When I first came up with the notion of writing a weekly newsletter, it was spawned from my habit of writing letters to clients way, way back when I toiled in the Canadian investment industry. In addition to being able to save a lot of time and energy by writing one letter to all clients, it enabled me to see the "big picture" as it pertained to the types of investments held in client accounts. Originally named "The Venture Capital Update," I used the word "venture" because of a famous quote that I found very early in my career that differentiated between the hedonistic practice of "gambling" and the noble art of "speculating."

"Gambling is a venture without calculation; speculation is a venture with calculation."

While investment purists would tell you that whether one is gambling or speculating, neither one is actually investing because investing involves the adherence to historically conservative, longer-term investments that throw off cash returns in the form of dividends or interest. Since none of the securities in which I specialized ever paid anything close to a coupon or dividend, I renamed the weekly missive "Gold and Gold Miners Update" in 2009 because I determined that the ocean full of bailout cash and credit splashed around the Wall Street banks in order that they could make payroll in 2008 (with liberal and completely obscene bonuses included) was going to be an inflationary event that would render gold and silver into highly-effective ventures.

That all ended in 2011 and was punctuated two years later with the Sunday Night Massacre, where the global banking community teamed up and blasted every available bid, sending gold and silver into what would evolve into a very nasty four-year bear market. I was actually quite happy with my weekly note until 2015, with gold trading just above the bear market low of $1,045, when I wandered into the office of a very well-heeled doctor and inadvertently saw my newsletter next to the coffee machine, protecting the surface of the table from the horror of caffeine.

So effective was my newsletter that one could barely make out the title or the name of the author, while piled neatly on the real coffee table was a stack of magazines and brokerage reports all discussing cannabis, crypto, or Indonesian love secrets. I went back to my office and immediately decided to change the name not in favor of any particular sector or industry but rather to remove any and all references to gold. I changed all the templates, letterhead, and business cards to "The GGM Advisory," and I did so at the absolute bottom of the bear market in gold — December 4, 2015.

The reason I relate this story to you all is the closing price for gold last evening, marking the end-of-week, end-of-month, and end-of-quarter ascent to all-time highs.

When I first launched the GGM Advisory in January 2020, I was certainly not aware that any laboratory technicians in Wuhan, China decided would decide to play frisbee with an infected bat in the local wet market, triggering a series of reactionary events that would forever change the scope and range of the term "sovereign debt."

Just as the gargantuan gobs of liquidity saved the banks in 2009 were seen to be inflationary by most rational market enthusiasts, an amount many times greater was thrown at the citizenry of the world to help their immune systems fend off those microbes that had threatened humanity for hundreds of thousands of years.

I surmised that the steps taken by our elected visionaries (politicians) would be outdone only by the inflationary exploits of the un-elected visionaries (central bankers) that would result in a massive rise in the cost of goods and services, rendering gold and silver as worthwhile ventures. Alas, from August 2020 thought to just before the start of the biggest mining conference in the world, Toronto's Prospectors and Developers Conference known affectionately as "PDAC," gold tried a number of times to advance beyond the 2011 highs just below $2,100 only to be repelled violently time and time again.

Pandemics, massive money-printing orgies of obscene size and vulgarity, Russian insurgence in Ukraine, and a number of bank failures in the U.S. could not move the gold market. Even an overnight explosion brought on by an Asian buying spree last December 3 failed to hold the breakout level of $2,100 as wave after wave of futures sell orders repelled the advance with terminal force and fierce tenacity.

So, I find it infinitely pleasing that the mainstream media completely ignored the significance of this enormous multi-year breakout to all-time highs. It was fine for CNBC to flash the "Bitcoin at All-Time High" thirty times an hour when it finally broke the 2022 high a few weeks ago. It is considered a "normal course" for commentators to remind viewers of all-time highs for the NASDAQ or the S&P 500 or NVidia but with gold, total silence.

Even those who would consider themselves to be authorities on the subject of gold were scrambling for answers, with catchphrases like "economic uncertainty" and "soaring debt levels" dominating the space. What followers of this humble scribe have known for decades is that the moment one tries to explain the movement in gold is the precise moment where one would admit total folly.

You see, only gold knows why it is being re-priced in U.S. dollars. In fact, gold should be seen as a divining rod of sorts whose movement can cast summary judgment on the impending fate of a currency or country. Before governments decided to manage stock and bond prices through the use of intervention and interference, stocks used to be a harbinger of either good times or bad times on the economic horizon. With gold, when the bullion bank behemoths in Chicago and London were able to wag the golden dog with firm grips on the gold market tail, the price could be managed, but once the fledgling Shanghai Gold Exchange shook off its early start-up chills, Asian demand reared to the forefront and seized control of the global pricing mechanism for gold. That, my friends, is what has changed, and with that, gold is free to resume its role as the time-tested store of value and safe haven, roles that the global bankers have tried fiercely to refute.

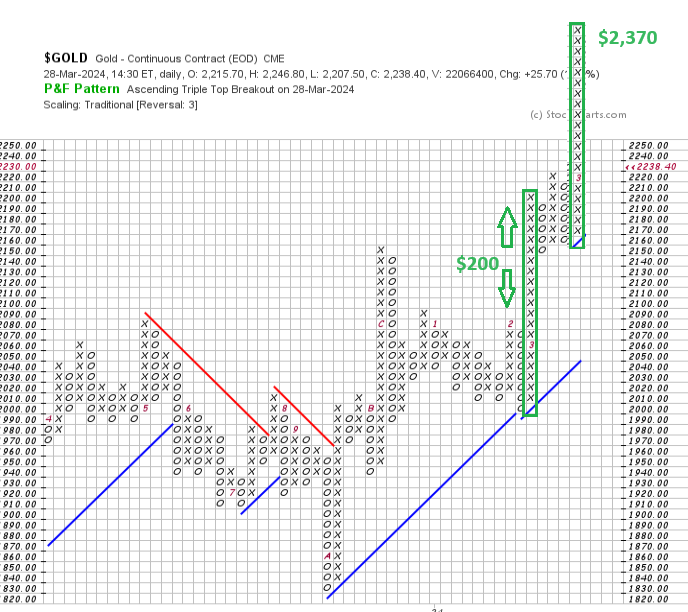

From a technical perspective, I refer back to my March 8 missive entitled "Lift-off: The Golden Bull Returns," in which I called for a two-day close above the high of December 4, 2023, when it oh-so-briefly touched $2,153 before being savagely beaten back. We now have such a close in spades, with the final three days of last week soundly above $2,153.

