In the lead-up to the summer, several companies have provided interesting updates on how they are preparing for the future. From assay results to released MREs, these companies had the best gold releases on Streetwise in May.

Heliostar Metals Ltd.

Heliostar Metals Ltd. (HSTR:TSX.V; HSTXF:OTC; RGG1:FRA) released the results of its initial drilling on the Ana Paula project in Mexico. This drilling program is ongoing and targets the high-grade Panel at Ana Paula, which the company believes to contain the potential to hold a high-margin, underground gold mine development opportunity.

Analyst Mike Niehuser said in a research note from Roth Capital Partners, "We have focused on the Ana Paula Project as it is the most important component of this valuation assessment."

The company released the results from its first two holes drilled on the property, Hole AP-23-292, and Hole AP-23-291.

- Hole AP-23-292 was drilled to 101.1m at 8.3g/t gold, including 53.2m at 11.0g/t gold.

- Hole AP-23-291 was drilled to 118.5m at 5.4g/t gold, including 44.5m at 11.0g/t gold, including 4.0m at 48.5g/t gold.

In light of the results, CEO Charles Funk said, "Drill results like this are rare anywhere in the world. Ana Paula's high grade and consistently wide intervals of gold mineralization demonstrate the underground mine potential."

In addition to Ana Paula, Heliostar also has the San Antonio Gold project, located in the Baja California Sur state of Mexico. Development is on hold while the company waits for an environmental permit for the project.

According to Reuters, Charles Walter Funk owns 1.07% of the company with 1.58 million shares, George R. Ireland owns 0.73% with 1.08 million shares, Samuel David Anderson owns 0.13% with 0.19 million shares, and Mahesh Nalinda Liyanage owns 0.08% with 0.12 million shares.

AIMS Asset Management Sdn Bhd owns 7.18% with 10.61 million shares, Euro Pacific Asset Management, LLC, owns 4.21% with 6.21 million shares, Mount Everest Finance S.A. owns 2.10% with 3.10 million shares, U.S. Global Investors, Inc. owns 0.91% with 1.35 million shares, and Konwave AG owns 0.48% with 0.70 million shares.

There are 147.77 million shares outstanding, with 1.41.63 million free-float traded shares. The company has a market cap of CA$44.71 million. It trades in the 52-week period between CA$0.20 and CA$0.57.

West Red Lake Gold Mines Inc.

The junior gold exploration company West Red Lake Gold Mines Inc. (WRLG:TSXV;WRLGF:OTCQB) announced its findings on the Rowan Property. The company intersected 10.34g/t gold over 8.0m, 68.46g/t gold over 1.1m, and 13.21g/t gold over 5.5m. These results are from the ten holes out of 16 that have been drilled so far. The remaining six holes are pending assay results. West Red Lake reports that 90% of the holes have shown high intervals grading of not less than 5g/t gold. The company has also reported that 50% of the intersected and completed drill holes have visible gold.

The findings confirmed the company's expectations regarding gold grade and confirmed the geologic model, and helped bolster the existing high-grade 827,462-ounce inferred mineral resource at the Rowan Mine.

CEO Tom Meredith said of the findings, "This impressive first round of assays from the Phase 1 drilling program at the Rowan Property confirmed (our) expectations based on the numerous accounts of mineralization observed in the drill core by our geologic team."

Per Reuters, Frank Giustra owns 0.82% with 0.47 million shares, Thomas W. Meredith owns 0.46% with 0.26 million shares, Shane James Williams owns 0.21% with 0.12 million shares, Jasvir Kaloti owns 0.11% with 0.06 million shares, John B. Heslop owns 0.09% with 0.05 million shares, and Susan Marie Neale owns 0.05% with 0.03 million.

Accilent Capital Management Inc. owns 14.01% with 7.91 million shares, 1291308 B.C. LTD owns 13.36% with 7.54 million shares, Sestini & Co. Pension Trustees Ltd owns 2.56% with 1.45 million shares, and Modern Farmer Media Inc. owns 1.17% with 0.66 million shares.

There are 56.45 million shares outstanding, with 45.79 million free float shares, and the company has a market cap of CA$26.9 million. It trades in the 52-week range between CA$0.31 and CA$0.93.

Lion One Metals Ltd.

