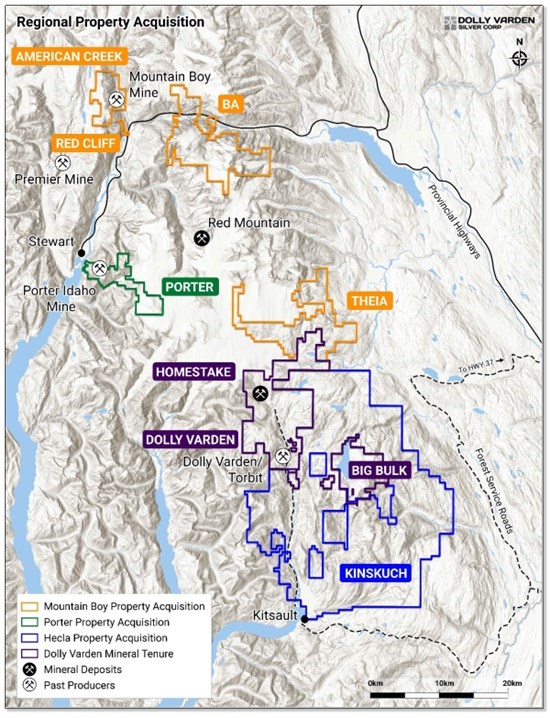

Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA; DVQ:FSE) entered into a definitive agreement with MTB Metals Corp. (MTB:TSX.V) to acquire its interests in four properties, totaling 20,000 hectares (20,000 ha) in the same historical mining district as Dolly's Kitsault Valley silver-gold project, a news release noted.

"Dolly Varden Silver has taken another bold step in consolidating its position in British Columbia's mineral-rich Golden Triangle," Jeff Valks, senior analyst for The Gold Advisor, wrote in the May 15 edition.

The properties are American Creek (consisting of Mountain Boy, Silver Crown and the Dorothy option), Theia, BA and Red Cliff. Three are road accessible and close to power and Ascot Resources Ltd.'s (AOT:TSX.V) recently completed Premier gold-silver mill near the port of Stewart.

The total consideration for the acquisition consists of up to 500,000 common shares of Dolly Varden at a deemed value of CA$3.59 apiece and a 1% net smelter return royalty on all production from each of these properties: Mountain Boy, BA, Theia and Silver Crown. Dolly Varden will assume MTB Metals' obligations with respect to Dorothy and Red Cliff.

Here's a look at the properties Dolly Varden gains via this acquisition:

American Creek: This 2,602-ha property revolves around the past-producing Mountain Boy high-grade silver mine. Historical grades of silver mined there range from 8,000–17,000 grams per ton (8,000–17,000 g/t). Drill result highlights from 2019 include 5.1 meters (5.1m) of 5,258 g/t silver (hole DDH-MB-2006-10) and 6.1m of 2,260 g/t silver (hole DDH-MB-2006-19). American Creek contains various unexplored targets. The mineralized system remains open to depth and along strike.

Theia: Strategically located, this 9,235-ha property is contiguous to the northern boundary of Kitsault Valley's Homestake Ridge property. Theia will expand Kitsault Valley to 86,000 ha hectares and increase the strike length of prospective Hazelton Group rock to the north. Historically, a 500m-long silver-bearing mineralized trend was identified at Theia and highlighted by a 2020 surface grab sample showing 39,293 g/t silver.

BA: Highway 37A passes through the northern portion of this 9,490-ha property, 30 km northeast of Stewart. BA hosts numerous mineralized showings. Historical drilling of 178 holes outlined a substantial zone of silver-lead-zinc mineralization about 4 km from the highway. At the project, there are several untested targets with high-grade silver potential, including a volcanogenic massive sulphide/epithermal hot spring deposit containing base metals. These occurrences are hosted in the same prospective Hazelton Group stratigraphy existing at Kitsault Valley.

Red Cliff: This property is part of a joint venture and consists of smaller crown grants encompassing a past-producing gold-copper mine. Dolly Varden is acquiring MTB Metals' 35% interest in the JV. Red Cliff is 1 km south of American Creek and within the American Creek corridor.

Also through the acquisition, Dolly Varden will receive a data set including results of property-wide airborne geophysics surveys, drilling and mapping.

Also through the acquisition, Dolly Varden will receive a data set including results of property-wide airborne geophysics surveys, drilling and mapping.

"[This] will integrate nicely into our regional models to help generate new target areas and prioritize follow-up work within the Hazelton Group rocks," Dolly's Vice President of Exploration Rob van Egmond said in the release.

On an Acquisition Tear

The MTB Metals portfolio is Vancouver-based Dolly Varden's third announced acquisition this month. The other two are StrikePoint Gold Inc.'s (SKP:TSX.V; STKXF:OTCQB) past-producing Porter project and Hecla Mining Co.'s (HL:NYSE) Kinskuch project, both also in the Golden Triangle.

"Shawn's vision for Dolly Varden is clear: becoming the premier advanced explorer in the Golden Triangle," Valks wrote, referring to the company's chief executive officer, Shawn Khunkhun. "With strategic acquisitions stacking up and historic grades to boast, Dolly Varden is carving out its claim in one of the world's richest silver and copper districts."

This expansion activity is consistent with one pillar of the junior mining company's growth strategy, as stated in its Corporate Presentation: accretive acquisitions.

The other pillar is aggressive exploration, and Dolly Varden is making moves in this regard, too. It is about to embark on its massive drill program at Kitsault Valley (at least 35,000 km), to grow its resource base and continue demonstrating its scale. With this fully funded campaign, the company will diamond drill various targets at both the Dolly Varden and Homestake Ridge properties.

