Joining us for a conversation is Ari Sussman of Collective Mining Ltd. (CNL:TSXV), Colombia's newest exploration company.

Maurice: Before we deep dive into company specifics, Mr. Sussman, please introduce us to Collective Mining and the exciting opportunity the company presents to shareholders.

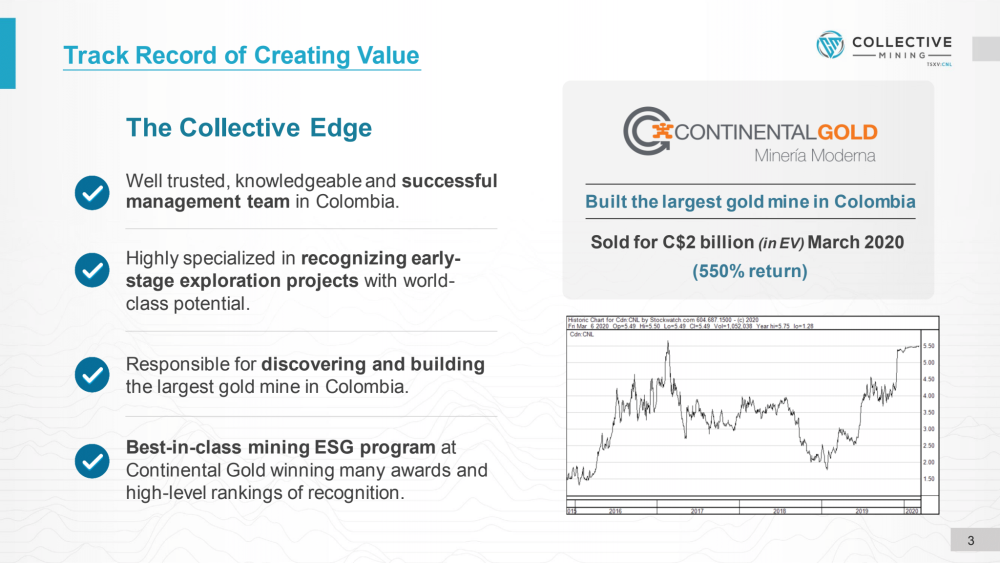

Ari Sussman: Collective Mining was born as a result of the COVID lockdowns, so just some background, my previous company was named Continental Gold, which was responsible for discovering and constructing the largest and most modern gold mine in Colombia, which was sold one week before the global lockdowns to a large Chinese mining company named Zijin Mining in March 2020, for a total sum of approximately $2 billion.

Within a month, my core team and I were bored at home like we all were, and said, "Let's get back to the drawing board."

And that is how Collective Mining was born.

Just some background on Collective, the name Collective Mining represents our business model. It's a collective mining model, meaning, yes, we're going to build, we hope to make a big discovery, and we're hopefully going to build a mine and, or, sell the company and then reward our shareholders for being involved. But it's also going to reward the local stakeholders involved in this project. We want to ensure that people living in the area of influence of the project, benefit, learn and grow with us. As we advance, they advance.

Maurice: Well, quite the pedigree of success here. Let's find out more. Mr. Sussman, take us to the mining-friendly department of Caldas and Colombia, and please acquaint us with the region, potential mineral endowment, and the mining jurisdiction.

Ari Sussman: Let's start with Colombia and then work our way inwards.

Colombia is a mining jurisdiction, for a country in South America that has the infrastructure in place, and there is no more prospective mining environment to be in. This is the Andes Mountain chain continuation, which starts in Chile and works its way northward, and goes right through Colombia. In theory, all of the large-scale types of discoveries will be made in Colombia that countries like Peru and Chile currently enjoy.

With that said, I don't want readers to think that Colombia is an early stage country for mining because, it is in terms of discoveries in commodities that we care about (copper, gold, silver, et cetera), but it's quite mature in the mining of coal.

Colombia is one of the world's top largest coal producers and most of those mines have been in production for 50 years or more. So as a result, it's a mature destination for companies to go and make discoveries in.

What I mean by mature destination, is there's a very strong mining code in place. Royalty rates have been stable for decades on end. There is a mining association, well established in place that represents the mining industry and will lobby the government on behalf of the industry. These are things that we expect to see in countries like the United States where I am, or Canada, but this is also in Colombia. From that perspective, it's stable and it's great.

Zooming in a little bit, we are in the department, which you mentioned, named Caldas. I don't think most people have heard of Caldas. Colombia refers to states as departments, by comparison. But if any of your listeners are coffee experts or coffee aficionados, they will have heard of Caldas because it's reputed to have the best coffee beans in the world. I, for one, am not the foremost coffee expert. I enjoy the coffee, Maurice, I do, but I don't have a real comparison, but this is what it's known for.

What makes Caldas so special, are two things. One is the coffee, and it's got a large, big industrialized business in Caldas. This entire department is made up of more mom-and-pop-style coffee farms, very specialized and high end and each coffee farm competes with its neighbor to produce a better bean and that leads to excellent quality.

But secondly, there is a mine which is currently operating in Caldas, which happens to be next door to our main property, named Marmato. Why I'm mentioning this now is, that Marmato has helped to create a very mining-friendly environment in Caldas. The reason for that is that Marmato has been producing gold and silver continuously for more than 500 years, believe it or not, and is still producing today. Virtually every person that lives in the department of Caldas has or had, mining in their blood in one way, shape, or form. As a result, there's a very strong comfort level with mining in this state and it's an excellent place to be.

Maurice: Collective Mining currently has two projects with district-scale potential. It has identified 11 highly prospective targets in the Cauca belt. Let's get acquainted with your flagship Guayabales project. Briefly walk us through the genetic and expiration model and share with us what has your team excited.

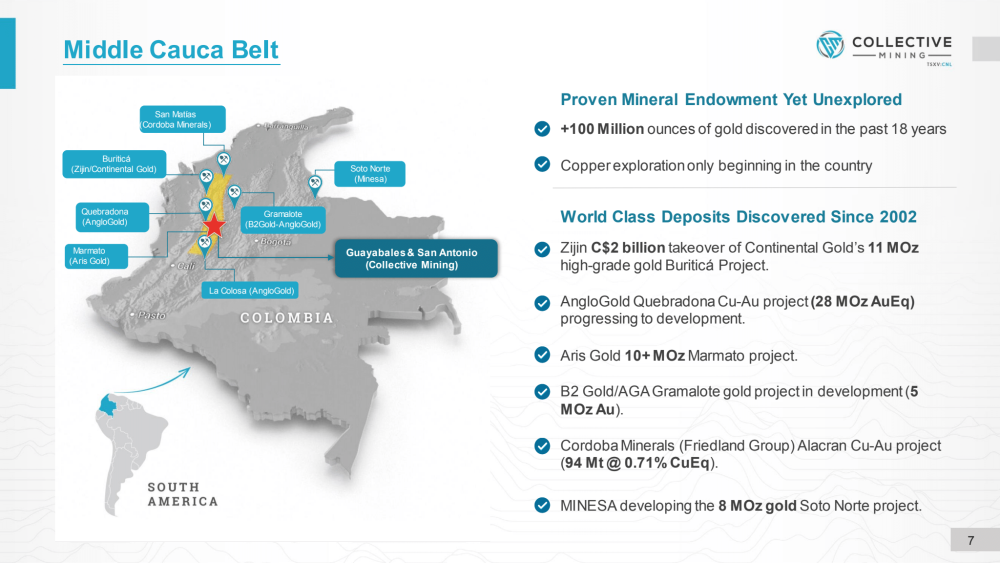

Ari Sussman: We are operating in the Cauca Belt. This is a well-known metal belt of Colombia, which runs along the Andes mountain chain. Just to understand how prospective it is. First off, let me back up. Colombia was not a mining destination due to security concerns in the 1980s and 90s, as everyone knows. Those were the horrible times for Colombia that have now resulted in many shows, like Narcos, et cetera, being made as a result of what happened in those times. But, the country turned around with the election of the former president Álvero Uribe in 2002. Now we've had 20 years of Colombia being open and prospective.

