Although the stock markets are under increasing pressure by sky-high inflation, commodity shortages, decreasing economic demand, and a desperate Federal Reserve that is looking to raise interest rates at record speeds, Aztec Minerals Corp. (AZT:TSX.V; AZZTF:OTCQB) keeps drilling diligently at its majority owned Cervantes gold project in Sonora state, Mexico. Cervantes is a 65-35% joint venture with Kootenay Silver Inc. [KTN:TSX.V], with Aztec as operator.

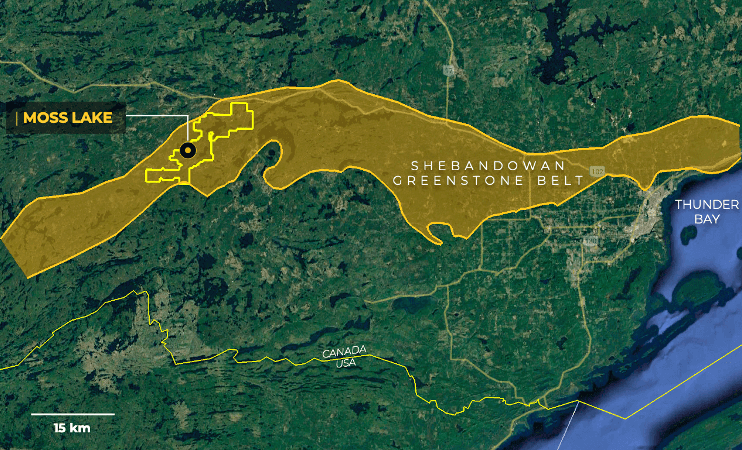

Earlier oxidized intercepts of 167.2 meters grading 1 gram per tonne gold (1 g/t Au); 136.8 meters at 1.49 g/t Au; 138.3 meters running 0.58 g/t Au; 88.4 meters at 1.1 g/t Au; and 152.4 meters of 0.87 g/t Au are already solidifying the prospect of a potential 1Moz Au heap-leachable resource (in my view) at the California Zone, but a new 350-meter step-out hole to the north also hit some gold, indicating there could be a new mineralized envelope nearby.

