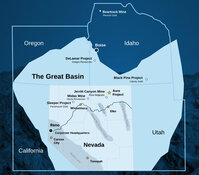

Eminent Gold Corporation (EMNT:TSXV; EMGDF:OTCQB) has initiated a high-resolution gravity survey at the Otis target within its Hot Springs Range Project (HSRP) in Humboldt County, Nevada. The survey aims to refine drill targeting across the 15-kilometer-long property, which is situated near the Getchell Trend, an area with a reported endowment of approximately 50 million ounces of gold.

The gravity survey, conducted in collaboration with Kinross Gold Corporation, a 9.9% equity holder in Eminent, is intended to map subsurface structures such as faults and fluid pathways that may control mineralization. This geophysical work builds on earlier drilling at Otis, which intersected gold mineralization across three core holes and suggested continuity of the system over approximately 150 meters of strike length. According to Eminent, drilling is expected to resume following the completion and analysis of the gravity data.

Dan McCoy, Chief Geologist and Director, stated in the news release, "Our early drilling at Otis confirmed a robust gold-bearing system . . . This will be our first opportunity to run a geophysical program over the entire 15+ km length of the property to reveal the structural plumbing at our other targets, Sitka and Eden, and could further reveal new targets."

The Hot Springs Range Project consists of 419 federal lode claims covering more than 3,500 hectares, all 100% owned by Eminent. The property lies approximately 15 kilometers northwest of the Turquoise Ridge District operated by Nevada Gold Mines.

Paul Sun, CEO of Eminent Gold, commented, "We believe we are in the early stages of uncovering a significant gold system at our wholly owned HSRP property in Nevada. Our collaboration with Kinross . . . is enhancing our exploration efforts as we advance the robust system we've identified."

Gold Sector Remains Resilient Amid Volatility and Economic Uncertainty

The gold sector demonstrated notable resilience through mid-2025, buoyed by global economic instability, persistent inflation concerns, and renewed interest in safe-haven assets. On July 15, Stewart Thomson of 321gold highlighted the cultural and economic factors supporting gold demand, particularly in Asia. "In China, it's clear that the young citizens are savers, and their favorite vehicle to save is gold," Thomson wrote, contrasting this with Western tendencies to sell gold on positive economic news. He also noted seasonal trends and inflationary pressures, stating, "It's likely that the brunt of the inflationary pain begins later in the summer, and it could help create quite a spectacular October month finale for the metals and mining stocks rally."

That same day, technical analyst Clive Maund described gold as being "in a powerful bull market" in his Gold Market Update. He acknowledged the potential for a brief correction if the U.S. dollar were to rally, but emphasized the sector's underlying strength. "The volume pattern is overall positive… the Accumulation line has remained strong, even rising to clear new highs," Maund noted, adding that any pullback would likely be "shallow and probably quite short lived."

On July 16, Kitco reported a sharp intraday swing in gold prices of nearly US$60 amid speculation that former President Trump might remove Federal Reserve Chair Jerome Powell. Gary Wagner wrote that "the precious metal's volatile performance underscores the market's sensitivity to monetary policy uncertainty and broader economic concerns." Gold closed the session at US$3,359.10, up US$22.40, with dollar weakness contributing to the gains.

A July 18 sector update by Josh Chiat of Stockhead referenced data from the World Gold Council on gold's performance during the first half of the year. The WGC stated, "the combination of a surging gold price and investor flight to safety pushed global gold ETF's total AUM 41% higher to US$383 billion." Central bank demand remained strong, and ETF holdings reached 3,616 tonnes, the highest month-end level since August 2022. The Council concluded, "gold — through its fundamentals — remains well positioned to support tactical and strategic investment decisions in the current macro landscape."

Positioned for Project Advancements

Eminent Gold's current gravity survey marks a key step in its broader development strategy, which focuses on advancing multiple gold projects within Nevada. According to the company's July 2025 investor presentation, the HSRP represents a potential geological analogue to the nearby Getchell Trend, with comparable structural features and geochemical signatures observed across the Otis, Sitka, and Eden targets.

Previous geophysical and geochemical data at Otis highlighted robust gold-in-soil anomalies and rock chip assays reaching up to 2.8 grams per tonne. Initial drilling into previously untested faults confirmed gold mineralization in all three holes, validating the interpreted northeast-trending structural corridor. The company reported that drilling remains open along strike and at depth.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Eminent Gold Corporation (EMNT:TSXV; EMGDF:OTCQB)

Alongside HSRP, Eminent is progressing its Gilbert South and Celts projects, both of which are located in the Walker Lane trend. All three projects are 100% owned and are slated for drilling in 2025 or early 2026, supported by permits and capital raised through multiple private placements. As of July 14, 2025, the company reported 76.5 million shares issued and outstanding, with Kinross Gold identified as a key strategic shareholder.

The current gravity survey is expected to be completed within weeks, after which drilling at Otis will recommence.

Ownership and Share Structure

According to Refinitiv, 9.5% of Eminent Gold Corp is held by management and insiders with Michael Kosowan at 6.36% and Paul Sun at 1.39% hold the most. Strategic entities hold 19.68%. Of them, Kinross Gold Corp has 9.9% and Milliard Geological Consulting owns 9.78%. The rest is retail.

Eminent Gold has a market cap of CA$20.89 million. The company has 54.82 million free float shares and a 52-week trading range of CA$0.21 to CA$0.52.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Eminent Gold Corp

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.