The Middle Cauca belt prospectivity. There has been somewhere in the neighborhood of three million meters of diamond drilling done since 2002, in this belt. That has resulted in the discovery of more than 100 million ounces of gold. Let me caveat that by saying that a lot of that gold is never going to come out of the ground. It's not all economic gold, but if you look at the prospectivity, for example, in my former company, Continental Gold, we discovered and drilled off 11 million ounces of high-grade gold at around 8 grams per ton and that deposit was open to grow further.

It would be when we got taken out by Zijin, just starting to pour gold from finishing construction. AngloGold alone has drilled off more than 40 million ounces of gold over a series of projects, for an approximately 20-year period. Then there are many others. So prospectivity is remarkable and being in the Cauca belt is fantastic.

Zooming in, I mentioned this project named Marmato, which we do not own, that is in another company. Marmato is an approximate 8 million ounce resource with less than 8 million ounces of reserves, that is pushing toward production, as we speak. What we recognized that one of the best places to find a mine, is next to a mine?

Marmato is a porphyry-related vein system. I want readers to think of Chile because Chile is the world's largest copper producer and the bulk of that copper production comes from porphyry deposits.

Porphyries are intrusions in the earth where individual fingers of porphyry rock come up, the pulse pushes them up and then you get these complexes, they are typically about, let's say, up to four miles by four miles in circumference within which, you will have fingers of porphyries which can be very large, in the billions of tonnes. Then you have breccia’s related to the porphyry and you have vein systems related to the porphyries. A key feature of the porphyries, breccia related to porphyries, and vein systems related to porphyries, is the dimensions of these deposits can get very large.

I mentioned billions of tonnes for porphyries, vein systems, my former project Buriticá at Continental Gold contained 11 million ounces. It has been drilled off over about 2 kilometers, or call it almost 1.5 miles vertically. That is enormous, and whatever you end up having in vertical, you end up having in lateral dimensions about mile-long vein systems along with huge vertical dimensions.

Breccia’s, porphyry-related breccias are also huge. I'm sure readers are familiar with Filo Mining in Argentina, which has been a huge success. They have a porphyry deposit, but what is driving their value is a porphyry-related breccia which sits in the middle of their porphyry and that's where those unbelievable grades we've seen of copper-gold and silver are coming out of this breccia.

Why is that relevant to Collective Mining? We recognize that Marmato is on the fringe of one of those four by four-mile circumference areas that have porphyry intrusion centers and they are our neighbor. We have come in with complete grassroots exploration, and I want to highlight that there are very few companies today doing grassroots exploration. Most companies are retreading old projects with new interpretations that have had lots of drilling and lots of work done. This is true grassroots exploration.

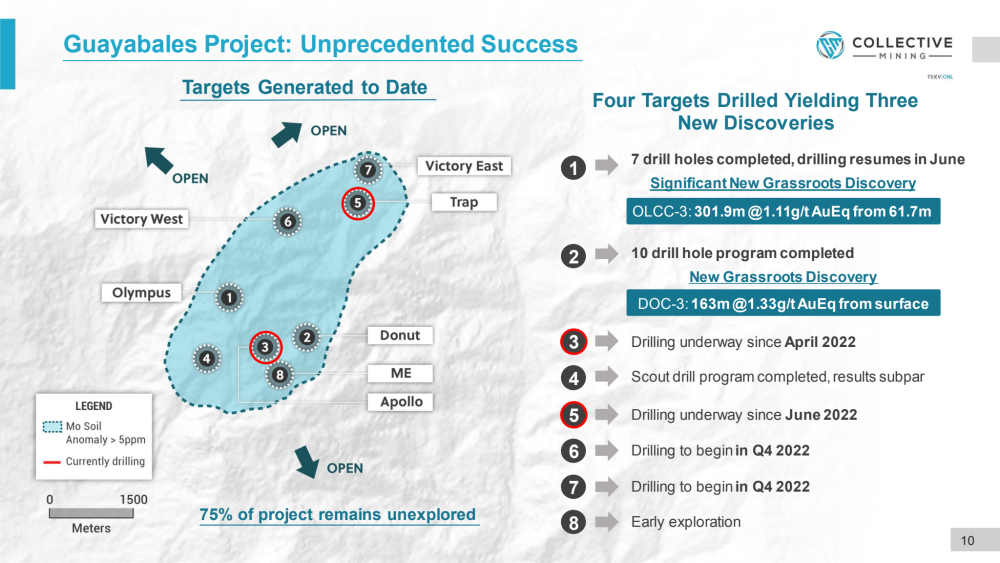

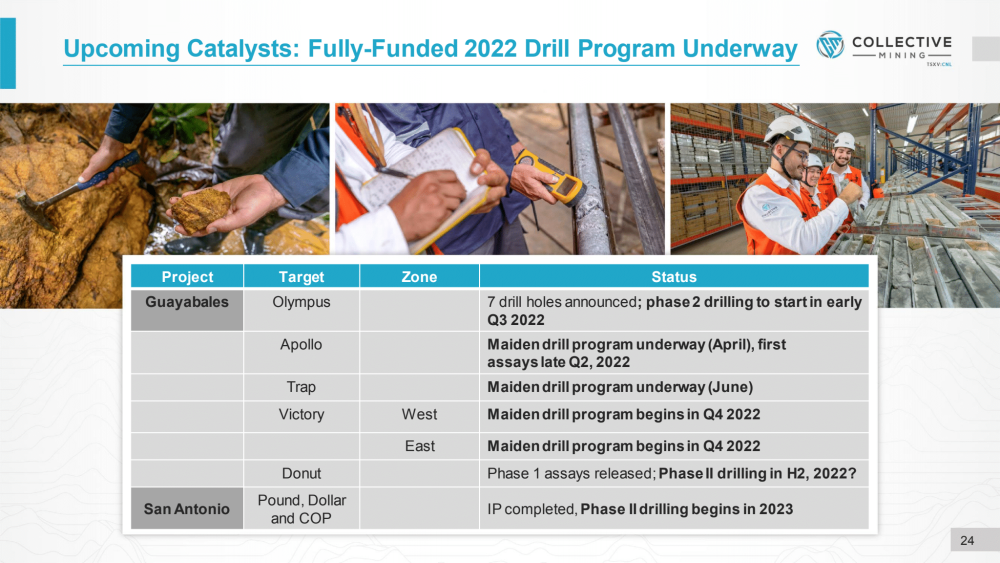

Collective Mining has generated 11 targets on two projects. Our flagship is called Guayabales. That is the one that is contiguous to the historic and current large resource the aforementioned Marmoto. And then we have another one called San Antonio. Although it's a second project, it's only about a mile away as the crow flies from the edge Guayabales to the concession edge of San Antonio. So, it's part of the same geological complex. And what we have identified in those 11 targets are either porphyry targets for drilling, porphyry-related breccia targets, or porphyry-related vein systems for drilling. I mentioned grassroots, so we've brought all of those targets except for two of them up to the drill, ready status as we speak.

