This week, the capital markets the world over started the week on pins and needles with the "Tariff Tantrums" (or fear thereof) keeping volumes muted and order flow on the defensive. Then, as if an executive order came down from the top, the Chinese sent an olive branch to the White House, a type of necessary nourishment for wounded sentiment, which was met with open arms and dovish headlines. And that, my friends, was all that Wall Street needed as the narrative shifted rapidly to one favoring the S&P 500 low around 4,910 caused by the "Liberation Day" hijinks as "THE" low for the correction.

All dips are to now be bought aggressively because "American exceptionalism" has returned with a vengeance, because the Department of Government Efficiency has solved the $36 trillion debt problem. The slowing economy is good for stocks and great for bonds, but even better for gold, which was coming off two weeks of downside probing as the equity markets recovered.

Call it "Chinese Food" for thought, consumption, or sentiment adjustment, but the fact that the Chinese have thrown a peace offering at the Trump administration is a testament to the severity of the damage to the U.S. bond market during the early April façade. To say that tariffs are "good" for America is about as inane a comment that could ever be levied, but what makes it even more absurd is that 100% tariffs levied on April 7 were great, but the revisions down to 10% tariffs this week are now perceived as "even greater."

If it is the "uncertainty" that prompted Fed chairman Powell to stand pat, leaving rates unchanged on Wednesday, it is the fact that he repeated the word 500 times during his 45-minute press conference. Powell said that the ramifications of tariffs on the U.S. economy would be deemed as "inflationary," but because no one at the Fed was "certain," they would take a wait-and-see approach while running the risk of being behind the curve if and when the data finally confirms an economy sliding headlong into recession.

Since the Fed relies primarily on lagging data, by the time the real-time evidence confirms that recession has arrived, it is by then far too late for the Fed to spring to action with "Emergency Rate Cuts" and TARP and QE and all the other gimmickry dressed up as "Fed tools" all cleverly disguised to deceive the masses. The real threat to the U.S. has nothing to do with "unfair trade deals"; the threat lies squarely on the shoulders of the banco-politico elite that continue to create fictitious "wealth" through the creation of a magical credit line called the budget deficit that continues to grow with each passing day. The U.S. Congress and the White House manufacture the debt and then try to tax foreign nations through tariffs to make up for the shortfall between tax revenues and government expenditures.

When I founded the GGM Advisory five years ago, the title of the introductory issue was "New Decade, Old Deceptions" and then ". . . but DEBT is the money of slaves. (Norm Franz)." In the past five years, I have pointed consistently to the growing and unsustainable debt monster lurking beneath the surface of "American Exceptionalism."

The mainstream media constantly highlight the standard of living and the innovation and the size of the GDP as proof positive of American superiority and while it is true that a great portion of technological advances have been born in the U.S.A., if every country on this planet was able to access an unsecured credit line whenever they chose to do so, they too could lay claim to "exceptionalism."

Because the world refuses to deny America the right to its "reserve currency status," lawmakers acting on advice and instruction from the banco-politico elite can create trillions of dollars with the wave of a pen and never be held accountable. No terms and conditions are ever in place; no time lines on the repayment of the debt; and no collateral need ever be used as security. A multi-trillion-dollar credit line, all based upon "the full faith and credit" of the American government, allows it to sustain the military-industrial complex that President Eisenhower warned of in his farewell speech. That insidious complex feeds on itself as the only thing that sustains the war machine, and the replacement of its tools is war itself. Take away the credit line afforded by the reserve currency status, and you take away the wars fought by the American war machine in Iraq, Afghanistan, and now Eastern Europe.

Fast forward to Q2 2025 and there is a stock market once again rushing blindly and obediently back to the highs of Q1 as the early-April "Tariff Tantrums" that sent stocks crashing have since been replaced by moderation and discretion enforced upon the White House not by sage counsel and wise introspection but rather by the violent objection of the bond market. Watching the 10-year yield swing from 4.30% to 3.85% and then back to 4.6% all within a one-week period was systemic instability of the first order.

