Image Taken from Stillwater West

Maurice Jackson: Joining us for a conversation is Michael Rowley, the CEO of Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE).

Mr. Rowley, glad to speak with you, sir, to get us up to date on the latest, exciting developments on the high-grade, polymetallic Stillwater West project located in Montana.

Before we begin, Mr. Rowley, please introduce us to Group Ten Metals and the opportunity before us.

Michael Rowley: Group Ten Metals is a growth-stage exploration company. We are pre-resource and we are about to debut three resources at our flagship Stillwater West project.

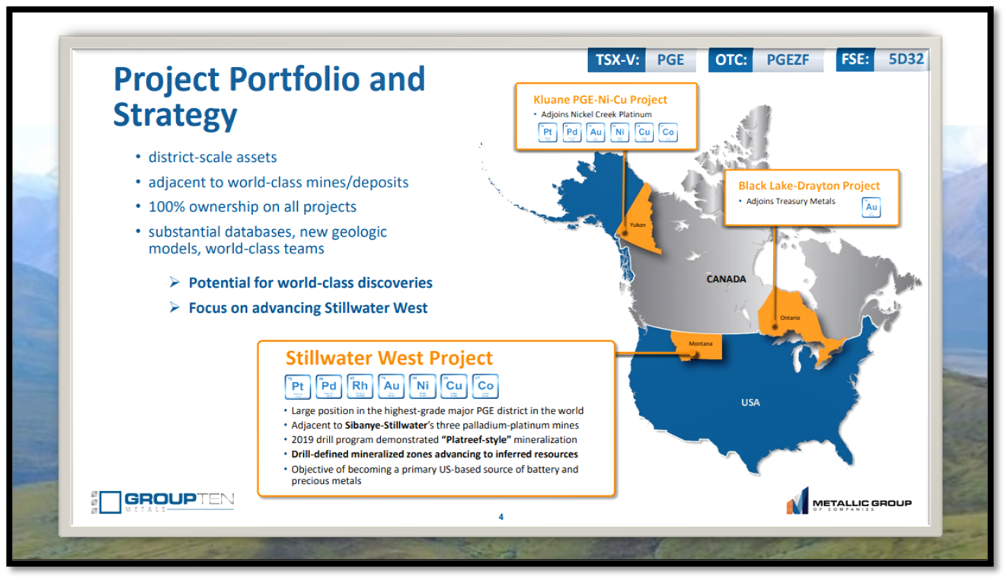

In total, we have three district-scale assets. Two of these are PGE-nickel-copper. One of them is high-grade gold and the two of them, one of the PGE [platinum group element] projects and the gold project, are effectively for sale, at this point, to focus on the Stillwater Project, which is what we'll focus on today.

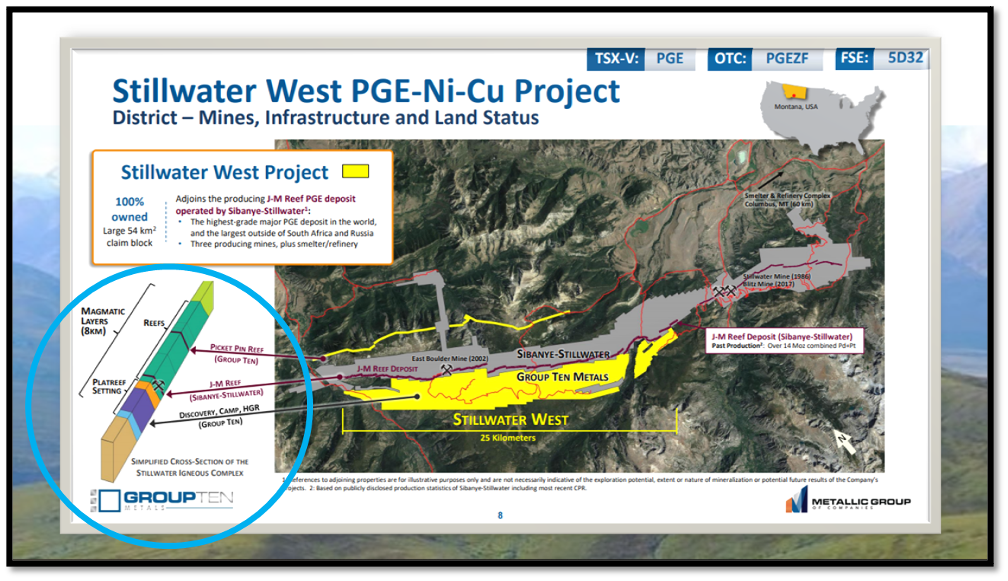

The Stillwater West Project is a remarkable opportunity. We got it in 2017 and quickly advanced it based on the database. We drilled it in 2019 and we just completed additional drilling a matter of weeks ago, and those results are pending. The potential that we see there, and our focus, is on proving up what we see as a Platreef potential.