Our flagship Guayabales Project has generated eight targets. I'm going to say something that I don't say lightly, but this is the best exploration project that I have ever seen or been involved with (period).

And I said that when my technical team identified it, and I iterate it much stronger today because I'm able to back that up with initial drilling success. Today at Guayabales, we have drilled or are currently drilling five of those eight targets.

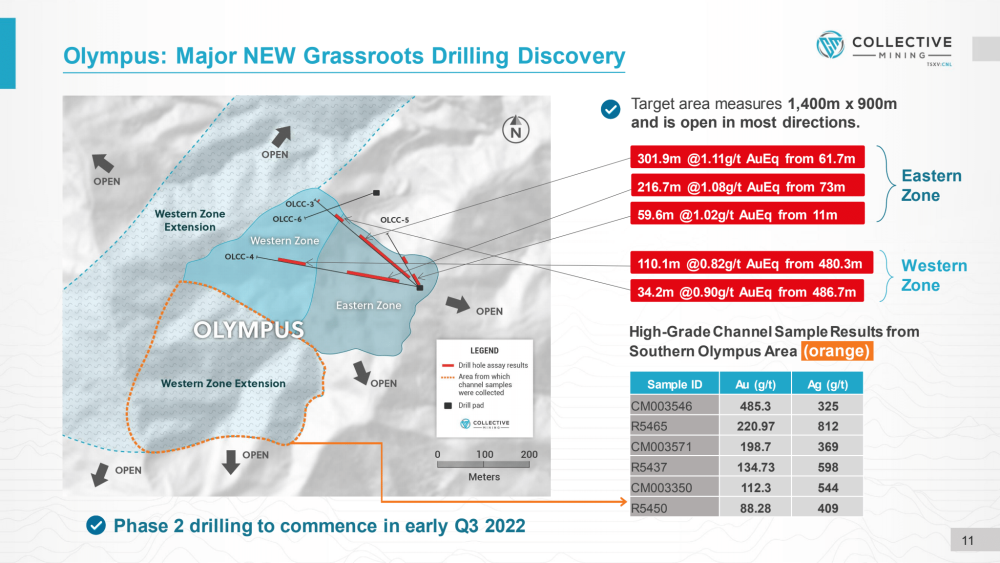

Our Olympus Target may be on the cusp of a significant discovery, which is a vein system over-printing breccia, porphyry-related. And as a result, we've drilled big bulk intercepts, including the discovery hole of 302 meters at 1.1 grams per ton, gold equivalent, starting just below surface. We will find out it's open-pitable as we do more work in the future and prove that up.

We think that Olympus has the earmarks of a multimillion-ounce gold and silver system. Looks similar to Marmato next door and similar to my previous project, Buriticá, which I previously mentioned, we drilled off 11 million total ounces.

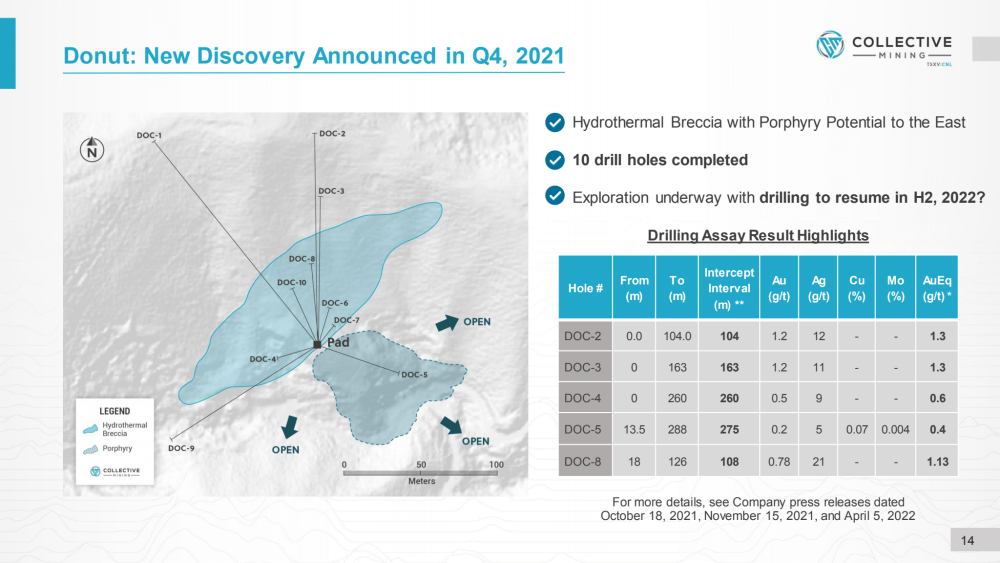

The second target with assays is called Donut. Donut is a porphyry-related breccia. I don't think this one is going to be huge. It doesn't have the potential of Olympus, but it's still significant. It starts right at surface and we have amazing intercepts in it, including up to 163 meters at 1.3 grams per ton, gold equivalent, beginning right at surface.

Why do I say modest? I don't think this one has multimillion-ounce potential. But if it does turn into a mine, with further work, I think it'll be a satellite operation that can feed a much larger complex for processing and it'll be nice to have because it will add incremental ounces onto the total deposit.

The third target that we drilled was called the Box. I say 'was' because that one didn't work for us. We drilled it, we published results, it doesn't have large-scale potential like we're looking for and therefore, we’ve concluded that Box is out.

