In what amounted to a subdued trading period for precious metals, numerous junior mining equities experienced significant price movements.

The previous week delivered fairly muted market action, characteristic of mid-summer doldrums. Gold maintained its trading range within the $3300s, silver achieved its second straight weekly finish exceeding $38/oz, and platinum registered its initial negative weekly candle following six consecutive positive weeks.

Platinum

A healthy scenario would involve platinum experiencing additional consolidation between $1350 and $1475 over the coming weeks. Following such a stabilization phase, we might witness a push toward fresh highs surpassing $1500/oz during August. Although platinum appears technically 'overbought' by traditional metrics, nothing suggests bearish conditions when an extensively under-owned precious metal breaks through a years-long base pattern and rapidly reaches overbought territory. In fact, I'd consider this exceptionally bullish behavior.

While major metals and equity indexes remained relatively calm, numerous junior mining stocks exhibited substantial volatility.

Our market review begins with an emerging American graphite producer that has unexpectedly found itself in an advantageous position as potentially the sole domestic graphite supplier—precisely as Trump's second administration implements a steep 93.5% anti-dumping duty on Chinese graphite imports.

Titan Mining

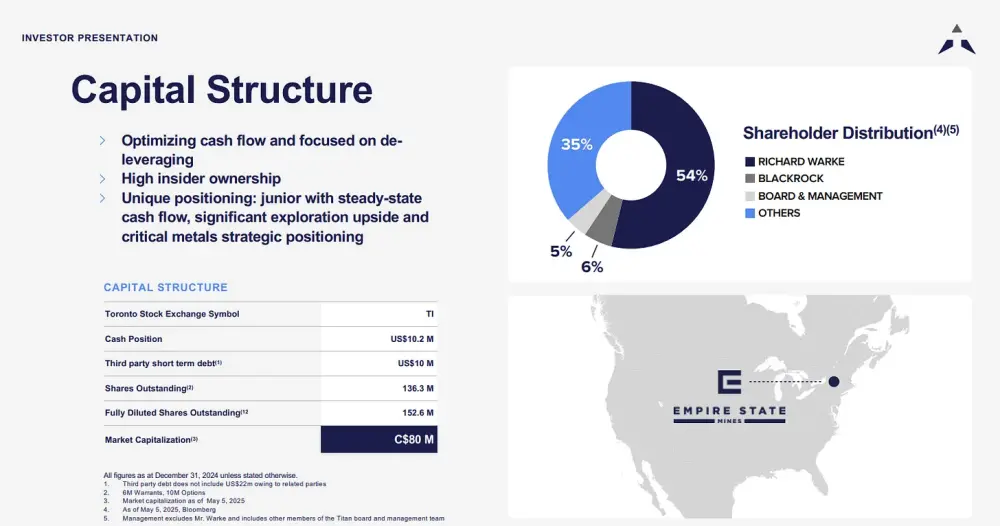

Shares of Titan Mining Corp. (TI:TSX; TIMCF:OCTMKTS) jumped over 50% amid the heaviest weekly trading volume observed in years.

Titan's strategic mineral assets in Saint Lawrence County, New York include the Kilbourne Graphite Deposit. The company aims to transform its ESM (Empire State Mines) operations into America's first complete natural flake graphite producer with facility activation targeted for 2025.

While graphite serves as a crucial component in electric vehicle batteries, the per-vehicle graphite expense remains modest enough that even with a punitive 93% import duty, American demand for Chinese graphite likely won't collapse entirely. Nevertheless, this tariff undoubtedly represents a windfall opportunity for small emerging domestic graphite producers like Titan.

Worth highlighting is that elusive mining magnate Richard Warke controls over 50% of Titan's outstanding shares, creating an extremely restricted free-trading float.

Northern Dynasty Minerals

Conversely, Alaska-based copper and gold developer Northern Dynasty Minerals Ltd. (NDM:TSX; NAK:NYSE.MKT) experienced a dramatic reversal of fortune with approximately a 52% weekly decline:

Investor confidence faltered upon news that Northern Dynasty failed to reach an agreement with the EPA, with the weekly selloff erasing more than US$600 million in market value.

Northern Dynasty submitted a motion requesting summary judgment to overturn the Biden administration's veto of its Pebble Project, situated 200 miles from Anchorage and 125 miles from Bristol Bay.

A company we featured on Goldfinger Capital several weeks ago, Gold Reserve, continues its impressive ascent toward fresh 2025 highs:

Gold Reserve Inc.

Recently, Gold Reserve Inc. (GRZ:TSX; GRZ:NYSE) announced Portugal's Supreme Court upheld a ruling recognizing the Company's 2014 international arbitration award against Venezuela, dismissing the state's sovereign immunity and public policy defenses. Venezuela's total obligation under the Award, including interest, now exceeds $1.1 billion.

Gold Reserve's enforcement efforts in Portugal complement similar initiatives underway in the United States, including GRZ's July 2, 2025, designation as the Final Recommended Bidder in the U.S. District Court for the District of Delaware regarding the sale of PDV Holdings, Inc. shares, the indirect parent entity of CITGO Petroleum Corp.