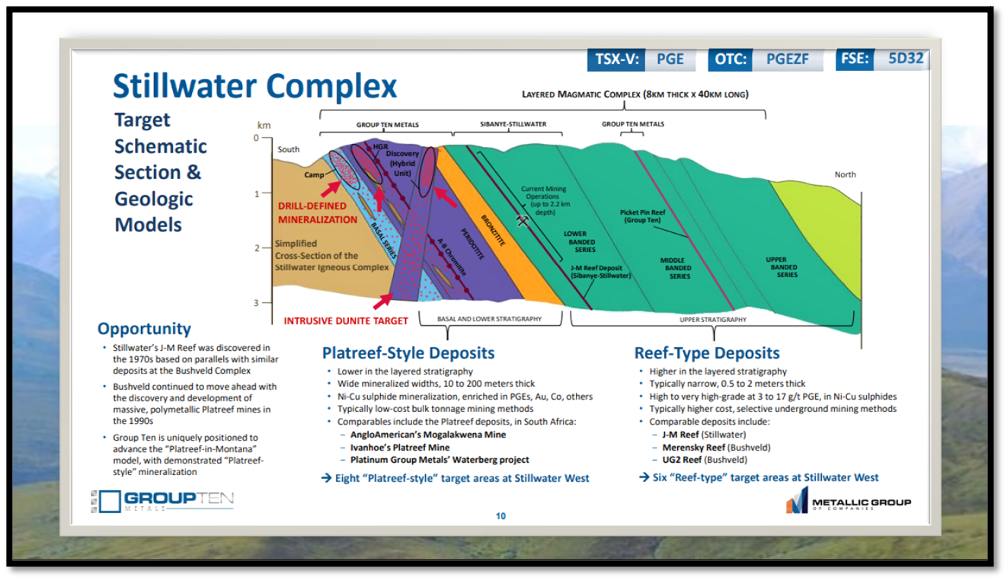

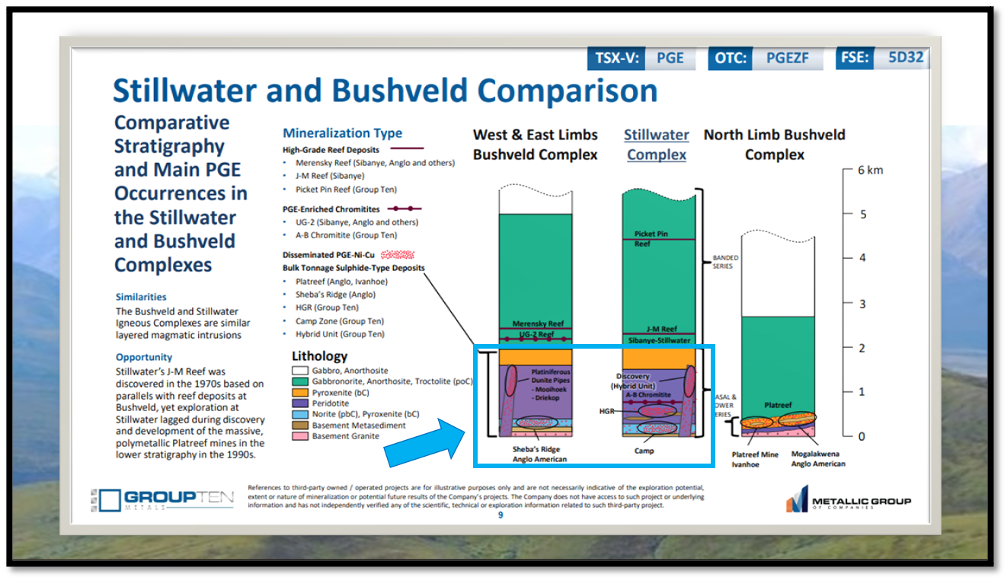

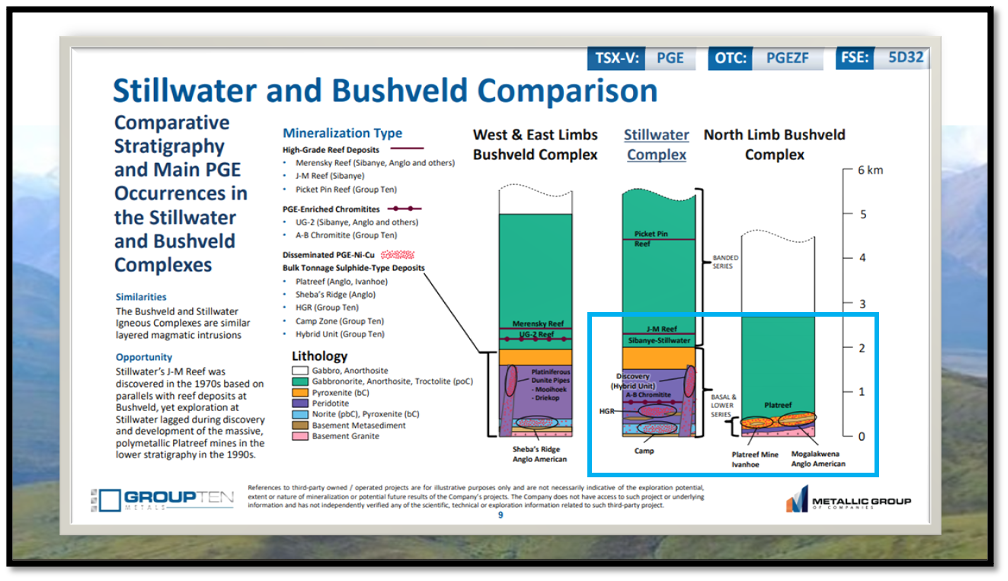

We're completing a process that started in the 1970s, when previous work in the Stillwater District and the Stillwater Igneous Complex was dedicated for platinum, when America needed catalytic converters. They took parallels from the Bushveld District of South Africa, which is the source of most of the world's platinum, and they found the J-M reef deposit, which is actually in the exact same place in the stratigraphic layers at Stillwater, as it is at Bushveld in the parallel system.

Now, what's interesting is that the Bushveld went ahead with the development of these massive nickel-copper-sulfide-PGE mines in the lower portion of the Bushveld Complex in the 1990s. That was never continued in Montana, even though the parallels were fairly well known and were even talked about in technical papers. So, in a sense, we're just completing that example. We're just completing that process and bringing that thinking back to Stillwater West from a known comparable system in South Africa.

Maurice Jackson: Group Ten Metals has been working very meticulously on the Stillwater West, as the company continues to demonstrate its proof of concept. The results to date, as with each press release, have been nothing short of exceptional, and what appears, as you referenced, to be the next major Platreef discovery.

