Silver X Mining Corp.'s (AGX:TSX.V; AGXPF:OTC) stock has made substantial gains since we last looked at it early in March, and even more importantly, as we will see in detail when we review its charts later in this update, it has broken out of a base pattern on strong volume to begin a major new bull market and as we will also see, further gains are in prospect over the short to medium-term.

That the technical picture for Silver X's stock has improved substantially should hardly be surprising, considering the rapid progress that the company is now making. On April 23, Silver X reported significant operational and financial improvement for the full-year and fourth quarter of 2024, with Jose Garcia, Silver X Mining's CEO, commenting: "As fourth quarter and full-year results at the Tangana Mining Unit demonstrate, our team accomplished a great deal in 2024. Production stabilized and grew. Revenue was nearly 40% higher, and we pared losses significantly compared to 2023. I expect both stronger growth and improved margins in 2025. In addition to our focus on growth and profitability at Tangana, we are excited to bring our new Plata Mining Unit into production in 2026. We continue to grow the value of our district, which we envision to be producing at least 3,000 tonnes per day and more than six million ounces within the next few years."

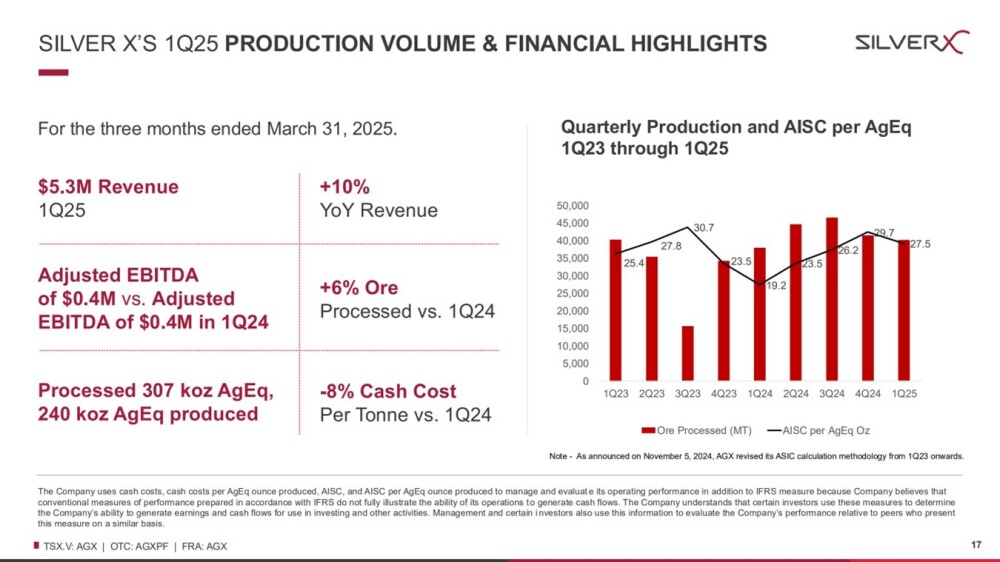

Then, on May 22, Silver X Mining reported pre-tax profit for the first quarter of 2025. While the pre-tax profit of $20,084 might not sound impressive, it's a whole lot better than reporting a loss and is a sign that the company is heading in the right direction.

The comments of the Silver X CEO on these results are worth repeating here: "Silver X is delivering improved results quarter after quarter, highlighted by strong operating performance, positive pre-tax income, and EBITDA. These results reflect the growing strength of our operations and the hard work of our team. With operating income of $786,330, pre-tax profit of $20,084, and EBITDA of $403,450, we are building momentum.

On the ground, we completed over 2,300 meters of mine development, advancing our access to higher-grade zones and setting the stage for the year's 8,000-meter drill campaign at the Tangana Mining Unit. These results, combined with the increase in our most recent mineral resource estimate, put Silver X in a strong position to capitalize on what we believe is a compelling outlook for the silver market. This is an exciting time for Silver X. We remain steadfast and focused on delivering value through disciplined, profitable, and growing production in one of the most prolific Districts in Peru."

