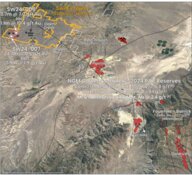

Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) announced the deployment of teams and equipment to the Wood Gulch target at its wholly owned flagship Aura Project, situated 80 kilometers north of Elko, Nevada.

"This mobilization signifies a thrilling phase for our 2025 agenda," said Chief Executive Officer and President Darcy Marud. "We are exploring one of the least examined yet historically rich sections of our property. Wood Gulch, initially developed by Homestake in the late 1980s, has not been extensively explored in recent times. However, our refined model, bolstered by our achievements at the Gravel Creek deposit, suggests a high potential for discovering new mineral deposits in this promising region."

Preparatory activities are underway, including the final setup of drilling platforms and enhancing access routes, the company said in a release.

Drilling is anticipated to start within the next week. The comprehensive 4,000-meter diamond drilling initiative will target the expansion of historical high-grade gold-silver mineralization along the Tomasina Fault Zone, focusing on areas beneath the previously mined Wood Gulch open pit.

Gravel Creek Resource Shows Increase

In June, the company submitted a National Instrument 43-101 technical report detailing a preliminary economic assessment (PEA) for the Doby George Deposit and an updated mineral resource estimate (MRE) for Gravel Creek.

The revised MRE shows a significant increase in both the quality and quantity of inferred mineral resources, reflecting positively from the discovery of a high-grade vein within the Jarbidge rhyolite east of Gravel Creek. The inferred gold content has risen from 367,000 ounces to 571,000 ounces, and inferred silver content has surged from 5,307,000 ounces to 9,726,000 ounces, marking an 83% increase in silver content and a 28% enhancement in silver grade, according to the company.

Chen Lin of What is Chen Buying? What is Chen Selling? expressed a positive outlook on the company, praising the resource report that showed increased grades and ounces in the Gravel Creek and Wood Gulch deposits.

The indicated gold equivalent grade, maintained at a cutoff of 3 grams per tonne (g/t) AuEq, has shown consistent figures from 2021 to 2025, with the latest MRE displaying 216,000 ounces of gold (Au) and 3,367,000 ounces of silver (Ag).

Key points from the Doby George PEA included a base case after-tax Net Present Value (NPV) of US$70.7 million and an Internal Rate of Return (IRR) of 25.4% (based on a gold price of US$2,150, escalating to US$211.2 million with a potential IRR of 62.2% at a gold price of US$3,000), an estimated total Life-of-Mine (LOM) after-tax net cash flow of US$271.2 million over a five-year project timeline, and projected average annual operating cash flow of US$112.1 million and a payback period of less than 18 months, assuming a gold price of US$3,000.

The report underscored new exploration opportunities along the GC Fault at Gravel Creek and the potential for expanding high-grade veins in the Jarbidge rhyolite. Management is optimistic that Western's successful drilling history could lead to further resource expansion with continued drilling and exploration activities. Gravel Creek remains open along strike and downdip, while Jarbidge is open in all directions.

Wood Gulch in Focus

The company's 2025 drill campaign will focus on Wood Gulch, another gold and silver deposit at Aura, alongside Doby George, for which the PEA was released in May.

This year, Western Exploration plans to continue its exploration with a 4,000-meter drilling program targeting the Tomasina Fault Zone within Wood Gulch, a previously producing open pit mine now identified as a highly promising target based on geological reinterpretation from earlier drill findings.

While Wood Gulch will be the primary focus of Western Exploration's exploration initiatives in 2025, the significant resource enhancements at Gravel Creek justify a broader drilling program dedicated to infill drilling and resource expansion.

Additionally, the company said it will focus on mitigating project risks by refining parameters related to potential processing and costs, conducting ongoing geotechnical assessments, pursuing environmental studies, and preparing for permit applications.

Expert Says Project Could Expand Significantly

Jeff Clark of The Gold Advisor, in his June 19 edition, included Western Exploration in the "Where to Devote Funds Now" section, highlighting the company's potential for significant resource expansion at Wood Gulch.

Clark initially described the explorer as a proven mine finder with strong indications that its flagship project could significantly expand, potentially doubling in size and pushing the resource over 2 million ounces (Moz). In a follow-up on June 26, Clark upgraded Western Exploration to the Gold Advisor portfolio, citing the company's undervaluation and the recent resource upgrade that he said effectively derisked the company, making it an attractive investment.

Chen Lin of What is Chen Buying? What is Chen Selling? also expressed a positive outlook on the company in his June 24 newsletter, praising the resource report that showed increased grades and ounces in the Gravel Creek and Wood Gulch deposits.

The Gold Newsletter has also shown support for this junior mining company. In its May 29 edition, it mentioned that the exploration potential at Aura could lead to noteworthy developments in the latter half of 2025. The geological assessment is described as "compelling," with Gravel Creek increasingly resembling another historic mine, Midas, located in Nevada. The report stated, "While much more drilling will be necessary, I’m pleased to be a shareholder, and I still consider Western Exploration a Buy."

Furthermore, Fundamental Research Corp. has recognized WEX as one of its Top Picks, as highlighted in a May 20 report that showcased the explorer as a standout performer in the preceding week.

The Catalyst: Gold Watch Continues

As July comes to a close with gold prices hovering around US$3,300 per ounce, investors are left with a pressing question: Will it reach US$3,500 before the month ends? Following a robust rally that saw prices rise from US$2,700 in January to US$3,400 in April, even a slight push could propel gold to new heights, reported Sharon Wu for CBS News on July 21.

However, since that April peak, the precious metal has remained confined within a narrow range, leaving investors anxious as the crucial resistance level remains elusive. Although gold continues to receive support from inflation worries and global tensions, the recent consolidation hints that momentum may be waning. So, will gold finally break through this vital barrier, or are investors facing more sideways movement?

"I don't foresee gold prices reaching US$3,500 until either [Jerome] Powell is replaced or the Fed lowers interest rates," Ben Nadelstein, head of content at the gold yield marketplace Monetary Metals, told Wu.

Since neither scenario appears likely this month, he anticipates that gold will remain below the target.

Brandon Aversano, CEO of precious metals buyer The Alloy Market, noted that the limited timeframe also works against gold achieving US$3,500, Wu reported.

Any significant price increase would require "a new major economic headwind or heightened global instability," he states. With such surprises unlikely and July nearly over, Aversano expects prices to remain stable.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC)

Not everyone believes the US$3,500 target is unattainable, however. Brett Elliott, marketing director at American Precious Metals Exchange (APMEX), highlights that gold can make unexpected moves, Wu wrote.

"[It] can sometimes increase over 3% in a single day [with the right] catalyst," Elliott said, pointing to trade policy changes as a potential factor that could provide the necessary boost for gold.

Aversano advises keeping an eye on specific indicators to assess gold's future direction, the article said.

"Monitor bond and yield markets … and pay attention to Fed language and policy positions," he suggests.

Ownership and Share Structure

According to Western Exploration, directors and management own 3% of the company. High net worth individuals hold 8%. Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) has 14%. Auramet holds 5%. Golkonda LLC holds a total of 46%, the company's website said.

Institutions, including Euro Pacific Asset Management, U.S. Global Investors, and tGOLD (TXAU), own 6%. The remaining 24% is in retail.

Refinitiv reports that Western Exploration has 52.58 million outstanding shares and 24.96M free float traded shares. Its market cap is CA$33.03 million. Its 52-week range is CA$0.58–1.49 per share.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Western Exploration Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Exploration Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.