Wave 3 is unfolding nicely here after yet another long period of consolidation.

So much money has been pushed into the global monetary system that all the central banks can have no real impact anymore.

Just jawboning is left. Great for gold and all resources commodities. Energy will be key.

- Exporters will have fun

- Importers will have misery

Gold

- Heading to US$2000

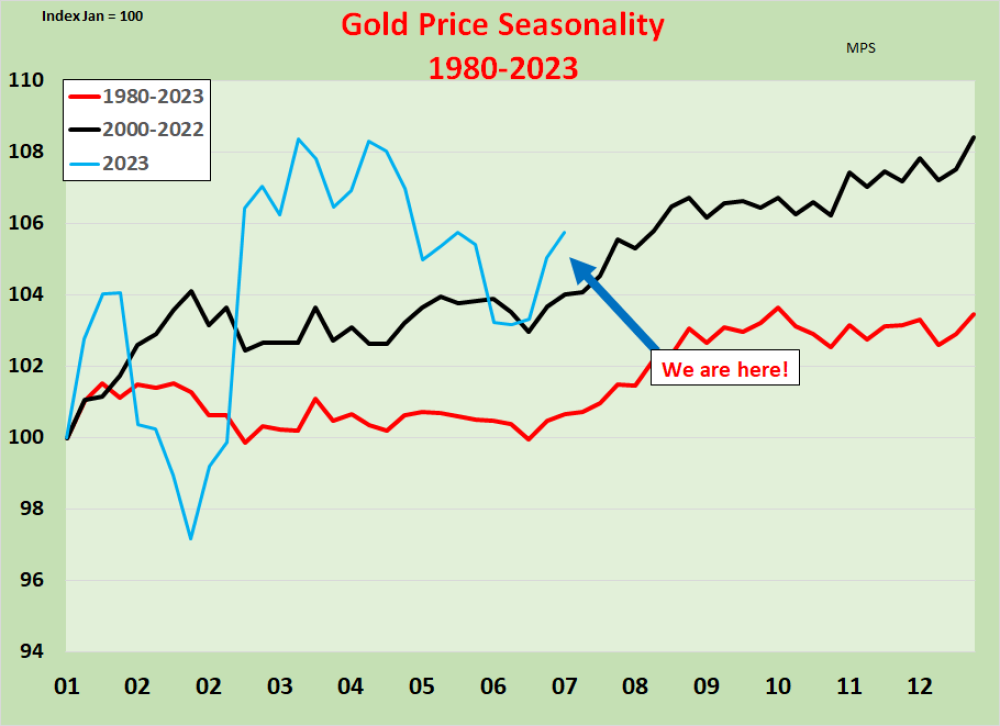

- Seasonal influences strong

- Short covering to begin in earnest now

Gold Stocks

- Breaking out

- To 145, then 165 on XAU

- Outperforming gold bullion again at last

Silver

- Through US$25

- Big move to US$30

US$

- Oversold

- Massive bearish consensus

- At bottom of wedge

- 125 target within a few years

- Will this work out as hoped?

- U.S. assets very attractive

- bonds

- equities

- real estate

US Bonds

- Yields have now clearly peaked

- New highs were not achieved in the latest yield spike

- Path is now down sharply (???)

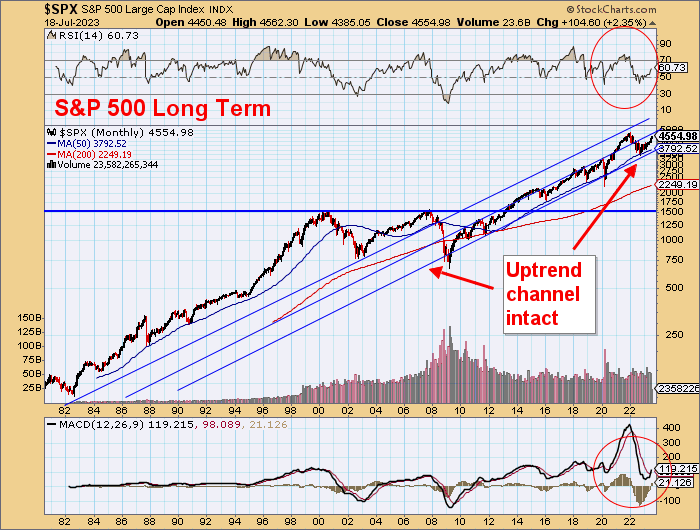

US Stocks

- On way to new highs

- Short covering still running

- Small caps starting to zoom

US Real Estate

- 18 month downtrend broken!

