For months I've been trying to convey (the possibility of) FenixOro Gold Corp. (FENX:CSEl FDVXF:OTCQB) being the next Continental Gold, a company acquired in late 2019 by Zijin Mining for ~C$1.4 billion. Based on FENX's share price of C$0.255, [April 6, 2021] one might argue that my efforts have failed (so far) to rally the troops!

The Feasibility Study that supported a C$1.4 billion takeout was based on gold / silver prices of US$1,200/oz. / US$15/oz., ~31% and ~40% below today's levels. And, the Colombian peso has weakened by 25% vs. the US$ since the 2016 report.

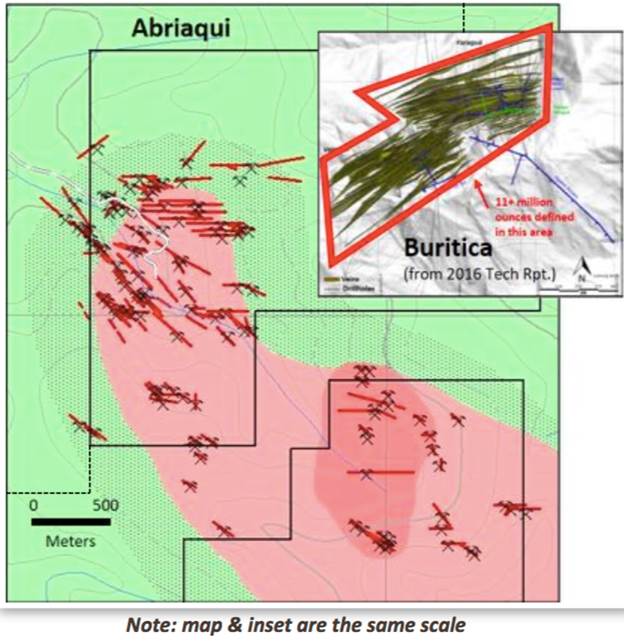

As a reminder, Continental Gold discovered and developed the world-class, high-grade Buritica project in Colombia, bringing it to 12.1M ounces of gold at just under 10 g/t, (Measured + Indicated + Inferred) and to within a year of commercial operations. Some pundits believe this is a 20M+ ounce mine, as the last publicly reported resource is several years old. Zijin officially placed Buritica into production six months ago.

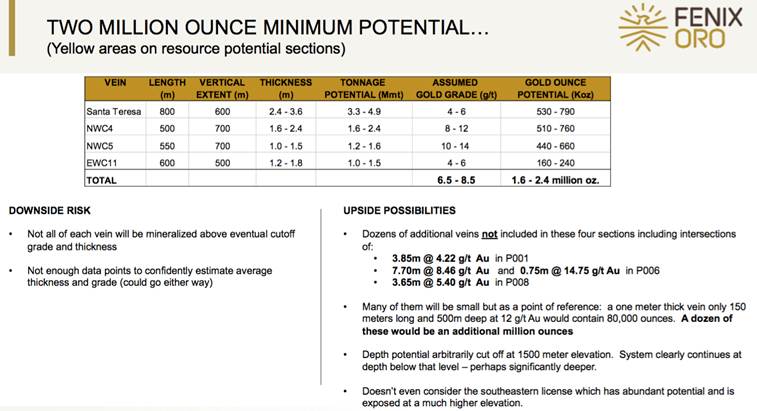

A portion of FenixOro's Abriaqui project could host ~2M ounces gold

There are compelling reasons to believe that FenixOro's flagship Abriaqui project could be following in Buritica's footsteps, none more so than this press release of March 19th. In it is a preliminary analysis of the company's phase 1 drill program—(nine holes / 4,029 m)—in which management lays out the potential of Abriaqui as it stands today at this early stage.

So, what's in the press release that has me so excited? An approximation, a conceptual exploration target, of 1.6 to 2.4M ounces of gold on four of the better veins, among over 100 identified so far.