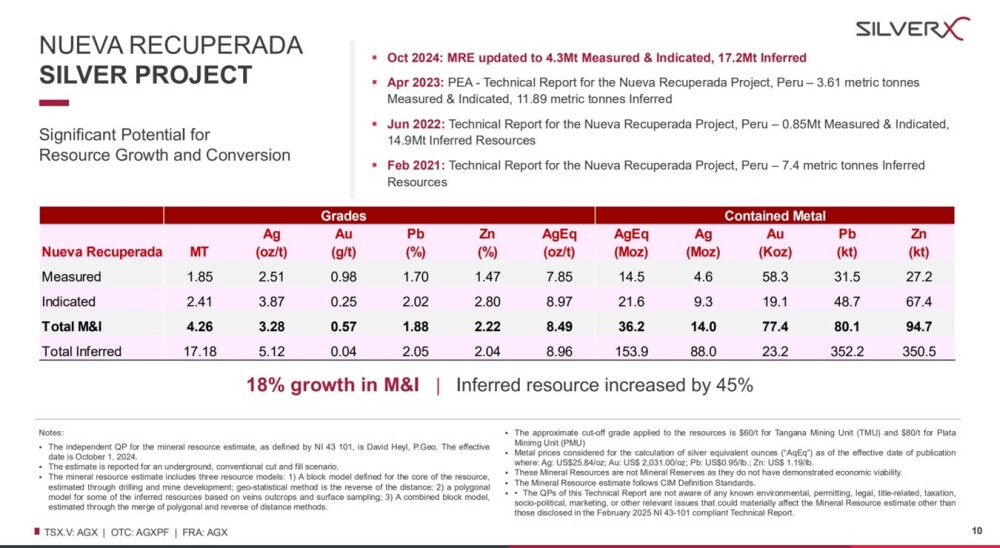

These positive developments follow on from the news released on February 26 that Silver X announced a significant increase in the mineral resource estimate for the Nueva Recuperada Project, including additional high-grade resource at the Plata Mining Unit. From the action of the stock in the weeks after this news of the increase in the MRE was made public, it is clear that the market did not take it seriously — well, it's taking it seriously now.

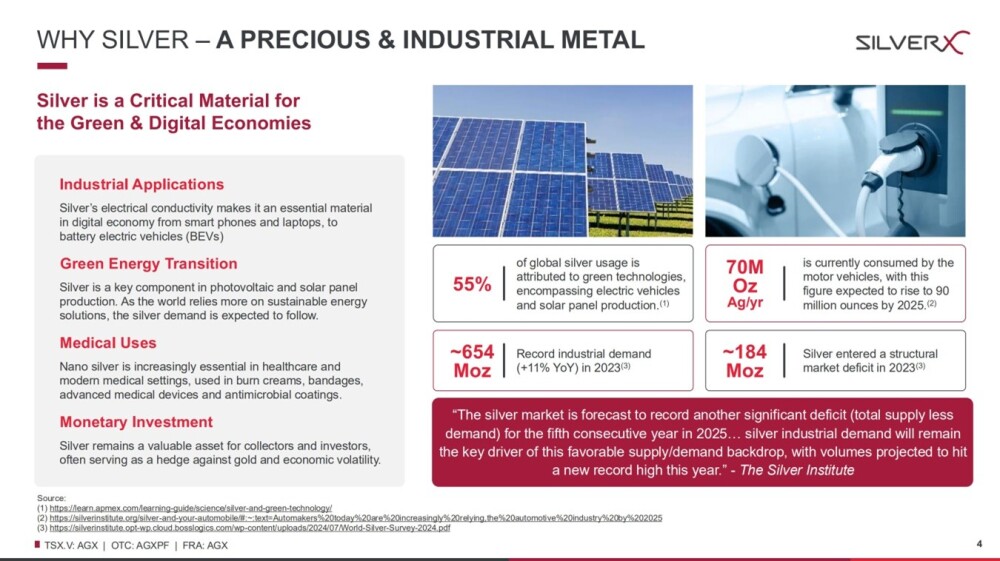

Before looking at the specifics of the company it's worth reminding ourselves why silver is now such an attractive investment.

