Premium Resources Ltd. (PREM:TSX.V) is viewed as a most attractive investment following a bear market from 2022 that is believed to have just ended. The company is moving forward rapidly with two critical minerals projects in the mining-friendly, safe jurisdiction of Botswana in southern Africa. Amongst many positive developments this year to date, the company has raised $46 million to advance its projects, which is as clear a statement of confidence by investors as could be hoped for.

Just last month, the company confirmed a high grade copper / nickel zone in Botswana and it has applied for a Nasdaq listing, so things are moving in the right direction fast.

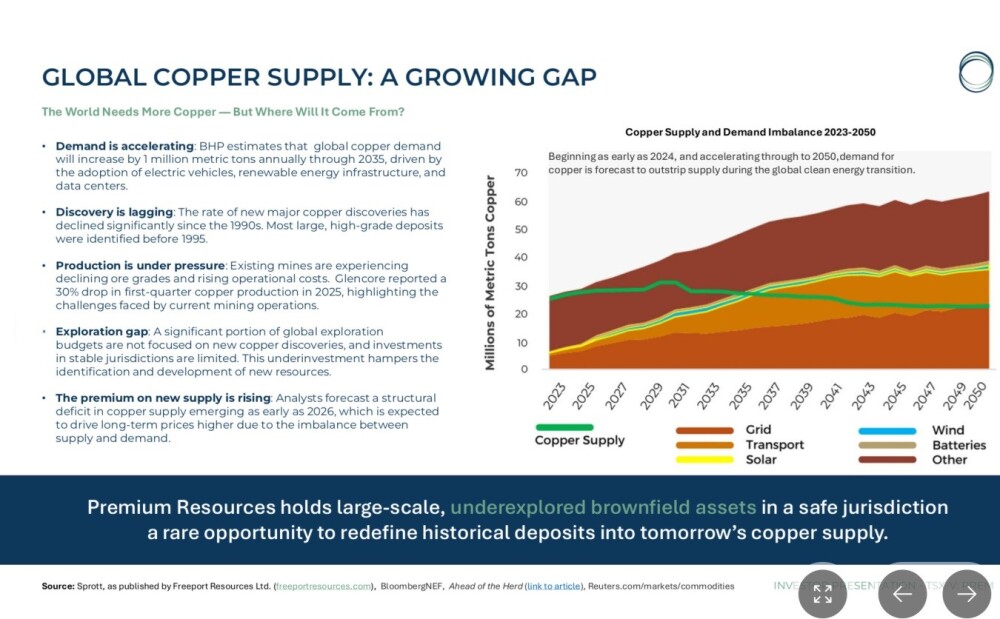

Most importantly, the company's two projects in Botswana are fully permitted and past-producing. This means that they can be fast-tracked to production. These projects have a strong copper component. The supply deficit in copper is set to grow rapidly in the coming years, and other things being equal, this is set to drive the price of copper higher and higher.

In February, the company appointed a new CEO, Morgan Lekstrom, who has a history of successes, and announced a new strategic advisor and investor group led by legendary investor in the sector, Frank Giustra, which again speaks volumes.

Before looking at the latest stock charts, we will overview the fundamentals of the company using pages lifted from the latest investor deck, new out this month.