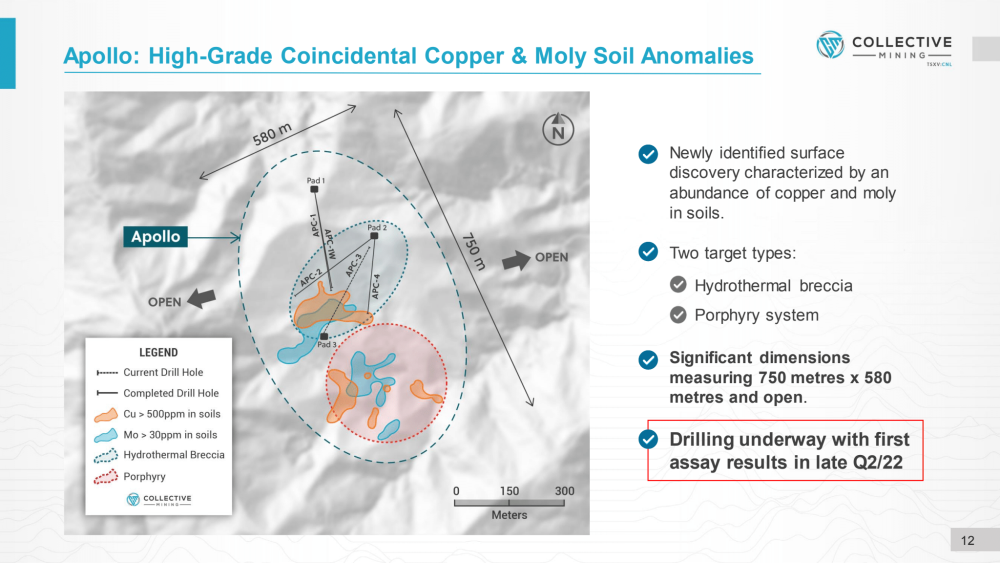

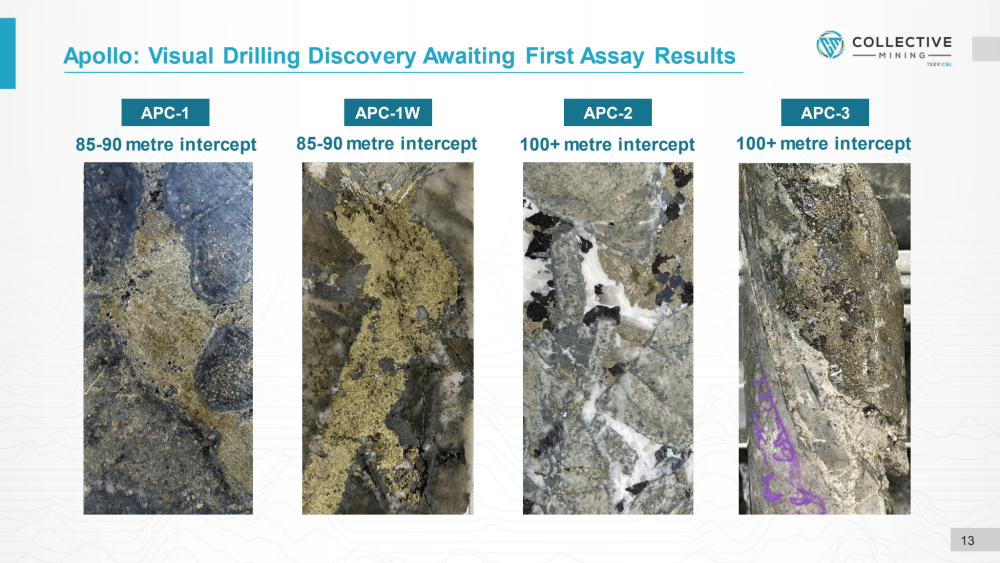

Our fourth target, the Apollo, we are currently drilling and to say we're over the moon on it is an understatement.

Now, I'm going to put a big caveat out there for readers. We do not have assay results for it yet. We are expecting the initial first assay results for the first drill into it in the next two to four weeks. That is a caveat. I want everyone to know that at the end of the day, the only truth in mining is the assay results. We can like what we see visually, but we need to prove it with the assay results.

With that said, we're pretty good at identifying rocks and what we see at Apollo, visually, is a porphyry-related breccia. It has an abundance of chalcopyrite and pyrite in the breccia matrix. For those that don't know what chalcopyrite is, that is a mineral that contains copper in it, so there's going to be a copper component to this one.

And then we expect there to be gold related to both the chalcopyrite and the pyrite, as well as silver. But, what makes us excited about it is, that the breccia that is mineralized and then over-printing the breccia is a porphyry-related vein system.

How do we know this? We see the pathfinder minerals of porphyry-related veins.

It’s important to note, that porphyry-related veins are known for being gold and silver-rich, which they typically are, but they also have byproducts of lead-zinc and to some extent, copper. So, what we see in the minerals that bring lead-zinc into the matrix are sphalerite for zinc and galena for lead.

These are very easy to identify, sphalerite is typically a brownish color and galena is a grayish color, and you get blobs of them. Why we know it's over-printed is, instead of being veins that are typically narrow anywhere in the world, when they get into the breccia, the metal blows out from the veins and fills up the matrix of the breccia.

Think of it like this, when you've tried to complete a puzzle, there's a lot of porosity or space between the individual pieces of the puzzle when they're put together. Metal fluids will come into a breccia structure that looks similar to that, and it will fill up those spaces. Because it's porous, the metal will spread out into those spaces. What's happened with the veins is they've come into the breccia and there's been room for the metal to spread. These have spread out into the breccia matrix, which suggests that we may have two overlapping systems.

Why I think this is significant, with the caveat that we don't have assays, is, in my experience, that big deposits in the world are very rarely found when there's only one style of mineralization dumping metal into the system. You typically need to see two or more styles. And here we have two very distinct styles.

So, stay tuned on Apollo, quite excited for the results. Then the first hole will be out soon. And, I should add that we are drilling thick visual intercepts at Apollo. This is not one or two meters we're drilling intercepts of the three holes that are completed so far, visually, between 85 meters and over 200 meters. We're hoping for long, big intercepts, and with some luck, with the assay, if mother nature is generous to us, we'll have some decent grade in that breccia.

Maurice: Well, speaking of visually, that was a good analogy there. Can you conclude by taking us north for a victory lap and talk to us about the Victory Targets? What are you exploring there?

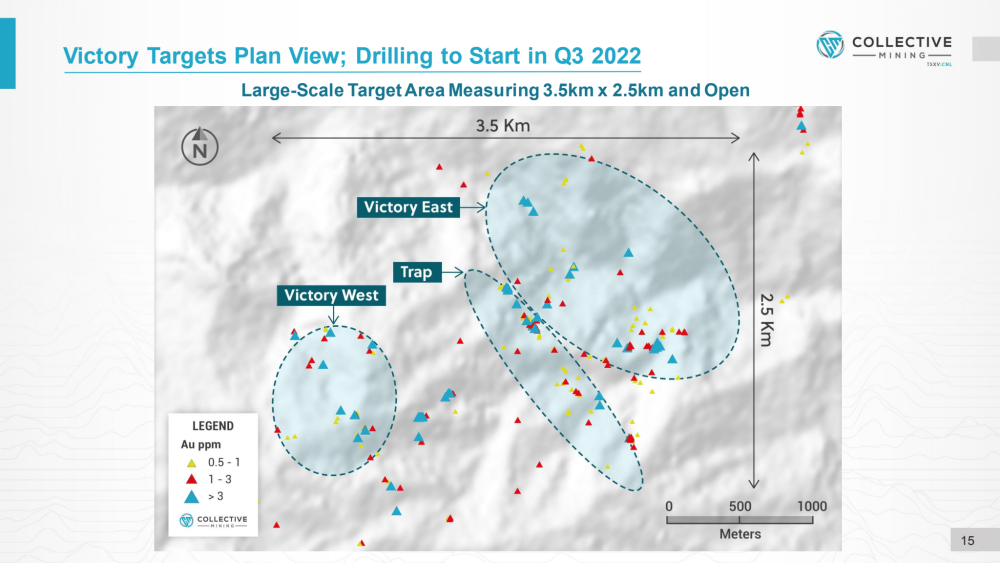

Ari Sussman: The Victory is the Northern complex of targets located in copper-gold country. We have identified a series of intrusions that are outcropping at surface, particularly at the Victory East Target. That is the one that excites us the most in the victory complex.

Victory has a Victory East, a Victory West, and something called Trap, which is in the middle. Trap is called Trap because it's trapped porphyry-related veins within a structurally controlled corridor. Victory West, I won't spend any time on it. It's a blind target that has interesting geophysics, there may be a porphyry below.

Regarding Victory East, we have identified multiple porphyry intrusion centers that are outcropping and continue to collect and see a significant amount of rocks that are very enriched with magnetite, which in this kind of porphyry setting will contain gold or should contain gold and some silver, as well as chalcopyrite, which is that copper mineral that I mentioned before.