Silver is both an investment and a practical industrial metal with a wide variety of uses.

Before we examine the latest stock charts for Silver X, we will review the fundamentals of the company using the company's June investor deck.

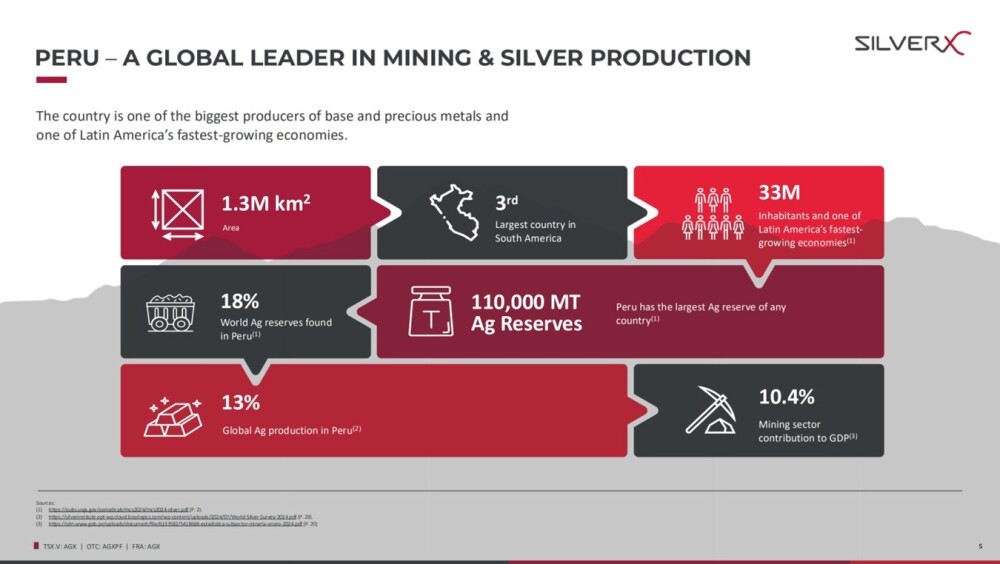

The company's projects are located in a district-scale land package in Peru, which is the second-largest silver-producing country in the world and holds the world's biggest silver reserves.

