As governments around the world race to implement fresh stagflationary tariff taxes, more spending, and debt, central banks and sovereign wealth funds are moving away from fiat currencies and government bonds.

They are moving into gold.

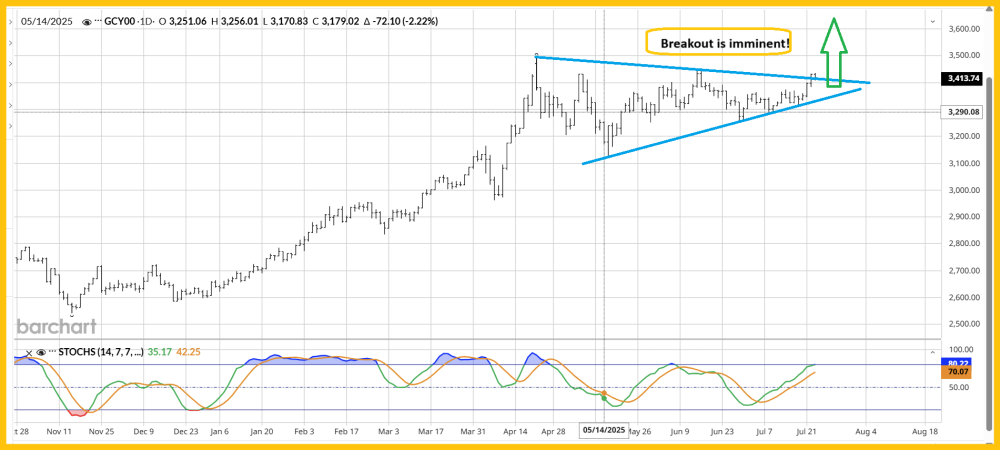

Here's a look at the daily chart:

A symmetrical triangle pattern breakout appears imminent, and the target of this pattern is about $3800.

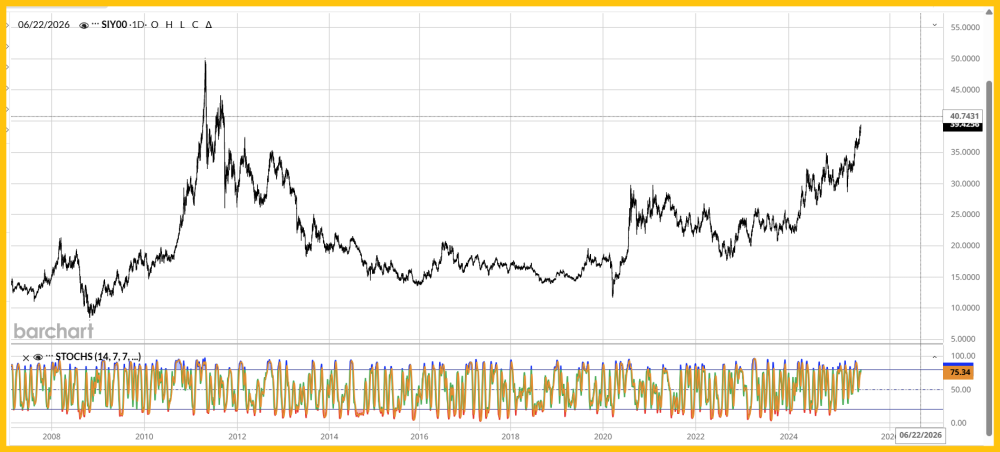

Silver tends to lag gold when deflation is in play and lead it when the big theme is inflation. In recent months, silver has taken the lead baton from gold, and I've suggested it could continue to lead until the year 2026 or even 2027.

Here's a look at the chart:

Silver is making a beeline to the $44 zone, and even some mainstream money managers are taking notice.

In this environment, gold and silver stocks have begun to surge, but they are still so undervalued that senior miners could rise hundreds of percent before they hit "fair value."

Junior miners could rise thousands of percent, and in some cases tens of thousands of percent. The current state of undervaluation of miners versus metal is truly surreal.

Here's a look at the weekly GDXJ ETF chart:

There are numerous bull flags on the chart, and a fresh upside breakout is occurring from one of those flags now.

Silver stocks? They look even better!

Here's a look at the SILJ chart:

Note the gargantuan volume that has accompanied the inverse H&S pattern breakout. It's almost surreal!

I've talked about a "seasonal inversion," where instead of swooning from July to October, the miners stage a mighty surge higher.

Well, that surge appears to be getting underway now, and the biggest price action of all appears to be occurring in junior miners that are in the CDNX

Here's a look at the weekly CDNX chart:

A short-term pullback would be a "gift" for investors, but it may not occur.

Charts that are as bullish as this one tend to feature only very short pullbacks that don't last long.

There are several individual miners that look very good this week. One of them is Big Ridge Gold Corp. (BRAU:TSXV; ALVLF:OTCQB).

They are reinvigorating a past producing property in Newfoundland.

What's interesting is that gold was stuck in a rough $300-$500 range during the previous operation.

So, a lot of additional gold could be there . . . gold that wasn't worth mining at the time.

Here's the Big Ridge chart:

I have a $2 target price for this stock, and if it's hit, the CDNX may only be in the 1000 area at that point, which is the neckline zone of its massive H&S base pattern.

The bottom junior mining stocks line: What looks like a high price or "overbought" situation needs to be taken in the context of a very large 40-year inflation cycle that is only in year 5 of the cycle. Arguably, the junior miners offer the greatest value in the modern history of markets, and the word that best sums it all up could be: Enjoy!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send you my free "Copper, Gold, & Rare Earths Too!" report. I highlight key junior resource stocks that are trading under $1/share and ready to soar! Key buy and sell tactics are included in this report. I write my junior resource stocks newsletter 2-3 times a week, and at just $199/12mths it's an investor favorite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stewart Thomson: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?