As you can see, the bond market has calmed down in perfect correlation to White House threats and rhetoric regarding tariffs and the trade deficit. President Trump is finally listening to the scolding of his advisors, like Treasury Secretary Scott Bessent, and has toned down the vitriol, which includes his public whipping of Fed Chairman Powell. Trump did a complete "one-eighty" in a very short stint, going from "I am going to fire him" to "I never said I would fire him" all in a highly predictable response to a plummeting stock market and bond market turmoil.

After all of the trade deals are consummated winding up pretty much as they were before the tumult, the only threat that remains is not China or Canada or Mexico ripping off the "average American worker"; it is the debt monster that continually eats away at the purchasing power of his/her savings through serial debasement brought about through debt monetization. The last time the U.S. floated a balanced budget was in the fiscal year ended September 30, 2001.

That was over 30 years ago. I know of no business or household that can survive running a deficit for twenty-three consecutive years. And yet, the S&P continues to recover with retail buyers back in the hunt just as they have been during every correction since 2008, when Hank Paulson begged Congress for a bailout and then let the banks and brokers pay out record bonuses with taxpayer cash. The New Generation of traders has all been brainwashed into an unwavering belief that no matter what goes down, stocks will be saved at all costs. Not the dotcom crash or 9/11 or the immolation of the mortgage holders in 2008 or the insolvent risk-impaired banks in 2023 could derail the march to 40,000 on the Dow and 6,000 for the S&P, all while debt continues to grow with the U.S. economy showing signs of fragility.

As I have written before in recent missives, this rally is a B-wave rally that is doomed to failure. It has been shepherded largely by the retail crowd that has been all over stocks like Palantir that have rewarded "AI" lovers with a near-double in January and again since the "Liberation Day" lows. In my experience, which goes back to the 1970s in practice and the 1900s in knowledge, true stock market bottoms do not materialize with the retail public repeating past behaviors (and getting rewarded). True stock market bottoms are born out of revulsion and disbelief. In the period of 1966-1982, markets absolutely punished investors to the point where, by the August 1982 bottom, less than 4% of households owned any common stocks.

Here in 2025, after decades of perennial stock market rescues, over 58% of all U.S. households own common stocks. In the end, you can't really blame the Millennials and Gen-Xers for behaving the way they do, blindly inhaling every stock deemed "cool" by their social media judges and juries. You can't blame them any more than the Pavlovian canine that salivates every time it hears a bell chime. When stocks dip, you buy. Unfortunately, my age and level of cynicism prevent me from carrying the banner of unbridled love for equities.

I remain a cautious bear.

Gold / Silver / Copper

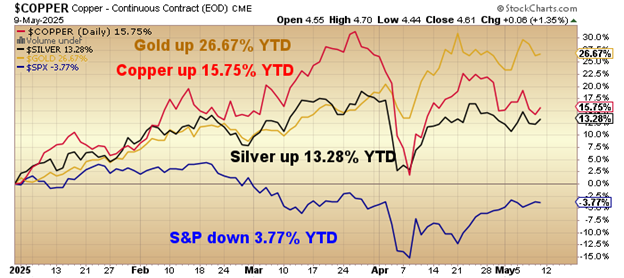

When the year began, I replaced copper with gold as the premier asset to own in 2025. My fears over tariffs and reduced fiscal stimulus rendered me incorrect in my reasoning, but bang-on in my execution. Gold has had a monster move led by central bank hoarding up 26.67% YTD, with copper up 15.75% and silver up 13.28%.

The S&P 500, which is down 3.77% YTD, was offside over 13.8 % at the close of "Liberation Day" trading back on April 7 and is having the worst start for any trading year since the Covid crash of Q1 2020. Mind you, it was massive debt creation through fiscal and monetary stimulus that rescued stocks in classic Pavlovian fashion back then, but thus far in 2025, we are seeing little in the form of emergency lifelines thrown to the Wall Street dog paddlers.

