Tulips were introduced to the Netherlands in the late 1500s and the country soon fell in love with the brightly colored flowers. Their arrival coincided with the Dutch Golden Age, when control of lucrative trading routes to the Far East made the Netherlands a marine superpower and one of the world's wealthiest nations.

Trade and the resulting prosperity set the stage for the tulip bulb mania of the 1630s. Businessmen who became wealthy buying shares in the Dutch East India Company would decorate their estates with lavish flower gardens of tulips, which had been introduced from Turkey. The rarest and most valuable tulips were the ones with genetic impurities, which produced vibrant colors and unique patterns. Human beings love natural beauty.

In diamonds as in tulips, the rarest and most beautiful are the most valuable. Lucara Diamond Corp. (LUC-T) has been demonstrating it for years, pulling spectacular stones out of its Botswana diamond mine and selling them for prices as high as US$63 million. That price-tag, for the 813-carat Constellation, was more than Lucara paid for a controlling interest in the Karowe project before it became a mine. Fancy pink diamonds from Rio Tinto's recently closed Argyle diamond mine in Western Australia also command high prices.

Human beings love natural beauty. It's something of a counterpoint to the narrative that De Beers created the demand for diamonds with its legendary "A Diamond Is Forever" advertising campaign in the late 1940s. That branding certainly introduced diamonds to new markets, such as Japan, and established mass market appeal for diamond engagement rings. Natural diamonds, of course, have been objects of desire for thousands of years.

According to legend, a single Semper Augustus tulip bulb sold for the price of a fine Amsterdam canal house at the peak of the Dutch tulip bubble. Centuries later, it was determined that a virus had produced the vibrant colors and unique patterns of the Semper Augustus. The tulip bubble quickly collapsed. Almost 400 years later, though, the Netherlands remains a flower powerhouse globally.

In diamonds as in tulips, chemical impurities create the vibrancy and color. Fancy diamonds fetch higher prices because the stones are rare and because they are beautiful. The presence of nitrogen, for example, is what gives a population of diamonds from North Arrow Minerals Inc. (NAR:TSX.V) Naujaat project in Nunavut their vibrant orangey-yellow hue.

STAGE SET FOR A DIAMOND REBOUND

The staying power of natural diamonds has been challenged by everything from lab-grown stones to changing demographic trends to COVID-19. It's been a rough ride for investors in Canadian diamond stories, too—Dominion Diamond Corp. and Stornoway Diamond Corp., operators of two of Canada's diamond mines, were both forced into bankruptcy protection.

North Arrow has not been spared. The stock has mostly been in the penalty box since a disappointing 2015 valuation of a 383.55-carat parcel of Naujaat diamonds. The primary conclusion of the valuation was that results and modelled values should be treated with considerable caution because of the small size of the sample. North Arrow has cost-effectively advanced Naujaat and its other Canadian diamond projects since, with successes including the discovery of new diamondiferous kimberlite fields at Pikoo (Saskatchewan) and Mel (Nunavut). While other diamond explorecos went bust or switched commodities, North Arrow shed non-core assets, sold small royalties on secondary projects and did modest raises with help from its billionaire backers.

As the world slowly emerges from the pandemic's grip and consumers from their homes, natural diamond prices and sales are bouncing back strongly. Rough diamond prices have rebounded and recently eclipsed pre-pandemic levels, reports New York diamond analyst Paul Zimnisky in the February 2021 edition of his State of the Diamond Market. De Beers just raised prices at its third consecutive sale, according to Bloomberg.

The pandemic appears to have created pent-up demand for jewelry and diamonds. Tiffany & Co., the world's largest jeweler, reported record sales for the November 1 through December 31 holiday period. China is leading the way, as the growing consumer powerhouse leaves COVID-19 in the rear-view mirror. Tiffany's Chinese sales rose 50% during the holiday period. Richemont, the world's second largest luxury conglomerate, said Q4 sales in China surged 80% year-over-year (Richemont is the parent company of Cartier and Van Cleef & Arpels). Chinese jeweler Chow Tai Fook opened 286 net new stores in the country in the fourth quarter of 2020.

From an investment perspective, diamonds may be one of the last contrarian bets left within the commodity complex. Base metals, battery metals, precious metals—prices of each have surged in the past year as inflation looms. Diamonds have lagged until recently, despite favorable supply-demand dynamics coming out of a long bear market that saw global diamond exploration screech to a virtual halt.

