Reyna Silver Corp. (RSLV:TSX.V; RSNVF:OTCMKTS) is a growth-oriented junior exploration and development company. The company focuses on exploring for high-grade, district-scale silver deposits in Mexico and the United States, and with silver on the verge of entering its greatest bull market for many years, in conjunction with gold, the time could not be better for investors to buy the stock which has been beaten down to a silly price, having lost over 90% of its value from its mid-2020 peak.

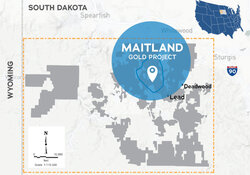

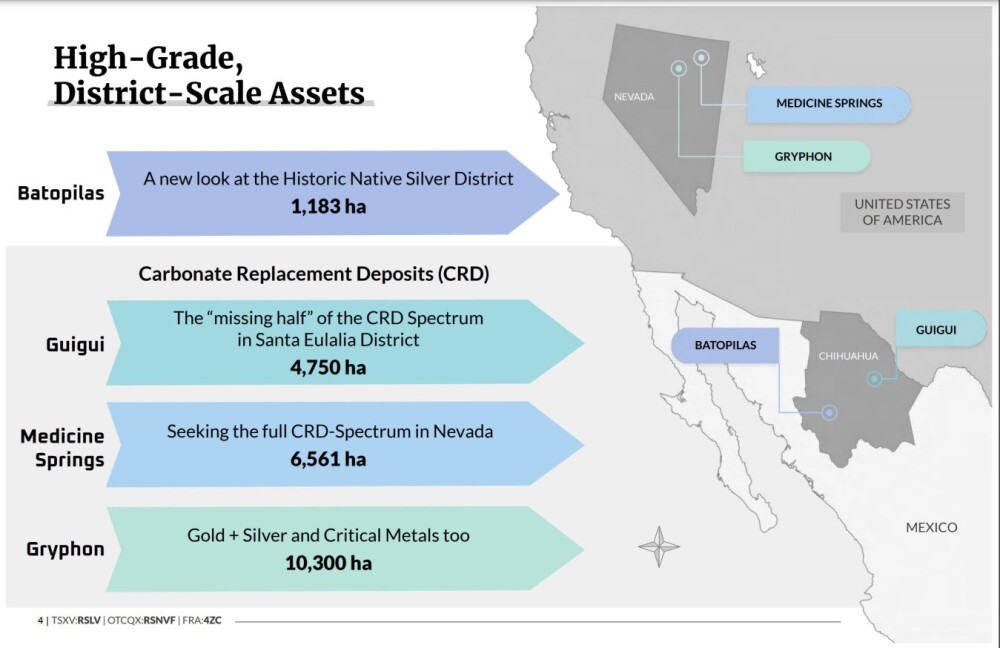

The company is working on developing four sizeable properties, two in Mexico and two in Nevada, as shown on the slide immediately below, lifted from the company's latest investor deck, and key points to note are that while the company's two properties in Mexico are 100% owned, with respect to the Nevada properties it has entered into an option to acquire 70% of the 10,300-hectare "Gryphon Summit Project" in a 50/50 partnership with Reyna Gold Corp. (REYG:TSX.V; REYGF; OTCQB) and also in Nevada the company is advancing its option to acquire 100% of the "Medicine Springs Project."

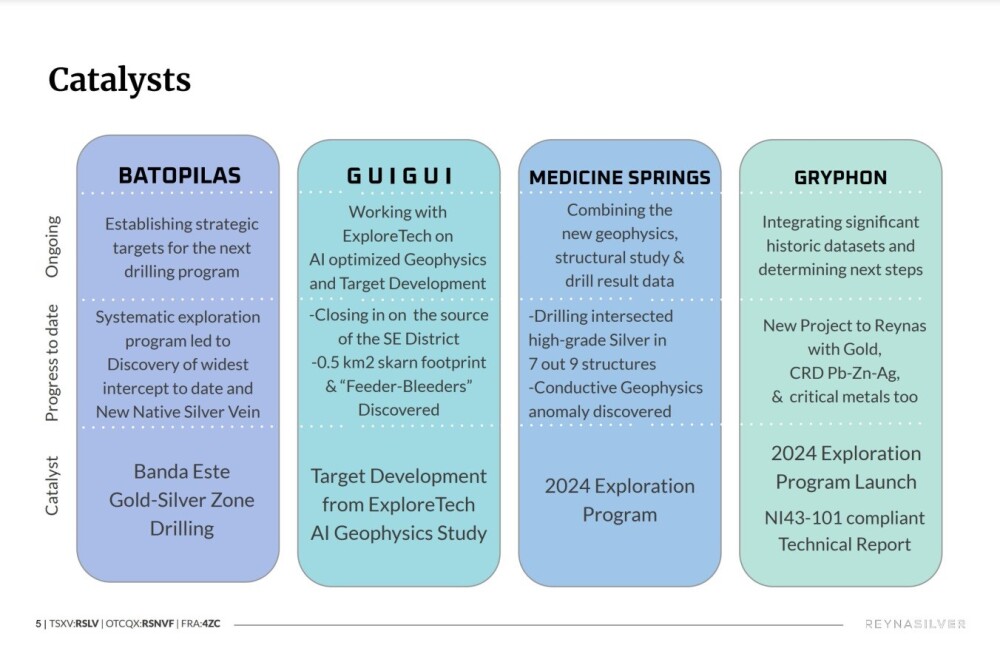

The good news for investors who show up now is that the proceeds of the recent funding, which contributed to beating the stock price down to its currently dismally low yet super attractive level, will be used to further explore all of these properties going forward, providing an abundance of catalysts as shown on the following slide which also briefly indicates the status of each of the company's four projects.