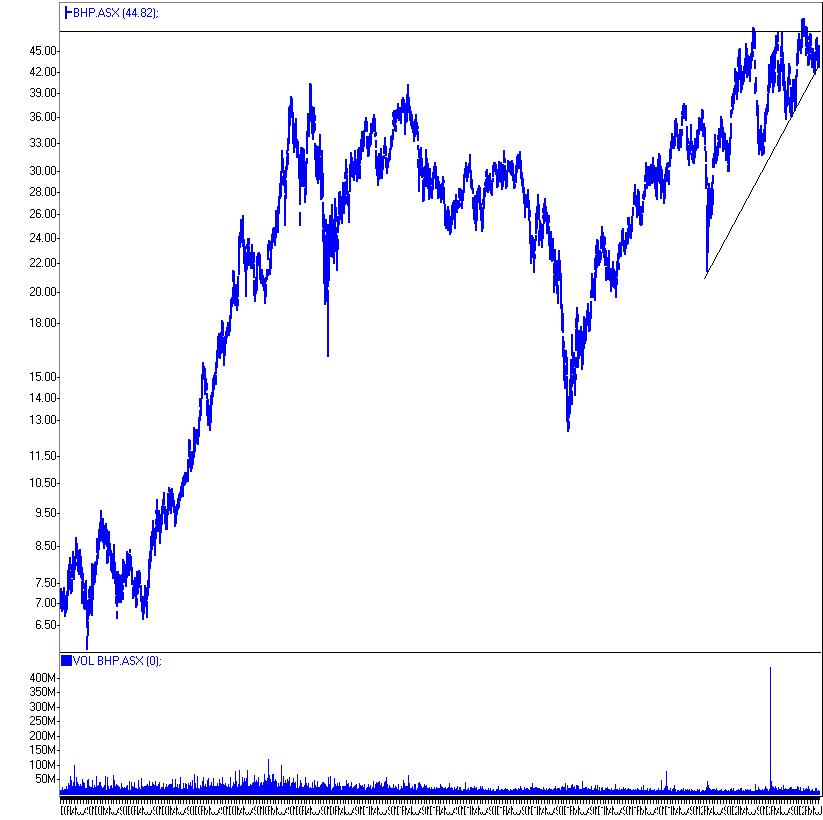

BHP

- Big, big base to surge from

Gold

Gold has continued to move out from that descending wedge that made that strong seasonal bottom and is now heading up to challenge US$2000 and beyond.

Given the seasonal influences, it could be expected that August might be relatively quiet until the end of the North Hemisphere summer, but the power of gold and its relative strength might push it much higher anyway.

I keep expecting that US$100 intraday move, which I am sure is on its way to us.

This was a nice move overnight.

More ~US$25 moves.

And fitting nicely into this seasonal pattern.

Note that gold has much more volatility in 2023 than the averages.

Where will we end up on December 31, 2023?

This move looks like a Wave 3 in Wave 3.

Strong up day.

Could expect this to be stronger again this week.

The longer-term gives a classic technical break out.

Breaking to new highs here will send gold MUCH higher.