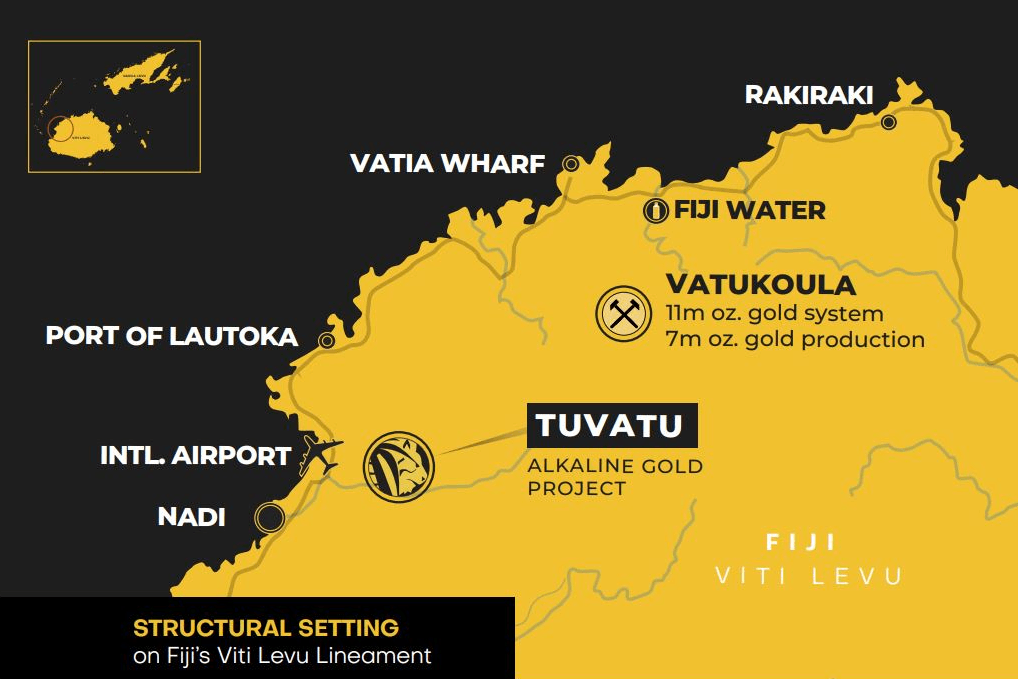

Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX) recently began mining high-grade gold mineralized material on the Tuvatu deposit in Fiji.

According to Mike Niehuser with Roth research, the first lode was found unexpectedly near the portal of main decline, and the second found higher-than-anticipated grades.

Niehuser commented," Experience exceeding expectations is consistent with our view that the Tuvatu deposit has the potential to surpass the long-lived Vatukoula mine in Fiji." He also noted that construction is already ongoing, with a December 23 due date for processing material.

"Early experience in mine development suggests bespoke underground mining approach," Niehuser continued. "In our opinion, this suggests that a one-size-fits-all approach to efficiently produce low-cost results may miss gold mineralization that may be mined through a more nuanced method."

The company's ability to work during Fiji's wet winter season was noted as an encouraging sign. The company has eliminated potential delays by transporting all of the essential bulk materials to the site and developing various infrastructure components.

The company also released several sets of assay results from its drilling in April, further defining Tuvatu as a minable resource. Some of the highlights of the assay results are as follows:

- TGC-0034 – 88.07 grams per tonne (g/t) gold over 5.7m (including 1,396 g/t gold over 0.3m)

- TUG-056 – 27.52 g/t gold over 5.55m

- TGC-0003 – 20.93 g/t gold over 7.2m

And from May 18:

- 2 g/t gold over 0.56 m

- 48 g/t gold over 0.19 m

- 99 g/t gold over 0.19 m

- 68 g/t gold (grab sample)

According to Niehuser, " In our opinion, as Tuvatu in the Navilawa Caldera has been identified as an alkaline gold system, it has the potential to grow into a multi-million oz gold resource."

Technical Analyst Clive Maund is also optimistic about the stock. In a June 14 update he wrote, "In any event, the selloff looks overdone, especially as the company is set to pour its first gold later this year, so this looks a good point to buy, especially as the Accumulation line has been creeping higher in recent days and momentum recovering. If it does break to the upside after the recent tight standoff, it is likely to be with a large white candle."

About 14% of the company is held by insiders, about 6% by institutions, about 20% by other investors, and about 60% is retail.

The CEO, Berukoff, owns about 11.8% or 20.9 million shares, according to Reuters. Franklin Advisers Inc. owns 4.27% or 7.56 million shares.

The company has a market cap of CA$142.31 million, and trades in the 52-week range between CA$0.59 and CA$1.66. Niehuser noted Lion One currently has 206.25 million shares outstanding, CA$36.8 million in cash, and CA$25.3 million in debt.

Emerita Resources Corp.

Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS;LLJA:FSE) released the assay results from its drilling on the La Romanara deposit in the Iberian Belt West project. These assay results also had implications for the MRE the company was set to release.

According to Joaquin Merina, "These holes are being incorporated into the block model for the forthcoming MRE . . . Assay data for the remaining few drill holes is being incorporated as they are received."

Some of the highlights of the assay results were as follows:

- Drill Hole LR096's upper lens intersected 0.3% Cu over 5.4m at a depth of 512.6m, along with 1.5% Pb, 3.0% Zn, 1.24 g/t Au, and 80.6 g/t Ag. The lower lens intersected 0.2% Cu, 2.0% Pb, 3.4% Zn, 2.28 g/t Au, and 225.0 g/t Ag over 4.5m at a depth of 518.0m.