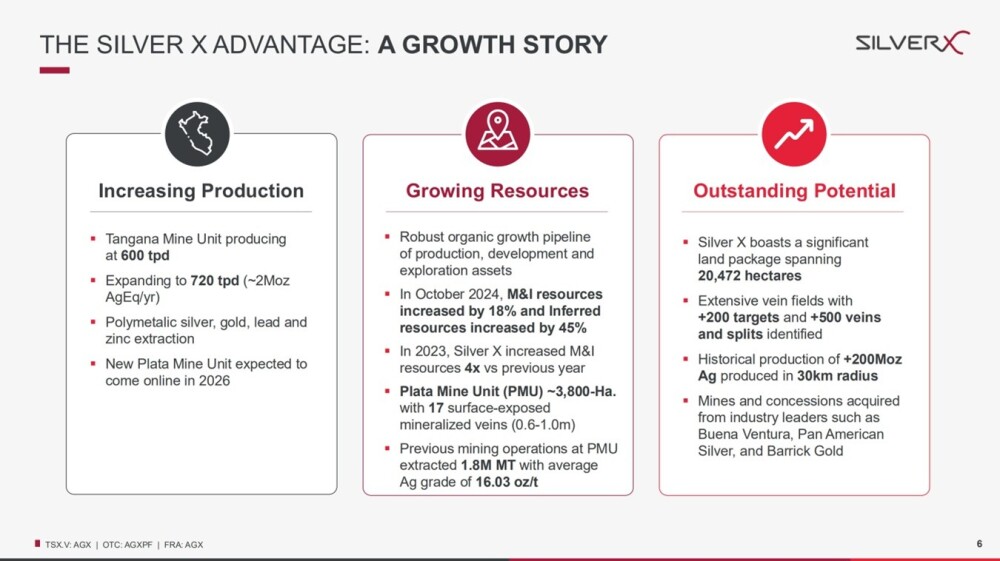

The case for Silver X Mining as an investment can be made on just one page, and remarkably, the company increased Measured & Inferred resources by 4X in just one year, 2023.

Silver X Mining is already producing, and in addition to its primary product, silver, it also mines gold, lead, and zinc. Its district-scale project has plenty of scope for both increasing production and brownfield expansion. Growth prospects are therefore excellent during a period when metal prices are expected to rise.