Large diamonds and rare colored diamonds are leading the way. Last year Louis Vuitton, the world's most powerful luxury brand and the recent acquirer of Tiffany & Co., purchased two of Lucara's most prized diamonds—the 1,758-carat Sewelo and the 549-carat Sethunya (above)—with plans to turn them into brilliant centerpieces. The Sewelo is the second largest rough diamond ever mined. A 59.6-carat fancy pink diamond, the "Pink Star," sold for a record US$71.2 million in 2017.

ENTER THE AUSSIES

Smart contrarian investors are taking notice. One is Michael O'Keeffe, an Australian entrepreneur who has made shareholders lots of money in coking coal and iron ore. A metallurgist by training, O'Keeffe got his start at Mt. Isa Mines and Glencore Australia before launching his own ventures. O'Keeffe took Riversdale Mining, a $7-million Australian coal junior with assets in Mozambique, to a $3.7-billion buyout by Rio Tinto in 2011.

These days, O'Keeffe runs Champion Iron Mines (CIA-T). In 2015, Champion bought the Bloom Lake iron ore mine in Quebec's Labrador Trough out of bankruptcy for $10.5 million and assumed about $43 million in liabilities. O'Keeffe has turned the operation around, developing Champion into an exporter of premium iron ore concentrate to markets in China, Japan, Europe and elsewhere. Champion shares bottomed at $1.10 at the end of March and now trade at $5.40, for a $2.6 billion market capitalization.

O'Keeffe (above) settled on diamonds after scouring the investment landscape for contrarian opportunities. He teamed up with diamond veteran Peter Ravenscroft, who was independently forming a strategy to consolidate the diamond project development space. They formed Australia-listed Burgundy Diamond Mines (BDM-AX), which plans to become a mid-cap diamond producer by developing premium projects that have been overlooked and/or under-funded.

In June, Burgundy signed a JV deal with North Arrow Minerals (NAR) that will see Burgundy earn a 40% stake in Q1-4 by funding a $5.6-million bulk sample of 1,500 to 2,000 tonnes at Naujaat, North Arrow's colored-diamond project in Nunavut. Burgundy advanced $300,000 of that last year so North Arrow could ship fuel and sampling supplies to Naujaat on the annual sealift. The objective of the bulk sample is to confirm that the more valuable colored diamonds occur in larger sizes throughout the deposit.

The favorable JV deal allows North Arrow to retain majority control of Naujaat on a partner-financed path and established timeline. It undoubtedly helped that North Arrow CEO Ken Armstrong cemented a relationship with Peter Ravenscroft, Burgundy's managing director and CEO, while the latter was in charge of resource delineation at the Diavik diamond mine in NWT. Ravenscroft is a diamond veteran with 40 years in the industry including with De Beers, Anglo American and Rio Tinto.

So what is Burgundy buying into? Naujaat's Q1-4 kimberlite hosts Canada's largest undeveloped diamond resource 100% held by a junior. The deposit hosts an estimated 26.1 million carats (Inferred) from surface to a depth of 205 meters; 2017 drilling showed Q1-4 extends below 300 meters depth. The outcropping kimberlite has a distinct population of rare orangey-yellow diamonds that could drive the value proposition and make the deposit economic. The Q1-4 deposit is seven kilometers from tidewater, near the community of Naujaat.

If this summer's bulk sample is successful, Burgundy could earn an additional 20% interest in Q1-4 (60% total). North Arrow and Burgundy have a non-binding letter of intent to negotiate a second option agreement giving Burgundy the right to earn the additional 20% interest by paying for collection of a subsequent 10,000-tonne bulk sample.

The purpose of that exercise would be to definitely answer the diamond value question. The price tag for that bulk sample would be much higher, too—in the order of roughly $20 million.

SIZE MATTERS. SO DOES SATURATION

Intriguingly, the fancy orangey-yellow diamonds tend to be larger than the other diamonds in Q1-4. The colored diamonds are a distinct, younger population of stones. In earlier samples taken by North Arrow, they made up between 9% and 12% of the stones but as high as 21% to 30% by carat weight. Establishing the size-frequency distribution of that fancy diamond population is the main objective of this summer's 1,500 to 2,000-tonne bulk sample.