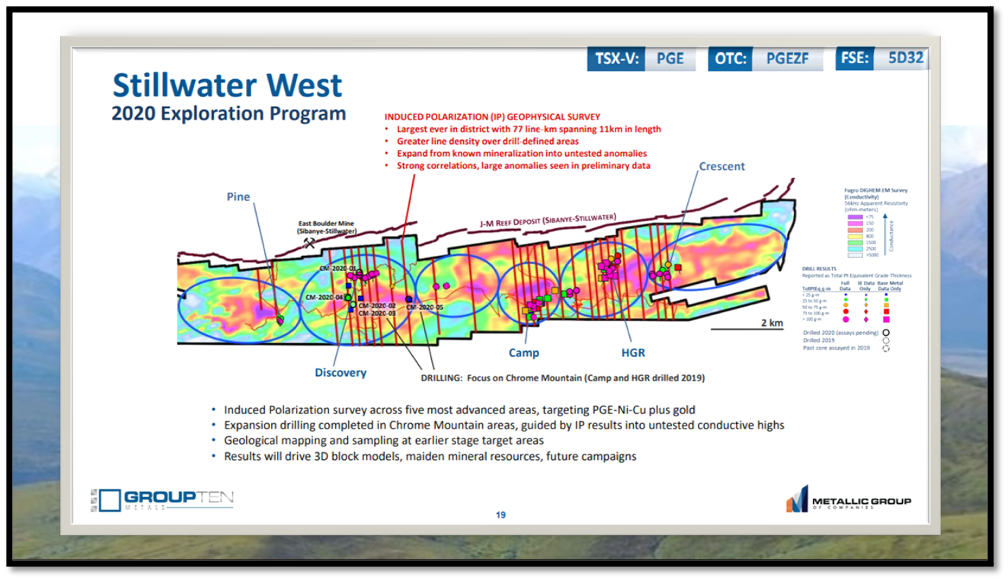

Mr. Rowley, Group Ten has just announced the completion of mapping and sampling yielding what has been a recurring theme, more high-grade results on platinum and palladium. Also, your latest release discussed a very large induced polarization survey conducted on the property. Take us to the Stillwater West and provide us with some context on what these early results from your 2020 program may indicate.

Michael Rowley: Group Ten had a fantastic year on the ground at the Stillwater West. We began early in the year with some studies based on drill core at the shack. We moved out in the field in April and May. You've got those results already from the earlier stage targets that we identified in the soil survey we did last year—some very high-grade results in those early areas.

We then moved to bigger programs at the most advanced target areas, and that's key to our strategy. We have a lot of targets, so we're focused on converting known mineralization at those three most advanced target areas to our first formal resources of the project, and then on expanding that drill to find mineralization into these untested adjacent highs that you can see in our figures. So we're looking for both grade and scale here, and that's been the priority in our work, and we're blessed in terms of our database that we're starting on second, or even third base, in terms of getting there.

In this year's program—our biggest yet—we drilled five holes, totaling more than 1,800 meters, in the Chrome Mountain target area. That's in addition to drilling that we did at Camp and HGR, the other two most advanced target areas last year. In all three cases, we're driving the exploration models and expanding known mineralization. We now have more than 31,000 meters of drill data, and we're on track to debut our maiden resources early next year.

I'll just maybe throw in a little bit about that Platreef-style target because, as mentioned, it's the Mogalakwena and Ivanhoe Platreef model from South Africa. So these are big, disseminated sulfide systems—nickel and copper sulfides—tens and hundreds of meters thick and kilometers long and rich in PGEs and also gold.

We also see cobalt in a system at Stillwater, which is something they don't have in the Bushveld.

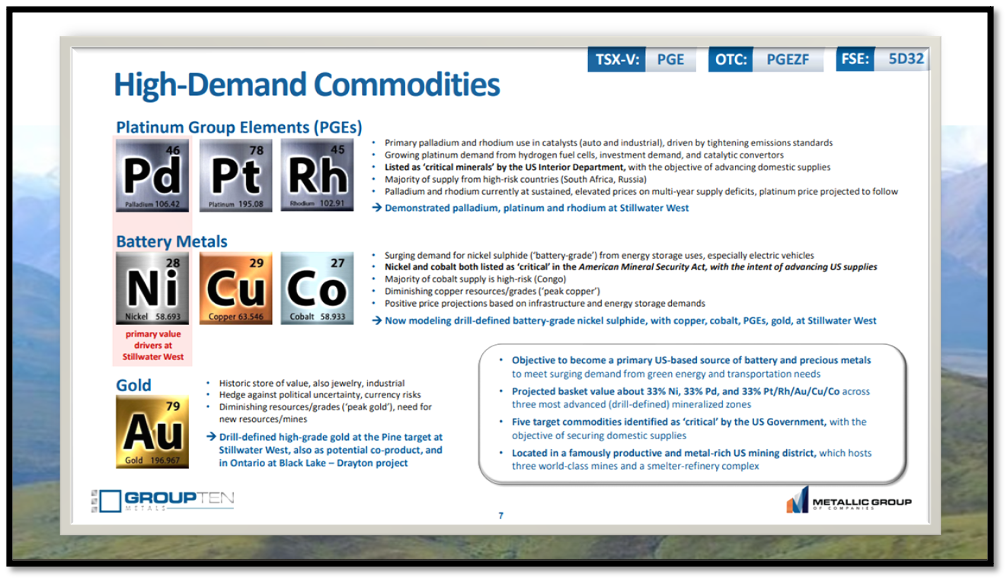

Maurice Jackson: Michael, the global demand for clean air is on the rise, with an obvious explosion in demand for electric vehicles, battery storage, fuel cells and so much more, that the US government has been prompted to add a number of your commodities on the critical metals list. In other words, these are mineral commodities that are vital to the nation's security and economic prosperity. The Stillwater West is a polymetallic and a potential source of several of these battery-grade metals, such as nickel, copper and cobalt. What can you share with us?

