Good Day.

Today, we are looking at Endeavour Silver Corp. (EDR:TSX; EXK:NYSE; EJD:FSE), a silver producer focused on the Americas.

Silver has a historical use as money, and this will continue and likely accelerate in a world that is experiencing great power competition, fragmentation/deglobalization, leading to monetary rethinking.

Standing beside silver as a use as money, it has an extensive industrial use - critical in solar panels, 5G, EVs, and semiconductors, as well as electrification and green energy.

With reshoring initiatives and growing AI and energy industrial demand, the world is only going to need more silver.

EDR has a market cap of $2.21 billion, and it has 289.9 million shares outstanding. Its share price at the time of this article is $7.53, and it trades in the 52-week range between $3.38 and $8.26. The company's revenue is $312.8 million, with a net income of around $90.92 million.

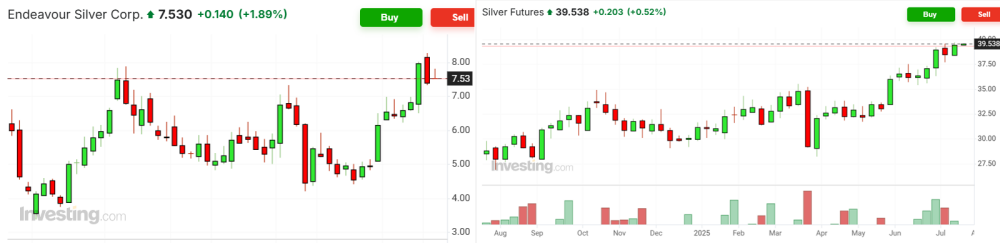

EDR versus Silver: Following the Metal Higher?

Endeavour Silver isn't just a silver miner — it's a turnaround growth story, a near-term free cash flow machine, and a strategic play on two unstoppable trends: silver's industrial utility and its historical role as sound money.

With three operating mines in Mexico, a flagship project about to go live, and a new Peruvian acquisition diversifying its portfolio, Endeavour stands at the edge of a major re-rating.

The chart below spans August 2024 to today and shows that EDR is poised to break higher.

Charts & Technicals

It's Time to look at some charts and technicals for EDR and decide when to buy.

As you can see, the current share price, marked by the dotted blue line, is attempting to break above a high nearly a year ago.

Support is marked by the dotted grey line at $6.97. The recent sell off coincided with below average volume and current price is in the bottom half of the recent channel marked by the yellow lines.

The 12, 26 MACD shows potential near-term weakness, and with RSI at 61.4, there may be a cheaper entry than the current price. However, the 10/20 Moving Average(MA) is healthy while the 25/100 MA crossed over June 17 – both not shown, while the 50/200 MA created a Golden Cross July 10, highlighted by the red circle.

A near-term resistance channel marked by the brown lines highlights a price range of about $7.75 to $8.25. Bullish investors will definitely buy now. Bearish investors may wait and see if it touches the bottom of the channel or the stronger support level marked above at $6.97.

Financials & Management

Q1 2025 Financial Results: Endeavour reported revenue of $63.5 million, supported by higher realized prices of $31.99 per ounce for silver (up 36% year-over-year) and $2,903 per ounce for gold (up 37% year-over-year).

However, the company posted a net loss of $32.9 million, primarily due to a $31.9 million loss on derivative contracts, reflecting the impact of commodity price volatility. Operating cash flow was $8.3 million, down 18% year-over-year, driven by lower production volumes.