How realistic is this 1.6 to 2.4M ounce conceptual target? I speak regularly with CEO John Carlesso and VP Exploration Stu Moller. They've been consistently optimistic in their commentary. Recently, their body language has been signaling that the team is quite pleased with phase 1 drill results.

Although they could be wrong in their assessments, they strongly believe in the analysis and are willing to go on record. If they're wrong, there will be negative consequences. The Board did not announce this news lightly; a great deal of vetting went into the press release.

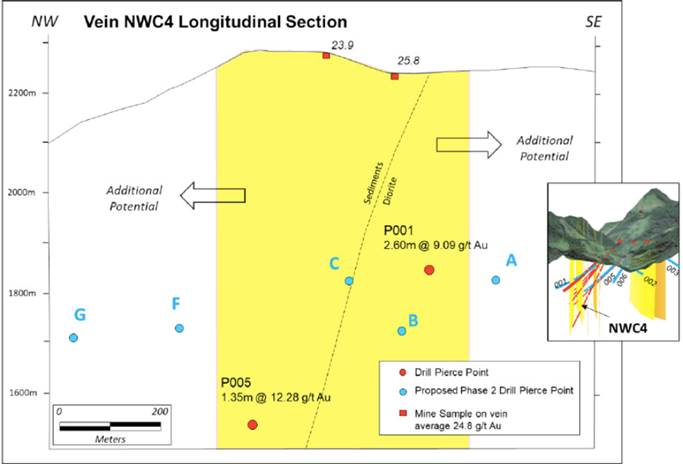

Phase 1 drilling focused on the easily accessible northwestern part of the property. Nine diamond drill holes ranging from 100-750 m in depth, tested 250-350 m wide corridors, each containing multiple veins with thicknesses ranging from 15 cm all the way up to 7.7 meters.

The BIG question—are the assumptions used in the base case 2M ounce total reasonable? If so, how likely is that number to grow? After spending considerable time examining the company and these results, in this author's opinion, the methodology and assumptions seem reasonable, and the conceptual exploration target of 2M ounces is likely to grow.

For example, management believes there are dozens of other veins, many of which might contain 50-100k ounces of gold each. Taken together that could quickly add to another 1M ounces. Importantly, none of this preliminary analysis considers the southeastern license, which is highly prospective as well.

More time and drilling (read: cash) will be needed to deliver a maiden mineral resource estimate ("MMRE"). A MMRE could be published as soon as the third quarter. Note: {if the MMRE is calculated soon after phase 2 drilling, there would remain a gap between resource potential and calculable resource ounces}.

In other words, the official NI 43-101 resource total always lags behind what sophisticated investors have already figured out in terms of where a deposit/resource is headed.

Taking a step back, I remind readers that well before the initial drill campaign, FenixOro's technical team already suspected it might be onto something big. They had mapped >80+ veins [now 100+ veins] grading up to 146 g/t Au—all gold-bearing—that had been sampled in outcrop and drill core over 900+ m of vertical extent [now observed >1,200 m].

FenixOro has a stellar technical team with vast experience in Colombia

One of the primary people behind Continental Gold's huge success was its VP Exploration, geologist Stuart Moller. Mr. Moller has 40 years' experience including senior roles at Barrick Gold and Pan American Silver. If that name sounds familiar, it should, he's now VP Exploration at FenixOro.

Moller's expertise in Colombia—at a globally significant project just 15 km away, (on which he led the discovery / development during its most formative years) — told him the geology of the two projects was similar.

Press Release outlines estimated dimensions, grades and thicknesses

In the press release, observations of length, width, depth and average rock density were provided on four veins to establish indicative tonnages. An average grade for each modeled area was also given. Then, simple math (approximate volume x estimated grade) resulted in ranges of the number of prospective gold ounces in each zone.

Assuming that the four mapped, high-grade veins contain a total of ~2M ounces gold, that would mean, all else equal, that FenixOro is trading at ~C$9/oz. (of moderate-to-high-grade gold) in the ground.

