Sometimes the best opportunities in the junior exploration sector sit quietly next to headline-making mines. That's the case with Harvest Gold Corp. (HVG:TSX.V), a low-cost, high-potential explorer advancing a trio of 100%-owned gold projects in the heart of Quebec's Abitibi Greenstone Belt, one of the richest gold-bearing regions on the planet.

The Abitibi Gold Belt: A Century of Discovery

The Abitibi Greenstone Belt is one of the most prolific gold-producing regions in the world, with over 200 million ounces of gold produced to date. Stretching across northeastern Ontario and northwestern Quebec, it has supported continuous mining for more than a century. Home to legendary camps like Timmins, Kirkland Lake, Val-d'Or, and Rouyn-Noranda, the belt is defined by its complex structural geology, rich orogenic gold systems, and exceptional infrastructure.

Major discoveries continue to emerge from this region, from historic mines to modern projects like Osisko's Windfall and Agnico Eagle's Canadian Malartic. The Abitibi has proven time and again that it rewards patient, technically driven exploration. Harvest Gold's land position sits directly within this world-class system, surrounded by current development and near a new wave of exploration investment.

Harvest Gold is advancing three large-scale gold projects, Mosseau, Urban Barry, and LaBelle — within Quebec's Urban Barry Greenstone Belt. This is the same belt that hosts Gold Field's newly acquired Windfall deposit and Bonterra's Gladiator and Barry deposits. The region is now being aggressively consolidated and explored by Gold Fields, which recently acquired a dominant land position, including the Windfall mine.

What sets Harvest apart is that it controls some of the only remaining significant land positions in the belt not held by Gold Fields. The company's flagship Mosseau Project is just 15 km from Lebel-sur-Quévillon and accessible year-round by road. With 195 claims covering 9,743 hectares and a 21 km-long gold-bearing structure, Mosseau is large, underexplored, and strategically located, a setup primed for discovery.

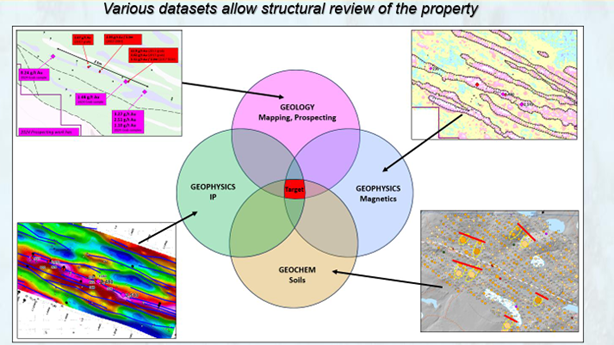

A 5,000-meter drill program is planned for Q3 2025, targeting a series of high-priority zones identified through magnetic surveys, geochemistry, and structural mapping. The funding is in place. The targets are defined. The team is ready.

Management and Technical Team

CEO Rick Mark brings over 40 years of leadership in public resource companies, including VMS Ventures and North American Nickel.

Under his direction, Harvest has secured not only technical depth but institutional interest, a testament to his strategic and disciplined approach.

The technical team includes:

- Louis Martin, P.Geo., with over 40 years of experience in Abitibi geology, led the PFS on Clifton Star's 4.5Moz Duparquet gold project;

- Neil Richardson, P.Geo., former Chief Geologist for VMS Ventures, where he led the Reed Mine discovery team, is VP Exploration for Canada at Hudbay;

- Warren Bates, P.Geo., former VP at Pelangio, who contributed to the Blackwater discovery.;

- Henry Awmack, co-founder of Equity Exploration; more than 40 years of experience across gold, VMS, and porphyry systems;

- Pat Donnelly, P. Geo, an active Director and former President of First Mining Gold; he helped grow the company from $30M to $600M in market cap.

This is a discovery-driven team with a track record of success in the very geological setting. Harvest is exploring and doing all the not-always market-driven fundamental groundwork and geophysical work the majors are looking for in a world-class exploration team.

Share Structure

Harvest Gold has 88.1 million shares outstanding and a market cap of approximately CA$7 million.

The stock has traded between CA$0.02 and CA$0.13 over the past year and recently closed at CA$0.08.5, with average daily volume around 120,000 shares.

Crescat Capital owns approximately 18.8% of the company, and insiders hold an additional 5%, ensuring alignment with shareholders and signaling long-term commitment.

Technical Analysis: A Long Base with Breakout Energy

Harvest Gold's long-term chart tells a story of patience, consolidation, and emerging momentum.

After a sharp decline from its 2017–2018 highs near CA$0.90, HVG spent several years carving out a broad base between CA$0.02 and CA$0.10. That prolonged downtrend was decisively broken in early 2025, with a clean breakout above $0.065, accompanied by a surge in volume, a clear sign that new investors are positioning ahead of catalysts.

For the first time since 2021, the stock has reclaimed both its 50-week and 200-week moving averages. This bullish crossover, along with strengthening RSI and liquidity, points to the early stages of a potential technical re-rating.

Key levels to watch:

- Support: CA$0.06–CA$0.065 prior resistance, now likely a floor or downside support

- Target 1: CA$0.16

- Target 2: CA$0.25: midpoint of the 2020–2021 rally and a measured move from the base

- Target 3: CA$0.35: base-to-breakout extension and historical congestion zone

- Big Picture Target: CA$0.45+: a retrace to 2021 highs if drilling success drives sustained accumulation.

The Relative Strength Index (RSI) is rising but remains well below overbought territory, suggesting further upside potential. If the stock can hold above CA$0.07 and volume continues to build, HVG could enter a new leg higher.

This is a classic bottoming structure: a long base, followed by a breakout with volume. The chart now reflects what the fundamentals have been hinting at a story in motion that could potentially go up the same way it went down, if the chart confirms what the fundamentals could be hinting at.

Why Speculators Should Watch Now

District-Scale Projects in a Tier-One Belt

Harvest controls three significant projects in one of Canada's most active exploration districts, surrounded by majors, including Gold Fields and emerging Bonterra . . . which Osisko bought out

Flagship Mosseau is Drill Ready

Historical drilling, surface showings, and new geochemical anomalies support multiple high-priority targets. The 5,000-meter drill program is fully funded (financing to close July 31) and scheduled.

Low-Cost Exploration in a World-Class Jurisdiction

Quebec ranks #7 globally for mining investment. Year-round road access, grid power, and proximity to infrastructure allow Harvest to drill efficiently and cost-effectively.

Institutional and Technical Validation

Crescat Capital's 18.8% ownership, alongside Dr. Quinton Hennigh's technical guidance, gives Harvest a rare combination of financial backing and geological expertise.

Classic Abitibi Geology

Each of Harvest's projects sits along key structural corridors similar to those controlling Windfall, Gladiator, and Barry. This is the right type of rock in the right part of the belt.

Multiple Shots on Goal

With three 100%-owned properties and a pipeline of targets, the company is not reliant on a single outcome. Urban Barry and LaBelle could deliver additional upside.

Final Thoughts

Harvest Gold offers a compelling combination of district-scale exploration potential, strong technical backing, and a chart signaling renewed interest.

With a tight share structure, drill-ready targets, and major catalysts on the horizon, HVG deserves a closer look from speculators seeking high-reward opportunities in the junior mining sector. The chart is breaking out. The team is very credible. The catalysts are near. Therefore, I rate the shares a Speculative Buy at current levels for risk-tolerant investors and speculators.

For more information, you can visit the company website here.

Harvest Gold Corp. (HVG:TSX.V) closed for trading at CA$0.08 on July 22, 2025.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.