I'm writing this piece just days following Israel's extensive aerial assault on Iran, aimed at thwarting that country's nuclear ambitions.

Naturally, this development has rattled international financial markets.

Oil prices climbed upward, driven by fears that Iran might target shipping vessels in the Strait of Hormuz or seal off this critical passage using a combination of explosives, unmanned aircraft, and kamikaze boats. Roughly 20 million barrels of petroleum traverse this waterway daily — nearly one-fifth of worldwide shipments. However, the price increase has remained modest at approximately 10%.

Equity values initially declined, though not catastrophically, and have since regained much of their earlier losses. The precious metal's value surged as anticipated, approaching $3500 per ounce, though it has subsequently retreated.

Ambiguity prevails. The globe questions whether this emerging conflict will broaden, and to what extent. Will America be pulled deeper into the fray as a more engaged participant? Should Iran strike any U.S. installations across the Middle East, retaliation becomes inevitable; countermeasures will follow. Should Iran attempt to blockade the Strait, this too would certainly provoke American intervention. But what form would such U.S. retaliation assume? And will any of Iran's aligned nations join the confrontation?

The situation remains complex, and tomorrow, as usual, remains unpredictable.

Thus far, market responses have been relatively restrained. Nevertheless, we can anticipate that anxieties regarding this conflict's trajectory will persist — for weeks or perhaps months — until reaching a resolution that might be internationally celebrated, disastrous, or something between these extremes. Generally speaking, an expanding conflict will likely push international investors further toward the yellow metal, the paramount security refuge. This tendency should amplify the ascending market already in motion.

Middle Eastern developments represent just one element. Let's examine additional forces propelling precious metal valuations. Predictably, we discover that a significant driver connects directly to international hostilities.

What Transpired in '22?

Individuals of a particular generation will recall a 1970s advertising campaign featuring a tagline that achieved legendary status: "When E.F. Hutton talks, people listen." The original Hutton has vanished, but if we updated that phrase today, we'd substitute it with the most powerful investment institution, Goldman Sachs.

Goldman operates not merely as a heavyweight financial entity; it maintains deep connections with U.S. governmental structures and monetary policy formation. When it communicates, it's reasonable to presume it possesses insider knowledge. For some time now, Goldman has emerged as the most bullish institution regarding the precious metal's prospects.

What explains this stance?

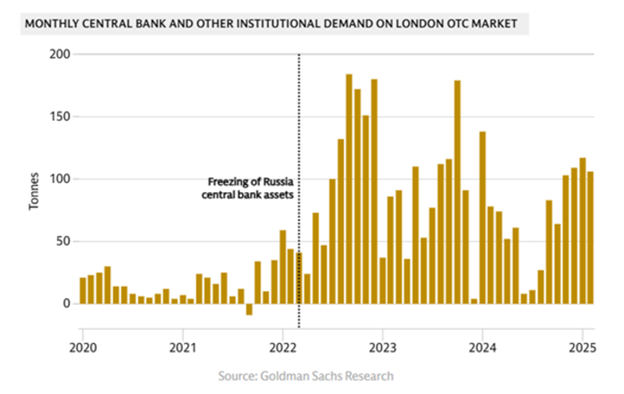

A Goldman Sachs bar chart illustrates the narrative.

During 2022, following Russia's incursion into Ukraine, Western nations (led by America) initiated the most extensive coordinated asset seizure in contemporary times.

More than $300 billion of Russia's foreign currency holdings stored in Western central banks faced freezing. This action was without precedent. Additionally, numerous wealthy Russian individuals, government officials, and Putin associates with wealth hidden throughout the West found themselves locked out. Multiple major Russian financial institutions were ejected from SWIFT, severing their international transaction capabilities.

Goldman's visualization demonstrates what followed.

International central banks scrutinized their reserve holdings, particularly U.S. currency. They pondered:

If Russians can be denied access to their wealth by America so effortlessly, what would stop identical treatment from befalling us?

Only one asset existed — a tangible commodity — that couldn't be efficiently seized. Consequently, central banks dramatically pivoted toward precious metal diversification.

