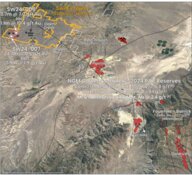

West Point Gold Corp. (WPG:TSXV; WPGCF:OTCQB) has announced new drilling results from its spring 2025 drill program at the Gold Chain Project in Arizona. The company reported gold intercepts from drill holes GC25-61 to GC25-64, which covered a total of 957.2 meters. The drill holes were located in the Central and Southern portions of the Tyro Main Zone.

Drill hole GC25-61 intersected 59.44 meters at 1.25 grams per tonne (g/t) gold, including a higher-grade interval of 33.53 meters at 1.63 g/t gold. This hole was located about 90 meters below a previously drilled hole, suggesting continuity of mineralization at depth. Hole GC25-62 returned 68.58 meters at 0.90 g/t gold, including 15.24 meters grading 2.89 g/t gold. The hole intersected mineralization near a rhyolite dike, which the company believes may be an important geologic feature.

Hole GC25-63, drilled about 200 meters south of the main zone, intersected 7.62 meters at 1.88 g/t gold. Hole GC25-64 encountered 36.58 meters at 0.91 g/t gold, about 190 meters below surface. These results extend the known mineralized area of the Tyro Main Zone to nearly 200 meters in vertical depth over a strike length of approximately one kilometer.

In a company news release, CEO Quentin Mai said the consistent grades observed in drilling "bode well for a future resource estimate and a potential development scenario." The mineralized zones consist of quartz-calcite-adularia veins and breccia, common in low-sulphidation epithermal gold systems. Assays were performed using fire assay with ICP finish, and quality control protocols followed the NI 43-101 standards.

Broader Market Commentary on Gold

The gold sector continued to show resilience in mid-2025. In a July 15 commentary on 321gold, Stewart Thomson noted cultural and macroeconomic support for gold demand, especially in Asia. He wrote that "in China, it's clear that the young citizens are savers, and their favourite vehicle to save is gold." He added that inflation and trade issues could lead to strong gold performance into the fall.

On the same day, Clive Maund stated that "gold is in a powerful bull market," despite some risk of a short-term correction if the U.S. dollar rallied. Maund pointed to positive accumulation patterns and suggested that recent consolidation was not unusual in a strong trend.

Kitco reported on July 16 that gold had a volatile trading day due to speculation around the potential removal of Federal Reserve Chair Jerome Powell. The news caused gold prices to swing by nearly US$60 intraday. The price closed up US$22.40 at US$3,359.10.

A July 18 Stockhead article cited World Gold Council data showing global gold ETF holdings rose by 397 tonnes in the first half of the year, boosting assets under management to US$383 billion. The Council said, "gold — through its fundamentals — remains well positioned to support tactical and strategic investment decisions in the current macro landscape."

Other Company Activities and Plans

The Tyro Main Zone is part of West Point Gold's broader Gold Chain Project, located in the historic Oatman District. The company has drilled 6,000 meters at Tyro over the past ten months and is planning another 10,000-meter program. Mapping and geophysics suggest mineralization could continue into the nearby Frisco Graben area.

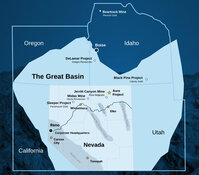

West Point Gold also has a joint venture agreement with Kinross at its Jefferson Canyon Project in Nevada. Kinross has the option to earn a 70% interest with US$5 million in expenditures and may earn an additional 10% with further investment.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Point Gold Corp. (WPG:TSXV; WPGCF:OTCQB)

Ownership and Share Structure

According to Refinitiv, about 8% of West Point Gold is owned by insiders and management, and about 1% by institutions. The rest is retail.

Top shareholders include Executive Chairman Derek Macpherson with 3.01%, Gary Thompson with 2.39%, Chief Financial Officer John McNeice with 0.49%, U.S. Global Investors Inc. with 1.29%, and Director Anthony Paterson with 1.51%.

Its market cap is CA$28.98 million with 65.86 million shares outstanding, and it trades in a 52-week range of CA$0.15 and CA$0.52.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Point Gold.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.