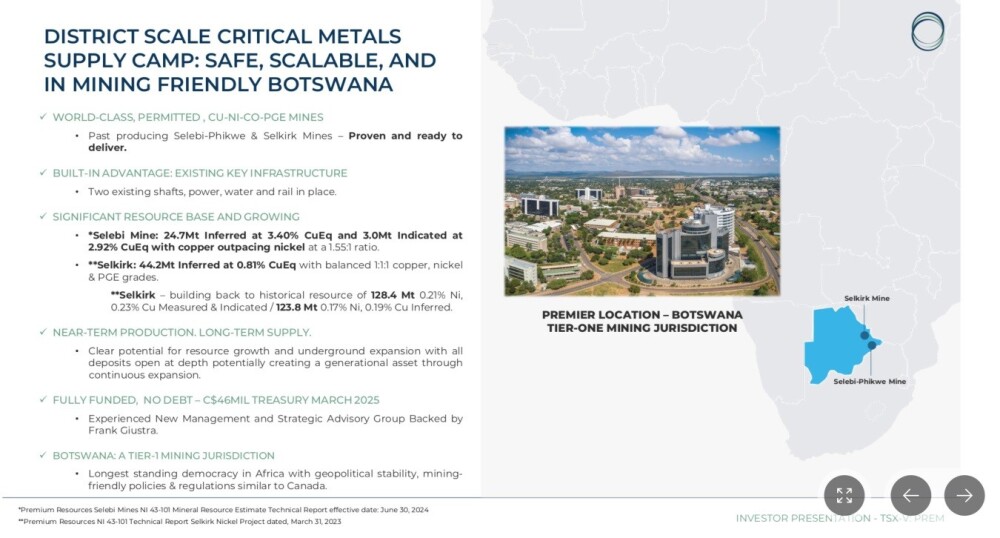

This page overviews the companies' two projects in eastern Botswana and shows their locations on a basic map:

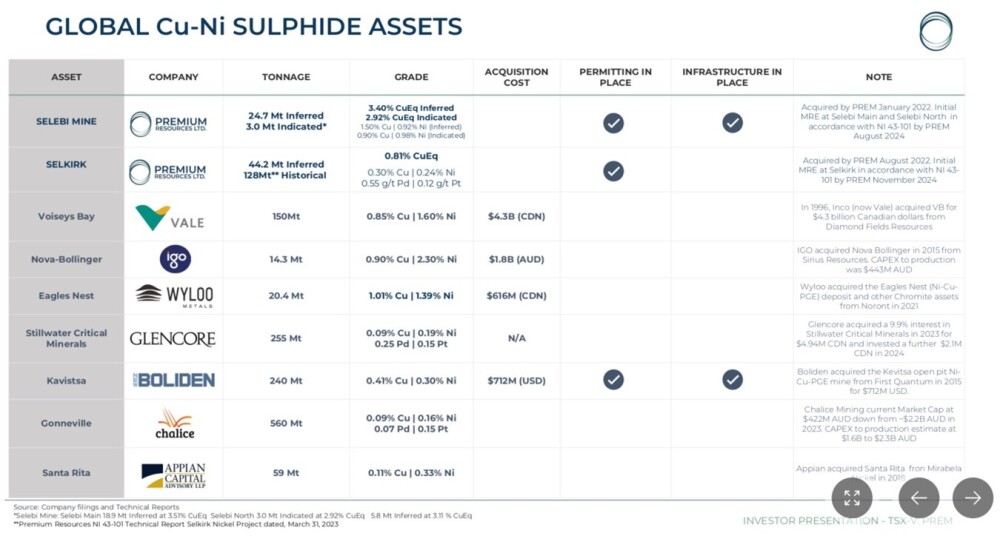

The company is already very well positioned compared to its peers in the industry, as this page makes clear. (Note the excellent grades.)

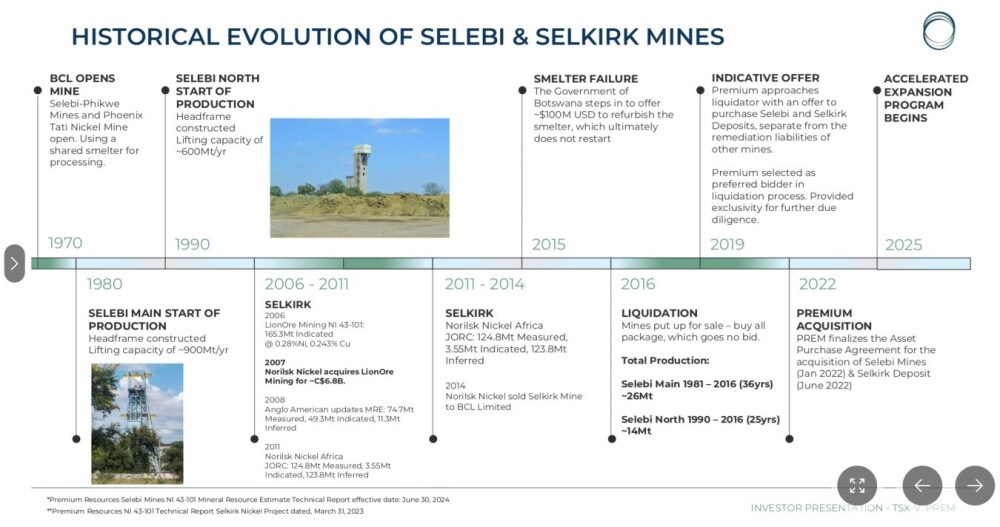

If you are interested in learning how the company got to this point — to know where you are going, you have to know where you've been — this page briefly sets out the history of the company's development:

