Copper prices broke higher last week, above $5.00, and are headed to all-time highs.

Not shown clearly on the weekly chart, but the high close was about $5.30 back in March. That is the level we want to see broken, and I believe it will soon happen.

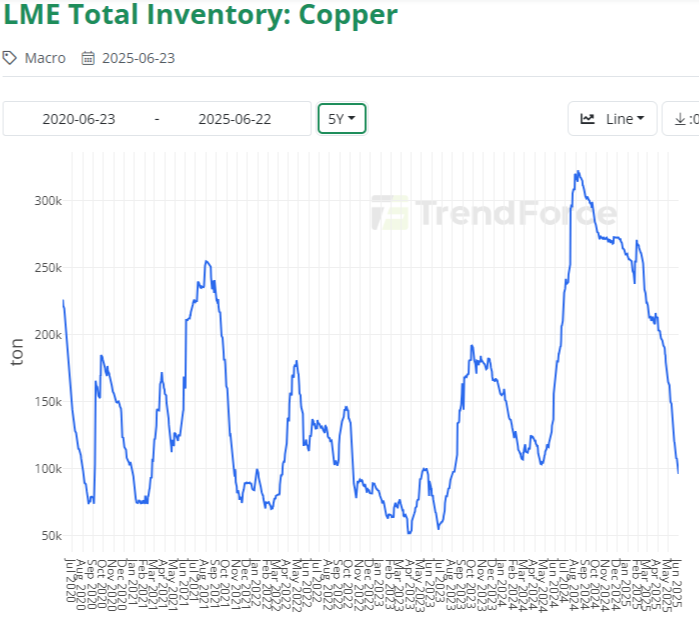

LME copper inventories have been plunging, and the market is setting up for a short squeeze.

Bloomberg reported that as of Monday (June 23), copper for immediate delivery was trading at a premium of US$345 per metric ton over 3-month futures, the widest spread since a record squeeze in 2021.

This backwardation has eased some since then, but the market is still very tight. The so-called Tom/next spread, the premium of copper due for delivery in one day to contracts expiring a day later, widened again on yesterday (Tuesday) after peaking at $98 a tonne last week, the highest since 2021.

That dramatic price divergence reflects the market's acute concerns over access to physical copper, with readily available inventories on the LME falling by around 80% this year alone.

Granted, a lot of copper inventory has moved to Comex in 2025 with some tariff concerns but even so, overall inventories are declining quickly.

According to "Copper in the U.S.: Opportunities and Challenges," without increased domestic copper production, the U.S. will be 60% reliant on foreign imports of refined copper by 2035. S&P Global projects the U.S. will require twice as much copper to satisfy its "energy transition demand" by 2035, which amounts to an additional 1.5 million metric tons. Adding conventional, non-energy transition demand, U.S. copper consumption will reach 3.5 million metric tons by 2035, an increase of 112%, or a compounded annual growth rate of 6.5%.

The U.S. has more than 275 million metric tons of copper reserves and resources, enough to meet the nation's projected demand for the foreseeable future; however, new U.S. mining projects currently average 29 years to begin production. Imports account for 44% of U.S. refined copper demand. Nearly all U.S. refined copper imports come from four countries with free trade agreements: Chile, Canada, Peru, and Mexico.

The U.S. and many other countries are ramping up their AI initiatives, and this will require an enormous number of data centers and power demand. I don't believe it is possible to build the energy infrastructure needed to meet AI plans and objectives.

Since 2015, the number of data centers worldwide has doubled to 7,000. This growth trend could intensify as companies shift data to remote cloud services. I plan on a newsletter mostly devoted to data center growth and resulting stress on the electrical and energy grids, but for now, a look at our copper producer, Capstone.

Capstone Copper

Recent Price - $8.90

Entry Price - $5.90

Opinion – Buy

I put Capstone Copper Mining Corp. (CS:TSX) on our Selection List because it was the purest copper play out there and has a strong growth profile.

Capstone has about 23% of production in the U.S. with its Pinto Valley mine, about 10% in Mexico with the Cozamin mine, and the rest in Chile with Mantos Blancos and Mantoverde mines.