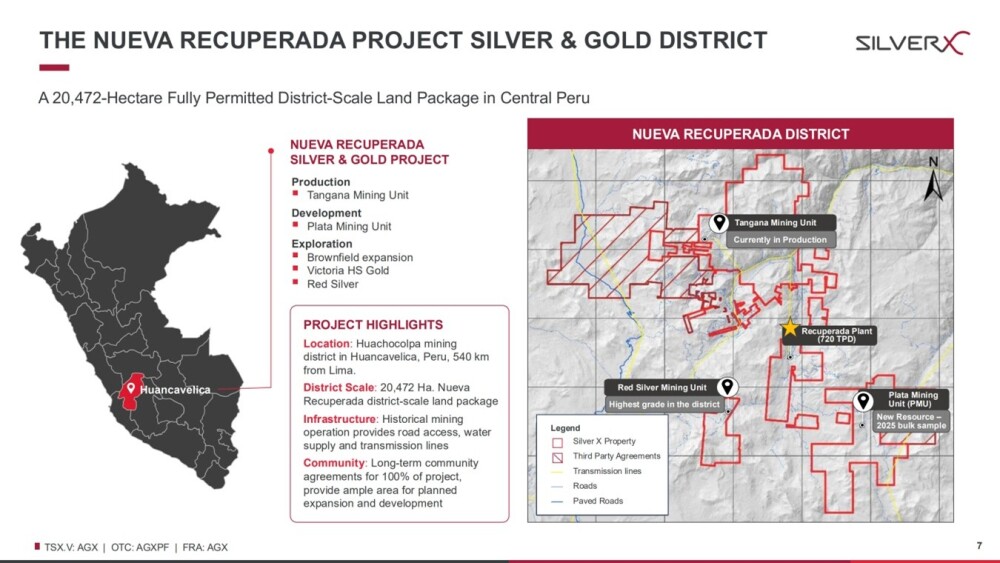

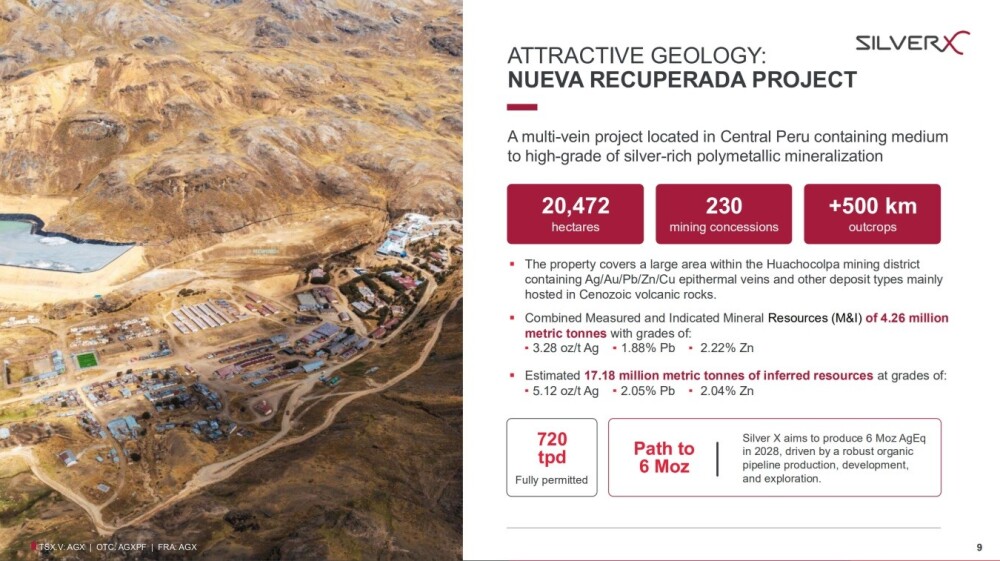

The company's flagship property is the Nueva Recuperada silver project, which is already in production, with production set to continue to increase. The next page shows the location of Nueva Recuperada in Peru, and a map details the main targets within the property.

Nueva Recuperada is a huge 20,000-hectare district-scale property with enormous potential.

The next image provides an overview of it.

This resource chart for Nueva Recuperada shows that there has been a 4-fold increase in Measured & Indicated resources in only one year.

This image shows Production Volume and Financial Highlights:

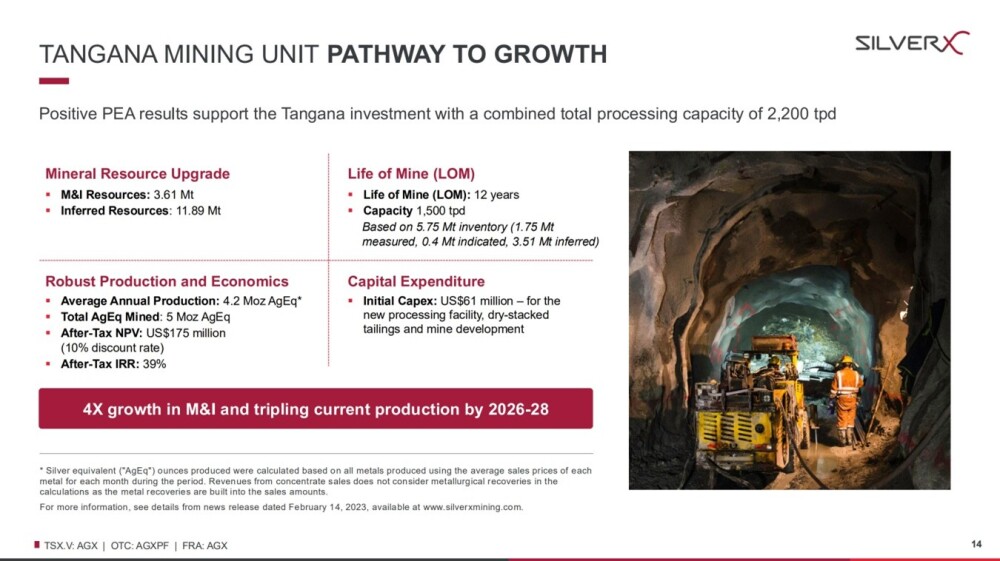

Production at the Tangana Mining Unit is expected to triple through 2026 – 2028.