Michael Rowley: The Stillwater West is fundamentally a nickel-and-copper sulfide system. That is the Platreef model. It's enriched in PGEs and cobalt and gold as well. Specific to nickel, battery-grade nickel is nickel sulfide, so we have what Tesla and the other EV [electric vehicle] companies are looking for.

There are very few projects with potential for grade and scale in the world in this regard. There are not many magmatic systems out there of any size. Group Ten shares one of the largest and best geological formations in the world, the Stillwater Igneous Complex, with the major producer, our neighbor, Sibanye Gold Ltd. (SBGL:NYSE). They operate three mines right beside us, and they have a smelter refinery complex in the district. Their mines are the highest grade of the type in the world, whopping 80 million ounces of palladium and platinum, and more than half an ounce per tonne grade. So there's a lot of metal in this system and that has to speak well for our chances as we get into that lower portion of the system.

In addition to nickel, the U.S. has listed PGEs, such as palladium, platinum and rhodium, as critical, and also cobalt. That's to secure domestic supplies and reduce dependency on Africa and Russia and other countries for supply. So we're not only in some of the very best rocks in the world for these target commodities. We happen to also be in a U.S. district that is a producing mining district, and that has to be beneficial for Group Ten.

Maurice Jackson: You somewhat alluded to it, but you also have the infrastructure that is paramount to the success of this story as well.

Michael Rowley: Absolutely. Our neighbor is mining just a few hundred meters north of one of our target areas.

Maurice Jackson: Michael, to date, each press release has been a complete success in my view. Tell us more about the results to date on the other precious metals that make up the portfolio, beginning with gold and then rhodium. What have you discovered on the Stillwater West?

Michael Rowley: Gold is a good one to discuss, because we have it broadly in that Platreef-style basket across the 25-kilometer span of the project. So, by co-product, I mean it's at co-product levels. Our value split at Stillwater is probably a third nickel, a third palladium, and then a third the other, and gold is in that other basket.

But we do have one area of high-grade gold at Stillwater, which is running more than 8 grams per tonne. It's a nice grade. It's drilled in the 1980s, drilled in the 2000s. We've block-modeled it there. It's not a resource that we can advance immediately this year. We are working on it, and I think we'll bring that to the table in the future. It is open for expansion, and our work with the soils, in particular, showed high-grade gold in soils two kilometers to the west of the drill-defined high-grade gold at the Pine target. So there's some very good expansion potential there.

We also identified similar levels of gold 9 kilometers away in the magmatic layers of the HDR target. So we've got a new model, a new understanding of gold mineralization at Stillwater here that's very exciting, and takes it away from what was thought to previously being contained to a shear zone. We're looking forward to reporting more on that. We did some good work on that this year.

Rhodium is very strategic, as there is essentially no mine supply in North America to speak of—it's very little. Earlier this year we announced, I think we talked about it in one of our interviews previously, we show good rhodium co-product values across some size, and that would be immensely strategic in North America. Rhodium, I think you just said it, is $14,000 per ounce today. It's back up; it's high. And, like palladium, that's due to persistent supply deficits year after year.

Maurice Jackson: What kind of grams are we looking at from the previous press releases? Was it about 6-7 grams per tonne, somewhere in that range?

Michael Rowley: We chipped a rock that was nearly 6 grams per tonne rhodium, which is the highest I've seen, and that certainly speaks to the potential for grade. The highest grade rhodium mine in the world is less than half a gram per tonne, so it's rarely at those high levels. That's the UG2 Reef in the Bushveld, South Africa. The great majority of other rhodium producers are running at 0.1 grams, even sometimes 0.2 grams per tonne, and that's the range that we're seeing in those results reported in drill core.

Maurice Jackson: Now I would be remiss if I didn't ask this two-part question. When can shareholders expect the maiden resource to be published? And where do you think it will put you in relation to your peers?