Noteworthy of mention, chalcopyrite is typically about 34% copper. Therefore, when logging a core in a drill hole, indicating there's 2% chalcopyrite, assuming your logging's correct, you can multiply by 0.34 and that should give you an approximation of what your copper content is.

We see a mineral that will contain copper and an element that will contain gold and a little bit of silver, over a very large area. We're working diligently to have Victory East drill-ready for Q4 of this year. I think we have another four hard months of work ahead of us. It's very big and the dimensions of the area, we're in the plus mile range in every direction. Our team is trying to figure out where the end of the system is, to be frank, before we zero in and decide where we're going to drill. That's what we're doing right now.

Maurice: To summarize this, early days. But Collective Mining may be on the cusp of at least two potential tier-one deposits before us.

Ari Sussman: Look, mining is a very difficult business. The professionals that are smarter than me, estimate you have about a one in 1,000 chance of making a discovery that ever becomes a mine. Making a discovery is very rare in a grassroots exploration program, and a huge compliment to the geological acumen of our technical team.

We are optimistic that we have two major discoveries under our belt already at Olympus and Apollo, subject to a lot more work. And they're going to require a lot of proving up. But we're seeing all the right indications of two big systems and Victory is indicating an enormous, grassroots discovered outcropping porphyry complex that we're looking forward to seeing if that offers the kind of potential that Apollo and Olympus have already shown us from initial drilling,

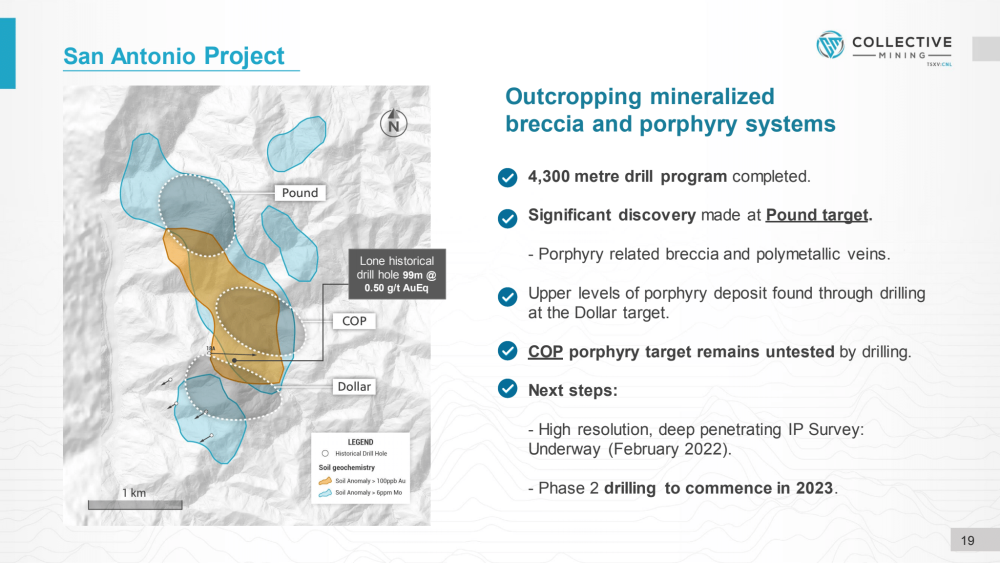

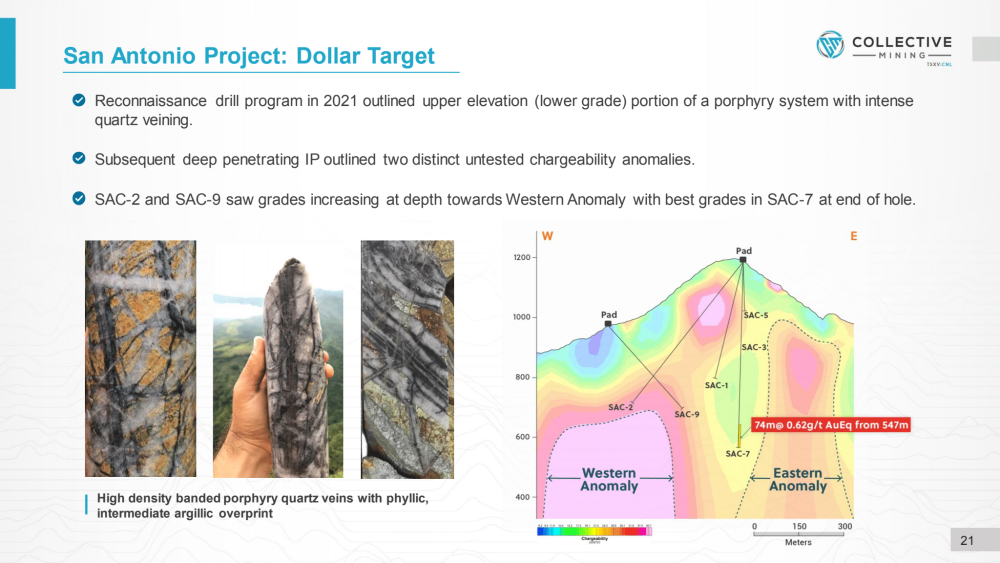

Maurice: Leaving the Guayabales, let's visit Collective Mining's secondary project, the San Antonio, which has over 4,300 meters of drilling completed along with a significant discovery. Sir, please introduce us to the San Antonio, along with the genetic and exploration model.

Ari Sussman: Our San Antonio Project is about a mile as the crow flies from the edge of its concession to Guayabales. It's a peripheral part of this same complex of porphyry intrusions. We got into San Antonio in mid-2020. We did a lot of surface work. We did some additional geophysics and were able to generate three targets.

The northern target is called Pound, the middle target is called COP, and the southern target is called Dollar. We got busy drilling it, it was an easy one to drill. It came with water permits in place, it was ready to go. So, we put a bunch of holes into the Dollar Target and two holes into Pound. We have not drilled COP as we speak.

This was in late 2020 into early 2021, and those that follow the mining space know that there's been a significant problem with assay delays plaguing the industry, resulting from COVID.

I think that was probably the peak of the problem at that point. To date, we have built 4,300 meters of core and had no assays and we were frustrated and shut down the program and said, "Well, we can't drill more until we wait and get assays." It took months and lo and behold, we got assays. I would say the results, we got a mixed bag. The mixed bag is as follows: Dollar, we drilled the most beautiful looking porphyry core you could imagine.

I urge any geologists to look at the photos of Dollar core. It is remarkable. However, we're in the very upper portions of a porphyry system where the metal content is leached, indicating that it needs to be drilled deeper, and that is something we plan to do in 2023 to see if we find the portion that contains the metal.

The surprise for us is known as the Pound Target. At the time that we drilled Pound, I can honestly say that the two holes that we put in were more of a Hail Mary attempt. We had done very little work on Pound.

We had found a porphyry-related breccia with a very small footprint, at the time it surfaced, and said, "Let's put two holes into it and see what happens."

And the discovery you alluded to is as follows. We drilled two long holes, both slightly more than 700 meters in length, and both hit. They hit about a .5 gram gold equivalent in each. That's not a grade that I think you're going to build a mine on in the future, it's too low. But anytime you drill a system that has two intervals with more than 700 meters of mineralization, and I should add, that both of those holes ended in mineralization, then there's a big system somewhere there.