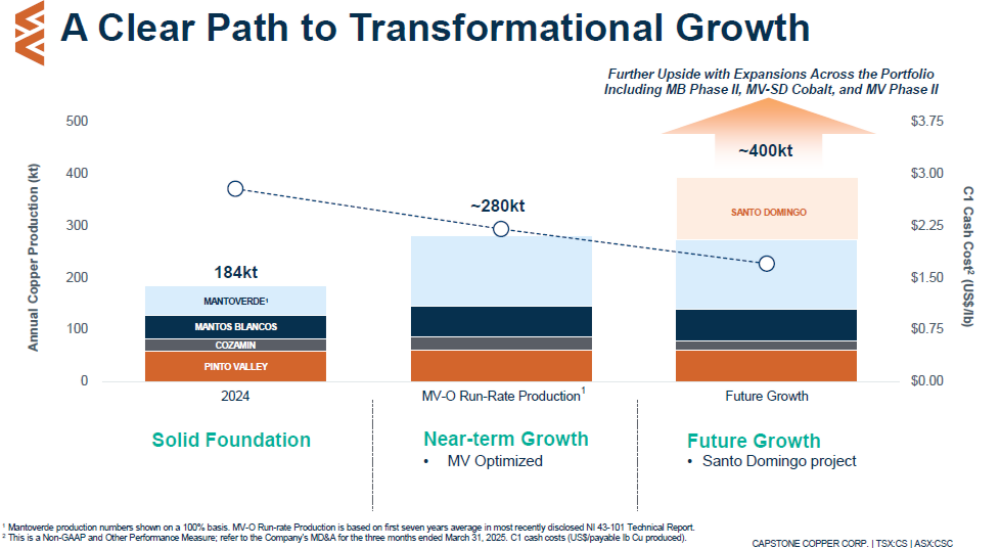

Their Santo Domingo project in Chile is fully permitted and will add significantly to future production.

Mantoverde just reached nameplate capacity in Q3 2024, so 2025 will see a full year of production at this rate.

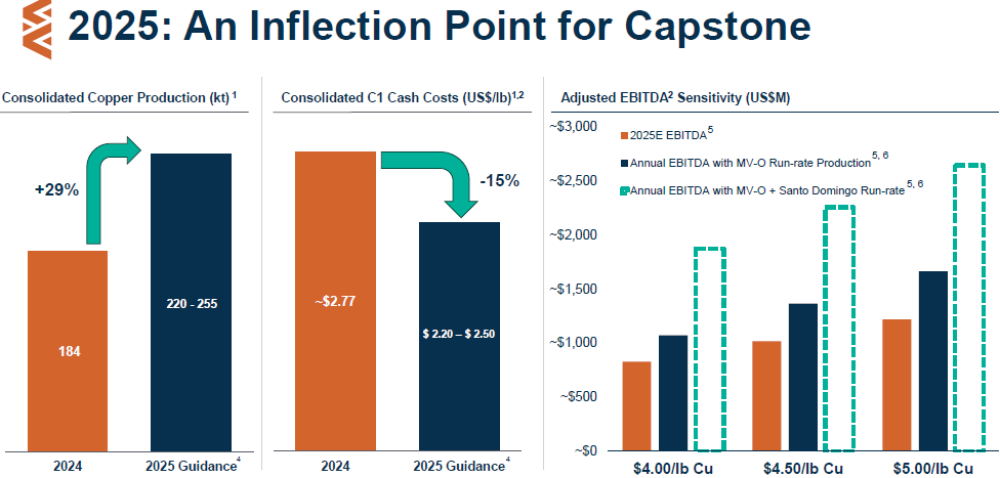

Capstone is on a path of strong production growth and declining costs. These two slides from their presentation sum that up well.

Capstone has a strong growth profile, and this next slide projects strong growth of +29% for 2025 and falling costs at -15%.

They released Q1 2025 results on May 1st. John MacKenzie, CEO of Capstone, commented: "Our operations got off to a solid start in the first quarter, marked by record sulphide copper production from both Mantoverde and Mantos Blancos, as we achieved record revenues and EBITDA. We look forward to maintaining this momentum through the remainder of 2025, demonstrating reliable copper production, lower costs, and increased cash flow generation while continuing to advance our growth options. Amidst heightened market uncertainty, Capstone is very well-positioned to deliver copper growth in top-tier jurisdictions, with a focus on safety, operational execution, and a strong financial position."

Consolidated total copper production for Q1 2025 was 53,796 tonnes at C1 cash costs of $2.59/lb. Sulphide copper production for Q1 2025 was 45,950 tonnes at C1 cash costs of $2.23/lb compared to 30,841 tonnes at $2.55/lb in Q1 2024, largely driven by contributions from Mantoverde sulphides following the successful ramp-up in 2024. Mantoverde sulphides produced 16,268 tonnes of copper at C1 cash costs of $1.53/lb in Q1 2025.

Operating cash flow before changes in working capital of $166.1 million in Q1 2025, compared to $62.1 million in Q1 2024.

Capstone has peer-leading Cu growth and leverage, has an attractive valuation, and also has takeover possibilities. And now you can see the stock is breaking out on the chart.

Today the stock is breaking out above resistance, and I would continue to hold, and if you don't own any Capstone, I see it as a Buy on this breakout

| Want to be the first to know about interesting Copper and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [COMPANY] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, [COMPANY] has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [COMPANY].

- Ron Struthers: I, or members of my immediate household or family, own securities of: Capstone Copper. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.