1. Introduction

With gold stabilizing and further inflation expected with a world economy continuing to recover from COVID-19, it seems Maxtech Ventures Inc. (MVT:CSE; MTEHF:OTC; M1N:FSE), a junior exploration company operating in Ontario and Quebec, is in the right place at the right time. It raised C$0.94 million on June 4, 2021, and recently commenced a 15,000-meter, three-stage drill program at its flagship St. Anthony Gold project, with the objective to prove up a historical 1.2 million ounce (Moz) resource, and maybe even more. Management already succeeded in attracting a few large institutional names like U.S. Global, and is followed with interest by more large parties, ready to enter when drilling delivers the right results.

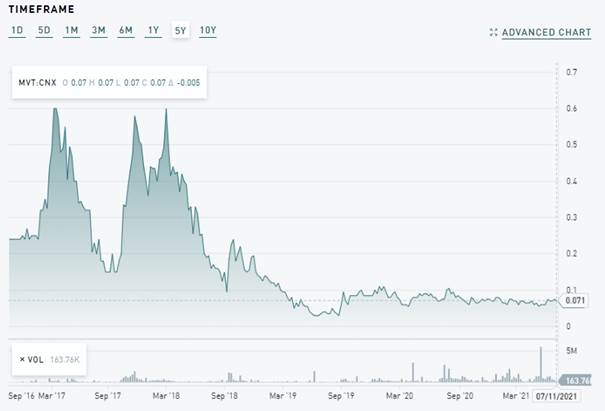

The company currently has a decent 121.87 million shares outstanding (fully diluted 148 million), 21 million warrants (the majority at @C$0.10 expiring in 2024) and several option series to the tune of 6.7 million options in total, the majority priced at C$0.12 and expiring from January 15, 2022, onwards. Maxtech Ventures has a current market capitalization of C$8.53 million based on the July 11, 2021, share price of C$0.07.

Maxtech Ventures, 5 year timeframe (Source: tmxmoney.com)

The current cash position of Maxtech Ventures is C$1.2 million, and if the upcoming drill results prove to be successful, the company is looking to raise more soon. The all-in cost of drilling is low at C$140/m, so financing the entire 15,000m program shouldn't be too problematic when incoming results are strong. Management, family and insiders hold approximately 30%, but the company also enjoys approximately 21% institutional ownership, as, for example, U.S. Global holds 9.3%, and Palisades Goldcorp 6%.

2. Management

CEO Peter Wilson: Finance specialist, raising over C$300 million of equity and debt in mining/energy the last 20 years

VP Exploration: Andrew Tims, geologist with over 30 years of experience with lots of relevant experience in the area, part of the team that expanded Rainy River from 550 koz to 6 Moz gold, and previously worked at the Red Lake Mine.

Strategic Advisor: Greg Ferron, former CEO of Treasury Metals, IR/Corp Dev of Laramide Resources, Treasury Metals