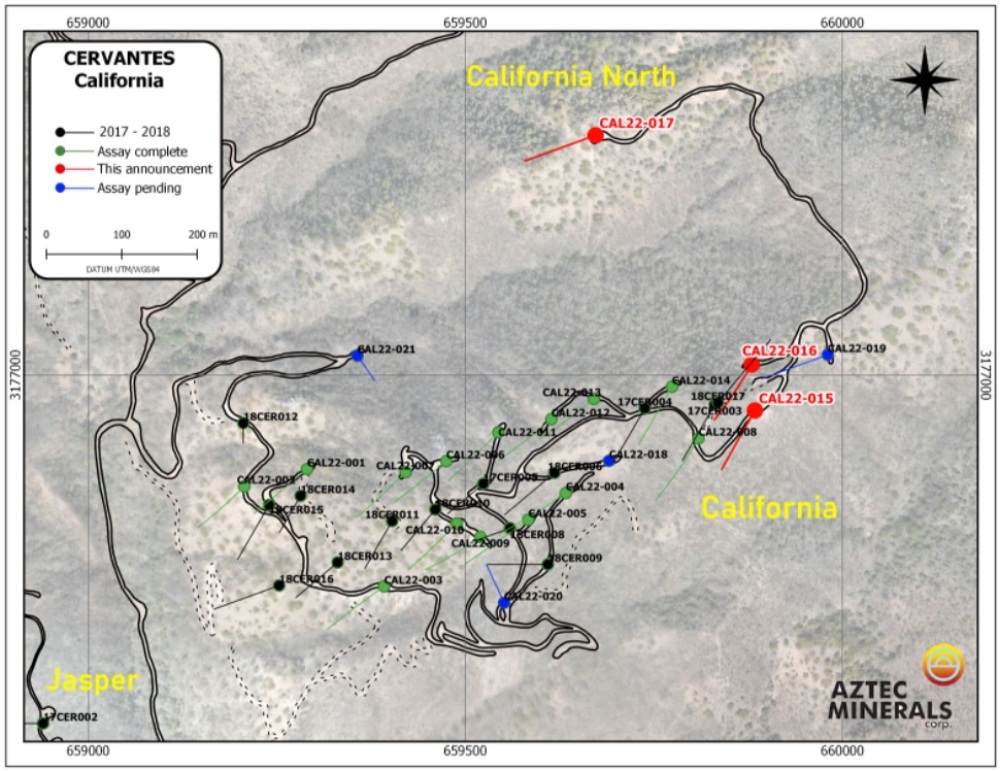

The 2021-2022 Phase 2 reverse-circulation drill program at Cervantes was completed in March for a total of 4,649 meters over 26 holes. Aztec recently reported assays from another 4 drill holes, with four more to go.

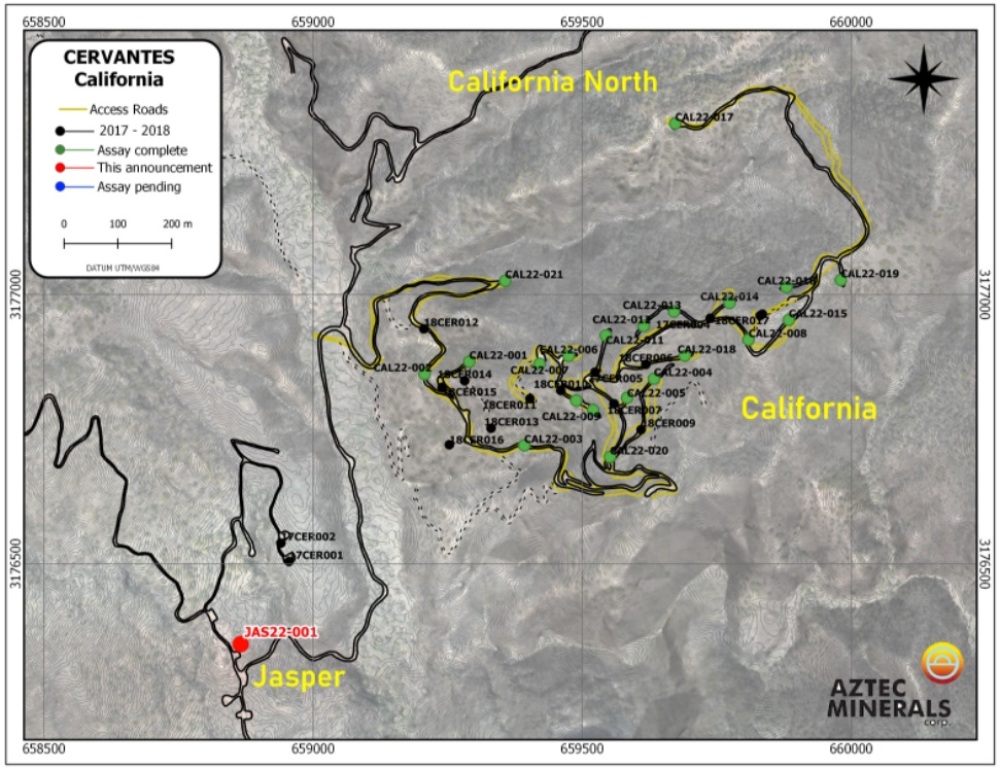

Most of the drilling was focused on the California Zone, but other targets included California North, Jasper and Purisima East. The highlights are as follows:

- CAL22-017: 24.3 meters grading 0.315 g/t Au from 29 meters downhole and 6.1 metres of 1.64 g/t Au from 115.8 meters downhole in mineralized quartz feldspar porphyry, sediments and hydrothermal breccias, as a 350-meter step-out north onto the southern edge of the California North target.

