For years, copper has quietly built a case for being one of the most strategically important — and structurally underappreciated — commodities in the global economy.

Today, that case is no longer just about long-term fundamentals.

Technically, copper may be on the verge of a historic breakout, with the gold-to-copper ratio flashing one of the clearest signals in decades.

The Coming Copper Supercycle

The world is entering a period of compounding copper demand across sectors that didn't even exist a generation ago. Clean energy infrastructure, electric vehicles, artificial intelligence, and data center expansion are all rapidly growing copper consumers. By some estimates, copper demand could double by 2035, from ~25 million tonnes to nearly 50 Mt.

This surge is colliding with mounting supply constraints. Ore grades have declined ~40% since 1991, permitting timelines now average more than 15 years, and only a handful of major discoveries have been made in the last decade. Mine development delays, social license challenges, and geopolitical instability in key regions are adding even more friction.

According to the International Energy Agency, even in its most optimistic scenario, a copper supply deficit of at least 1.6 million tonnes will persist by 2035, and under more aggressive climate targets, this deficit could exceed 10 million tonnes annually. With energy transition goals looming, this shortfall threatens to delay or derail critical electrification projects worldwide.

Meanwhile, new demand centers are emerging. Both India and Vietnam are poised to become major copper consumers, while China continues to dominate refining capacity with a 45% global share. Supply, however, remains concentrated in jurisdictions such as Chile and the Democratic Republic of Congo, increasing geopolitical and logistical risk.

The Gold-to-Copper Ratio: A Hidden Signal

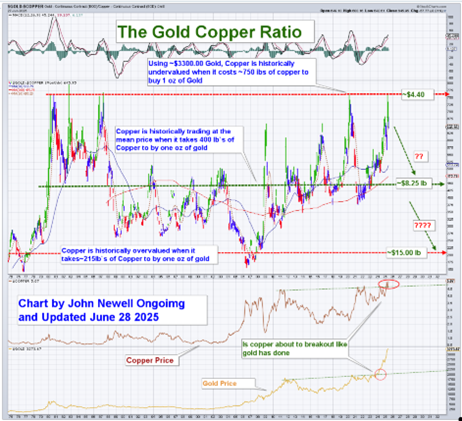

While most headlines focus on copper supply and demand, the gold-to-copper ratio may offer the most striking indicator of what's coming next.

Historically, this ratio oscillates around a long-term mean, but today, it's signaling copper is historically cheap relative to gold.

- At $3,300 gold, the ratio currently implies copper is undervalued at ~$5.00 per lb historically

- At $3,300 gold, the ratio implies copper should be trading at approximately $8.00/lb to revert to the mean

- A return to the lower bound of historical undervaluation could imply copper over $15/lb

Technically, the ratio has reached levels not seen since the early 2000s, just before copper launched into a multi-year bull market

This isn't just a valuation story, it's a sentiment shift. When gold leads, copper often follows. And gold's 2024 breakout may be the prelude to a similar move in copper.

Fractal Patterns and Price Projection

Copper's price chart is showing a clear fractal pattern resembling its 2003–2007 breakout period. Key technical levels have already been tested and held, and copper appears to be forming a bullish base with higher lows.

The breakout above $5.00/lb could confirm a long-term trend reversal.

Using Fibonacci extensions and historical symmetry:

- A 2x move from the current base projects copper to ~$8.00–$9.00/lb

- Longer-term targets range up to $12.00–$15.00/lb, particularly if inflation and energy transition tailwinds persist

Fundamental Tailwinds Align

Beyond charts and ratios, the copper bull thesis is grounded in urgent global realities:

Electrification & Renewables: EVs use 3–4x more copper than internal combustion engines. Offshore wind, solar farms, and smart grid infrastructure require unprecedented copper input.

AI and Data Centers: AI infrastructure and high-powered computing require heavy-duty copper wiring and cooling systems. This sector alone could consume 1–2% of global copper demand by 2030.