A big plus is that the company is led by a strong management team, as set out on the following slide, with the Chief Technical Advisor, Dr Peter Megaw, who has been the Co-Founder of MAG Silver Corp. (MAG:TSX; MAG:NYSE American).

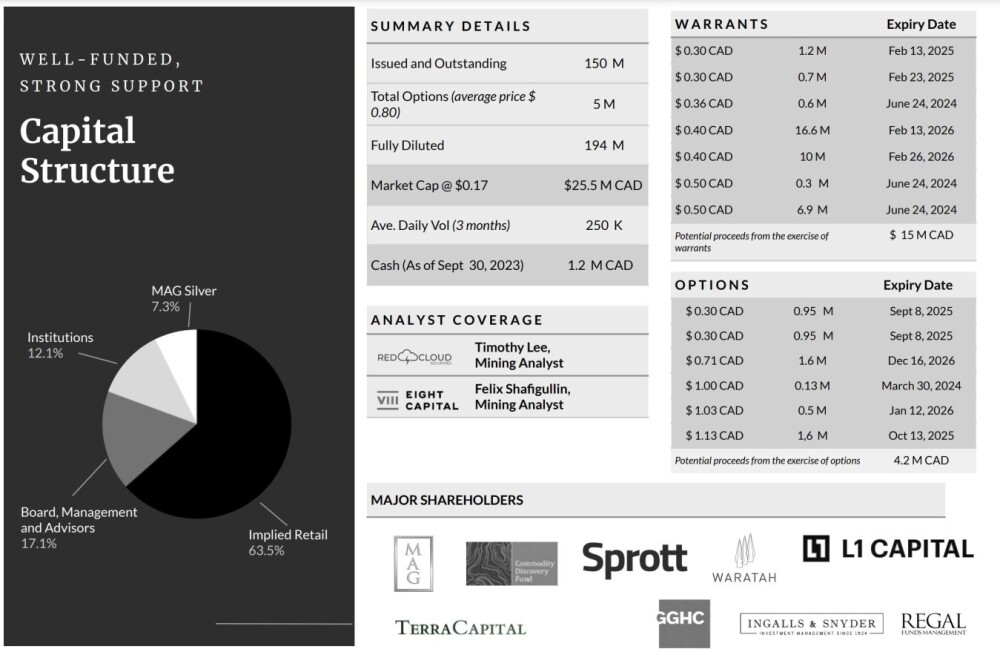

The capital structure is set out on the following slide, on which we see that the company is well supported by management, insiders, and institutions who own a sizeable percentage of the stock, with MAG Silver owning a further 7.3%, so that of the 150 million shares in issue, less than 100 million are in the float.

Details of the attributes and geological characteristics of the company's four main properties are set on other slides within the investor deck for those interested in studying them.

Now, when we analyze the stock charts for Reyna Silver, it will soon become apparent why it is presenting investors with an extraordinary opportunity. Its stock has fallen by well over 90% from its mid-2020 peak, as we can see on its latest 4-year chart below, yet its recent sizeable financing that was closed a few days back was oversubscribed and upscaled, and the proceeds from this will be used in part to finance the company's upcoming drilling program that should generate interest in the stock against the background of a new and powerful bull market in silver that is just about to start as silver follows gold whose major bull bull market has already started.

The conclusion must be that this is an excellent time to buy Reyna Silver, which is rated a Strong Buy for all timeframes as a major new bull market in the stock. It looks set to commence very soon and possibly immediately.

On Reyna's 54-month (4-year 6-month) chart, we can see how the savage bear market in the stock from mid-2020 has brought the price down to a very low level indeed, with "the ball being kicked downhill" in recent weeks by the now closed financing at 12 cents.

Of particular note on this chart is the way the decline has decelerated in steps, as made clear by the four fan lines, and the diminution in downside momentum, as shown by the MACD indicator trending higher back towards the zero line, action, which typically precedes a reversal to the upside. Although the Accumulation line still looks weak on this chart, there has been a marked buildup in upside volume this month that has started to turn it higher, as we will now proceed to see on the 6-month chart.

On the 6-month chart, we can see how the recent downtrend in Reyna culminated in its dropping quite hard in the middle of last month, with a sharp gap moving lower on the announcement of financing at 12 cents, with it naturally dropping to the vicinity of the funding price, but most interesting to us is the way it has tracked sideways in a tight range since this announcement forming a small base pattern, with a quite dramatic increase in upside volume so far this month which is bullish and suggests that once the funding is complete, which it now is, the price will break out upside from the small base and enter a bull market, and why shouldn't it with sizeable and upscaled funding successfully completed which shows investor confidence in the company, and a summer drilling program set to start against the background of silver entering a major bull market.

Other technical factors supporting an upside breakout from its current narrow range are the large gap between the price and the 200-day moving average, which is a measure of how oversold it is, and the steadily improving momentum with the MACD indicator climbing back steadily towards the zero line.

The conclusion must be that this is an excellent time to buy Reyna Silver, which is rated a Strong Buy for all timeframes as a major new bull market in the stock. It looks set to commence very soon and possibly immediately.

Reyna Silver Corp. (RSLV:TSX.V; RSNVF:OTCMKTS) closed at CA$0.125, $0.09 on March 15, 2024.

Reyna Silver's website.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Mag Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- In addition, Reyna Silver has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Reyna Silver Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.