3. Projects

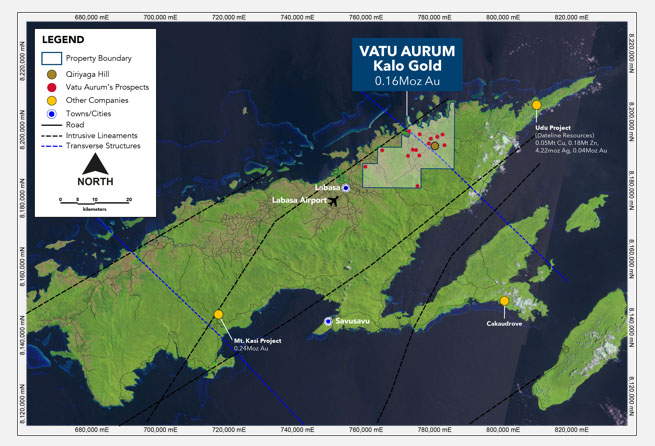

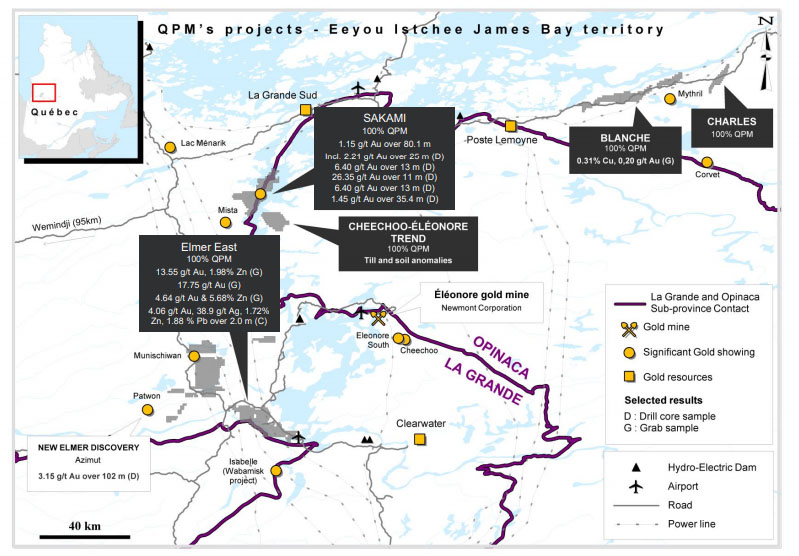

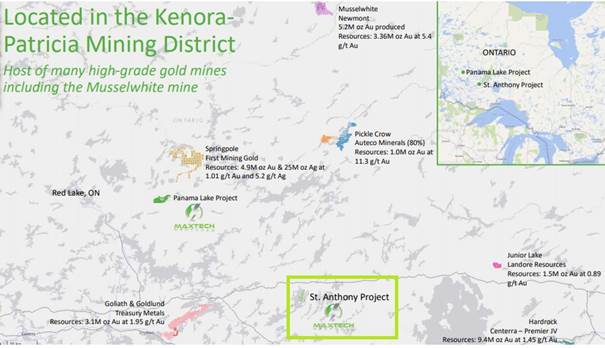

Maxtech Ventures has a portfolio of three projects, St. Anthony, Panama Lake and Kali, with most of the focus on St. Anthony. The company's Panama Lake project in the Red Lake district in Ontario is on trend with Great Bear Resources' (TSXV:GBR) Dixie project and the company is earning into a 100% interest through a JV with Benton Resources. The terms encompass a 3-year period, 2 million shares, cash or share payments of C$600k, and C$1 million in exploration expenditures. The Kali project is already 100% owned, and is located in the James Bay region of Quebec, adjacent to the Elmer property held by Azimut Exploration (TSX:AZM).

Maxtech's flagship asset is the St. Anthony Gold project, a 4224 hectare property in Ontario. Newmont's Musselwhite Mine lies in close proximity to the north, and New Gold's Rainy River Mine further to the west. The company has a JV with Magabra (private company) for a 100% interest, and the project has no royalties. The project and region enjoy good access, power and infrastructure. Magabra is the operator of the St. Anthony Project and Maxtech jointly approves all work programs. The former deal terms at the St. Anthony Gold project were improved significantly in H1 2021 for a 100% ownership JV by spending C$6 million in exploration expenditures and issuing 30 million shares to Magabra. The accelerated terms also properly align the vendor (Magabra) with Maxtech shareholders, and being the operator, the extensive vendors knowledge of the project is retained.

Historically a few small underground mines were developed at the St. Anthony Gold property in the to a 200m depth (St. Anthony Mine itself produces 63koz Au), but the project has not seen much modern exploration since. The main mineralized structural corridor, which contains the St. Anthony Mine, has been traced over 10km of strike with widths of up to 1.0km and hosts two gold deposits (St. Anthony and Dawson White), with three high grade target zones (Buckshaw, Couture Lake & Lucky Bones).

