"Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants, but debt is the money of slaves."

As I sit here on the shores of the Kawarthian swamp called Scugog, I am once again seeing the image of a metallic Pegasus in full ascent with those powerful wings taking it to the clouds. I refer, of course, to the one metal on our planet that carries the most mesmerizing narcotic known to mankind. A newsletter writer and friend of mine once described members of the audience when he gave seminars on gold and silver.

He said that if it was a gold speech, the audience was usually fairly normal, usually quite conservative, and more "mainstream" than not. If it were a silver speech, the audience would be vastly different, with a large number of NRA vests or caps, elderly men wearing bandanas over grey pigtails, and all carrying shopping bags full of complimentary keychains, ribbons, and/or calendars.

He said that during the meet-and-greet portion of the seminars, the gold crowd asked intelligent questions, showing grace and manners in an orderly fashion. By contrast, silver "bugs" resembled "gold bugs on steroids, crystal meth, and Mad Dog 2020 sipping Red Bull from soon-to-be crushed cans," all demanding immediate answers to very angry questions.

There is no doubt that silver ownership has always been the domicile of a particular type of individual investor. Of course, there is the stereotypical silver bug that lives in the mountains in a cabin with vast quantities of survival gear stored in its various buried chambers and vaults. A cache of non-fiat currency comprised of silver coins and wafers would be commonplace amongst the "preppers" so that they would have negotiable tender once the system came crashing down.

However, there is another type of silver investor that hides quietly in full sight but also sees through the charade that has become the financial markets in 2024. This type of investor knows that silver is more than simply a commodity; it is next to gold as the singular most important monetary metal in world history. This investor recognizes that after the recent $500 breakout in gold to record high price levels, silver at some point is sure to do the same, and if $2,087 was the old high in gold in March 2022, then the old high of $50/ounce in 2011 is certainly attainable.

Only we old-timers are able to recollect the breathtaking advance of gold to $857 in 1980, but what is unfathomable was silver's move to $50.35 on January 18, 1980, only to be beaten back by a combination of Wall Street shenanigans and Justice Department strong-arming.

So while it is easy for the stock junkies to thumb their noses in disgust at those funny, rifle-toting, tobacco-chewing silver bugs, there is a legacy of sound money advocacy behind the ownership of silver. This week, that legacy finally found validation by registering a weekly close above $30 per ounce, the level last seen in February 2011 in advance of a print at nearly $50 a mere two months later.

As many followers of mine know, I have refused to be lured into silver's den of financial iniquity because, for what seems like an eternity, it has slapped me around like a rented mule. However, I wrote back in April when it first tested $30 (and failed), "give me a 2-day close above $30.50 and I will gladly join the bullish camp."

Friday night, we were granted a close at $31.63, so given the weekly close at that level, I have to expect a follow-through on Monday and a substantial one at that. So, while it was too late to fire off an email alert to subscribers, I bought a few carloads of Pan American Silver calls, giving me a toehold on the most visible name in the silver space and the one that the algobots would inhale if the memo arrives on their virtual desk by Monday morning. I did so without the critical "2-day close" based on the amplitude of the move above $30.50, and by doing so, I absorbed a degree of additional risk.

I do not wish to hear about fundamentals for silver, citing solar or AI usage or the big move in copper as a catalyst for a similar move in silver. As many of the larger copper-zinc mines have silver as the predominant byproduct, these record copper prices are going to mobilize a great deal of new above-ground supply, such as those Peruvian slag heaps owned by Glencore. Silver is simply "a trade" and one that will be given little leeway if it reverses course.

Last week, I focused on the junior miners who for the most part have remained unaffected by the $500 move in gold prices since last December. I have had no fewer than a hundred emails from followers and subscribers asking me why companies with proven resources or new discoveries have been orphaned by the legions of Millennials and Gen-exers that have only recently found the stock market.

The answers are many and varied, but if you asked a sample size of 100 kiddies if they made money in stocks since Joe Biden air-dropped a few trillion dollars from his shiny new Huey's transporting relief from a nasty flu bug back in 2020, they would all collectively answer with a resounding "Hell yes!" If you then asked them if they got the idea from a financial statement or research report, the answer would be a "Hell no!"

If you asked them if they made money in resource stocks, you would be considered quite fortunate if all you received was a gape-jawed blank stare.

For example, let me give you an example of exactly why the kiddies have avoided the junior miners. I have a dear friend from the "Show me" state of Missouri whom I have known for over thirty years who, from time to time, sends me emails with stock "tips" in areas of the market about which I know absolutely nothing. Nada, nil, zilch. That includes technology, artificial intelligence, crypto, and "meme" stocks. In other words, all non-resource related securities that I am neither equipped nor able enough to write about. My colleague from Missouri has a network of hundreds of desk traders whose only function is to monitor and trade the "pink sheets" where many of these penny dreadfuls are incubated.

