I came up with a name for my market overview. First off, let's talk EVs and green energy. I have been critical of EV performance and the deception that nameplate capacity is used for wind and solar projects when their real capacity factor is way down around 25%. The EV problems are finally coming to light as the big auto companies are jumping ship.

The gig is up!

Last week, Honda and GM announced an end to their two-year collaboration in building a platform for lower-cost EVs. Honda execs said it was too hard. October 25, the world's largest auto maker Toyota, Chairman Akio Toyoda says people are finally seeing the reality of EVs. Toyota has gone the route of hybrids.

Oct. 31, Ford is delaying production at one of two EV battery plants located on a common site in Kentucky, the Louisville Courier-Journal reports. Citing lower-than-expected demand for EVs.

Oct. 25th GM has announced that it is pulling back on its ambitions to build 400,000 EV units in North America by the mid-2024 calendar-year time frame. General Motors has also detailed delays in retooling the GM Lake Orion plant in Michigan for production of the Chevy Silverado EV and GMC Sierra EV all-electric pickup trucks.

Perhaps my substack 'Cheap EV Charging is a Myth, Costlier than Gas' back in March got more traction?

Amazingly, less than 10% of all new car sales over the past two years were EVs. This is despite the fact that the U.S. government is writing a $7,500 check to people for buying an EV, and some states are kicking in $5,000 more. The Texas Policy Foundation calculates that all-in EV subsidies can reach $40,000 per vehicle.

According to Stephen Moore, a senior fellow at the Heritage Foundation and chief economist at Freedom Works, this is easy to verify:

"News is even worse for wind and solar power. The Wall Street Journal reported last week that "clean energy" investment funds are tanking, with some down as much as 70 percent in recent months. Solar has been one of the worst-performing industry stocks this year. This collapse is happening right when Exxon and Chevron have engineered a combined $110 billion in blockbuster acquisitions to expand oil and gas drilling in the Permian Basin in Texas, one of the biggest oil fields in the world. This year, they both reported their largest profits ever. They and their investors are looking at real-world data, not green energy propaganda. In 2023, the world is guzzling oil and gas like never before. Global consumption of fossil fuels was higher in 2022 than at any time in human history."

Here are charts of popular wind etf FAN and solar etf TAN:

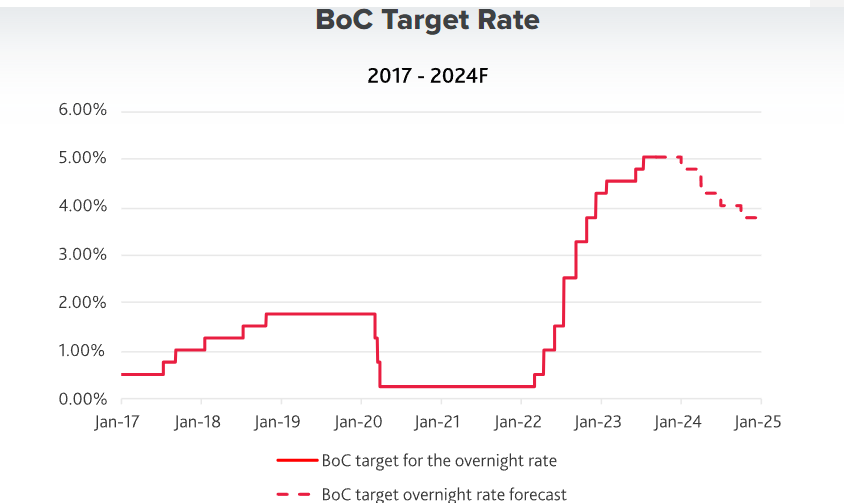

Another thing the market has not figured out yet is interest rates. There still seems to be dreams of rates going back down to where they were, like 2% and less. I will tell you that we will be lucky to get back down to 4%.