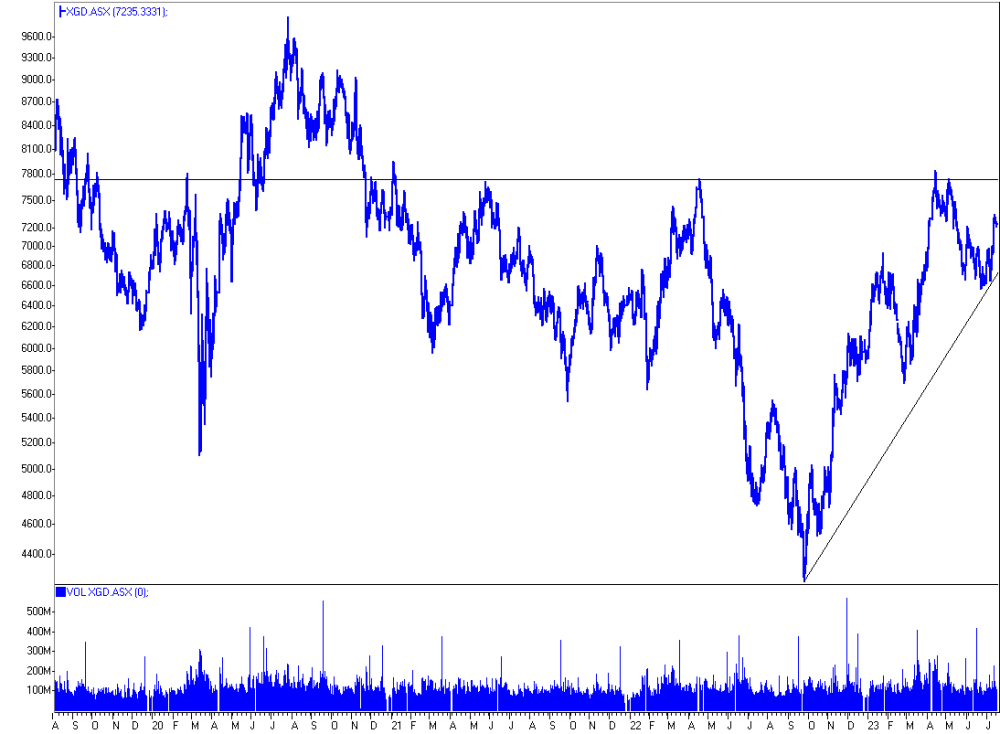

Gold Stocks

- This suggests to me that the next move could be very strong and rapid

- Possibly straight to 145 within a week

- Then much higher

165 won't take long to achieve.

Gold stocks are now outperforming gold.

ASX gold stocks are completing Right Hand Shoulder and should slice through the 7700 neckline.

Silver

Very strong technical pattern here.

It won't be just gold.

Remember

- No metals inventory

- Energy Cliff ahead

- Not enough undeveloped mineral deposits

- Not enough exploration

BHP

A massive breakout is coming.

- Earnings

- Dividends

- Acquisitions

US$

- Bearish consensus must be at stratospheric levels!

- US$ is extremely oversold

- But who really wants to buy the Euro?

- Or the Yen?

- Or a collection of third-rate players, even if it was gold backed

- Not enough gold there to make it work

- Would you buy a Yuan 20 Year security even if it was gold backed?

- Probably not

- And that would be the best of them

- You can't have a monetary union without a political union

There is a big wedge here!

It would take US$ to about 125!

US Bonds

The bond market is continuing the fight between the bulls and the bears.

Technical evidence of no new highs is strongly suggestive of a continuation of the decline in yields.

- 10-year showed that false breakout, then a break of the uptrend

- No new high was made (important!)

- Brinkmanship indeed!

5-year showed sharp selloff.

30-year did not make a new high in yields.

There is a lot at stake here, with the possibility of sharply higher bond yield or sharply lower bond yields.

The case for either direction is strong.

The case for higher yields:

- A more robust economy

- higher inflation

- an increase in the supply of bonds

The case for lower yields:

- Inflation subsiding

- US$ assets are attractive

- Massive short position still to be covered

Either way is good for gold.

US Stocks

- Nice short covering here

- New highs are not too far away!

Small stocks are breaking higher.

The big picture is looking good here.

US Real estate

- Very attractive asset class

Timing is everything.

Heed the markets, not the commentators.

Sign up for our FREE newsletter

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.