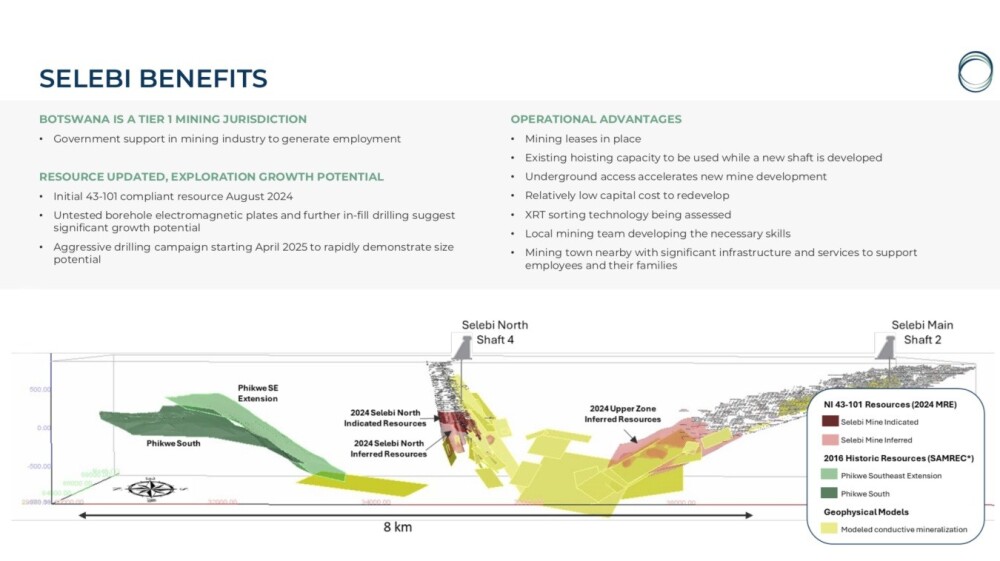

This page overviews the Selebi underground project and includes a profile map of the deposit:

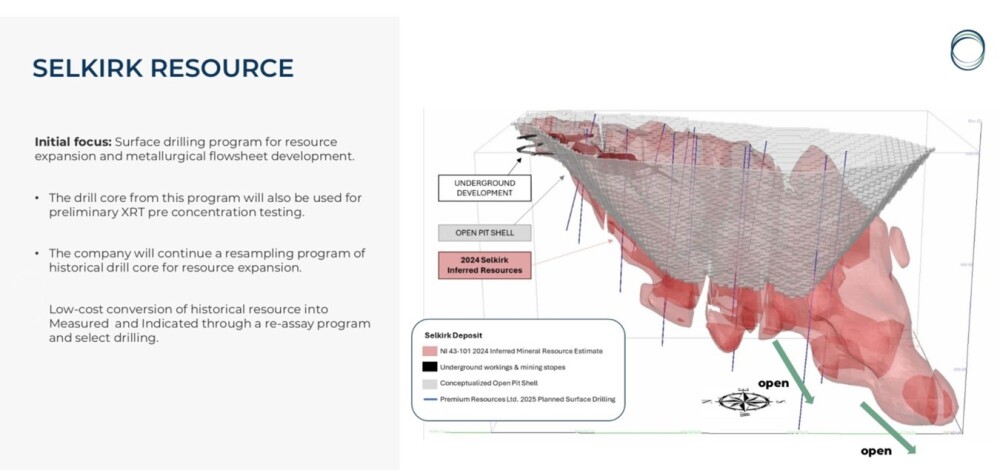

The other big project, the Selkirk open pit resource are shown below.