Michael Rowley: We have block models developing on five target areas. Those are presented very nicely in our materials. The focus is on the most advanced three, and those are the Discovery Camp and HGR areas. They've got the most drilling, and it's holding together really nicely in terms of continuity and grade. We're going to incorporate this year's drill results and then do our best to get them out quickly. So we're looking, I think, at an early 2021 release date, and we're looking forward to providing more details on that.

In terms of our peers, it's hard to find a direct fit and, of course, we do not have published numbers to talk about yet. But in broad terms, if you look at our current peers, we have the PGEs that, say, a Generation Mining Ltd. (GENM:TSX; GENMF:OTCQB; 9GN:FSE) has, but we also have nickel that they don't have. I guess another point that separates us is that we own our asset 100%, and they have a 51% interest to date. Another peer might be Canada Nickel (CNIKF:OTCMKTS), but again, it's not a direct comparison, as they have limited PGEs so far.

If you could just blend those two in terms of geology, then you're getting somewhere closer to the Platreef model that we're looking at, which is Ivanhoe Mines Ltd.'s (IVN:TSX; IVPAF:OTCQX) Platreef Line in South Africa.

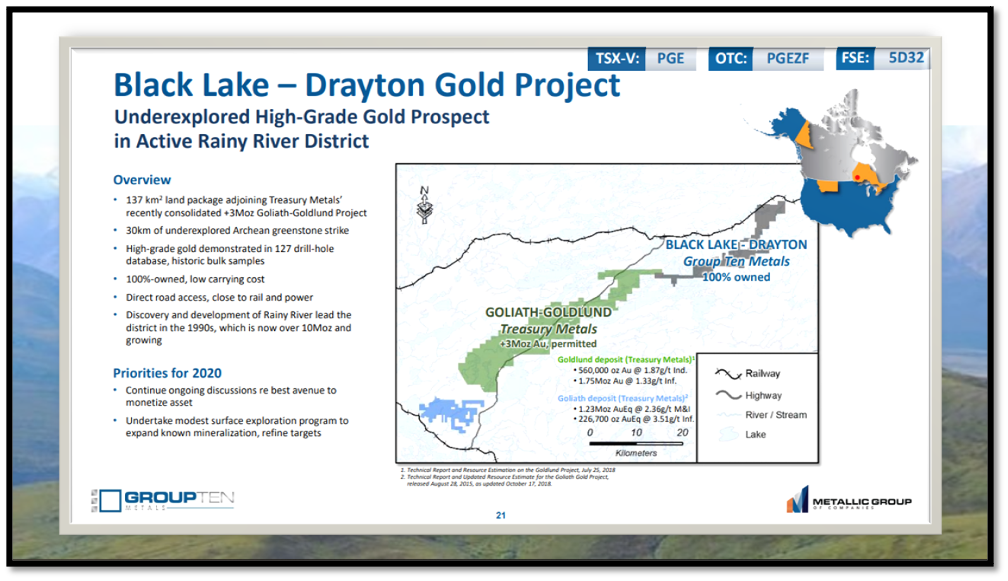

Maurice Jackson: Leaving Montana and moving onto Ontario, Group Ten has a portfolio of projects, any of which could be a flagship for an explorer. With gold resuming an upward trajectory, update us on the Black Lake-Drayton Project in Ontario, Canada, sir.

Michael Rowley: Very interesting things happening in the district out there. Treasury Metals Inc. (TML:TSX: TSRMF:OTCQB) has done a fantastic job of consolidating the rest of the district. They've purchased effectively the Goldlund deposit so they now have, between their Goliath and Goldlund now consolidated, they have over 3 million ounces and a permit to build a mill. That's one of the largest undeveloped gold projects in Canada and North America. It's very attractive. That's right beside a highway, power, all that good stuff.

We share the district with them. We have the remaining one-third of the district. We have all the same geology, 127 holes in the database. We're getting a lot of interest in this asset now from some very good parties. I think that reflects the move in gold that you mentioned, and also a quickly accelerating M&A environment. So I'm optimistic to see what we can do in that regard.

Our objective here would just be to get some value for it. We're not getting anything, I think, on our balance sheet at present for it, yet it's a really good project. We'd be glad to have a very good share position in the gold space, for example, and let somebody else advance it so we can focus on Montana.

Maurice Jackson: Should that come to fruition that would be great for organic growth and no more shareholder dilution without any financing down the road.

Michael Rowley: Absolutely!