Falling Ore Grades: As copper grades decline globally, more energy and capital are needed to produce each tonne, raising costs and limiting supply elasticity.

Lack of Discoveries: less than 20 new copper deposits have been discovered in the last decade, compared to over 200 in the prior 23 years.

Capital Intensity and Timelines: New mine development now averages 17+ years, making it nearly impossible to respond quickly to demand shocks.

Recycling Limitations: While helpful, recycling cannot offset primary demand growth in the next two decades.

Strategic Implications for Investors

For investors, the opportunity lies in positioning before the re-rate. Major mining companies are already investing in juniors, particularly in stable jurisdictions like British Columbia, Arizona, Ontario, and Australia.

As copper breaks out technically, capital will chase leverage, and junior explorers offer the highest torque to rising copper prices.

This isn't about chasing hype. It's about reading the signals that the market is quietly flashing:

- Historic undervaluation versus gold

- Fractal price patterns signaling acceleration

- Structural supply deficits meeting exponential demand

- Geopolitical risks realigning the global copper map

New Generation Copper Developers Are Stepping Up

Amid mounting supply pressures and accelerating global demand, a new wave of copper exploration and development companies is emerging to meet the challenge. These juniors are advancing well-positioned projects with strategic advantages, from shorter development timelines to favorable jurisdictions, that could help close the widening copper gap.

As majors increasingly turn to partnerships and acquisitions to secure future supply, these agile explorers and developers are becoming vital players in the next chapter of copper's story.

McEwen Mining Inc. (MUX:TSX; MUX:NYSE ) is advancing the massive Los Azules copper project in Argentina, one of the largest undeveloped copper projects in the world.

With over 10 billion pounds of contained copper, Los Azules represents a cornerstone asset with tremendous long-term leverage to rising copper prices.

Recent technical work and a defined development plan are moving the project toward pre-feasibility.

The company has also announced progress on infrastructure, permitting, and funding strategy, positioning itself as a potential takeover target or future producer as the copper cycle matures.

NexMetals Mining Corp. (NEXM:TSX.V) is quietly drilling into one of Botswana's past-producing copper-nickel mines, and the story is picking up speed.

The Selkirk Mine already has a known copper-nickel-PGE footprint, and the company has completed 2,050 meters of new drilling with assays expected shortly.

A second drill rig is now turning, and NexMetals is also resampling historical holes and running metallurgical tests to define recovery parameters.

All this work is feeding into an updated mineral resource estimate, as the company positions Selkirk for a potential copper-Ni-PGE revival at a time when global supply remains tight.

It's early days, but with the fundamentals behind copper and the right rocks in the right address, this is a name to keep an eye on.

Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCQB) is shaping up as a serious copper-silver-gold exploration story, backed by some of the smartest money in the business.

With Newmont (formerly Newcrest) holding a 9.5% stake and Eric Sprott at 12.5%, the company's flagship La Plata Project in southwest Colorado is drawing comparisons to world-class porphyry systems like Cadia.

The 2023 resource at the Allard deposit shows 1.2 billion lbs of copper and 17.6 million oz of silver, with the next update expected to include gold and PGEs.

What stands out is the scale of the alteration system, over 25 km² with multiple untested targets, including Ridgeway-style zones that could host much higher grades.

With permits in place and Newmont technical input in the field, 2025 could be a breakout year.

Final Thoughts

Copper is no longer just a metal. It's the backbone of electrification, data, mobility, and decarbonization. The market is beginning to wake up to this. But the technical charts suggest the real move hasn't even started.

For investors who understand both the fundamental and technical case, copper could represent the most asymmetric opportunity of the next decade.

| Want to be the first to know about interesting Critical Metals and Copper investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Metallic Minerals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- John Newell: I, or members of my immediate household or family, own securities of: [None]. My company has a financial relationship with [None]. My company has purchased stocks mentioned in this article for my management clients: [None]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.