Fresh from closing a deal for a US$90 million (equivalent in Argentine pesos) investment by big-three automaker Stellantis (formerly Chrysler), Argentina Lithium & Energy Corp. (LIT:TSX.V; PNXLF:OTC; OAY3:FSE) announced it has resumed drilling at its Rincon West lithium project in the Lithium Triangle.

The company received the environmental permit last summer to start exploring the contiguous Rinconcita II concession, expanding the project to the east.

Argentina Lithium has since finished geophysical surveys on the site and mobilized a diamond drill, which is sinking the second of six holes.

"This factor is what prompts me to go from watching to recommending with Argentina Lithium & Energy, given the news just out the last few days that car maker Stellantis has decided to put US$90 million [equivalent in Argentine pesos] into LIT's wholly owned local subsidiary companies exploring these projects." — Chris Temple, editor of The National Investor

"The US$90 million equivalent [to Argentine pesos] investment in our company by automotive giant Stellantis comes with the mandate to accelerate exploration at our core projects, with the aim of advancing to the assessment of development potential as quickly as possible," Argentina Lithium Chief Executive Officer Nikolaos Cacos said. "We anticipate increasing the scale and number of our exploration programs as permits are received for our projects. This is a big undertaking, and we are now well financed to aggressively move forward with this work."

The Stellantis umbrella includes iconic brands like Chrysler, Alfa Romeo, Citroen, Dodge, Fiat, Jeep, Maserati, and Peugeot. Under the agreement, Peugeot Citroen Argentina SA, a Stellantis subsidiary, owns 19.9% of the LIT's Argentine subsidiary, and Argentina Lithium will own 80.1%.

Stellantis' investment drew one newsletter writer to change his advice on the company seeking out the battery metal vital for the new green economy.

"This factor is what prompts me to go from watching to recommending with Argentina Lithium & Energy, given the news just out the last few days that car maker Stellantis has decided to put US$90 million [equivalent in Argentine pesos] into LIT's wholly owned local subsidiary companies exploring these projects," wrote Chris Temple, editor of The National Investor.

Extending the Project

Rinconcita II, which is more than 465 hectares, is contiguous to Rincon West and extends the project east over the salt flat toward Rio Tinto Plc's (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) Rincon project.

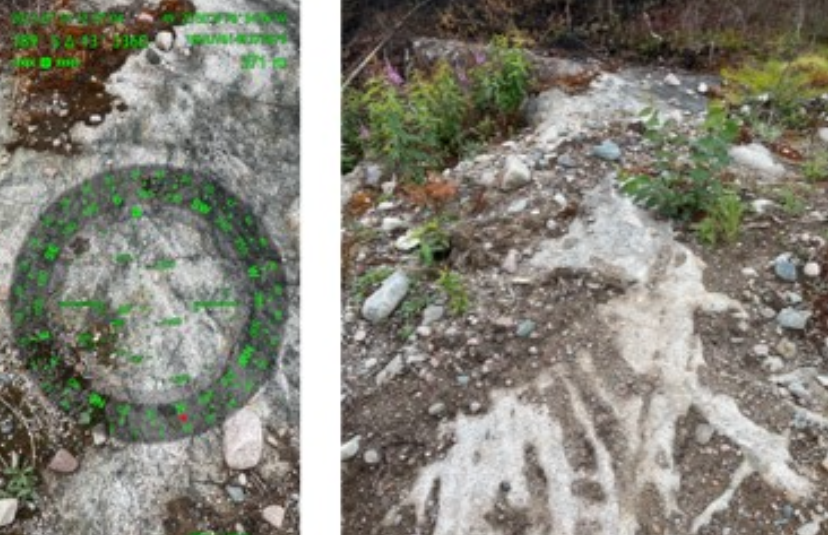

In July, the company completed 12 line-kilometers of magnetotelluric geophysics surveys of Rinconcita II. The results showed extremely conductive strata (low resistitivity) at less than 100 meters below the surface, which is consistent with lithium-bearing brine formations.

Argentina Lithium has engaged AGV Falcon Drilling SRL to drill down and confirm the presence of enriched brines.

Five diamond drill holes will be sunk followed by one rotary drill well for pump-testing, the company said. The first hole was finished in September, and workers have begun drilling the second.

Argentina Lithium's projects are all within the Lithium Triangle in the Argentinian provinces of Salta and Catamarca. They include Rincon West, Antofalla North, Pocitos, and Incahuasi. All are "salar" properties were the company hopes to produce lithium carbonate from brines enriched in lithium. They are currently at the exploration stage.

The Catalyst: Transition Coming 'Fast and Furious'

Stellantis' investment in Argentina Lithium highlights the approaching shortage of the element, which will be needed for electric vehicle (EV) batteries.

The EV transition is "is coming fast and furious," Cacos has said.

A major component of EV batteries, lithium is a soft, silvery metal with highly reactive and flammable properties. It's also used to strengthen alloys, as a high-temperature lubricant, and as a drug to treat bipolar disorder.

Analysts from Eight Capital predicted that lithium market deficits will widen this decade, and the shortfalls will be driven by demand in North America.

The United States' EV penetration of 6% lags China's 26% and Europe's 20%, analysts Anoop Prihar and Alex Riazanov of Eight Capital wrote in a research note. But President Joe Biden's administration has committed to a target of 50% of new vehicle sales being EVs by 2030.

"We estimate North American lithium nameplate production capacity will be 262,900 LCE (million tonnes lithium carbonate) in 2026 based on projects that currently have completed a Definitive Feasibility Study (DFS)," Prihar and Riazanov wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Argentina Lithium & Energy Corp. (LIT:TSX.V; PNXLF:OTC; OAY3:FSE)

"Although this is a significant increase from the current North American production capacity of 6,000 tonnes LCE, it's still more than 128,000 tonnes short of what we anticipate will be required by the battery plants. As such, we anticipate the fundamentals underlying lithium demand to remain robust," the analysts wrote.

Ownership and Share Structure

The company doesn't officially share any information regarding management or institutional ownership, but Reuters reported that about 37% was owned by strategic institutions in the most recent reporting.

Its largest shareholders are Lithium Investment Partners LP with 17.68%, Jack Yetiv with 15.24%, Joseph J. Grosso with 3.05%, and the CEO Cacos with 1.04%, according to Reuters.

Its market cap is CA$52.68 million, with 130 million shares outstanding. It trades in a 52-week range of CA$0.63 and CA$0.19.

Sign up for our FREE newsletter

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Argentina Lithium & Energy Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.