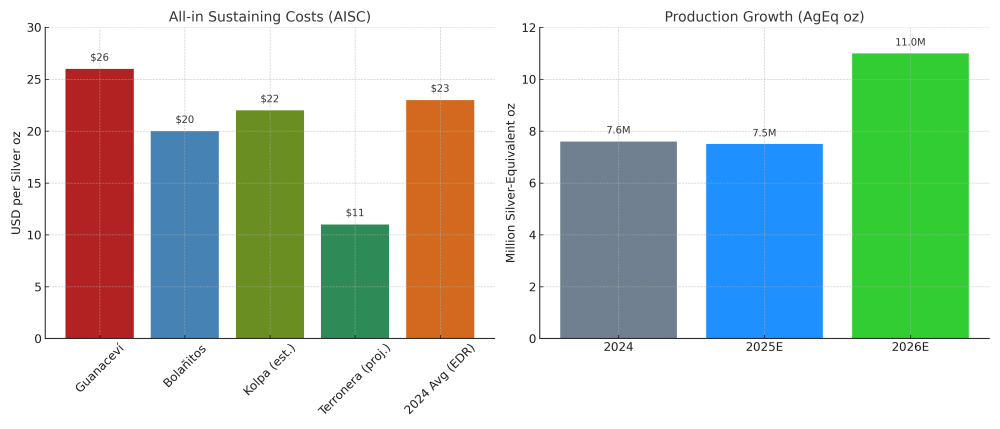

Cash costs were $15.89 per ounce of silver, and all-in sustaining costs (AISC) were $24.48 per ounce, reflecting higher operational costs due to inflationary pressures and a stronger Mexican peso. The company maintained a cash position of $64.7 million, though working capital declined 74% year-over-year to $14.8 million, signaling tighter liquidity amid significant capital investments in the Terronera project and the Minera Kolpa acquisition.

CEO Dan Dickson leads a team that has weathered bear markets, navigated Mexican regulatory hurdles, and avoided massive shareholder dilution. With strong governance and KPMG-audited financials, Endeavour stands out in a sector often plagued by poor management.

The team's decision to hedge debt on Terronera through derivatives - while painful on paper in 2024 - was a strategic move to lock in costs during a volatile environment. It may end up looking quite prescient.

Operational Snapshot: 2025 Is the Inflection Year

Guanaceví Mine (Durango, Mexico)

Guanaceví is a high-grade underground silver-gold mine that has been in operation since 2005, primarily targeting the Santa Cruz vein and other high-grade structures using a combination of longhole and cut-and-fill mining methods. While specific mine-level production data is not fully disaggregated, Guanaceví remains Endeavour Silver's largest silver producer and contributed significantly to the company's 2024 consolidated output of 4.47 million ounces of silver and 39,047 ounces of gold (7.6 million silver-equivalent ounces).

In Q1 2025, it was included in consolidated production of 1.21 million ounces of silver and 8,338 ounces of gold (1.9 million AgEq ounces). Guanaceví's all-in sustaining costs (AISC) are typically higher than those of Bolañitos due to deeper underground mining, although high ore grades help offset this; the company's consolidated AISC in 2024 ranged from $22.00 to $23.00 per ounce of silver, net of gold by-product credits.

For 2025, Guanaceví is expected to contribute to total guidance of 4.5–5.2 million ounces of silver and 30,500– 34,000 ounces of gold (7.0–7.9 million AgEq ounces), with a capital budget of $21.2 million focused primarily on mine development to access new reserves. Despite a 17% year-over-year decline in silver production in Q1 2025, Guanaceví's high-grade mineralization and continued exploration efforts, particularly at the El Curso property, underpin its long-term potential, though the mine currently has a limited reserve life of just two to three years — highlighting the need for ongoing resource expansion.

Bolañitos Mine (Guanajuato, Mexico)

Bolañitos, located in Guanajuato, Mexico, is an underground silver-gold mine focused on epithermal vein deposits and has been in operation for over a decade. Known for its lower-cost profile compared to Guanaceví, Bolañitos benefits from shallower operations and strong gold by-product credits, making it one of the lowest AISC contributors in Endeavour Silver's portfolio.

In 2024, the mine produced approximately 347,000 ounces of silver and 18,800 ounces of gold, forming part of the company's total 7.6 million silver-equivalent ounces (AgEq), with Bolañitos contributing a higher proportion of gold due to its ore characteristics. In Q1 2025, it was included in the consolidated production of 1.9 million AgEq ounces, though it experienced an 18% year-over-year decline in gold output.

Despite this, the mine remains a strong margin contributor, supported by a 2025 capital budget of $8.8 million focused on mine development and resource expansion. Production guidance for 2025 suggests modest growth, and recent drilling has confirmed high-grade silver-gold mineralization, supporting ongoing operations, although the mine's maturity may limit significant long-term production gains without further discoveries.

Kolpa Mine (Peru)

In April 2025, Endeavour Silver acquired Minera Kolpa in Peru for a total consideration of $145 million, comprised of $80 million in cash, $65 million in shares, and up to $10 million in contingent payments — marking a transformational move that diversifies the company's portfolio beyond silver.

Kolpa is a polymetallic operation with over 25 years of production history, currently processing 1,800 tonnes per day, with plans to expand to 2,500 tonnes per day by Q3 2025, pending environmental and operating permits.