We finish this week's Market Snapshot with a visit to Idaho. Idaho-focused copper and silver explorer Hercules Metals delivered performance worthy of its ticker symbol, surging 34.3% on its highest weekly volume since February:

Hercules Metals

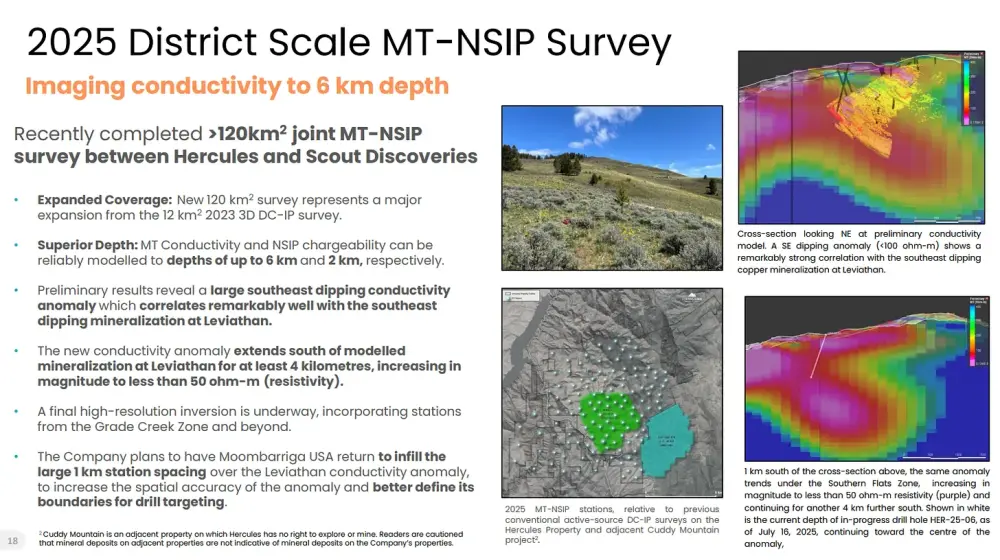

Last week, Hercules Metals Corp. (BADEF:OTCMKTS; BIG:TSXV) issued an encouraging drilling update packed with promising indicators. Thus far, seven completed drill holes have confirmed all key aspects of Hercules' predictive geological model, aligning with classical porphyry copper formation patterns. Notably, CEO Chris Paul's enthusiasm in both the press release statements and subsequent interview captured market attention.

The expansion potential along the north-south strike has broadened previous assumptions about possibilities at Leviathan. Northward, Hercules has progressed stepping out from hole 25-02 toward Grade Creek. Meanwhile, the company emphasized that hole 25-02 demonstrates potential for both primary porphyry mineralization and hypogene enrichment extending northeast into the Grade Creek Zone. Last week's update revealed that hematized red conglomerate (interpreted as an ancient river channel) was discovered 1,500 meters northeast of hole 25-02, at the Jurassic cover's base, containing significant porphyry-altered and veined boulders of leach cap, consistent with an underlying porphyry system, further supporting the case for a potentially extensive northeast extension.

The newly discovered veined boulder area lies north of Grade Creek, beyond Hercules' IP geophysical survey coverage and previous soil and rock sampling work. CEO Chris Paul observed that red burgundy hematite (evident in the veined boulder discovery) typically follows bornite formation.

South of the central Leviathan Porphyry Area, hole 25-06 is currently in progress. This represents an 800-meter step-out southward from last year's hole 24-19 into the Southern Flats Zone. Hole 25-06 has successfully penetrated beneath Jurassic cover and intersected the porphyry system underlying the Southern Flats Zone. Currently, hole 25-06 is traversing what appears to be the hanging wall pyrite halo, targeting the center of a newly identified MT conductivity anomaly showing strong correlation with Leviathan Porphyry mineralization.

Hercules has secured a more powerful drilling rig from Scout Drilling to more effectively test the complete depth extent of the newly identified MT conductivity anomaly.

Finally, we conclude with Idaho-based gold and antimony developer Perpetua Resources.

Perpetua Resources

Following completion of a substantial US$474 million financing package, including full broker over-allotment totaling US$49 million, Perpetua Resources Corp.'s (PPTA:TSX; PPTA:NASDAQ) shares climbed more than 16%.

Perpetua's Stibnite Gold-Antimony Project has secured all necessary permits, with construction expected to commence before year-end. Initial production is scheduled for the latter half of 2028.

Benefiting from robust gold prices and valuable antimony byproduct credits, Stibnite is positioned to become one of North America's most profitable mining operations.

To read more from Robert Sinn at Goldfinger Capital, you can follow him on his Substack.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Perpetua Resources Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Robert Sinn: I, or members of my immediate household or family, own securities of: Hercules and Gold Reserve. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Robert Sinn Disclosures

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. West Red Lake Gold Mines Ltd. is a high-risk venture stock and not suitable for most investors. Consult West Red Lake Gold Mines Ltd’s SEDAR profiles for important risk disclosures.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.sedarplus.ca for important risk disclosures. It’s your money and your responsibility.