Subsequently went in and conducted some surface work. We have outlined a zone that's over a mile to the north-south by about a half a mile east-west, and open in each direction. And that is worth going back and drilling one or two or three more holes.

The San Antonio is our secondary project, and it doesn't offer the near-surface, exciting grades visually and with assays, that we're seeing at Guayabales, but it offers big scale. So our plan is, let's poke a few more holes into both of these targets. If we get lucky, we're going to be talking again about it in great deal. If we don't, I think the business plan would be to bring in a joint venture partner, which would be a major who's excited about drilling deeper porphyry-style targets. Who's willing to fund long drill holes and let someone spend that money and to earn a majority interest in the project and Collective Mining shareholders will get carried along for the ride and the potential upside.

Maurice: Before we leave the project sites, a multi-layered question. What is the next unanswered question for Collective Mining? When can we expect a response? What determines success? And what can we expect as far as news flow?

Ari Sussman: Anyone that invests in us wants the excitement of a drill hole. That is why you would invest in us. You are going to see a steady flow of drilling assay results beginning later this month, which would be the first hole from Apollo.

Then we will have a series roughly every month between now and year-end coming out of Apollo. Additionally, our phase two drill program at Olympus. We are going to be drilling from underground to test the high-grade center of the Olympus area. Olympus is characterized by having approximately a hundred artisanal miners that are mining very high-grade veins.

We've reported assay results close to 500-gram gold, and well over 1 kilo silver from these veins in channel samples. We want to drill that area because we know there's a large vein system there. We don't know how large, but we're going to prove it out with drilling.

We also think that it could be a bulk tonnage target. The first results from that will start to flow in August or September. So, if you invest in us today, you're going to see heavy news flow and particularly heavy beginning in August, and it will continue through the balance of the year.

Maurice: Leaving the project site, let's discuss some important topics germane to your projects. Do you own your projects 100%?

Ari Sussman: So we have an option to earn 100% undivided interest in both projects by making a series of option payments over a number of years. The payments will culminate in 2031. No private royalties are underlying the property. There are no streams, et cetera. We will be clean and clear for 100% pathway to production. Colombia as a jurisdiction, as far as if you were to build a mine, is favorable from a tax perspective. If you're in the gold business, the royalty rate is 3.2%. That's below the Latin American average, which is in the +5 something percent range, as we speak. And taxes are in the low 30% which is kind of common for any country. We are in a good jurisdiction, favorable potential economics based on success and constructing a mine and we are excited to be there, 100% ownership is the only way to go on these things.

Maurice: Are you fully permitted?

Ari Sussman: Currently, Collective Mining is permitted for exploration. We are not permitted to build a mine. That is something that you will do once you complete a feasibility study and then follow the procedures in Colombia. Keep in mind, that I have permitted in Colombia, it's an excellent jurisdiction to permit. We permitted a gold mine, as I mentioned, and it's not an overbearing process in terms of timeline. It's very detailed in terms of the workload. It is first class in terms of the government's ability to assess permits and evaluate them, but they give you a reasonable timeline. You can permit a project in under one year to construct a mine in Colombia. You compare that to the United States where I think the average now is about 10 years. So much more favorable, but it's a lot of work. But, as far as exploration goes, yes, we are permitted to explore for several years.

Maurice: Is the ultimate goal to build a mine or arbitrage?

Ari Sussman: Having been through this, you need to plan to build a mine. Because, what we can't control, any of us, is the cycle itself. We all know commodities are cyclical. And so there are periods in the cycle where M&A is very active. Then there are periods where it's slow. You must build your company as if you're going to build a mine. But you keep the option open to be taken out. And if someone wants to acquire the cycle's right, you do that.

That is how we're going to proceed. If I have a choice in the matter, and I can determine my future, I don't know if I'd want to build a mine again. I enjoyed the experience, but at its peak, we had about 5,000 people working at our former project Buriticá, between employees and contractors at the peak of construction. It's a lot to manage, so we are willing to do it again? Yes. Would we want to do it again? I think ideally we would like to sell before we commence construction,

Maurice: We've discussed the good, let's address the bad. What can go wrong and what are your action plans to mitigate that wrong?

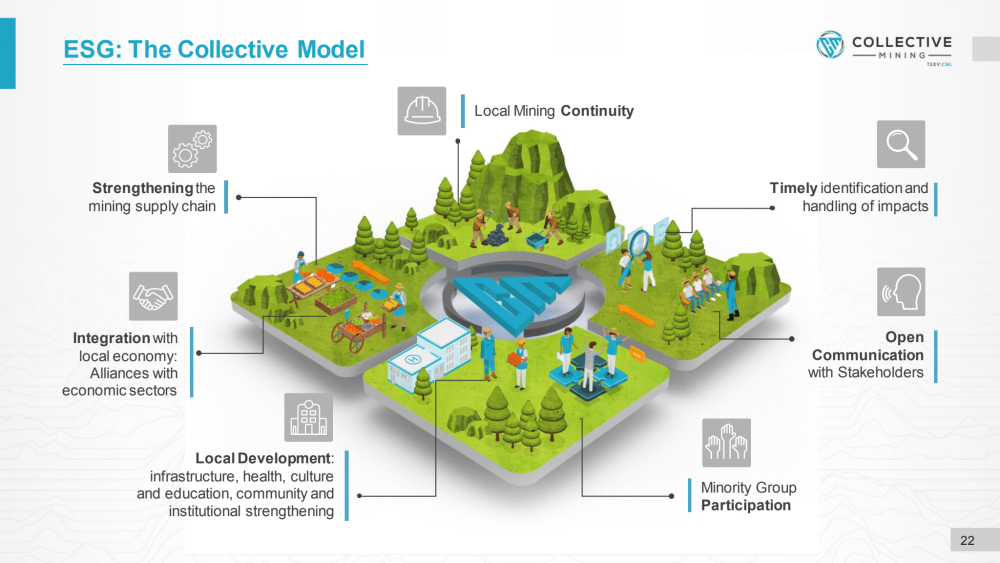

Ari Sussman: Colombia. For good or bad, Colombia is very similar to investing in Peru. We all know Peru is one of the world's largest producers of silver, gold, and copper. But not all projects work in Peru and the reason for that is Peru has a lot of population, similar to Colombia. virtually anywhere that you're going to find a project that you want to explore and hopefully construct a mine on, you're going to be dealing with populations, whether it's villages, towns, or even larger. And what I mean by that, is why it's like Peru is, that we see projects in Peru that succeed and then we see others that fail. The typical failure is based on having opposition from the locals that are in your area of influence on your projects. So, if you do that part well, you should succeed. If you don't, you're going to have problems. And that is critical.

Environment, Social, and Governance (ESG), is a big buzzword that all industries are talking about today. Having been in Colombia for more than a decade, this was critical for us more than 10 years ago when it wasn't as popular a topic because we would not have succeeded if we didn't have a good program.

What does a good program mean in ESG? Everyone throws it around like, "How do we do it?" But what does it mean?

It means many things. One, it's education. People need to understand that mining can be beneficial for their communities and not a detriment.

Two, in Colombia you're dealing in an agriculture-based economy, so it's educating people that Colombia and mining are not competitors. They coexist well and are good for the economy because they're cyclical but at different points in the cycle. So, it's always nice to have one industry that's strong while the other one has a low point in the cycle and struggling, to offset each other. That's very good.