- Drill Hole LR142's upper lens intersected 0.3% Cu, 1.6% Pb, 1.5% Zn, 2.61 g/t Au, and 193.5 g/t Ag over 30.5m at a depth of 517.2m, including 0.5% Cu, 3.6% Pb, 0.4% Zn, 7.54 g/t Au, and 675.7 g/t Ag over 5.40m. The lower lens intersected 0.2% Cu, 3.1% Pb, 9.4% Zn, 1.79 g/t Au, and 141.8 g/t Ag over 7.45m at a depth of 518.6m.

- Drill Hole LR144's upper lens intersected 0.4% Cu, 4.1% Pb, 8.0% Zn, 2.96 g/t Au, and 149.5 g/t Ag over 1.6m at a depth of 91.4m. The lower lens intersected 0.2% Cu, 2.9% Pb, 1.0% Zn, 2.34 g/t Au, and 119.8 g/t Ag over 97.3m.

Management plans to advance the Iberian Belt West with a PFS by the end of 2023. Additionally, environmental baseline studies began in April of 2022, and Emerita planned to submit an application for an exploitation permit in Q2 of 2023. An alteration zone was discovered between El Cura and La Infanta, indicating mineralization in places that had not been previously considered.

In light of these results, Sadif Investment Analytics gave Emerita an Above Average rating, saying, "Emerita Resources Corp's relatively attractive valuation is due to high price attractiveness and positive market multiples."

Management and insiders own 15.17% of Emerita, while institutions own 16.85%.

The company has a market cap of CA$166 million, with 207.32 million shares, 8.8 million warrants, and 18.85 options. The company trades in the 52-week period between CA$0.56 and CA$1.88.

Outcrop Silver & Gold Corp.

Last but not least, Outcrop Silver & Gold Corp. (OCG:TSX.V; OCGSF:OTCQX; MRG1:DB) also made our Best of May list for its encouraging look at its Santa Ana project.

The company released a maiden resource estimate for its flagship Santa Ana silver-gold project in Colombia, which meets other projects in terms of grade and project upside, according to Stuart McDougall.

Santa Ana has a total resource of 27,000,000 ounces of silver and 140,000 ounces of gold, according to an estimate prepared by AMC Consultants. This resource includes seven veins of mineralization. Indicated resources amount to 1,230,000 tons of 446g/t Ag and 1.64g/t Au.McDougal has stated that he believes that Santa Ana is undervalued. The 530g/t high grade of Santa Ana's resource compares well to that of similar silver projects. However, despite the equivalent grade, Outcrop is trading at a 40% discount when compared to its peers.

The Santa Ana resource estimate also reveals significant potential for expansion. Each of the seven veins remains open at depth and along strike, and the project contains additional veins that have been identified but are untested. However, these veins bear similar geological characteristics to the veins included in the estimate. Outcrop intends to drill test some of these new targets later in the year.

These factors lead McDougall to believe that this company offers investors a significant potential return. Outcrop's share at the time of the article, CA$0.28, could increase to CA$0.75 per shares, an increase of 173%. McDougall rated Outcrop as a Speculative Buy for investors.

Initial indicated resources are estimated at 1.2 million tons grading 614g/t silver equivalent, containing 24.1 million ounces of Ag eq. Initial inferred resources are estimated at 966,000 tons grading 435g/t eq., containing 13.5 Moz Ag eq.

The report classified 64% of the resource as indicated, compared to 54% for Dolly Varden and 45% for Vizsla. The Outcrop MRE also had an M&I EV/ounce Ag of US$2.23 compared to US$5.35 median for its peers. According to the data, OCG's resource has the third largest number of ounces among its explorer peers with 37.6 million silver equivalent ounces after Vizsla with 201.8 million SEO and Dolly Varden with 90.9 million SEO.

The MRE further supported McDougal's claim that the Santa Ana project could have the potential to increase in value.

Mining financier Eric Sprott owns about 14% of Outcrop. Management and directors own about 12%, and the rest is held by high-net-worth investors and retail, the company said.

Major inside shareholders include Executive Chairman of the Board Ian Slater, with about 10.1% or 20 million shares, and Chief Executive Officer Joseph Hebert, with 0.95% or 1.88 million shares, according to Reuters.

Outcrop has a market cap of CA$70.11 million with 197.6 million shares outstanding and 148.5 million free-floating. It trades in a 52-week range of CA$0.43 and CA$0.10.

All in all, May had a number of great gold releases, and we at Streetwise cannot wait to see what the rest of June has in store.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Lion One Metals Ltd., Emerita Resources Corp., and Outcrop Silver & Gold Corp.are billboard sponsor(s) of Streetwise Reports and have paid SWR a sponsorship fee between US$3,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Ltd., Outcrop Silver & Gold Corp.,

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.