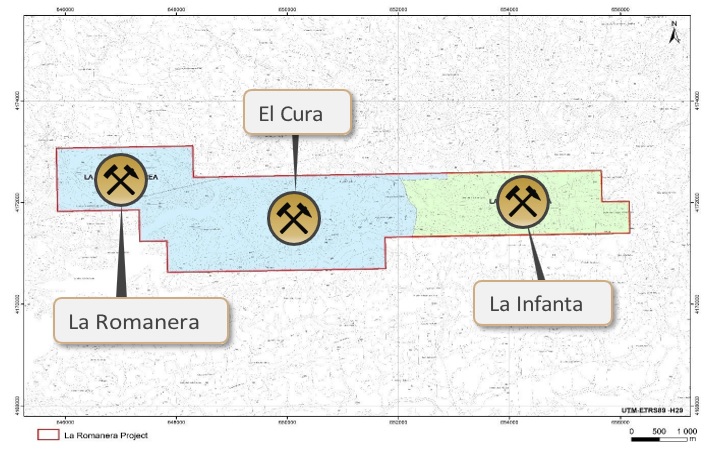

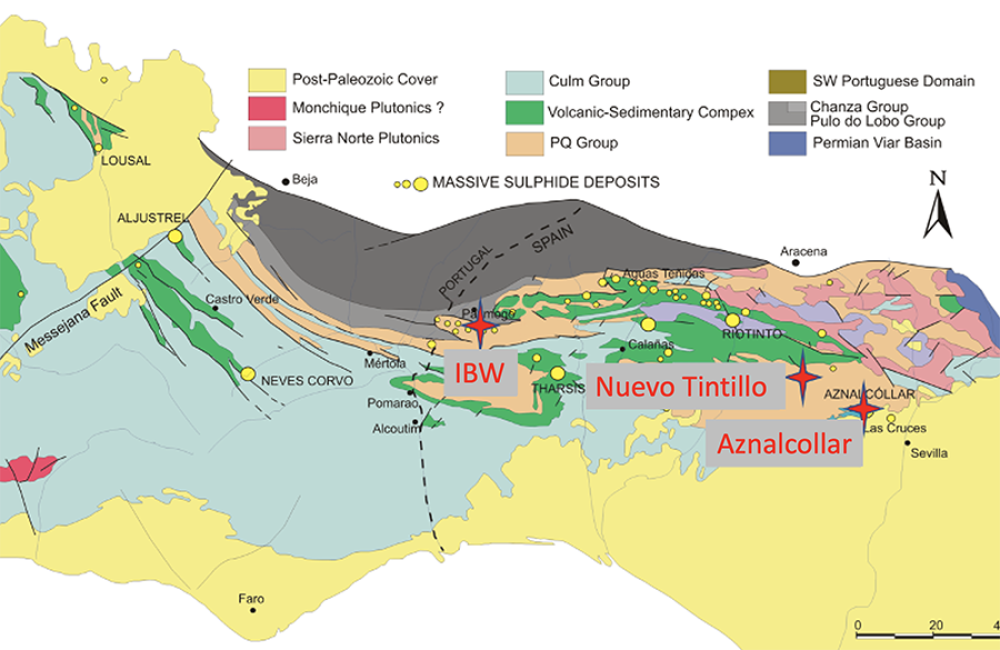

Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS; LLJ:FSE) released news Friday morning, September 30, 2022, from this year's drilling at its fully-permitted La Romanera deposit at its 100%-owned Iberian Belt West project (IBW).

Emerita had intersected 14.0m grading 4.3% Cu included within 26.8m grading 2.6% Cu at its La Romanera deposit. This increases the number of drills at IBW project to 13.

Emerita is a Canadian natural mining and exploration company based in Toronto. It is focused on the acquisition, exploration, research, and development of prospective mining properties in the Iberian Pyrite Belt in Spain.

It centers around traditional base metals (zinc and copper) and precious metals (silver and gold).

According to the company, Emerita has planned a 70,000-meter (70,000m) drill program to be completed by year-end at the La Romanera deposit, designed to expand the resource.

On September 12, 2022, we covered Holes LR009, LR013, and LR015 drilled at its Romanera project.

At that time, Research Capital Corp. analyst Adam Schatzker said he continued "to be impressed by the drill results at Romanera."

Research Capital Corp. analyst Adam Schatzker said he continued "to be impressed by the drill results at Romanera."

To Schatzker, "it certainly [appeared] that Romanera could prove to be a significant precious metals deposit."

During that report, Schatzker gave Emerita a Speculative Buy rating and a target price of CA$3.75. That is around a 331% increase from the current stock price of around CA$0.87.

The Catalyst

Friday, Emerita announced assay results from two drill holes (LR019 and LR023) at the La Romanera deposit. It had intersected 14.0m grading 4.3% copper (Cu) included within 26.8m grading 2.6% Cu at its La Romanera deposit.

Arora continued by saying, "We believe EMO’s Romanera is a mine in the making."

This increases the number of drills at the IBW project to 13.

Emerita has 12 holes still in the lab and 12 with drilling in progress at La Romanera.

On Monday, October 3, 2022, Varun Arora, MBA of Clarus Securities, noted new results of 26.8m of 10.26% ZnEq (with 2.6% Cu), incl. 14m at 16.4% ZnEq (with 4.3% Cu). Arora said, "We estimate a weighted average grade of 12.4% ZnEq over 14m based on the drill results to date."

Arora continued by saying, "Given the significant upside potential from the uptick in precious metals grades and the expansion of the resource footprint, we believe EMO’s Romanera is a mine in the making."

In light of these results, Arora gave Emerita a Speculative Buy rating with a CA$5.00 target price, a 33.33% increase from Schatzker's target price on September 12th.

Ownership and Share Structure

2.30% of Emerita Resources is held by insiders, management, and strategic shareholders, the most significant of which is 2176423 Ontario Ltd., which owns 10.02% or 35.37 million shares, according to Reuters.

As for the company, President Joaquin Merino, P.Geo. owns 0.99% or 2.03 million shares. CEO David Gower owns 1.21% or 2.46 million shares. Chairman Lawrence Guy owns 1.24% or 2.52 million shares. Director Marilia Bento owns 0.49% or 1 million shares, and Director Catherine Stretch owns 0.73% or 1.50 million shares.

The company's shares also trade in the U.S. on the OTCQB under the symbol EMOTF and under the designation LLJ on the Frankford Stock Exchange in Germany.

Emerita has 203.96 million shares outstanding, including 172.71 million free floating. Its market cap is CA$177.52 million, and it trades in the 52-week range between CA$0.74 and CA$4.14. It is currently trading at CA$0.87.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Katherine DeGilio wrote this article for Streetwise Reports LLC. She or members of her household own securities of the following companies mentioned in the article: None. She and members of her household are paid by the following companies mentioned in this article: None. company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Emerita Resources Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.