And three, make sure that you strengthen local businesses. I've seen this all over the world, a company comes and says, "Hey, we're going to hire thousands of people locally and that's great. And indirectly, we're going to impact thousands more." And of course, that's great. But if the businesses that aren't going to be solely focused on selling to the mine, don't understand what mining is and how to strengthen their businesses to succeed in that environment, they're going to fail.

Companies must be willing to spend money, help, and time. Helping small businesses evolve and mature so that they can continue to service the area for whatever goods and products they service, plus accommodate the mining company coming in there, because there's a big change coming where there are areas of mining, in terms of the number of people. Populations grow due to the needs of a mine. Those are just some of the elements. ESG is the critical thing to focus on. If we don't do this well, if our sustainability program isn't strong, it doesn't matter how many great drill holes or scales of deposit we find, we will get stopped.

Maurice: One of the virtues of Collective Mining is the pedigree of commercial success of building those relationships your team has a proven track record of, it may not make headwinds by saying that you're permitted and you have the buy-in of the community, but it makes the difference of whether you can proceed or not. That's one of the virtues, again, that Collective Mining brings to the table.

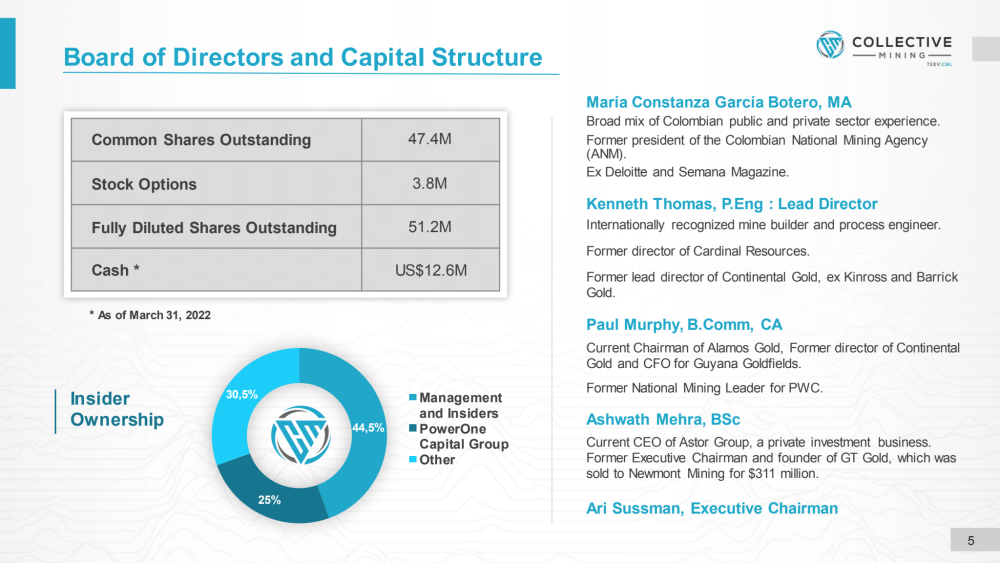

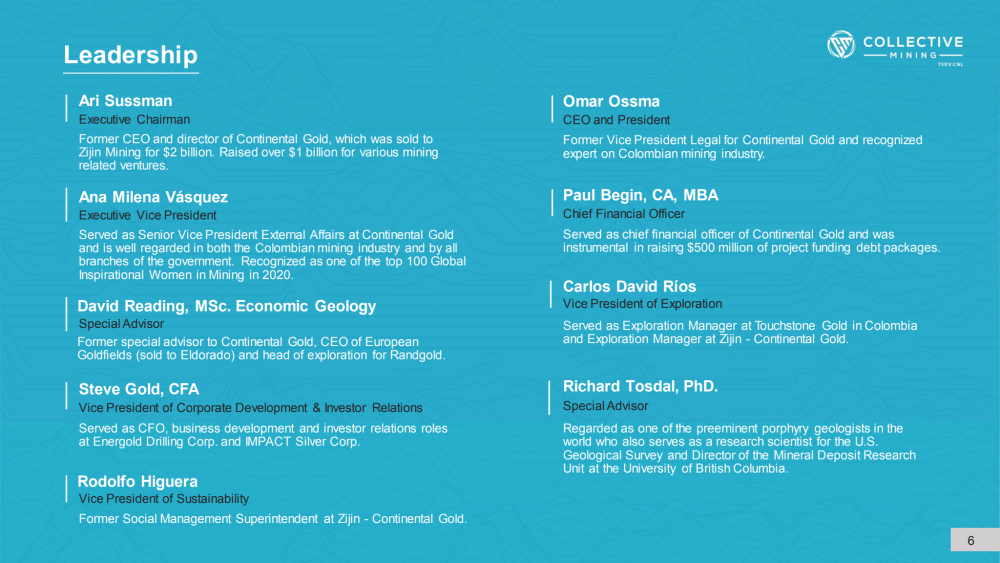

Switching gears, let's discuss the people responsible for increasing shareholder value. Please introduce us to your board of directors, management team, and, technical teams, which bring along a vast amount of intellectual capital and have a track record of creating value.

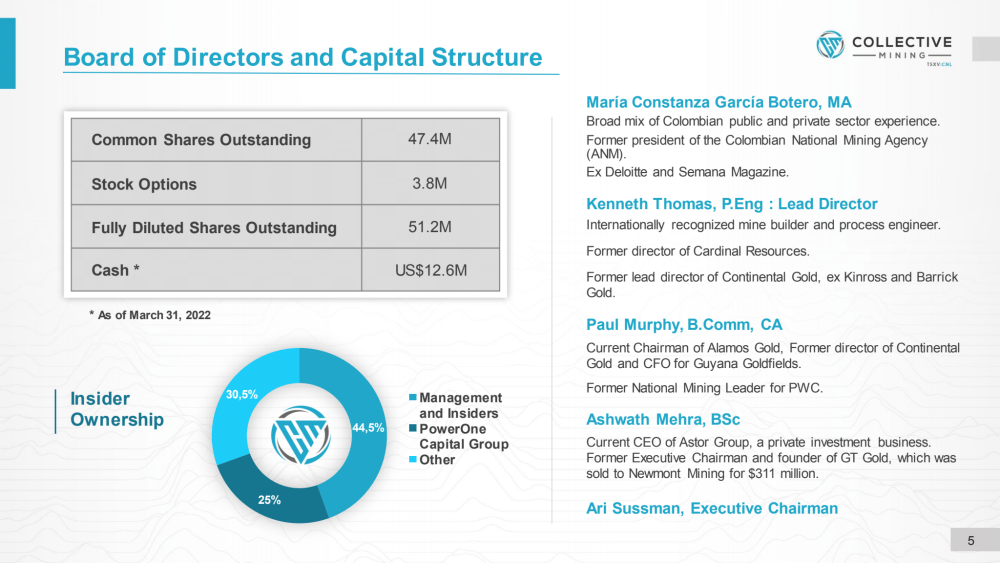

Ari Sussman: Let's start with the Board of Directors. We have one Colombian representative on our Board, an amazing woman named Maria Constanza. She brings something very strong to the table for us. Although she doesn't work in the mining business today, she's been very involved in mining over her career, including being the original president of the A&M, which is the Colombian mining agency that is the division of the government in charge of titling for the country from an exploration standpoint, as well as from an operating standpoint, not environmental permits, but a mining license.