The following page shows a simplified overview of the production process and lists the many advantages enjoyed by the company. Note the potential to blend Selkirk and Selebi ore, which will mean economies of scale.

Botswana is a tier-1 mining jurisdiction with many advantages.

This page sums up the key attributes of the company:

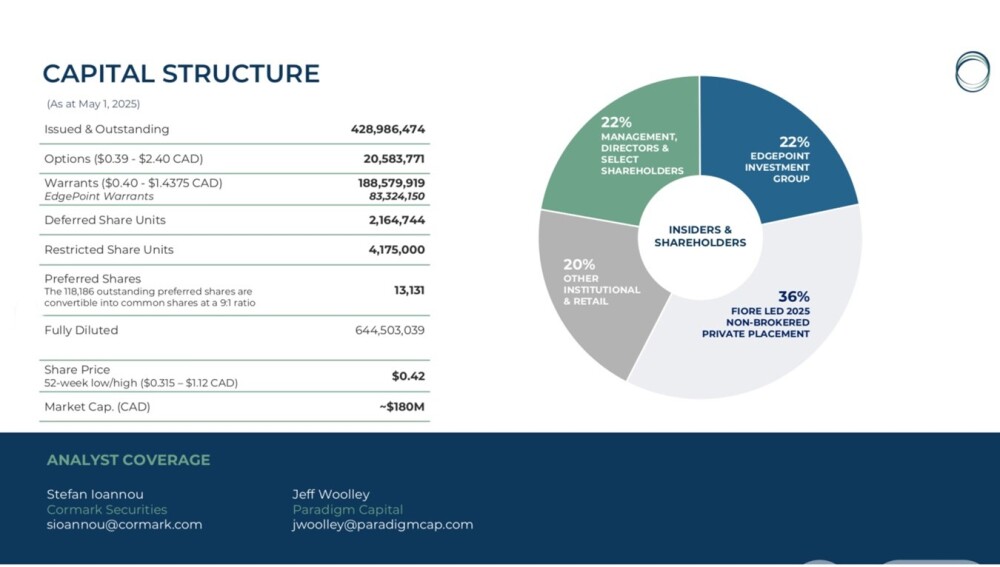

This last page sets out the capital structure of the company.

Whilst the number of shares has expanded greatly this year as a result of the major funding to drive the projects forward, most of the new shares are accounted for, with less than 20% now available to retail investors.

For more details of the geology of the projects and additional information, please refer to the investor deck, linked above.

Now, we will review the latest stock charts for Premium Resources.

After it started trading again in August of 2022, a large top Triangle formed in Premium Resources before it broke down into a bear market in March of last year, which saw a quite severe downtrend develop that culminated with a capitulative high volume selling climax in February of this year. This selling climax marked the low point of a bottoming pattern that we can see in more detail on shorter-term charts. We can see all this on the 3-year chart below.

On the 14-month chart, we can better see how the breakdown from the Top Triangle triggered a steep decline. Also on this chart, we can see how the capitulative selloff into the lows in February marked the low point of the Head-and-Shoulders bottom pattern shown. This positive price pattern coupled with the 50-day moving average turning up during its formation and the steady improvement in momentum (MACD) is what presaged and led to the breakout that occurred just last week, which looks all the more significant because the price simultaneously broke out from the Head-and-Shoulders bottom and the downtrend in force from last July / August.

This means that a new uptrend has begun that is targeting the Dome boundary shown on the 3-year chart as a first objective and then the resistance level also shown on that chart, a move which that will mark the start of a major new bull market that will be confirmed by the price breaking clear above the resistance level.

In conclusion, a rally has begun that should see Premium Resources advance to the CA$0.80 – CA$1.00 area as a first target, and once it succeeds in breaking above the resistance in the CA$0.90 – CA$1.10 zone, it should then advance to the next target in the CA$1.80 area.

There is a third target in the CA$2.20 area, and beyond that, it is a "blue sky" stock.

Premium Resources is therefore rated an Immediate Strong Buy for all time horizons.

Premium Resources' website.

Premium Resources Ltd. (PREM:TSX.V) closed for trading at CA$0.45 on May 14, 2025.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.