Even without the benefit of a sector bull market, Sanu Gold Corp. (SANU:CSE;SNGCF:OTCQB) is looking like a most attractive gold stock investment here, but as it happens, a major gold and gold stock bull market is just getting started that promises to be of unprecedented magnitude and will be of enormous benefit to a well-positioned company like Sanu Gold.

A big reason that Sanu Gold is looking so attractive at this point is that it is not some junior that is looking for gold in a forlorn windswept northern moose pasture — it is looking for gold in the number one gold mining district in the world where it is surrounded by significant discoveries, in addition to which it has made some significant discoveries of its own.

We will now proceed to overview the company, looking at a selection of slides from its latest investor deck, which is new out this month, and then continue on to an analysis of its latest stock charts to see what they say about its prospects, and as we will discover, they are very bright indeed.

First of all, where does Sanu Gold operate, and at what stage of development are its properties?

The company has three significant properties in the prolific Siguiri basin in northeastern Guinea, which is in West Africa, and the exact position of Guinea in Africa and within Guinea, the position of the Siguiri basin is shown on the first slide.

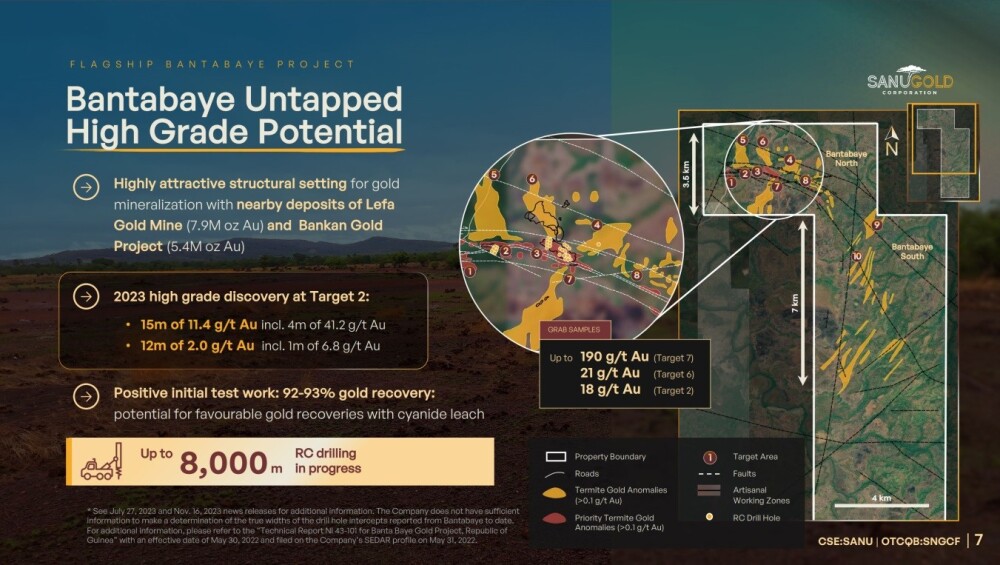

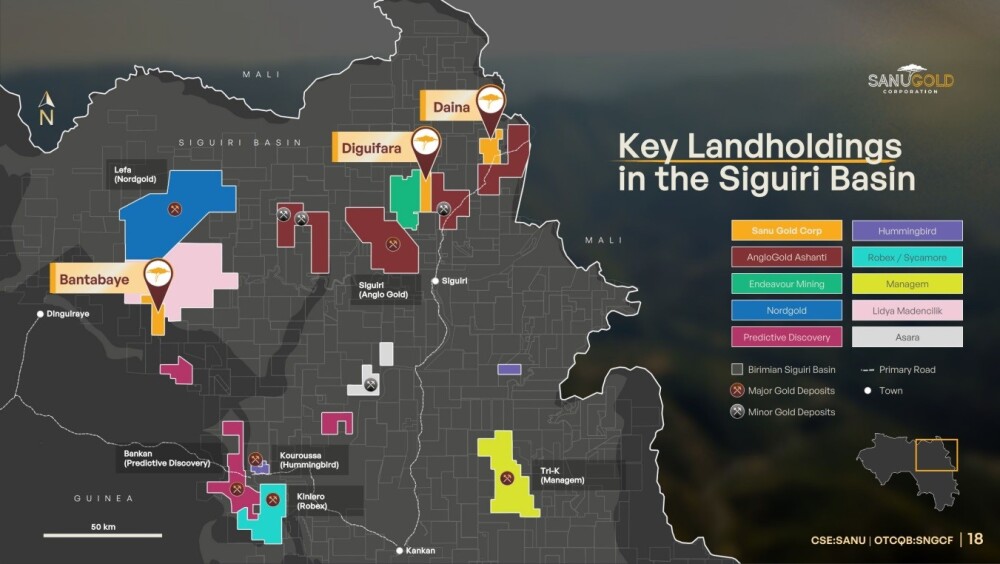

The second slide shows the position of the company's three properties within the Seguiri basin, and also the numerous significant discoveries in the area, with some big mining companies such as AngloGold and Endeavour active in the district and also on this slide, there is information about high-grade discoveries at Sanu's Bantabaye and Daina properties from the first drill program illustrating that work at these properties is well beyond the initial exploration phase.

This slide shows the high-grade discovery potential of the flagship Bantabaye project.

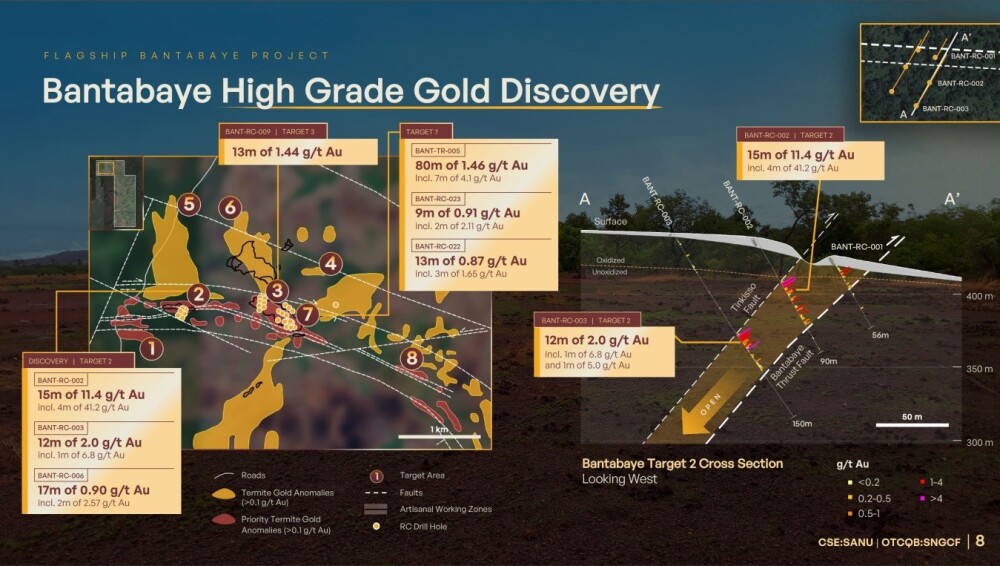

The following slide shows details of the company's already achieved high-grade discoveries at the Bantabaye property.

The next interesting slide shows the location and size of other key landholdings in the Seguiri basin, who owns what, and how they relate to Sanu's properties — as we can see — AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) has a spread of big holdings very near Sanu's properties.