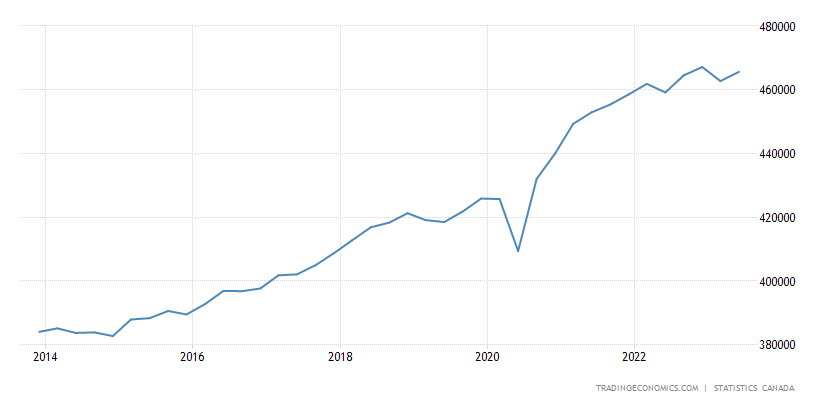

Canada is in a mild recession. Q2 GDP was -0.2%, and Q3 is forecast for small negative growth of -0.1%. In Q2, housing investment fell 2.1%, the fifth consecutive quarterly decrease.

The decline was led by a sharp drop in new construction (-8.2%), which was observed in every province and territory except for Nova Scotia. Renovation activities (-4.3%) also fell. When the country needs more housing, investment in the sector is actually declining.

With the economy sliding into recession, and I expect this will worsen, most economists predict the Bank of Canada (BoC) is done increasing rates and will start lowering them in early 2024. I mostly agree, but I doubt rates will ease very much or quickly. Growth in the U.S. is much stronger, and their economy is more resilient. I expect the U.S. economy will slow significantly in 2024 and also enter a recession, but for now, it is much stronger than Canada.

If the BoC deviates too much from U.S. rates, the Canadian dollar will drop, and that is inflationary as all commodities and most goods are priced in US$. In both countries, we have governments spending more than drunken sailors, and this is also adding inflation pressure. I also expect the Middle East conflict to intensify and put more upward pressure on energy prices again.

Last week, the Canadian government tabled supplementary estimates in the House of Commons, which include a cut of $500 million to the government's $443 billion spending estimates. This is really nothing and equates to 0.1%. It is easy to see the excess spending on this chart. The last data point is June 2023 at $465 billion.

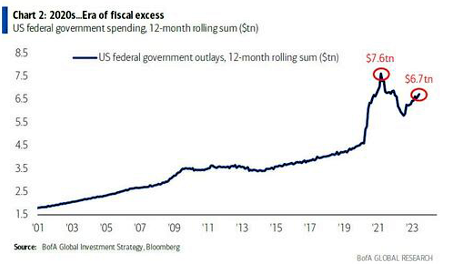

Considering its larger size (10 times), the Biden administration is spending more than Canada.

October's U.S. CPI is expected to rise only 0.1% M/M, compared with a 0.4% increase in September. On a Y/Y basis, it's expected to rise by 3.3%, down from 3.7% in the previous month. Core CPI, which excludes food and energy, is anticipated to increase by 0.3% M/M, the same rate of increase as in September. Y/Y economists, on average, project a 4.1% rise in October, also unchanged from the September rate of inflation.

Numbers came in a bit better than expected as M/M rise was flat at 0.0%, thanks to a 5.0% decline in the gasoline index. Core CPI was up 0.2%. The Y/Y increase is 3.2%. Markets should be happy with this, except Jamie Dimon is worried about something.

A huge sell signal October 27, we learn that the most famous banker of recent times, J.P. Morgan-Chase CEO Jamie Dimon, is selling about 12% of his stock for US$140 million in a transaction explained away as "preplanned and done for tax purposes and diversification."

For the biggest bull in banking history to dump stock for the first time since assuming leadership of the most powerful (and fined) bank in the world is a clear danger signal. Dimon sailed through the 2008 crisis while helping orchestrate the greatest financial bailout in history. He held through a global pandemic and economic shutdown in 2020 without selling. What changed? I believe we will find out in 2024, and it won't be pretty. It's no surprise the markets like the inflation numbers. The S&P breached the 4400 area, and I expect it will test 4600. There are good odds the S&P breaks above 4600 as it normally is a better time of year, and the market is coming off a 3-month correction.

This will be another sell opportunity.

With gold, I pointed out in October that there was strong resistance around $2020 to $2040, so it is no surprise it has corrected after hitting this level. Gold is now in a support area, and I expect that to hold.

