It's called the Golden Triangle, but it's home to lots of silver too.

Dolly Varden Silver Corp.'s (DV:TSX.V; DOLLF:OTCMKTS) large Dolly Varden property in northwest British Columbia has a long and storied history. The Dolly Varden/North Star Mine operated only for a few years, from 1919 until 1921, but in that short interval produced 1.3 million ounces of silver at an average grade of 1,109 grams per tonne (g/t). Several decades later, the Torbrit Mine operated from 1949 through 1959, and produced 18 million ounces of silver, with an average grade of 466.3 g/t.

Production ceased at the Torbrit Mine in 1959, Dolly Varden President and CEO Shawn Khunkhun told Streetwise Reports, because of the low silver price, 85 cents per ounce. "And a lot of the deposit was left intact."

Dolly Varden has been quantifying that silver. The company drilled more than 55,000 meters in 174 holes from 2017 to 2019, making new discoveries and expanding the resource. The updated mineral resource estimate released in May 2019 calculated 32.9 million ounces of silver Indicated and 11.4 million ounces of silver Inferred.

Shawn Khunkhun took the helm of the company in February of this year. "At that time, Dolly Varden was trading well below its peers. The first thing I did was bring in a team of regional experts," he said. "Mining areas can be very dissimilar. Nevada, Ontario's Red Lake, South Africa are all very different from each other; operating in these disparate jurisdictions takes a certain type of skill set. There are nuances in the Golden Triangle, so I brought in a technical team—exploration geologists, mining engineers, miners—that had regional expertise."

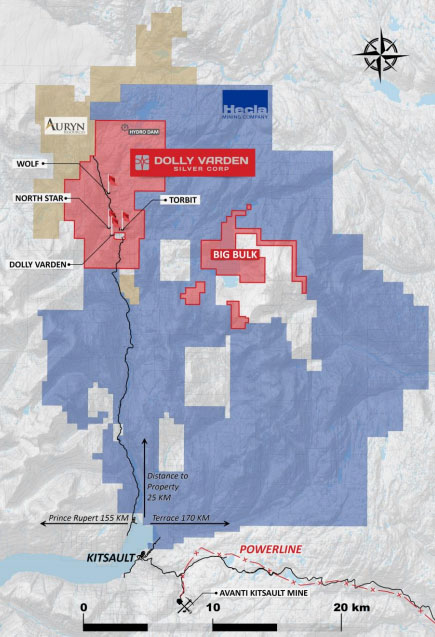

Khunkhun also focused on building a foundation of shareholder support. "Eric Sprott, who was a shareholder in the company, took a bigger stake, growing his interest to 19.9%. Hecla Mining operates the Greens Creek silver mine in Alaska just outside of Juneau that may be analogous to our project. Hecla has been a shareholder and in 2016 tried to take over Dolly Varden. Hecla has supported the new management team by investing about $2 million this year and now has about a 12% stake."

Khunkhun noted that positioning Dolly Varden as a "high-grade silver company in a safe jurisdiction, backed by Eric Sprott and Hecla Mining, caught the interest of a lot of silver-focused shareholders. We immediately went from trading at half the value of our peers, to trading in line with them."

This summer the price of silver broke out, and with that the market cap of silver companies also increased. "We took advantage of that to raise around CA$20 million," Khunkhun said, "so now we are in a great cash position."

This year, Dolly Varden initiated a 10,000-meter exploration program, focused on growing the Torbrit deposit. On October 7, the company announced stepout drilling assays as high as 351 g/t silver over 12.75 meters, including 1083 g/t silver over 2.70 meters, and 135 g/t silver over 37.50 meters, including 906 g/t silver over 1.00 meter. In-fill drilling returned assays as high as 302 g/t silver over 31.95 meters, including 642 g/t silver over 4.00 meters.

"We are pleased to see step out drill intercepts with consistent, strong silver mineralization, significant thickness, and areas of very high-grade silver," Khunkhun said. "These results should support continued resource expansion and the growing potential for bulk underground mining around the past-producing Torbrit Silver Mine."

Dolly Varden has two rigs working on the property, "and we've got a tremendous amount of drilling to report," Khunkhun said.

The rising price of silver may change the plan for Dolly Varden. "When I took over, the company had 44 million ounces of silver in the ground, in a modern 43-101 resource estimate from 2019. At $17/oz silver, there's a certain net present value to that. But once you start looking at where spot silver prices are today, I'm now looking at Dolly Varden through a different lens. I'm now looking at it as a potential development story," Khunkhun explained.

Khunkhun sees the potential for a regional play. "Hecla Mining owns a huge concession of land and a mineral trend to the east of our property. On the other side of our property is Fury Gold Mines, which put out a preliminary economic assessment in April of 1 million ounces of gold and 20 million ounces of silver. Dolly Varden sits in the middle. This is really a regional opportunity. The economies of scale of the region make developing and making a production decision a lot more compelling than just one of these three pieces going alone."

In addition to Dolly Varden's main silver property, to the east lies its Big Bulk copper-gold prospect. "The Dolly Varden property has some structural and stratigraphic similarities to Eskay Creek and Brucejack, two of the big mines in the area, while Big Bulk is more similar to the KSM or Red Chris porphyry deposits. So we have two projects in the area that cover both styles of mineralization—it's all highly prospective." Khunkhun explained.

Khunkhun notes that the Dolly Varden project is a silver pure play. "Many silver companies put out their figures as silver equivalents, but if you look closely, you will see they may have a lot of zinc or lead. The silver price is soaring while zinc and lead are not accelerating in price at the same trajectory."

"Dolly Varden has the potential to significantly grow its deposit; it offers the potential of M&A regionally or beyond," Khunkhun concluded.

Dolly Varden has 121.96 million shares outstanding, 136.55 million fully diluted. Institutions such as U.S. Global Investors, Sprott Asset Management, and Ingalls and Snyder accounts account for 50%; Hecla Canada 11%, Eric Sprott 19.9% and insiders 5%.

Analyst Stuart McDougall of Mackie Research covers Dolly Varden and rates the firm Speculative Buy, with a CA$1.00 share target price. The shares are currently trading at around CA$0.83.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Dolly Varden Silver. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.