Kitsault Valley is prospective for additional precious metal deposits, the company said, because it is in the same structural and stratigraphic belts of numerous other, on-trend, high-grade deposits, including Skeena Resources Ltd.'s (SKE:TSX.V) Eskay Creek and Newmont Corp.'s (NEM:NYSE) Brucejack.

Silver Breakout Expected

Silver and silver mining equities are about to have their time in the spotlight, experts say.

"The negative economic outlook characterized by rising inflation fears, wildly swinging currencies and stock market uncertainty creates a perfect setup for silver to shine," noted an InvestingHaven article on May 15. "Historically, silver has thrived during periods of inflationary pressure as investors seek hard assets like silver to preserve wealth."

According to Technical Analyst Clive Maund, the main driver for higher precious metals prices is the worsening debt market crisis, he wrote in a May 13 report. He explained that more and more money is being created as a way to stabilize debt markets, which is destroying the purchasing power of currencies and creating greater inflation. This accounts for the ongoing gold bull market, he added, "with silver set to follow."

Given the macroeconomic factors of debased currencies and unsustainable deficits at play today, silver is re-emerging as a financial safe haven, purported Dan Amoss for Jim Rickards' Strategic Intelligence. This is evidenced by investor money flowing into silver exchange-traded funds beginning in 2024 and continuing to date. Yet, despite this, the silver:gold ratio remains depressed. Thus, the implication is that silver could bust out into a major rally to catch up to gold.

"Dolly Varden Silver has taken another bold step in consolidating its position in British Columbia's mineral-rich Golden Triangle," Jeff Valks, senior analyst for The Gold Advisor, wrote in the May 15 edition.

"Silver would have to rise by 60–70% to simply regain its 30-year average ratio to gold," Amoss wrote.

The strategic analyst also pointed out that the ongoing silver supply deficit supports a repricing of the metal.

Last year was the fourth consecutive year of a silver deficit, during which the supply-demand gap reached 149,000,000 ounces (149 Moz). "The total drawdown of above-ground inventories since 2021 now stands at a staggering 796 Moz," he wrote. Another large deficit is expected this year despite the forecasted production increase.

"These aren't temporary mismatches," Amoss added. "They are structural shortfalls."

Jesse Colombo, financial analyst and investor, expects a strong bull market in silver mining stocks, he wrote in a Money Metals article on May 13. The Global X Silver Miners ETF (SIL) closing decisively above the $48–52 resistance zone, he wrote, would confirm further the bull market is underway.

"Silver mining stocks, in my view, represent one of the most compelling and potentially profitable opportunities in the next leg of the commodities bull market," Colombo added.

Peter Krauth of The Silver Stock Investor wrote on May 14 that silver looks poised for a two and a half-year breakout, a boon to silver mining equities. However, it may not happen until after the current typical seasonal weakness.

"The breakout could be spectacular," he added. "That's why you'll want to own the best of the best in this sector as we wait for that move."

The Catalysts

The start of Dolly Varden's drill program at Kitsault Valley is imminent, and this event could boost the company's share price. Once underway, drill results will be released on an ongoing basis.

The company is expected to update the Kitsault Valley resource in early 2026. In the meantime, the close of each of its three recent acquisitions (Kinskuch, Porter and MTB Metals' property portfolio) could be additional catalysts.

Analysts Like the Stock

The Gold Advisor's Valks recently described Dolly Varden as "an exciting silver play mixed with substantial geological evidence." Management stepped up its game this month, he wrote, with its "serious push to gain market dominance and drive value back into the stock price."

He noted DV is a "core position and a Strong Buy at current prices." He and his colleague Jeff Clark, founder of The Gold Advisor, hold long positions in it.

Raymond James Analyst Craig Stanley has an Outperform rating on Dolly Varden, according to his May 8 research report.

The Silver Stock Investor's Krauth pointed out in the May 14 edition that Dolly Varden's acquisition of Porter is "a great deal for Dolly" in that it is "buying high-grade silver at about $0.09/ounce (silver equivalent), paying in shares, consolidating more land in their neighborhood and gaining exposure to what’s likely a lot of exploration/discovery upside."

Regarding the stock, he wrote, "Dolly shares continue to consolidate as the market waits for catalysts. "Patience may be required but DV should offer good leverage to silver prices."

Haywood Securities Analyst Marcus Giannini rates Dolly Varden Buy and has a target price on it reflecting a potential 167% return. In his most recent report, he highlighted that the Canadian explorer offers investors something unique with Kitsault Valley, and that is, exposure to both high-grade gold and high-grade silver throughout. He considers the asset an ideal takeout target.

"Ultimately, we continue to view Dolly's Kitsault Valley project as increasingly suitable for larger miners, such as Hecla, given its uncapped growth potential, as seen in the company's most recent exploration program, as precious metal grades at site are highly competitive amongst peers," Giannini wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dolly Varden Silver Corp. (DV:TSX.V; DVS:NYSEA;DVQ:FSE)

Raymond James Analyst Craig Stanley has an Outperform rating on Dolly Varden, according to his May 8 research report.

Ownership and Share Structure

According to the company's latest corporate presentation in January 2025, 52% of its stock is held by institutional investors, including Fidelity Management & Research Company LLC, Sprott Asset Management LP, U.S. Global Investors Inc., and Delbrook.

About 37% is with strategic investors, including 15% with Fury Gold Mines, 12% with Hecla, and Eric Sprott owns 10% himself.

The rest, 11%, is with retail and high-net-worth investors.

The company has 79.52 million outstanding shares. Its market cap is CA$279.91 million, and its 52-week trading range is CA$3.21–5.84 per share.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- StrikePoint Gold Inc. and Dolly Varden are a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of StrikePoint Gold Inc and Dolly Varden.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

- Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.