High-quality diamonds that are saturated in color can sell for multiples of the price of white diamonds, but the mines producing them are shutting down. The latest is Rio Tinto's Argyle mine in Australia, the world's primary source of fancy pink stones. Argyle closed last year. The Ellendale mine, also in Australia, produced 50% of the world's fancy yellow diamonds and was Tiffany's primary supplier for those stones. Ellendale closed in 2015 (although another company is attempting to revive the project).

There were some initial doubts that the Naujaat fancy colored diamonds would cut and polish well. North Arrow addressed those concerns with its cutting and polishing exercise that yielded beautiful, valuable stones. The polished diamonds received favorable certifications by the GIA (Gemological Institute of America). The diamonds were certified by GIA as fancy vivid orangey yellow—fancy vivid diamonds have the highest color saturation and command premium valuations.

TOP TEAM, LOW PRICE

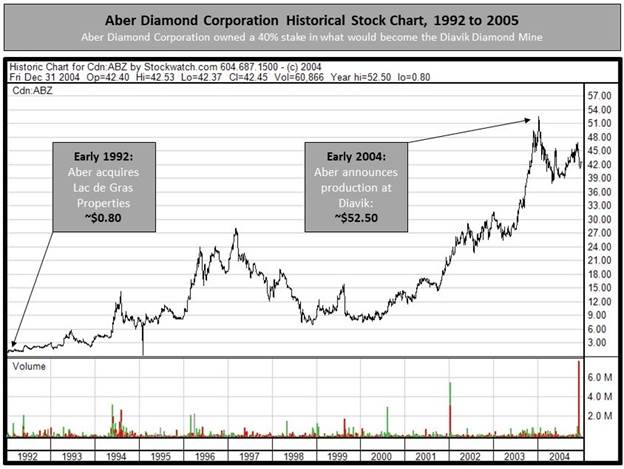

In the notoriously risky junior mining sector, investing with people who have track records of making investors money greatly increases the odds of success. Gren Thomas, North Arrow's chairman and a Canadian diamond pioneer, fits the bill.

On the heels of Chuck Fipke's September 1991 diamond discovery, Thomas and South African diamond expert Chris Jennings (now a North Arrow director) headed north on a cloak-and-dagger staking mission. They flew into Yellowknife and split up at the airport, staying at different cheap hotels as they systematically staked as much prospective ground as possible.

"We got the feeling that the town was just trembling on the verge of a staking rush," Thomas recalls. "At any minute, the whole place could blow wide open."

That winter staking adventure eventually yielded the Diavik diamond discovery and Thomas's Aber Diamond Corp. (40% owner) saw the rich mine through to production. That worked out rather well for shareholders.

Thomas owns 11.1% of North Arrow's shares and recently increased his position by loaning the company $400,000. Jennings, his old staking partner, owns a 5.3% stake in North Arrow. Gren's daughter Eira Thomas led the field exploration team that made the Diavik discovery leading to Canada's second diamond mine. She co-founded both Stornoway Diamonds and Lucara Diamond Corp. and now runs Lucara, the world's premier producer of large, high-quality diamonds. Eira is a North Arrow advisor and large shareholder who was key to securing Naujaat for the company. CEO Ken Armstrong is a 25-year veteran of the diamond space and has been involved in the discovery of 10 diamond-bearing kimberlites in Canada and Greenland.

Through Burgundy, O'Keeffe joins three billionaire backers who are involved with North Arrow. Mining tycoons Lukas Lundin (through Zebra) and Thomas Kaplan (Electrum) each own 10.3% stakes in North Arrow; Ross Beaty owns 8.8% of shares. All three put money into North Arrow's last financing; insiders and key shareholders hold more than 53% of North Arrow's shares.

A VALUATION GAP

There aren't many active junior exploration companies backed by the likes of Lundin, Beaty and Electrum that trade below a $15-million market cap. And that's not the only metric that suggests North Arrow shares are fundamentally undervalued at these levels.

Eira Thomas (left) and Gren Thomas (right) at the Diavik mine opening.