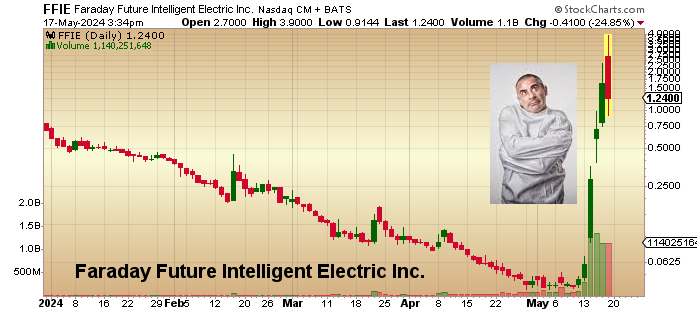

Faraday Future Intelligent Electric Inc.

On Tuesday, I received his latest little gem, an upstart little jewel called Faraday Future Intelligent Electric Inc. (FFIE:NASDAQ) whose share price had closed the prior Friday at $0.045 on no news and 443,000 volume. Average daily volume for this textbook case study in advanced securities analysis was under 300,000. Now, whoever named this Nvidia (NVDA:NASDAQ) wannabe was a genius.

They cover "mystique" with the word "future," they cover "AI" with the word "intelligent," and they nail "electrification" with the word "electric." This is one-stop shopping for the WOKE movement! There isn't one Millennial on the plane who will balk at the chance to own this absolutely perfect stock for their social media chat group. If they had named it "Transgender Future Intelligent Electric," they could have taken out an electric billboard in Times Square and broken records with the crowds.

By the time I received the "tip" late afternoon on Tuesday, the stock had already traded 37 million shares, and after a high of $0.33, it was bobbing around at $0.27-$0.28 with millions of shares on both bid-and-ask sides of the quote. In my infinitesimal wisdom (and more due to the fall I had in the kitchen banging my noggin on the center island), I picked up a 20,000 share piece just as an experiment in Millennial Investing 101, fully expecting that the $5,800 would be the tuition cost of septuagenarian education in an entirely new industry.

After closing down at $0.255 that night, I found myself agonizing in self-recrimination and guilt at the thought of my actually falling for a "meme" stock that took the form of a shameless stock "tip." After all these years and all of the studying to pass courses that gave me the appearance of an educated stock professional, here I was, chomping on the three-pronged barb like a back-alley wino-guzzling Ripple.

The next morning, about five minutes before the opening, overwhelmed by embarrassment at my indiscretion, I offered FFIE $0.05 above the pre-opening bid and "what to my wandering eyes should appear, but a $0.60 bid and a thunderous cheer!"

At this point, I quietly awaited my fill notification and upon receipt of same a few moments later, I let an audible sigh of relief and went about my normal workday, bereft of all the nonsense of that silly WOKE stock.

Well, about three hours later, I had the gumption to check out the price, fully expecting a crash back to a penny or two but when I pulled up the quote, the stock had closed at $0.988! The next day it traded at $1.64 and finally, Friday morning, the stock hit $3.87 before closing at $1.01 on 1.27 billion shares volume.

So, to put this all into perspective related to exactly WHY junior resource stocks are sitting idle in a pool of bid-less agony despite massive increases in gold, silver, and copper prices, here you have a four-cent stock with no fundamentals, no volume, and no apparent future suddenly leap out of nowhere and start to trade at metric multiples of it average daily volume and in five short days that could easily have been a lifetime for the brave at heart, trades at eighty-four times its closing price on Friday volume alone equal to two-hundred ninety-five times its issued capital. 295 times its issued capital in one trading session!

How on earth does one expect that a drill hole play in lower Mongolia or high-Andes Chile can possibly compete with a story like Faraday Future Intelligent Electric Inc.?

There is nary a resource stock on the planet that comes within a Scottie Scheffler roadside pullover when compared to that which I just described. The sheer insanity is at once disturbing and a lesson learned because while there will be those out there that will laugh at "all those archaic babyboomers sitting on these doggy gold stocks while our sh*t goes batty," remember that some college kid with an Etrade account using grandma's credit card bought FFIE at $3.87 and went home for the May Two-Four long weekend down 73.3%.

And THAT is why the junior mining stocks are stuck in neutral.

Dow 40,000

With the Dow moving through 40,000 briefly yesterday, the Wall Street paper hangers would love to have a weekly close with a 40-handle for the Dow in order to fire up the retail crowd into which they can offload more paper. With the metals running hot and stocks seemingly without the ability to correct for more than a coffee break, what you are witnessing is what happens when currency units are created out of thin air, diluting the existing money stock, which renders each currency unit less valuable than they were prior to the debasement.

The fiscal floodgates that have been fully open since COVID are now forming a "gusher" and are intended to create the aura of organic growth for the purposes of getting the Democrats into office for a second term this November. The same stock market action was seen in Weimar Germany 1921-1923 and in Zimbabwe in the 1980s. They are attempting to reflate away the debt.

Always remember the phrase:

"Never underestimate the replacement power of equities within an inflationary spiral."

Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Faraday Future Intelligent Electric Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.