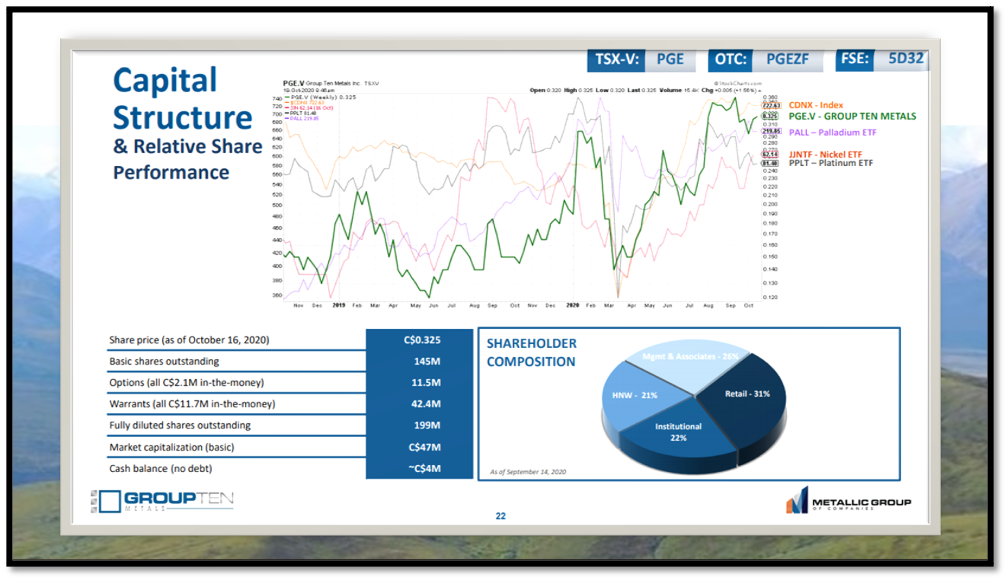

Maurice Jackson: Switching gears, sir, please provide us with an update on the current capital structure for Group Ten Metals.

Michael Rowley: We have about 145 million shares out at present. Our prices just moved up nicely the past few days. We're about a $50 million market cap, I think. I haven't calculated it recently.

A key point is that we have $4 million in the treasury and we have $11 million in the money warrants. So we are presently funded through everything we need to do this year and potentially even next year if you assume those warrants come in.

We do have some key news events on the horizon that are going to drive price, and that would be drill results, which we expect to start receiving shortly. That will be ongoing over the next couple of months. The final results from that IP survey, which was fantastic, I think people can look forward to some updated promotional materials with lovely pink images from that survey and, of course, the resources, ultimately, in the new year at some point, and those would be major catalysts. I don't think we'll have to do a placement before then.

We are in some very good discussions with some big players in the industry. If, on the right terms, we see the right opportunity to bring a strategic partner in, we will do that. But so far, we see a lot of value we can add here as well before we look at further placements.

Maurice Jackson: Last question, sir. What did I forget to ask?

Michael Rowley: We should probably touch quickly on the Yukon, the Kluane Project, as our neighbor Nickel Creek Platinum (NCP:TSE) has a new CEO. That deposit, formerly known as the Wellgreen Deposit, now the Nickel Shaw Deposit, they seem to be putting some attention to again.

It's a great district. This is one of the largest undeveloped nickel-copper-PGE deposits in the world. The whole Kluane Belt is good and we, of course, are the largest landholder in that belt. We currently have some interest in one project of the four that we own in that group, and I think we'll see that accelerate in the coming weeks and months.

Maurice Jackson: Mr. Rowley, if someone listening today wants to get more information on Group Ten Metals, please share the website address.

Michael Rowley: www.grouptenmetals.com

Maurice Jackson: Mr. Rowley, it's always a pleasure to speak with you, sir. Wishing you and Group Ten Metals the absolute best.

Before you make your next bullion purchase make sure you contact me. I’m a licensed representative to buy and sell physical precious metals through Miles Franklin Precious Metals Investments where we offer a number of options to expand your precious metals portfolio from physical delivery of gold, silver, platinum, palladium and rhodium directly to your home or office, to offshore depositories and precious metal IRAs. Call me directly at (855) 505-1900 or email [email protected]. Finally, please subscribe to Proven and Probable, where we provide mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Group Ten Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Group Ten Metals is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Group Ten Metals and Generation Mining. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Group Ten Metals, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.