June gold futures peaked on April 22 at $3,509.90, with the GLD:US peaking at $317.63, with relative strength readings for both in the high 70s, which constituted overbought conditions that did not necessarily indicate a top was in, but certainly hinted at a pause. I put on a hedge shortly after the peak and have been trading that position back and forth, covering on sharp down days and re-establishing it in sharp rallies. As I have written before, in majestic bull markets such as the kind that gold is currently enjoying, one should be either flat, long, or leveraged long. The only reason to be short in a bull like this one is to protect other positions vulnerable to a gold drawdown.

If the current consolidation runs its usual course, there should be a 15-20% correction off the April highs that will serve to work off the overbought condition (which still appears on the weekly and monthly charts).

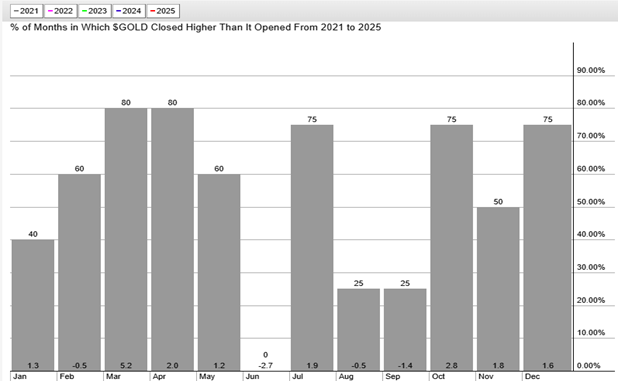

That correction should align with the seasonality chart shown below where the weakest month of the year for gold is June.

If my calculations are correct, then my proxy for gold (GLD:US) should find its footing in the $254-$270 range, which for June Gold would be in the $2,807-$2,983 range.

Make no mistake; I am a gold bull and have been since the first issue of the GGM Advisory was emailed out in January of 2020. However, I am not a gold zealot. I have no issue whatsoever selling gold or silver if the technical picture demands it. There are thousands of body bags lying at the side of the precious metals highway, containing the remains of those who viewed a sale of either metal as sacrilege. It is what keeps the bullion banks enriched as they rub their hands together every time one of Rick Rule's followers enters the fray.

The billion bank cretins are merciless in their treatment of those underfunded players in the precious metals pits. They are absolute masters in setting up false break-outs and false break-downs purposely designed to entrap, torture, and disembowel the unsuspecting speculator that just finished watching a podcast with retired investment bankers posing as gold "gurus" drone on for what seems like days about "government debasement" and "the need for sound money" and "my favorite strategy for making money." These precious metals "influencers" are usually gifted orators with wonderful commands of the English language, using seductive body language and subtle nuance to lure the newbies with a few thousand dollars into the crosshairs.

From conversations with the younger members of the investment community, it would appear that the "kiddies" (as I like to call them) have voted to use Bitcoin as their store of value as protection against the currency debasement, leaving gold as the metal of choice for their aging (and obviously out-of-touch) grandparents. Not so for silver, though, no-sir-ee, because it remains both a monetary metal and an industrial metal whose use in solar panels and the Electrification Movement place it squarely in the category of being "socially conscious" and therefore an exclusive domain of the younger generation.

This is the precise reason why this elderly grandparent has elected to begin building a position in silver by way of a number of junior explorers/developers with projects that include primary silver deposits. You see, it matters not what we Baby Boomers think is justified as a "store of value" because my generation is rapidly becoming yesterday's news. It is a generation in decline by way of aging or retirement or other more punctuative outcomes, which means the bids for gold are going to be growing fewer and farther between as the years roll on. By contrast, the world population is expanding, and these new entrants to the investment community have decided that silver is a far better place to have their savings than gold, where the evil bullion banks (populated largely by corrupt Baby Boomer traders) have been punishing investors for decades.

The way I see it, the kiddies are coming in waves for silver. Silver futures, silver bars and wafers, silver coins and silver forks and spoons, but by far the biggest impact will be felt when they descend upon the scant few primary silver equities out there that can be counted on all fingers and toes, but not a lot more. Scarcity will certainly be a factor when they decide that there are just too many cryptocurrencies and "AI" companies from which to choose and elect instead to buy all of the listed silver deals at any price.

(As an aside, there is one such company that I am including in my silver basket that shall remain the exclusive property of my subscribers. Drop me an email and I will provide details.)