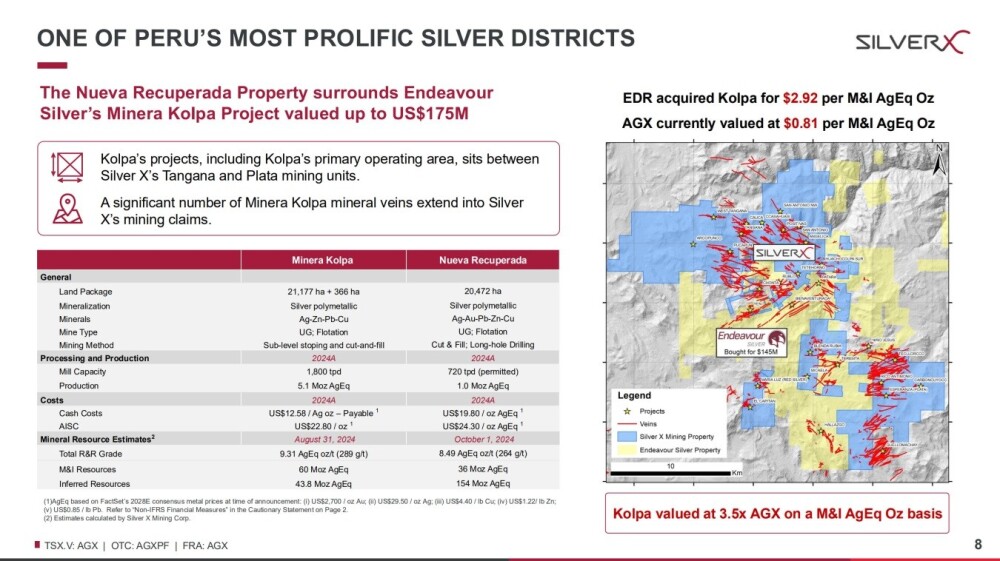

It's a swift and worthwhile exercise to compare Silver X's Nueva Recuperada Project to Endeavour Silver's Kolpa Project, which surrounds it, especially because these projects occupy an approximately similar land area, as we can see in the following image.

It doesn't take a genius to work out the implications for the future revaluation of Silver X, given that Endeavour acquired Kolpa for $2.92 per M&I AgEq Oz while Silver X is currently valued at CA$0.81 per M&I AgEq Oz.

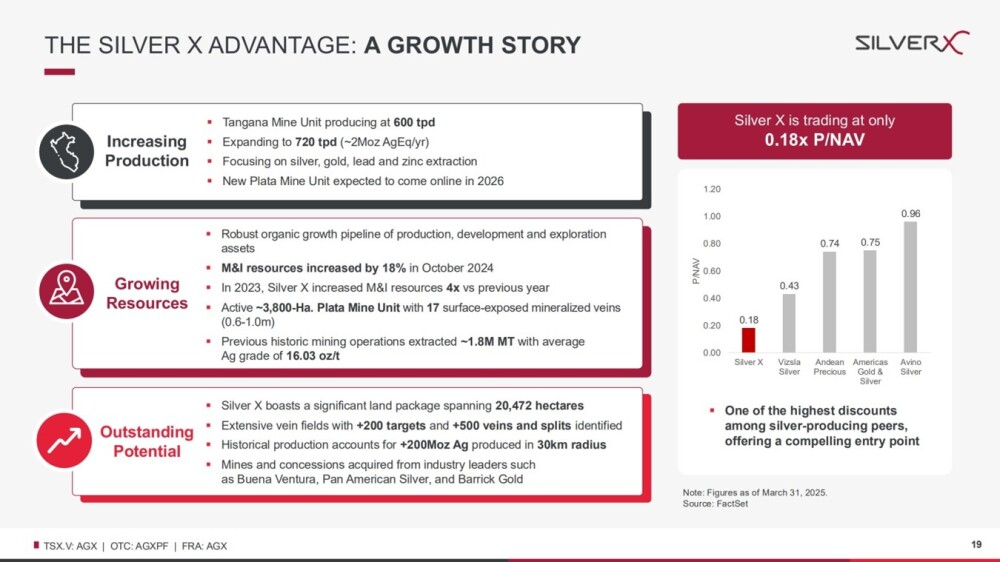

To sum up, Silver X Mining is very much a growth story as shown on the following page, although we note that its undervaluation relative to its peers has narrowed somewhat since this page was made, due to the stock breaking out to commence a new bull market.