Historical drilling in 2009–2010 showed a non-compliant 1.2 Moz gold resource (2012) in the St. Anthony Mine zone. Significant historical drill results already returned 1m @22g/t from 62m, 1m @ 36g/t from 79.5m depth, 54m @ 1.73g/t Au from 183m, and 100m @ 1.37g/t Au (including 1m @98g/t Au) from 281m. However, the re-assaying of historical drill cores showed gold values up to 35(!) times higher than reported in the past, because assaying methods back then were often inaccurate compared to today's standards, and were not assayed for free gold, and it seems free gold is present in almost every drill core. In addition, target zones Buckshaw, Couture Lake and Lucky Bones have seen sampling and trenching results up to 12.95–24.1g/t Au. Management believes there is high-grade and bulk tonnage open pit gold potential, and historical work focused on the gold potential of the quartz veins only, with little to no attention paid to the low-grade mineralization in the altered wall rocks (less than 3 to 5 g/t Au, which is certainly of interest at today's gold prices). All this has convinced management they might have a realistic chance of proving up 1 Moz with the potential for more.

4. Current Exploration Program:

A maiden NI 43-101 resource will likely require 15,000 meters of drilling according to management, and completing drilling ASAP is the goal for now. The Phase 1, 5,000m, 15 hole infill and expansion drill program started in April 2021 will be carried out on a 50-meter spacing and designed to confirm historical drill results along Zone 1, as well as test along strike to the north, south and down-dip below the 330-meter (1,000 ft.) level of the St. Anthony mine. There are at least two additional structures running parallel to Zone 1 that remain to be tested, as well. One of these is Zone 2, with a strike length of 200m and 20–30m wide.

Phase 2 and 3 drilling (each 5,000m programs) have the intention of opening up the current deposit in other directions by drill testing the Buckshaw, Couture Lake and Lucky Bones targets and by properly assaying for nugget effect mineralization, a typical Red Lake feature in Ontario. Some visible gold showings can be seen in the pictures below, coming from historical drill cores (2009–2010):

Six holes have been completed as of July 8, 2021, with drill results of the first four holes being announced in the coming week. Visible gold has been observed in all holes so far. Management is excited for the first assays to come back within a week from now, and if these results confirm or even supersede the historical results, it seems Maxtech Ventures has definitely made a strong start in proving up a potential 1 Moz gold resource at the St. Anthony Gold project.

Key points

- Management is delivering on promises made, including successful exploration permitting (during COVID-19), improving JV terms, and raising capital to commence the Phase 1 drill program.

- NW Ontario is experiencing an increase of investment and activity, including Wesdome's recent spin-out of its Moss Lake project and Treasury Metals' consolidation of the Goliath-Goldlund projects.

- This could be a unique opportunity for Maxtech to quickly convert a historical (non-complaint) resource estimate into an NI 43-101 resource following the 15,000 meter drill program. In addition to this, management hopes that successful expansion drilling could confirm more tonnes, and improve the overall average grade, growing the resource even larger.

- We believe that the St. Anthony Gold project has the potential to be a prize in the region. Following potential drilling success, Maxtech should appear on the radar of producers, as a potential 1 Moz open pit gold resource in Ontario is highly sought after.

- The two twinned holes are important to watch, those results go a long way in verifying and validating successful historical drilling.

- As re-assaying of historical cores showed, the actual grades are much higher than previously reported because of assayed free gold. Combined with observed visual gold in all currently drilled cores, management expects better overall drill results.

Therefore, we see realistic potential for a strong re-rating, as peers with a compliant 1 Moz resource have market caps 2.5 to 5 times higher than the current, tiny C$9 million market cap of Maxtech. Stay tuned!

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer: The author is not a registered investment advisor, and currently has a long position in this stock. Maxtech Ventures is a sponsoring company through a third party. All facts are to be checked by the reader. For more information go to www.maxtechventures.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.