In 2024, the mine produced 2.0 million ounces of silver and other metals, totaling 5.1 million silver-equivalent ounces (AgEq), and in Q2 2025, it processed 118,896 tonnes — exceeding expectations and contributing meaningfully to Endeavour's consolidated production of 2.5 million AgEq ounces.

While Kolpa's specific all-in sustaining cost (AISC) is not broken out, it contributed to the company's Q1 2025 consolidated AISC of $24.48 per ounce, with copper by-product credits helping offset costs. The planned throughput increase is expected to add 2–3 million AgEq ounces annually, supporting Endeavour's full-year production guidance of 7.0–7.9 million AgEq ounces. Strategically, Kolpa strengthens Endeavour's cash flow profile, introduces long-term growth optionality, and establishes a foothold in one of Latin America's most prolific mining jurisdictions — positioning the company to benefit from rising demand for copper in electric vehicles and power infrastructure, and quietly evolving Endeavour into more than just a silver story.

Terronera: The Game-Changer

Endeavour Silver's most significant near-term growth catalyst is the Terronera Project in Jalisco, Mexico — a high-grade underground silver-gold mine poised to become the company's cornerstone asset within the next 1–2 years. Located in the Sierra Madre volcanic belt, Terronera contains proven and probable reserves of 7.4 million tonnes grading 197 g/t silver and 2.25 g/t gold, and will be mined using long-hole and cut-and-fill methods, supported by a modern 2,000 tonnes-per-day processing facility.

As of Q4 2024, surface construction was 90% complete, with $258 million of the $271 million capital budget already spent. Wet commissioning began in May 2025, with full-scale production targeted for Q4 2025, and underground development reaching over 5,500 meters. The feasibility study outlines an annual output of 4 million ounces of silver and 38,000–40,000 ounces of gold (roughly 7 million silver-equivalent ounces) over a 10-year mine life, with an expected AISC of just $10–12 per ounce — significantly below Endeavour's Q1 2025 consolidated AISC of $24.48. At current silver prices near $30, Terronera could generate $40–50 million in free cash flow annually, giving Endeavour the ability to self-fund future growth and potentially eliminate debt.

With its construction nearly complete, explosive permit pending, and production set to ramp up alongside rising silver prices, Terronera is expected to double Endeavour's total production capacity and firmly establish the company as a leading low-cost silver producer.

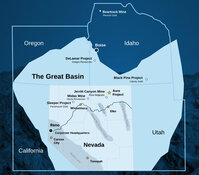

Exploration Projects

Endeavour Silver's exploration portfolio plays a critical role in its long-term growth strategy, with substantial investments in several high-potential projects across the Americas. The flagship exploration asset, the Pitarrilla Project in Durango, Mexico — one of the world's largest undeveloped silver deposits — features significant silver, lead, and zinc resources, with 2025 drill results confirming high-grade mineralization.

Backed by a 2024 exploration budget that included 18,000 meters of drilling and $8.7 million for economic studies and targeting programs, Pitarrilla has the potential to become a producing mine within three to five years, pending feasibility outcomes and financing. In parallel, the Parral Project in Chihuahua offers silver-gold-lead-zinc potential and is being advanced using proceeds from Endeavour's $60 million at-the-market (ATM) offering, with a production timeline of four to five years, depending on exploration success.

Beyond Mexico, Endeavour is also exploring properties in Chile and the United States, while continuing to drill high-grade targets near its operating mines at Guanaceví (El Curso) and Bolañitos. These efforts aim to extend mine life, uncover new deposits, and lay the foundation for the company's next generation of growth.

Conclusion: Entering Silver's New Dawn

Endeavour Silver is approaching a rare alignment of operational readiness and macro tailwinds. With Terronera near full production, the recent Kolpa acquisition broadening its footprint, and exploration assets like Pitarrilla adding long-term optionality, Endeavour is no longer a speculative play — it's a silver growth engine on the cusp of transformation.

While Q1 losses and cost pressures warrant caution, the setup for 2025–2026 is powerful: low-cost production growth, high silver prices, and strategic geographic diversification.

As silver continues to assert its dual role as industrial metal and monetary hedge, Endeavour is positioned not just to survive — but to lead. For investors seeking leveraged exposure to the coming silver supercycle, Endeavour Silver may well be a timely pick.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Endeavour Silver. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.