However, we are coming into the typical year-end weakness when the gold price is most often driven lower. That said, last year, gold rose in November and December, so perhaps the year-end pattern has ended.

Regardless, I expect gold to move higher in late December and into 2024 and break above the $2020 resistance area. I would watch for a solid close above $2040.

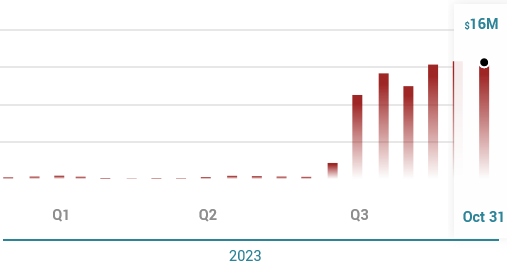

With this latest rally in gold, I commented that I am convinced that the bottom is in, and I have some further confirmation. Increased Merger and Acquisition activity is a hallmark at market bottoms. Those who know the markets the best are the participants or, in this case, the miners. On Monday, Calibre Mining announced it would acquire Marathon for its Valentine gold project in NFLD. I thought that there seemed to be a lot of M&A action this year, and sure enough, my inclination was correct.

Literally, hundreds of agreements have been signed, with most flying under the radar of mainstream media and retail investors. In the third quarter of 2023, when there were 323 M&A announcements totaling $14 billion, according to GlobalData's Deals Database. The biggest one was the $3.4B minority acquisition of Vale Base Metals by Engine No. 1 and Manara Minerals Investment.

According to the report, at Mining Technology, M&A activity increased by 137% in the third quarter of 2023 compared to the second quarter's $5.9B, and rose by 34% compared to Q3 2022. In Canada alone, there were 121 M&A deals totaling $3.9B — a whopping 323% increase compared to Q2's $842.8 million and 597% more than the third quarter of 2022.

According to Fitch Ratings, The rise in M&A activity across the mining industry over the past year will likely continue into 2024. The need for consolidation and reserve replenishment will support transactions in the gold industry.

Those operating in the industry know it best and they are telling us that the assets are so cheap they are on a buying binge. It currently is far more cheaper to buy the gold in the ground than explore for it. The other big important point for investors, it takes hundreds of companies off the market so there are far fewer to buy, hence a better prospect that the remainder will get bid up in price.

Argonaut Gold TSX:AR Recent Price - $0.46 Entry Price - $0.39 Opinion – Strong Buy on short squeeze

Today, Argonaut Gold Inc. (AR:TSX) reported financial and operating results for the three and nine months ended September 30, 2023, as well as a progress update for the Magino mine.

"Since the beginning of the fourth quarter, Magino's throughput has been averaging 9,200 tonnes per day, in-line with nameplate capacity. As we continue to ramp up, we are focused on driving mining productivity, mill optimization, and further advancing the plant expansion that has the potential to increase throughput to annual production above 200,000 ounces per year for the life of mine," said Marc Leduc, Chief Operating Officer of Argonaut Gold.

Financial Highlights

- Revenues of $104.8 million was 39% higher than $75.3 million from the third quarter of 2022, due to initial production at the Magino mine and higher production at the Florida Canyon mine, partially offset by lower planned production from the Company's three Mexican mines - El Castillo, La Colorada, and San Agustin.

- Revenues include $22.0 million of pre-commercial production ounces sold from the Magino mine. Subsequent to the end of the third quarter, the Magino mine achieved commercial production on November 1, 2023.

- Gross profit of $17.1 million was 146% higher than $7.0 million from the third quarter of 2022, due to higher revenues from the Magino mine and Florida Canyon mine.

- Generated cash flow from operating activities before changes in working capital and other items totaling $21.1M, an increase of 55% from 2022 comparative period due to higher gross profit.

- Net loss of $0.5 million, or $0.00 per share, compared to net loss of $1.3 million, or $0.00 per share, a decrease largely due to higher gross profit, partially offset by increases in foreign exchange losses and unrealized losses on derivative instruments.

- Adjusted net income1 of $9.9 million, or $0.01 per basic share, compared to an adjusted net income1 of $0.4 million, or $0.00 per basic share, an increase of $9.6 million primarily due to an increased gross profit of $10.2 million.

- Cash and cash equivalents of $44.9 million and net debt of $179.1 million, as of Sept. 30, 2023.

