StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) is an exploration company focused on building precious metals resources in Canada and the Western United States.

It is exploring its 100%-owned Cuprite Gold project in Nevada's Walker Lane gold trend, starting with the geochemical, geophysical, and structural vectoring techniques that led to the discovery of AngloGold Ashanti Ltd.'s (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) Silicon gold project.

StrikePoint believes Cuprite is an analog to Silicon and plans to follow up the surface work with 2,000 meters of drilling in the second half of 2023.

"The similarities between Silicon and Cuprite are striking," Chief Executive Officer Mike Allen said.

Allen said he said he had driven past the Cuprite site dozens of times when he was CEO of another mining company and became interested when AngloGold revealed the Silicon discovery, and Cuprite came on the market. StrikePoint initially acquired the project earlier this year from Orogen Royalties Inc. (OGN:TSX.V)

According to Orogen, Cuprite is one of the largest alteration cells in the Walker Lane trend, and prospective feeder structures are untested by historical drilling.

The Catalyst: Close to More Gold

The Silicon gold project is just 75 kilometers away from Cuprite. A growing resource of 4.22 million ounces gold (Moz Au) has been defined at Silicon. In addition, a new geological target of 6 to 8 Moz Au has been identified by Anglogold at the nearby Merlin target.

StrikePoint filed a National Instrument 43-101 report for Cuprite in April.

Cuprite is underlain by Miocene and Oligocene tuff and is located on the western flank of the Stonewall Mountain Caldera. Several nearby gold deposits and mines are in similar locations within the calderas of the Walker Lane Trend, including the Goldfield District Deposit, now owned by Centerra Gold Inc. (CG:TSX; CADGF:OTCPK). A caldera is a large depression formed when a volcano erupts and collapses. Allen believes Cuprite hosts the same potential for gold mineralization along the margins of the caldera as its neighboring deposits in Walker Lane.

At the time of Cuprite's acquisition in January of this year, the company's share price was CA$0.07. Technical Analyst Clive Maund told Streetwise Reports that "StrikePoint looked like a good value."

"The Cuprite property includes areas of intense, steam-heated, advanced-argillic alteration with potential for gold-silver mineralization at depth, and the author believes that the Cuprite project is an initial-stage project of merit," geologist Steven I. Weiss wrote in the NI 43-101 report.

At the time of Cuprite's acquisition in January of this year, the company's share price was CA$0.07. Technical Analyst Clive Maund told Streetwise Reports that "we shouldn't expect any fireworks soon," but StrikePoint looked like a good value.

Those "fireworks" could arrive with Strikepoint’s drill program commencing this fall and results following in the winter.

"It is down in a zone of strong support and oversold," Maund said.

The stock was at CA$0.045 on Tuesday afternoon.