In fact, I see $2,370 coming as early as next month because when I look at the point-and-figure diagram, this move should mirror in amplitude the same move it had the first time gold moved above $2,200, which was a $200 advance. This last advance started at $2,170 and is projected to reach $2,370. Mind you, if the generalist investors in the West finally join their Asian brethren and start reallocating profits from the Mag 6 into a gold position, $2,370 will be a glint in the rearview mirror in retrospect.

Last year, when the blogosphere and Twitterverse were filled with lithium cheerleaders and #silversqueezers, I was elevated on a soapbox of my own, large megaphone in hand and wearing a very gaudy red-and-white striped suit and straw hat beseeching people to ignore the EV disciples and the bullion bank vanquishers and instead move into the only two metals that really count these days which are gold and copper.

This was during a period of time when the darlings of the lithium space were beginning their descent to earth and where nary a soul could muster up the courage to buy shares in anything gold with copper not terribly far off. People could listen politely and quietly shake their heads in somber pity for that "poor old man that still owns gold," but they could not do the same for the sermonizing on copper. Of all the metals seen to be front and center in the electrification movement, the only metal that had yet to move up was copper. The kiddies went after nickel and cobalt and then absolutely piled into lithium

before turning to uranium, which they chased right through the first week of the New Year at ridiculous price levels before getting subjected to the most vicious of rug pulls. Copper, by contrast, simply plodded along between $3.50/lb. and $4.00/lb. driving both the bulls and the bears crazy. As this maddening level of tedium was happening, the CEO's of the world's largest copper producers were warning of an impending supply crunch while the greatest book-talker of the last century, Robert Friedland, was spewing off to anyone who could listen to his bullish view on the red metal.

To know Friedland is to love Friedland — his Ivanhoe Mines owns a 39.6% interest in the lowest-cost copper mine on the planet, the Kamoa-Kakula Mine in the deepest heart of Africa, the DNC. However, these champions of an industry even included the poster child for the gold industry, Barrick Gold, whose CEO Mark Bristow, has been actively pursuing copper-gold porphyry deposits for the better part of the last decade. How quaint! A global gold giant moving to copper! Who would have ever imagined?

So, since I have lauded gold and luxuriated in copper in the last six pages, it stands to reason that I would mention my top blue-chip selection and holding for 2024 and on which I have traded frequently over the years but one which I am definitely not trading in 2024. That company is the world's largest copper producer and — no — it is not a Chilean or Australian company as one might have presumed. It is American-born and bred, and it is called Freeport-McMoRan Inc. (FCX:NYSE) that also, I may add, is a substantial gold producer through its ownership of the legendary Grasberg Mine in Indonesia.

FCX hit a multi-year high at USD if $47.19 per share last week, and looks like it has an all-time high at $50.33 in the crosshairs. If it clears the old high, I see $70, then $100 assuming, of course, that the Goldman Sachs target of$6.80/lb. is achieved. Near-term, copper needs to surmount the high of around USD $4.19/lb. last seen two weeks ago on the first move above $4.00. More importantly, copper needs to continue to work off the overbought condition, allowing the MACD sell signal to reverse along with Money Flow Index ("MFI").

Just as gold shares historically lead the physical metals, it is entirely possible that share prices in FCX and Antofagasto (ANTO.L), which are primarily copper producers, are leading to higher copper prices. Mind you, interventions and interference have served to defray the predictive power of the "shares lead metal" relationships, particularly since governments and central bankers assumed the responsibility for global price management. As I have been writing about for months, the gold component of the FCX business mix gives them such a definable advantage over most other miners that I am forced to look carefully at Barrick and Newmont, whose forays into copper-gold porphyry gives them both advantages similar to FCX.

I try to keep the weekly missives focused on the bigger picture stories rather than getting lured into the world of the "penny dreadful," where the probability of infinite riches is on a par with lighting strikes and shark bites. The problem that afflicts me was a life-altering injection of "gold fever" administered in 1981 when I bought my initial position in Goliath Gold Mines, one of two junior explorers that made the initial discovery of the Hemlo dep. The rush one got watching the pre-opening bids playing leapfrog with one another in the $2.00, $2.50, and $3.0 0 price ranges after closing pre-announcement at $0.35 was truly unfathomable.

Five times between 1981 and 2011, I found myself experiencing that combination of adrenalin and codeine 30 (that the nurses gave me after I broke my leg in 1980) as the two massive gold discoveries (Hemlo and Eskay Creek) gave way to the mighty Dia Met diamond discovery of 1991, Voisey's Bay with Friedland, and finally the Mountain Province diamond discovery. Of those five monster discoveries, the biggest pass of all was actually Friedland's Diamondfields Resources Corp. acquired by Inco Limited in 1997 for $4.3 billion, an amount that over the fullness of time was estimated to be a 2X overpayment, but anyone that has met Bob Friedland would never fault Inco. This is why I like being a shareholder in copper deals, which is Friedland's #1 metal of interest these days.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.