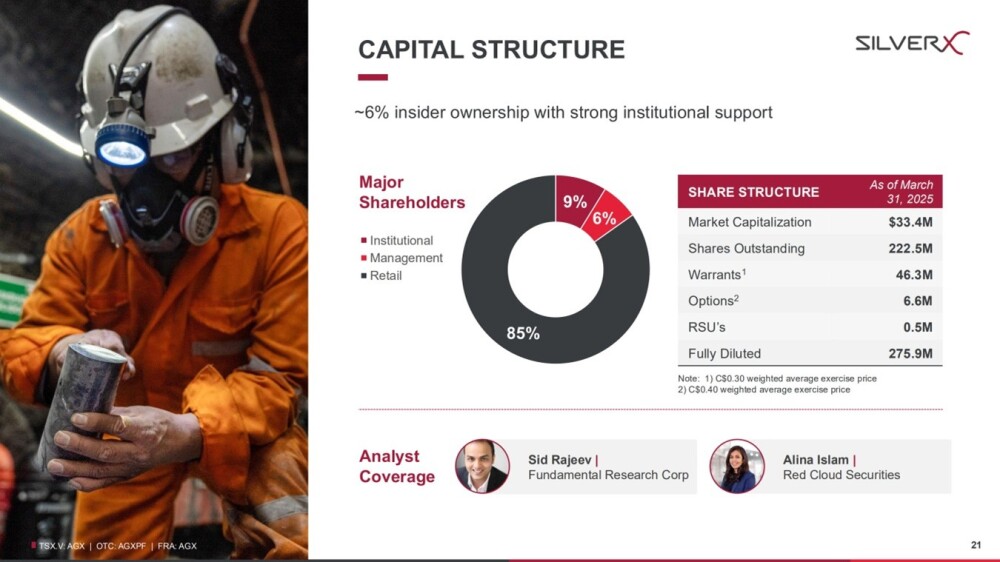

This last image shows the capital structure of the company.

Now, we will examine the latest stock charts for Silver X Mining, which show that it has just begun a major bull market.

We had been expecting a major bull market to get underway in Silver X Mining for some considerable time, and with the strong advance from mid-May through early this month, which can be seen to advantage on the 15-month chart below, it looks like it has started.

This move, which saw it break out of the Head-and-Shoulders bottom pattern that formed from late February, has the characteristics of an "impulse wave," meaning a move in the direction of the primary trend, which is now up.

It was a big, decisive move on strong volume that drove volume indicators steeply higher, and it broke the price clear above its 200-day moving average, which has now turned up, with the 50-day now rising more steeply in readiness for a bullish moving average cross.

Whilst Silver X remains within the giant basing pattern that has built out from when it resumed trading in the middle of 2021 whose upper boundary is at about CA$0.50, the marked volume buildup since the Spring of last year and especially during this year to date shows heavy stock rotation which is bullish because it means that stale old holders of stock are being replaced by new buyers with more belief in the future of the company who will not be inclined to sell until they turn a profit.

So, in effect, this persistent high volume means that the available supply of stock is being reduced, which means that new buyers will increasingly have to raise their bids in order to secure stock, which is exactly what we have seen in recent weeks.

In conclusion, recent action in Silver X Mining stock is seen as a Buy, as it is seen as very bullish, so the dip of the past several weeks — is a normal consolidation of its gains since mid-May above its 200-day moving average — is viewed as presenting a buying opportunity as downside from here looks very limited with the current tight pattern viewed as a bull Flag that will lead to renewed vigorous advance.

The first target for an advance is CA$0.36 – CA$0.38. The second target is CA$0.45 – CA$0.50, and it should ascend to higher levels.

Silver X Mining Corp.'s (AGX:TSX.V; AGXPF:OTC) closed for trading at CA$0.225, US$0.169 on June 27, 2025.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver X Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver X Mining Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.