Importantly, additional upside is reasonably possible as the announced conceptual target does not include 80% of reported drill intercepts. Only about half the known veins at surface have been drill-tested. Substantial potential exists on those same veins at depth, on many additional veins intersected, and across un-drilled parts of the property.

Although management is rightfully focused on demonstrating growth of the known structures and the potential in new, untested areas, in my view (not necessarily that of mgmt.) we can't rule out a resource of 5M+ ounces, grading 5+ g/t, across the entire project. Surpassing 5M ounces (if ever), would probably require two or three years of additional drilling.

This spring, phase 2 drilling will start, potentially followed by a MMRE

In April/May, a (minimum) 4,000 m, [8-10] hole phase 2 program is planned to start. It will consist of both infill and step-out drilling on the 1,400 x 350 m northwest trending corridor ("NWC") consisting of at least nine veins.

Although more time and drilling will be required, if one of the world's best gold mines (Buritica) is one's closest analog—it's prudent to start making assumptions and contemplating potential exploration outcomes.

Readers should recognize that the calculations and assumptions adopted for FenixOro's preliminary review represent a sound modeling methodology that sophisticated investors, investment funds, sell-side research analysts, strategic partners and potential acquirers of the company are already doing. Management is working on estimating additional structures.

FenixOro CEO John Carlesso commented,

"We recognize that for many investors it can be challenging to decipher drill results and technical information disclosed in press releases. We believe we have an obligation to state as plainly as possible that our Phase 1 drilling has identified a significant gold discovery, with clear potential for 1.6–2.4 million ounces of gold on just four of the vein structures drilled to date….

…. Additional potential exists on those same veins at depth, on many additional veins intersected, and throughout portions of the property that remain un-drilled. The process of turning that potential into NI 43-101 compliant resources is a function of time and drilling, but we believe the most difficult challenge, the initial discovery, has been achieved."

Four of the better veins were chosen for this initial modeling exercise. On each section, the topographic surface is plotted along with all available surface and drill data. The targeted tonnage potential for each vein is a simple volume calculation of:

Length X average width of drill intersections X vertical extent (depth) X rock density (averaged from over 200 measurements of drill core). Note: {these observations are estimates subject to further exploration work and drilling}.

Cautions from the press release included:

1) There's downside risk to this preliminary form of analysis, most veins around the world are not homogeneous blocks of ore-grade material, there may be lower grade sections. 2) the assumed grades and thicknesses are based on relatively few data points. Time and drilling will be required to convert potential ounces into a NI 43-101 compliant resource.

3) There's no guarantee that a resource of any size will ever be delineated. 4) There's not enough information available after nine drill holes to precisely estimate future resource potential, so average thicknesses and grades are presented as +/- 20% of the best estimates derived from existing data.

Conclusion

It's still early days, but internal modeling points to the potential (no guarantees) of a 2M ounce deposit. There will be a lag in booking NI 43-101 compliant resources vs. estimating conceptual ounces, due to the need for subsequent infill drilling, assay lab turnaround times and report writing.

Buritica was taken out by Zijin at roughly C$110/oz, based on a Feasibility Study done at US$1,200/oz Au + US$15/oz. Ag. With a stronger US$ plus meaningfully higher precious metal prices, Buritica could easily be worth C$2 billion today.

Assuming that FenixOro Gold Corp.'s (CSE: FENX) / (OTCQB: FDVXF) share count was to double in coming years, and Abriaqui turns out to be worth half (C$1 billion) of Buritica, FenixOro is trading at just ~5% of its potential C$1 billion value. Make no mistake, pre-MMRE the company warrants a steep discount to an operating mine.

However, if the company can book even 1M ounces in a MMRE this year, at moderate-to-high-grade—that would demonstrate management's understanding of geology and structure. And, at that point, the valuation could be substantially higher than it is today.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of the above article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about FENIXORO GOLD CORP., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc., is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, professional trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of FENIXORO GOLD CORP. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, FENIXORO GOLD CORP. was a former, but a recent advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.