- CAL22-015: 68.4 meters at 0.42 g/t Au from 4.6 meters downhole in mineralized porphyries and hydrothermal breccias located at the southern edge of the eastern portion of the mineralized zone, but also 10.6 meters at 2.2 g/t Au from 117.4 meters downhole.

- CAL22-016: 56.2 meters at 0.47 g/t Au from surface in mineralized porphyries and hydrothermal breccias, at the northern edge of the eastern portion of the mineralized zone, but also 13.7 meters of 0.34 g/t Au from 79.3 meters downhole.

- JAS22-001: 9.1 meters at 0.33 g/t Au from 10.6 meters downhole, and 150 meters with visible copper oxides and secondary sulphides in a mineralized quartz feldspar porphyry intrusive, sediments and hydrothermal breccias, as a 180 meter step-out in the Jasper target to the southwest of 2018 drilling.

I was pleased to see more mineralization near surface in substantial intercepts to the east at the California Zone in holes 015 and 016, but step-out hole 017 seemed to indicate there is gold present 350 meters from the current envelope, which is encouraging.

As the mineralization at the California Zone seems to be confined to the higher parts of a ridge, it might be the case that, as hole 017 is also situated on a parallel ridge on the California North target zone, there could be another mineralized envelope of some size there.

It could also represent a continuous mineralized area stretching from the California ridge to the California North Zone ridge. In that last scenario lots of tonnage could be added, in theory.

"The presence of gold mineralization in Hole17 at California North demonstrates the openness of the larger California zone and provides justification to continue stepping out from the main California zone northern fence," Aztec CEO Simon Dyakowski said. "We are in the planning stages of a followup program and expect to plan additional drilling in another parallel fence, as well as around the California North ridge.”