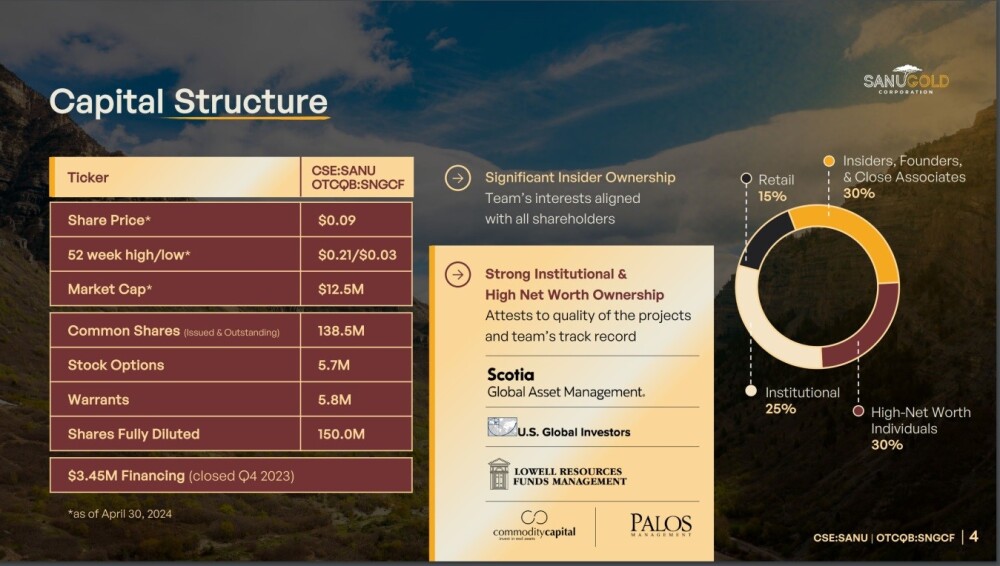

Now, we come to a very important slide for investors, which demonstrates that there is a lot of belief in and confidence in this company.

Of the 138.5 million shares in issue, insiders, founders, and close associates own 30%, high net worth Individuals own another 30%, and institutions own 25%, which only leaves about 15% for retail investors, or about 19 million shares, so clearly any serious influx of demand for the stock can be expected to drive the price substantially higher.

Our last slide sums up some of the main attributes of the company that make its stock so attractive at the current price.

Now, we will turn our attention to an analysis of the stock charts for Sanu Gold.

The charts for Sanu Gold Corp look very positive indeed. On its 2-year arithmetic chart below, we can see that, following a severe bear market from the fall of 2022 when it peaked at CA$0.45, a giant slightly downsloping Cup (or Pan) and Handle base has formed. Despite the price bottoming as recently as late February of this year, the giant base pattern actually started to form as far back as June of last year, as this chart makes plain.

The duration of this base pattern has allowed time for the 200-day moving average to drop down close to the price and swing into much better alignment, for downside momentum (MACD) to drop out, and also time for a substantial quantity of stock to rotate from weaker to stronger hands, thus laying the foundation for a new bull market to develop.

One of the "hallmarks" of a genuine Cup and Handle base (or Pan and Handle if it is relatively flat) is the appearance of heavy volume on the rally to form the right side of the Cup, and that we have definitely seen in the case of Sanu Gold. The reason for this is that a group of Smart Money investors suddenly realize that the prospects for the company are getting a lot brighter, and they pile in.

The Handle of the pattern then forms due to the fact that it takes time for the fundamentals of the company to catch up with these heightened expectations. Observe also on the chart how the strong recent upside volume has caused the Accumulation line to surge, which is also a very bullish indication. An important point for buyers or would-be buyers of the stock here to note is that the boundaries of the Handle drawn on the chart are provisional and may require adjusting, depending on how long the Handle continues to build out. The central point to keep in mind though is that "the writing is on the wall" as far as this stock is concerned — it's going higher and is expected to do so against the background of a broad sector advance as gold and silver's still young major bull market continues to unfold.

The shorter-term 6-month chart enables us to review recent action in much more detail, and on it, we can see that price / volume action following the sharp high-volume rally in March to complete the right side of the Cup of the Cup and Handle base has been very bullish, with the dieback in volume suggesting that the pattern of recent weeks may be a bull Flag and if this is what it is the price may not bother to hang around in this price area making a longer Handle before it gets on with it and breaks higher again soon.

It is clear, though, that whether or not it tarries in this area to mark out a longer Handle, we are at a favorable point here, with it having reacted back to the support shown not far above its rising 200-day moving average.

The conclusion is that the outlook for Sanu Gold is very positive, and with it now at a good entry point, it is rated an Immediate Strong Buy for all timeframes. Given that it has already made significant discoveries and that the prospects are good that it will make further important discoveries, there is a strong possibility that it will be taken over.

Sanu Gold Corp.'s website.

Sanu Gold Corp. (SANU:CSE;SNGCF:OTCQB) closed at CA$0.07, $0.053 on May 7, 2024.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Sanu Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.