StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) has announced significant progress at its Hercules Gold Project in Nevada, including a spring 2025 drill program and an established exploration target with open-ended potential. In an interview with Streetwise Reports, CEO Michael Allen discussed recent milestones and provided insight into the project's development and the broader mining landscape in Nevada.

StrikePoint's exploration target at Hercules ranges between 819,000 and 1,018,000 ounces of gold, with grades between 0.48 and 0.63 grams per tonne (g/t). Allen emphasized that this target, located in the northern section of the property, "established a backstop of value" for the company. The drill program that followed demonstrated that the mineralization is open, with Hole H25005 intersecting 117.35 meters at 0.45 g/t gold, described by Allen as "a big, solid hit for Nevada."

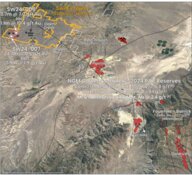

The Hercules project is located in the Walker Lane trend, a historically productive mining district. Allen noted that Nevada offers a favorable mining environment due to well-developed infrastructure, straightforward permitting, and a skilled, multi-generational workforce. "Even low-grade operations in Nevada can be profitable," he said, citing recent production results from nearby companies operating at grades as low as 0.21 g/t gold.

In the broader context, Allen acknowledged the impact of rising gold prices, which have climbed from US$2,000 to US$3,000 over the past year. He pointed out that while input costs have increased, the surge in gold prices has created favorable conditions for low-grade operations to generate significant profits.

StrikePoint holds one of the five largest land packages in the Walker Lane district and is currently in the permitting stage to access and drill the southern portion of the Hercules property. "We're working on a permit . . . give or take September, Labor Day, we should be in a situation where we can drill in the southern portion of the project," Allen said.

The CEO also commented on the broader geopolitical climate, stating that secure supply concerns and shifting trade policies are pushing mining and raw materials to the forefront. "Mining is going to move to the forefront . . . people are starting to realize you need raw materials, and you better have a place to get them," he said, emphasizing the importance of domestic and friendly-jurisdiction production.

Gold Sector Shows Strength Through Economic Shifts

The gold sector continued to demonstrate stability through mid-2025, supported by ongoing global economic uncertainty, persistent inflation risks, and heightened demand for safe-haven assets. On July 15, Stewart Thomson of 321gold pointed to cultural and economic trends driving gold demand in Asia, noting that "In China, it's clear that the young citizens are savers, and their favourite vehicle to save is gold." He contrasted this with Western markets, where gold is more often sold on signs of economic optimism. Thomson also highlighted the potential impact of inflation and seasonality on market sentiment, suggesting that late-summer conditions could lead to a strong October for metals and mining equities.

On the same day, technical analyst Clive Maund described gold as being "in a powerful bull market" in his Gold Market Update. While acknowledging the possibility of a short-term pullback if the U.S. dollar strengthens, he pointed to positive trading patterns, noting that "the volume pattern is overall positive . . . the Accumulation line has remained strong, even rising to clear new highs." Maund viewed any potential correction as likely to be "shallow and probably quite short-lived."

Market volatility was evident on July 16, when Kitco reported a sharp intraday swing in gold prices of nearly US$60 amid speculation that former President Trump might remove Federal Reserve Chair Jerome Powell. Analyst Gary Wagner commented that the price movement "underscores the market's sensitivity to monetary policy uncertainty and broader economic concerns." Gold ended the day at US$3,359.10, a gain of US$22.40, with dollar weakness contributing to the increase.

Further supporting the sector's position, a July 18 update by Josh Chiat of Stockhead referenced World Gold Council data showing a 41% increase in global gold ETF assets under management during the first half of 2025, reaching US$383 billion. The Council reported that ETF holdings had risen to 3,616 tonnes, the highest month-end level since August 2022, and cited strong central bank demand as a key factor. According to the WGC, "gold — through its fundamentals — remains well positioned to support tactical and strategic investment decisions in the current macro landscape."

Positioned for Progress in Walker Lane

StrikePoint's upcoming catalysts include the anticipated September permit approval that would enable drilling in the southern area of the Hercules property, which has shown surface samples as high as 72.4 g/t gold and visible gold at multiple targets including Sirens, Pony Meadows, and Telephus. The company holds a plan of operations for larger drill programs and two existing exploration permits.

The spring 2025 drill campaign demonstrated consistent mineralization across multiple holes, with near-surface gold and open-ended zones, aligning with the company's geological model. All holes hit significant gold mineralization, including high-grade intervals such as 6.09 meters of 1.33 g/t gold and 6.10 meters of 1.90 g/t gold.

StrikePoint is also advancing its Cuprite Project, located in the emerging district near AngloGold's Silicon discovery. Drilling at Cuprite identified gold-silver mineralization in four out of five holes across 1,600 meters, reinforcing its geological potential.

With one of the largest land holdings in Walker Lane, a strategic financial position, and experienced leadership, StrikePoint has maintained an active presence in a region that continues to attract major mining companies and consolidation efforts.

Third-Party Expert Analysis

On May 1, Jeff Clark of the Gold Advisor offered commentary on StrikePoint Gold Inc. following the release of new drill results from the Hercules Gold Project in Nevada. According to the update, StrikePoint's assays from the first four of seven holes in its 1,400-meter reverse circulation drill program returned notable intercepts, including 32.0 meters of 0.54 g/t gold and 4.62 g/t silver. Within this interval, narrower zones included 4.6 meters of 1.14 g/t gold and 10.5 g/t silver, and 6.1 meters of 1.5 g/t gold and 11.8 g/t silver.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB)

The report acknowledged that while the results were not considered high grade, the intercepts were wide and located near surface, indicating possible viability in an open-pit development scenario. \

The publication stated that StrikePoint remains on Hold in its model portfolio but noted that "many of our explorers are well financed and thus able to conduct significant, potentially market-moving work programs this summer and fall." According to Paydirt Prospector, the company's ability to continue advancing the Hercules Project will be closely monitored for major developments in the second half of 2025.

Ownership and Share Structure

According to Refinitiv, Executive Chairman Shawn Khunkhun owns 0.28% of the company, President and CEO Allen owns 1%, Director Ian Richard Harris owns 0.07%, and Director Adrian Wallace Fleming owns 0.02%.

Refinitiv reported that institutional and strategic investors own approximately 13.47% of the company, including 2176423 Ontario Ltd. with 7.17%, and Pathfinder Asset Management Ltd. with 4.81%.

According to Refinitiv, the company has 41.59 million shares outstanding and a market cap of CA$6.24 million. It trades in a 52-week range of CA$0.12 and CA$0.85.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- StrikePoint Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of StrikePoint Gold Inc.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.