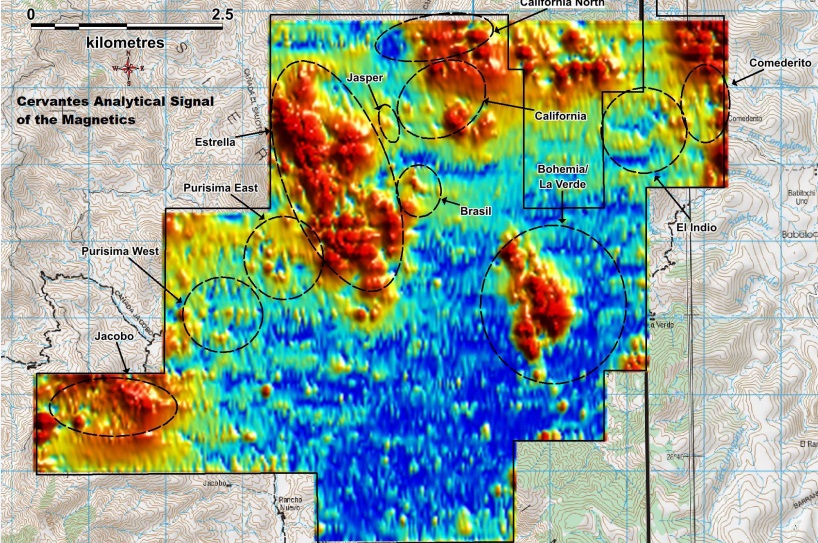

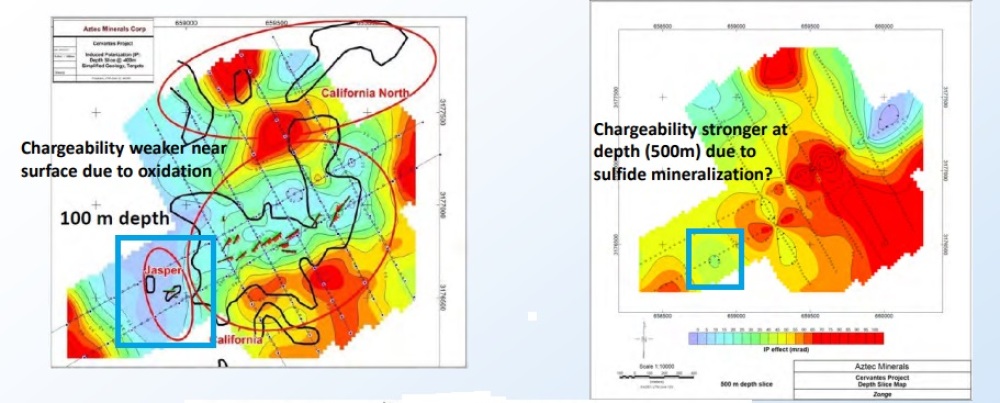

It would be interesting to see what the assays will return for hole 021, as this can be viewed as an extension of the ridge hosting hole 017. If successful, this could warrant another set of infill exploration holes between 017 and 021 in a followup program. As a reminder, Aztec Minerals is testing the California North target, as earlier surveys indicated great potential:

The California North target seems sizeable for magnetics, as does Estrella. When asked if Aztec Minerals has any plans to go after Estrella or other targets soon, Dyakowski answered: ”We are currently re-mapping the Estrella ridge with the goal of generating drill targets.”

The gold intercept at the hole drilled at Jasper wasn’t long at just 9.1 meters grading 0.33 g/t Au. Yet company geologists noticed widespread visible copper oxides/sulphides over 150 meters — so this hole could indicate the deeper porphyry potential Aztec Minerals is chasing. Although, I must say, Jasper isn’t close to the IP chargeability anomalies already detected elsewhere (Jasper target in blue rectangle):

The Jasper target location relative to the California targets can be seen in more detail on this map:

Dyakowski says the final assays for hole JAS22-001 and the remaining holes are expected soon.

It is still too early to estimate anything at Jasper or California North but holes 015 and 016 at California point to a slightly longer mineralized hypothetical envelope of 850 meters x 275 meters x 85 meters x 2.7 meters = 53.65 Mt. At an estimated average grade of 0.6 g/t Au in 53.65 Mt, we arrive at a hypothetical 1.03 Moz Au — which would pass a very important threshold, as you probably know.

As a reminder, management is contemplating a 5,000-meter followup drill program at Cervantes in Q2/22. Not only will the near-surface heap leachable mineralization be explored, but a stronger diamond drill will finally test a large IP chargeability anomaly at depth to see if it is indeed a large porphyry.

Aztec is also carrying out channel sampling and geologic mapping of the new drill roads at the moment at California, California North and Jasper. The company is also expanding surface sampling and mapping on the property in order to continue the 2021 phase 1 surface program.

The exciting thing here, of course, is that the Cervantes oxides aren’t the only thing Aztec is exploring. It is also planning a drill program for the Tombstone gold-silver oxide project in Arizona as part its joint venture with Tombstone Gold & Silver. Aztec owns 75% of the project and is the operator. This would enable Aztec to go after large porphyry/carbonate replacement deposit (CRD) potential at depth at both projects.

Since the share price of Aztec Minerals is holding up pretty nicely despite devastating broad market selloffs, I would assume the company will soon raise cash in order to properly budget its planned drill programs for California and Tombstone.

Conclusion

As holes 15 and 16 returned decent intercepts and extended the California Zone by another 75 meters or so, my estimates indicate that Aztec could very well be looking at 1Moz Au deposit — the vast majority of which is in heap-leachable oxides.

Step-out hole 17 could indicate a second mineralized ridge parallel to the California Zone or indicate a much larger oxidized cap. More drilling is needed to shine light on the possibilities and the company is already making plans to approach this in the most efficient way possible.

And as I keep mentioning: Cervantes isn’t the only project, and both Cervantes and Tombstone have near-surface oxides plus deep porphyry/CRD potential.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclaimer: The author is not a registered investment advisor and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.