly Varden, writing earlier this month, "As the company acquires valuable assets and unlocks potential, I expect the market to bid shares higher. Attractive to add on weakness."

Similarly, Haywood Securities Analyst Marcus Giannini rates the Canadian explorer Buy and has a target price on it, implying an 81% return from its price at the July 24 market close, he reiterated in his May research report. In an April report, he pointed out that given Kitsault Valley's "uncapped growth potential," the project is an ideal takeout target for large miners, such as Hecla Mining Co. (HL:NYSE) that has a 13.7% stake in Dolly Varden Silver.

The analyst expressed optimism about the company's exploration efforts.

"With multiple high-grade trends open for expansion at the project, we believe Dolly is well-positioned to deliver further exploration success as it continues to demonstrate the scale and growth potential of the Kitsault Valley trend," wrote Giannini.

He noted that the company offers investors unique exposure to both high-grade gold and high-grade silver throughout Kitsault Valley.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA;DVQ:FSE)

Another analyst, Raymond James' Craig Stanley, has an Outperform 2 rating on Dolly Varden, meaning the explorer is expected to appreciate or outperform the Standard & Poor's 500 over the next 12–18 months, he noted in his May 8 research report.

Ownership and Share Structure

According to Dolly Varden's Corporate Presentation, institutional investors own 50% of the company. These include Fidelity Management & Research Co., Sprott Asset Management LP, U.S. Global Investors Inc. and Delbrook Capital Advisors Inc.

Along with Hecla with 13.7%, other strategic investors include Fury Gold Mines Ltd. (FURY:TSX) with 13.5% and Eric Sprott with 9.5%. The rest is in retail.

Dolly Varden has 87.1 million (87.1M) outstanding shares and 90.5M fully diluted shares. Its market cap is CA$476 million. Its 52-week range, according to Refinitiv, is CA$3.21–5.84 per share.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dolly Varden and Seabridge Gold billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor/employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.