A Fundamental Transformation

Between 2000 and 2009, central bank acquisitions remained negligible, typically below 100 tonnes annually. From 2010 to 2020, appetite increased somewhat, averaging roughly 400 tonnes yearly. Then, in 2021, with Russian military aggression approaching, purchases skyrocketed. Following the February 2022 invasion and subsequent penalties, they escalated dramatically.

During 2022, central banks accumulated 1,136 tonnes, establishing a new record. The 2023 figure reached 1,037 tonnes, while 2024 achieved 1,086. The momentum has decelerated slightly in 2025, though acquisitions still project between 900 and 1000 tonnes by year-end.

With this surge, precious metal overtook the euro as the globe's second-most significant reserve asset for central banks in 2024, and by a substantial margin. Bullion represented 20% of worldwide official reserves last year, surpassing the euro's 16%, trailing only the U.S. dollar at 46%, per European Central Bank data.

These central bank transactions occurred through London's over-the-counter marketplace. We're not discussing Maple Leafs and jewelry chains. These involve enormous, 400-troy ounce "good delivery" ingots. This means they're being withdrawn from circulation. They're entering bank storage facilities permanently.

Banks currently absorb roughly 25% of yearly precious metal production, thereby restricting supply for alternative purchasers. However, while central bank acquisitions drove prices upward, retail investor purchases remained comparatively sluggish.

Until recently.

Purchasers are emerging from hibernation, and dramatically so.

First quarter 2025 investment appetite leaped to 552 tonnes (+170% year-over-year), the peak since early 2022. Precious metal-backed exchange-traded fund holdings spearheaded this movement, increasing by 227 tonnes in Q1 and achieving 342 tonnes by April — the most robust expansion in years.

Beyond ETFs, bar and coin acquisitions climbed +15% year-over-year to 325 tonnes during Q1. Appetite was driven by Chinese investors converting U.S. currency for metal, representing one of the two strongest quarters historically.

Domestic public enthusiasm was supported by retailers like Costco, which struggles to satisfy demand for its physical bullion offerings.

The Forecasting Sphere

Goldman Sachs leads the field with remarkably aggressive price predictions.

Others exercise greater caution. Bank of America, for instance, anticipates precious metal declining below $3100 per ounce throughout the year's remainder. Deutsche Bank maintains extreme pessimism, projecting prices between $2,450-3,050. Citibank forecasts a $3,100-3,500 range.

Goldman, however, continues elevating its targets and now envisions $3,700 per ounce as the probable end-2025 milestone. Yet in a stress scenario — such as economic downturn or international risk escalation — the institution believes it could surge to $3,900 or potentially reach $4,500 per ounce at maximum.

That represents the highest projection anyone ventures, though some follow closely. UBS anticipates a base scenario of $3,500 per ounce at 2025's conclusion, with $3800 upside potential and $3,200 downside protection. J.P. Morgan's projections also trend high, at $3,675 in Q4 of '25 and $4,000+ in Q2 of '26.

Much depends on global developments, naturally. Ongoing chaos in Ukraine and the Middle East will likely support elevated precious metal valuations. Federal Reserve interest rate reductions would similarly help. And FOMO (fear of missing out) appears to be accelerating among individual investors.

Conversely, recession might suppress values. And substantial stock market declines always mean temporary price drops, as people liquidate their precious metal holdings to offset paper losses.

But generally, when Goldman communicates, it's typically prudent to pay attention.

And recall that the precious metal's ascent has occurred despite minimal retail buyer interest. That's shifting. As it does, capital will inevitably flow into mining companies, generating substantial free cash flow even at present valuations.

Best assessments suggest the precious metal's market capitalization currently stands between $21 and $23 trillion. Yet, the total market capitalization of all global mining companies amounts to merely $500 billion. Minimal interest shifting would ignite the next mining stock surge, which historically begins by lagging the metal — then leveraging gains far beyond it. Junior miner advances could prove spectacular, since this sector has declined roughly 70% from its 2012 peak.

Jeff Clark recently published a Best Buy compilation of companies he personally overweights, ones he believes could match historical gains we've witnessed. It's a bull market, and it's time to be long — check it all out here.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.