I previously commented on the huge short position on the U.S. side, and it is up to new highs of almost 43 million shares with the October 31 short report and 4.6 million on the Canadian side. Marketbeat's short report estimates 162 days to cover, and so does the short squeeze, but this is based on low volume on the OTC as the stock mostly trades in Canada at around 4 million shares per day.

Volume has been a bit higher in November, probably more shorts?

This is a very significant short position, and I believe shorts jumped on the stock because they thought Argonaut would default on their loan facility or they would have to do an equity financing that shorts could use to cover, so these points in today's Q3 release are very important.

On Sept. 29, 2023, the company obtained a waiver on certain financial covenants on its $250- million financing package (collectively referred to as the loan facilities) for the continuing development and construction of the Magino mine. A subsequent waiver was obtained on Oct. 31, 2023, which now requires the company to maintain a minimum cash balance of $10 million at all times until Nov. 30, 2023, and additional financing to be raised by the same date. It was anticipated the company would not be in compliance with certain financial covenants and accordingly obtained the waivers to prevent a default event, which could trigger the loan facilities becoming immediately due and payable.

On November 2, 2023, the Company announced raising the additional financing with the sale to Franco-Nevada Corporation and certain of its subsidiaries ("Franco-Nevada") of an additional 1.0% net smelter return ("NSR") royalty on its Magino mine and its non-core royalty holdings in Canada and Mexico for an aggregate price of $29.5-million. Upon the closing of this transaction, Franco-Nevada will hold an aggregate 3.0-per-cent NSR royalty on the Magino mine.

The Magino mine has had a slower-than-projected startup with some solvable problems that pressured the balance sheet. It is not unusual for a new mine to have some hiccups and/or technical issues at startup. The important thing is Argonaut has got through this with no loan defaults and financing with no share dilution. I believe shorts will have to cover!

On the chart, it looks like the stock has put in a double bottom leading up to jitters ahead of the Q3 report today. I think all is well, and there is huge potential for Argonaut as they continue to ramp up their Magino mine.

Greenbriar Capital TSXV:GRB OTC:GEBRF Recent Price - $1.11 Entry Price - $1.15 Opinion – Strong Buy

Today, Greenbriar Capital Corp. (GRB:TSX.V; GEBRF:OTC) announced that their 995-home sustainable entry-level residential subdivision, Sage Ranch in California, has received Planning Commission approval for the Precise Development Plan ("PDP") at the November 13, 2023 Planning Commission meeting.

Wow! This is huge news we have been waiting for. Just consider it lucky that this development was not in Canada because it would have probably taken another two years to get approved. Construction will soon start, and Greenbriar will sell around 140+ plus homes per year for about six years. I can give a more solid revenue projection when we see what the first homes sell for, but some simple round numbers of $100,000 profit per home on 140 homes is US$14 million per year revenue.

Greenbriar only has 35 million shares out, so a measly $39 million market cap.

Jeff Ciachurski CEO of Greenbriar, says: "The City has requested our team meet with the city staff within the next day or two to get everyone moving forward to obtain the necessary construction permits. Sage Ranch was purchased by the company 12 years ago, and today marks a huge milestone to have a 995-home project approved in the State of California. We congratulate city staff, the Planning Commission, the City Council, and our Greenbriar engineering, building, and architectural teams for this gold medal effort."

From an environmental standpoint, Sage Ranch will be a low-carbon showcase. Nowhere in the subdivision will any resident be more than a short three (3) block walk to either elementary, middle, or high schools. Match this with State-mandated solar roofs, smart meters, optional battery storage and EV charging, smart appliances, and energy-efficient building techniques; Sage Ranch amounts to an exceptional model of environmental planning and carbon reduction. Greenbriar is also named as one of the top performers on the TSXV Venture Exchange. The 2023 TSX Venture 50 celebrates the strongest performances on the TSXV over the last year. The Top 50 ranking is selected from 1,713 TSXV public companies. It is great the stock is among the top, but in reality, GRB stock is about even on the year or down a bit, proving how bad the TSXV has been.

'

'

| Want to be the first to know about interesting Gold, Critical Metals, Base Metals and Battery Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of: Greenbriar Capital Corp.

- Ron Struthers: I, or members of my immediate household or family, own securities of: Argonaut Gold and Greenbriar Capital. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.