Consider the discrepancy in market capitalization between North Arrow and its JV partner, ASX-listed Burgundy Diamonds. The Naujaat diamond project is the recognized flagship for both companies; after this summer's bulk sample, North Arrow will own a 60% interest in Naujaat and Burgundy a 40% interest. Yet consider the market cap comparison between joint venture partners:

North Arrow Minerals

60% stake in Naujaat (flagship)

Canada's best portfolio of advanced diamond exploration projects

100% share in Hope Bay Oro, a gold project adjacent to Agnico Eagle's Hope Bay mine

Market cap: C$12.2 million

Burgundy Diamond Mines

40% stake in Naujaat (flagship)

Exploration alliance in Botswana

Nanuk, an early-stage diamond project in northern Quebec

Legacy Peruvian gold/silver asset (25%)

Market cap: C$76.9 million

A GOLDEN CALL OPTION

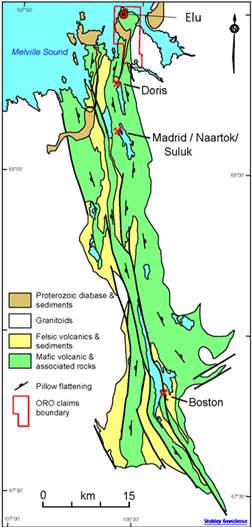

Buried in the property portfolio is a gold asset that just moved up in relevance: the Hope Bay Oro property in Nunavut. Hope Bay Oro is directly north of Agnico Eagle's Hope Bay gold mine, recently acquired for $287 million from TMAC Resources. Prior to the purchase, Agnico Eagle had already upped its exploration budget. In subsequent interviews, Agnico CEO Sean Boyd has emphasized exploration as a key focus at Hope Bay as the miner seeks ounces to build annual production levels.

North Arrow's 4,103-hectare Hope Bay Oro property is three kilometers north of the Doris gold mine—the first to go into production at Hope Bay—and adjacent to Agnico ground. Oro hosts the same rocks, the same structural setting and the same mineralization style as Doris, where gold grades are about 10 g/t Au.

A 1,225-meter drill program completed by North Arrow in 2011 confirmed near-surface, high-grade gold mineralization over 300 meters of strike.

Ten of the 11 drill holes along the Elu shear hit significant gold grades, including:

- 7.55 meters grading 4.91 g/t Au from 38.4m, including 4.2 meters grading 8 g/t Au;

- 2 meters grading 20.22 g/t Au from 125m;

- 4 meters grading 7.04 g/t Au from 42.6m;

- 1.45 meters grading 31.92 g/t Au from 43.55m.

Acquiring Hope Bay Oro seems to be a logical bolt-on for Agnico, especially given the gold miner's renewed focus on exploration. Selling it could provide North Arrow with a non-dilutive source of funds. North Arrow CEO Armstrong is evaluating next steps at the property, including a potential drill program.

A BEAUTIFUL FUTURE?

The bet on North Arrow is that 60% or even 40% of a diamond mine that produces valuable fancy diamonds would be worth multiples of the current market capitalization. North Arrow has a partner-funded path to determine if Naujaat hosts an economic diamond deposit sweetened by a population of valuable fancy orangey-yellow diamonds. The JV partner is top-shelf, with the financial backing to fast-track a mine into production.

A final word on tulips and diamonds. Contrary to popular belief, the speculative tulip bubble occurred primarily among a small number of Amsterdam businessmen who had grown wealthy from maritime trade. The tulip bulb trade was considered too speculative for the Amsterdam stock exchange, which was well established by that time. As spectacular as the 1636–37 tulip price collapse was, it did not affect many Dutch citizens or even have ramifications for that small country's economy, let alone the world. This was a niche phenomenon.

The appeal of diamonds, on the other hand, spans the globe. While America remains the dominant market, fast-growing and populous countries such as China and India are taking their place on the diamond center stage. Rising tides of prosperity have brought luxury consumer purchases within reach.

Human beings still love natural beauty. That bodes well for fancy colored diamonds and the companies that can bring deposits hosting those stones into production. The quality of the Naujaat fancy diamonds, the strength of the North Arrow and Burgundy teams, and the recent rebound in diamond sales says North Arrow may be closer to that objective than its market capitalization suggests.

North Arrow Minerals (NAR-V)

Price: 0.11

Shares outstanding: 111.68 million (166.4M fully diluted)

Market cap: $12.17 million

James Kwantes is the editor of Resource Opportunities, a subscriber supported junior mining investment publication. Kwantes has two decades of journalism experience and was the mining reporter at Vancouver Sun, the city's paper of record.

[NLINSERT]Disclosure: James Kwantes owns North Arrow shares and was compensated by North Arrow Minerals for the writing and distribution of this article. This article is presented for informational purposes and is not financial advice. All investors need to do their own due diligence or consult an investment advisor.

Streetwise Disclosure:

1) James Kwantes' disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Resource Opportunities Disclaimer: Readers are advised that this article is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information is based on sources which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available data.