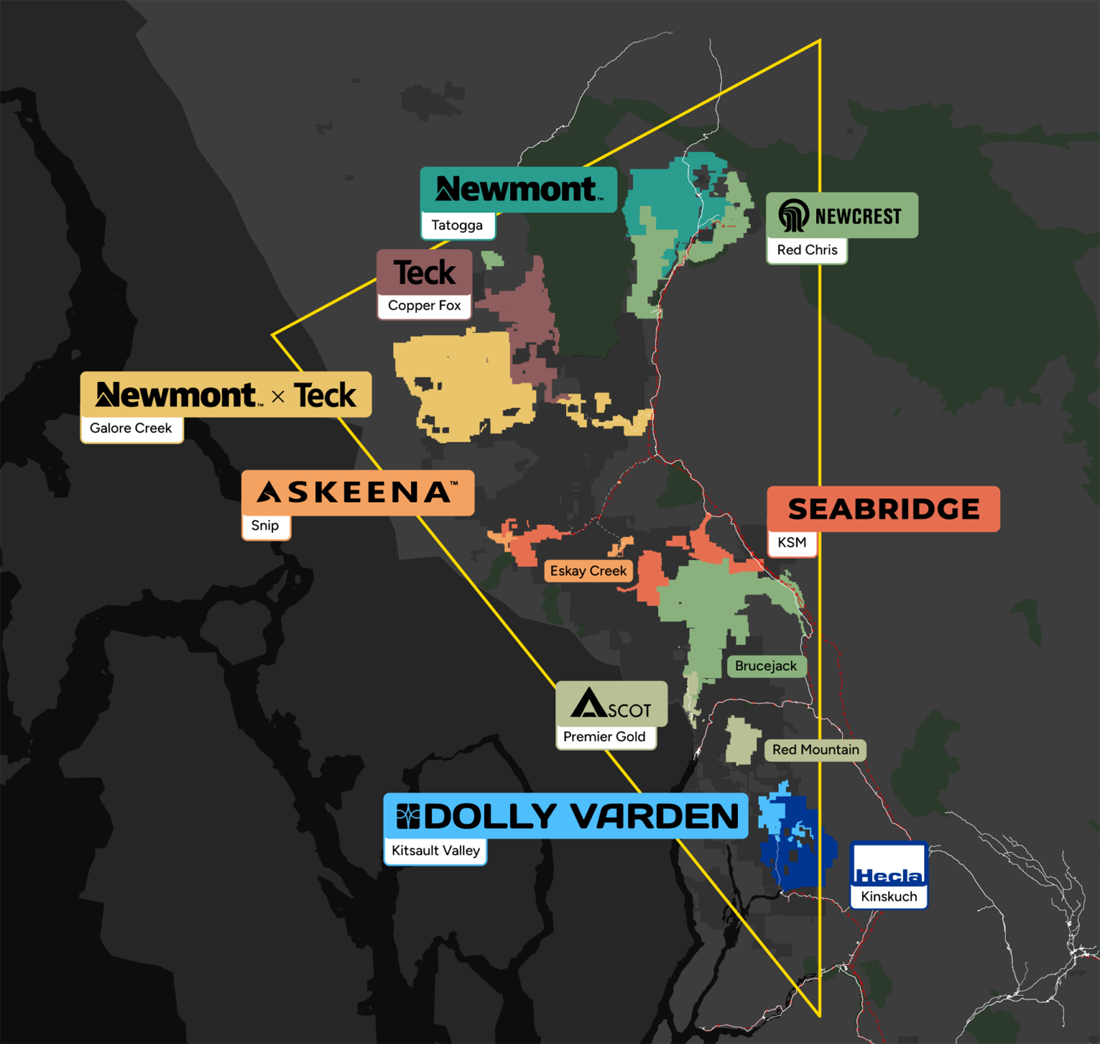

In addition to Cuprite, the company also controls two advanced-stage exploration assets in British Columbia's Golden Triangle: the past-producing high-grade silver Porter-Idaho Project and the high-grade gold Willoughby Project.

Allen 'Has a Track Record'

Allen has more than 20 years of experience in the mineral exploration and development business. He has advanced projects through all stages, but most notably, was previously president, chief executive officer, and director of Northern Empire Resources, where he was responsible for identifying, acquiring, and advancing the Sterling Project in the Beatty District of southwest Nevada.

After starting with a market capitalization of CA$10 million, Northern Empire was sold to Coeur Mining for about CA$120 million just two years later.

StrikePoint Executive Director Shawn Khunkhun, who is also chief executive officer and director of Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX), said Allen's reputation preceded him when Allen was brought in.

"Mike has a track record," Khunkhun said after Allen joined the company last year. "He's proven that he can sell these projects."

Khunkhun said Allen is rare because he's good at the science of the job — he's a geologist — and he's also good at the business side.

"There are certain guys in this business who are both technical but are also very commercial. Mike is an economic geologist," Khunkhun said.

The Rest of the Team

Much of the team from Allen’s Northern Empire success continues to work together at StrikePoint. These include Director Adrian Fleming, Chief Financial Officer Paulo Santos, and field geologists Rich Histed and Ron Kieckbusch.

Fleming was a founding board member of Northern Empire, a current board member for StrikePoint, and is also a geologist with more than 40 years of technical and executive experience with exploration and development stage mining companies.

Santos also has significant experience in various senior executive financial roles within the mining industry, including most recently as the CFO of Elevation Gold Mining Corp. (ELVT:TSX; EVGDF:OTCQX) He also served as the CFO for Allen's Northern Empire and the treasurer and corporate secretary for Newmarket Gold Inc., which was sold to Kirkland Lake Gold Inc. (KL:TSX; KL:NYSE) for about CA$1 billion.

Recently StrikePoint brought on another former Allen associate, Knox Henderson, as head of Investor Relations. Henderson is a corporate communications and capital markets professional with a two-decade career with exploration companies including Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX), which sold its high-grade Dixie gold project in Red Lake to Kinross Gold Corp. (K:TSX; KGC:NYSE) for CA$1.8 billion.

Allen's team and a group of geologists and contractors have mobilized to explore Cuprite, which StrikePoint has called a district-scale opportunity.

"We hope to be able to start announcing (drilling) results in 2024," Allen said.

Why Gold?

The precious met has long been "considered a safe-haven asset for retaining its value throughout history," Forbes wrote in "Why Gold Is a Good Investment Right Now" in May.

"Gold became a darling for investors in 2020 during the worst pandemic in generations, gaining as much as 40%," Forbes wrote. "Gold has returned 18% over the last three years, 54% over the last five years, and 41% over the last decade. That compares unfavorably to the S&P’s 41% three-year return, 51% five-year return, and 156% ten-year return but easily trumps the low- to mid-single-digit returns for other nonequity investments such as government bonds and high-yield savings accounts."

According to a recent Gallup poll, about one-quarter of Americans think gold is the best asset to invest in long-term, its highest level in more than a decade.

In addition to buying physical gold or futures contracts for the metal, investors can also purchase shares of public companies that explore for or mine the metal.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB)

It can also hedge against high inflation.

"Gold generally holds its value and preserves your purchasing power over the long haul, despite fluctuations in the dollar," according to "Why You Should Invest in Gold in 2003" by CBS News.

Ownership and Share Structure

Some of the industry's biggest players are shareholders in StrikePoint, including Eric Sprott, who owns about 14.5%. Institutions own about 46.7% of the company. Management and insiders own about 4.8%, and 33.9% is retail.

Some major institutional investors include Crescat Capital LLC, with 4.99% or 10.67 million shares, and U.S. Global Investors Inc., with 1.29% or 2.75 million shares.

Major insider shareholders include Board Executive Chairman and Director Shawn Khunkhun with 0.56% or 1.17 million shares, and Director Ian Harris with 0.29% or 0.61 million shares.

StrikePoint's market cap is CA$12.83 million, with 213.78 million shares outstanding, according to the company. It trades in a 52-week range of CA$0.12 and CA$0.045.

Sign up for our FREE newsletter

Important Disclosures:

- StrikePoint Gold Inc. and Dolly Varden Silver Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden Silver Corp. and Orogen Royalties Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.