So, we have a deep knowledge of both the private sector and the public sector with her and she's been involved in numerous companies and has lots of experience.

We come out of Colombia, and on our board of directors is an individual named Ken Thomas. Ken, in the mine building business, is extremely well known, has been around a long time, won many awards over his long and illustrious career, including being one of the original engineers of Barrick Gold when it used to be known as American Barrick. He was around when Goldstrike, which is the largest mine in the Americas, in Nevada, was founded and evolved and grew. So, excellent experience.

We have another individual on our board named Paul Murphy. He's also the chairman of Alamos Gold Inc. (AGI:TSX; AGI:NYSE), which I'm sure some of your readers are familiar with. But, importantly, he was the national mining leader of PricewaterhouseCooper for a quarter of a century. Paul’s experience in leading the audit committee team in financing projects, he's an amazing person for that.

And lastly, we have a Swiss national named Ashwath Mehra who is a fantastic guy, and readers probably remember GT Gold, which Newmont purchased for $311 million about two years ago. Ashwath founded that company, brought it forward, and led the sale to Newmont. So, success breeds success, and we're happy to have him involved on our management team.

We have a big management team. Allow me to begin with myself, I'm the executive chairman of the board of directors, meaning I'm involved in management. Omar Ossma is the president and CEO of the company. Omar is a Colombian, accomplished, and very smart lawyer trained and based in Colombia.

One of the things we wanted to do this time around is to make sure that the President and CEO must have boots on the ground on a full-time basis because the challenges that a company will face will be in the host country in which you operate.

We have an executive vice president named Ana Milena Vásquez, who is recognized as one of the top 100 most influential women in mining, by a prominent UK organization in 2020. And more importantly, she is a sustainability expert as well as government relations. So, ESG is synonymous with Ana and she's a very powerful force representing our company.

Paul Begin is our chief financial officer. He was the chief financial officer for almost the entire evolution of Continental Gold, so been there, done that, and helped finance and build our former mine Buriticá.

Lastly, I'll mention two names, two special advisors to the company from a technical perspective. David Reading, David is an internationally recognized economic geologist. Importantly, he was the founding partner of Mark Bristow for Randgold, which is now part of Barrick, to create the largest gold company. And David was instrumental in making multiple multimillion ounce discoveries in West Africa as the team leader of the exploration team of Randgold.

Then lastly, we have another special advisor named Richard Tosdal, better known as Dick. In our view, this is one of the world's top porphyry experts. I mentioned to you that we have a porphyry complex. We always make sure we bring the best technical talent to the geology end of it to ensure we have the best chance of success and having Dick's leadership is paramount. That oversees our Colombian team. We have a strong group of vice presidents.

Carlos Rios is our vice president of exploration. This is a geologist who thinks like a business person and has a resource modeling background, not just a pure explorationist. Rodolfo Higuera is our vice president of sustainability, he is responsible for ensuring that on the ground, where we operate, our relationship with all the area of influence communities is sound and solid, and they're transparently educated on what we're doing and able to speak. We want to remain in good standing with the communities, and this is key to the platform. Transparency is paramount for our success.

Maurice: Well, let's get into some numbers. Mr. Sussman, please provide the capital structure for Collective Mining.

Ari Sussman: Collective Mining has approximately 47 million shares outstanding and slightly more than 50 million fully diluted. No warrants are outstanding from any financings. The difference between the outstanding and fully diluted is simply stock options to employees, which everyone will hold long-term.

We are well-financed, meaning we're fully financed for the calendar year, 2022. And that's financed for a 20,000 to 25,000-meter diamond drill program. We are going to spend $13.5 million this year, and then we will need money to advance the plans for 2023. That's something we will look to do toward the end of the year, is to raise additional capital. And that will be done on the back of what we hope is going to be a significant success from drilling at Olympus and Apollo.

Maurice: And how much debt do you have?

Ari Sussman: We have no debt. So we're very clean. There's no intent to take on any debt for a very long time. The only time I would ever consider debt is if it's part of a financing package to construct an actual mine.

Maurice: What percentage of ownership does management have and who are the major shareholders?

Ari Sussman: Management controls approximately 40% of the 47 million shares that are outstanding. We put our money where our mouth is. Management intends to do well as we have confidence that our share price will appreciate, not by drawing exorbitant salaries out of the company to maintain a lifestyle. In addition to that, we have very strong support from a group named PowerOne Capital, who was intimately involved with me at my predecessor company, as well as today.

They are long-term shareholders and they own about 25%. We don't expect their stock to ever come out into the market and be sold. I can confidently say that the founding partner of PowerOne Capital group invested in Continental Gold previously, held his stock through our sale, to Zijin Mining, and participated in all financing rounds along the way. If you invest with us, you not only have our money where our mouth is, so to speak, because we're very large shareholders of the company, but you will see management and strong supporters participate in subsequent financings that come as we evolve the business and advance.

Maurice: Well, that 40% ownership is very positive. That's not common.

Ari Sussman: I would agree with you that 40% ownership is not common.

Maurice: I'm used to hearing about 10%.

Ari Sussman: Collective Mining is a tightly held stock. This is an ideal and more advantageous position for retail investors at this point, more than the institutions. Junior Mining companies, have to do a series of financings over the next number of years to get from today to a production decision. And so, the stock float will loosen up in time and that's by design because we want to make sure we have a structure that works in the market today and can withstand downturns in the cyclical business we're in, but will also benefit us in the future as we evolve and leave.

The whole point is to get the share price up as high as possible, and hopefully sold, based on the success of the company. And we don't want to ever be in the position where we're in a financing spiral where the market cap grows, but the share price doesn't. Many mining companies seem to fit that bill, unfortunately, we don’t plan to subscribe to that business model.

Maurice: In closing, what keeps you up at night that we don't know about?

Ari Sussman: Well, it keeps me up at night. It's 100% making sure that we maintain the strong sustainability-based program and meaningful relationships with the local communities that we currently enjoy. It's making sure that we apply our collective model properly so that it is collective for everyone. Everybody needs to jointly benefit together in our success, as well as take the risk with the project. If you want the upside, you have to be involved in the risk too.

Maurice: Last question. What did I forget to ask?

Ari Sussman: I just want to remind readers that Collective Mining expects strong news flow with lots of drilling activity. We are a discovery-based company with already significant results under our belt, and I hope everyone either tries to participate by buying shares, or at least watches us continue to put out news, and hopefully, we'll end up convincing the naysayers in a short time with what we have in the ground.

Maurice: And for the record, I am a proud shareholder. Mr. Sussman, for someone who wants to learn more about Collective Mining, please share the website address.

Ari Sussman: www.collectivemining.com

Maurice: Mr. Sussman, it's been a pleasure speaking with you today, wishing you and Collective Mining, the absolute best, sir.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will improve the world.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Maurice Jackson Disclosures:

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site and also to create content by interviewing experts in the sector. Proven and Probable LLC does accept stock options and cash as payment consolidation for sponsorship. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The information presented on Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The information is not intended to be and does not constitute financial investment or trading advice, or any other advice. You should not make any financial investment or trading decision based on any of the information presented without first undertaking independent due diligence and consultation with a professional broker or competent financial advisor.

All Rights Reserved.

Images provided by the author.

Disclosures:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Collective Mining Ltd. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Collective Mining Ltd. is a sponsor of Proven and Probable. Proven and Probable disclosures are listed above.

) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.