Copper looks like it is struggling to maintain its uptrend after a blistering move in March to a record high of $5.346/lb. After which it got totally smoked down to $4.03 after the White House threatened to impose a 100% tariff on the biggest copper consumer on the planet — China.

They responded in a manner very "Chinese" in manner as inventories on the Shanghai Exchange dropped to record low levels. Copper-consuming companies are hoarding any and all existing copper supply for fear that U.S. actions may interrupt the flow of the red metal into their domain.

We know for sure that Chinese exports contain a lot of copper, either in electronics or in household products such as stoves and refrigerators. Followers of this publication have heard the bullish narrative all too many times, but from where I sit, there is no plausible argument against copper that can survive when one considers both the dwindling state of supply and the soaring state of demand.

I have read volume after volume of essays, white papers, and industry reports on why copper is moving into surplus in 2026, with the authors all using the "China slowdown" narrative as the principal reason for their copper-bearish outlook. The problem is that none of these reports considers that the demand driver for Chinese copper does not emanate from exports. It is emanating from the desire for an upgrade to their electrical grid. The uranium gurus out there in the Twitterverse and the blogosphere all point to the fifty-odd modular nuclear reactors under construction in the Red Dragon as a bullish driver for uranium but I choose to counter that by asking them how they plan to transmit all of that new electrical current through a grid that hasn't been upgraded in over fifty years.

It is domestic demand for copper that is going to drive copper pricing from now until the end of the decade, at which point prices will need to exceed US$15,000/metric tonne in order to rationalize the CAPEX required to build a copper mine. New discoveries are going to be fiercely impactful upon valuations for the junior explorer fortunate enough to make such discoveries. Demand for new supply is always met by exploration success by the junior explorers. We have seen it since the pandemic in lithium, nickel, and uranium, and are about to experience it in copper.

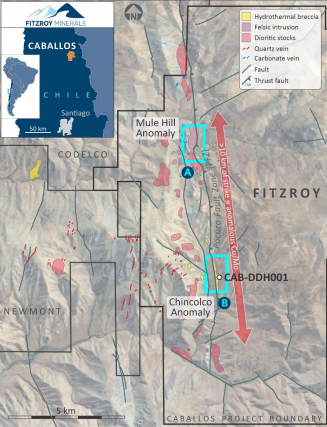

Speaking of copper discoveries, GGMA favorite Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) released a drilling update last week, which includes two crackerjack copper projects (Caballos and Buen Retiro) and one gold-silver-copper (Polimet).

They also released a video via "X" (Twitter) whereby COO Gilberto Schubert describes the context of the molybdenum content in drill hole DDH001, which was the initial discovery hole announced on March 27, just before the "Liberation Day" nonsense torpedoed the junior mining markets.

Schubert explains that copper-molybdenum deposits in Chile usually average 200-400 ppm (0.02-0.04%) "moly" in the larger deposits, with extremely high-grade moly occurring only in narrow veins or dikes. In this initial discovery hole, there was a 42-meter section that ran 1,700 (0.17%) molybdenum making the moly content a "co-product" along with the copper rather a "credit" in that section of the intercept which, I should add, was 200 meters of 0.83% Cu-Eq mineralization starting from a depth of 66 meters (shallow).

The moly content is "off the scale. . ."

Drilling should be underway with another 2,700 meters (approximately nine holes) in their Phase Two program, which I believe carries the potential to launch FTZ/FTZFF into the big leagues if they can repeat the success encountered in the initial discovery hole.

The "Chincolco anomaly," the site of the initial discovery, has a twin brother located ten kilometers north of it called "Mule Hill," so it will be interesting to see if this next round of drilling confirms that the mineralized corridor moves in the direction of the "la Mula."

At a US$60m market cap, the Caballos discovery provides the company with the potential to quickly develop into a billion-dollar enterprise, which includes none of the other assets, especially Buen Retiro, which stands tall and proud on its own.

Assays pending from Buen Retiro and Polimet shortly.

| Want to be the first to know about interesting Silver, Base Metals, Critical Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- : Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involve