Back in the last bull market, the big trend was the "prospect generator" business model. In this market, that switched to royalty companies, led by some former prospect generators.

The prospect generator model should allow companies to use less cash to generate projects, then bring in partners. In return, the partner would carry the prospect generator the rest of the way.

In theory, companies could churn through lots of projects, until they made a discovery. For some companies, it worked. Companies like Kaminak Gold Corp., AuEx Ventures Inc. and Altius Minerals Corp. (ALS:TSX.V) all made the model work.

For many others, it didn't. Some claimed the name but spent the money anyway. Some chose poor partners or failed to find partners. Some of the best survived by adaptation.

Two former prospect generators changed their business models to focus on royalties. EMX Royalty Corp. (EMX:TSX.V; EMX:NYSE.American) (formerly Eurasian Minerals) and a href="https://www.theaureport.com/pub/co/10008" target="_blank">Orogen Royalties Inc. (OGN:TSX.V) (formerly Evrim Resources) are prospect generators turned royalty companies.

They are part of a much wider trend in small "royalty" companies. Here's where it gets tricky for investors.

Back in 2008, there were only a couple—Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) and International Royalty Corporation were the two main entities. They merged in 2010. Franco-Nevada Corp. (FNV:TSX; FNV:NYSE) was public until 2002, when Newmont Mining acquired it. It relaunched in 2007.

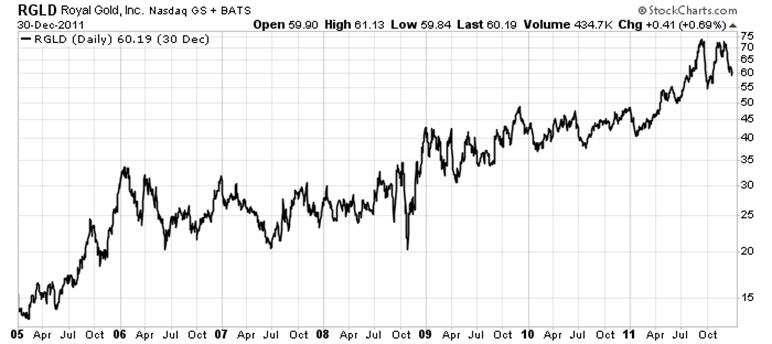

These were some of the best performers in the last bull market. Just look at Royal Gold's chart from 2005 to 2011:

It's easy to forget that Royal Gold's stellar growth came on the back of some outstanding royalties on iconic gold mines like Leeville, Goldstrike, Pipeline, Bald Mountain, Mulatos and Robinson. Those were all in production during that period…it was the revenue growth from the rising gold price that sent Royal Gold's shares soaring.

That's important…

Today, many companies want to recreate that performance. And investors are jumping into these stocks based on that history.

We must be careful what we pay for, because the value of these royalties varies wildly.

For example, we can value a royalty or a stream on a producing mine. If we know the amount of metal and the royalty percentage, we can figure out the volume of metal we own. The risks are the metal price and the mine performance. That's gives us a path to a valuation.

However, many of the new companies claiming the "royalty" model have royalties on exploration or development projects. In most cases, the actual production could be many years in the future. That means investors are overpaying for the name and not the substance of the royalty companies.

The table below shows a list of royalty companies. I included some non-mineral royalty companies, for valuation comparisons:

Company |

Market Cap |

Price to 2020 Revenue |

Price to 2021 Revenue* |

Description |

SIR Royalty Income Fund |

$13,819,686 |

0.8 |

- |

Restaurants |

Timia Capital |

$7,047,315 |

1.9 |

- |

Technology |

Dorchester Minerals |

$360,322,848 |

5.9 |

- |

Minerals |

Diversified Royalty Corp |

$226,653,024 |

7.5 |

5.7 |

Non-Minerals |

Altius Minerals |

$421,547,776 |

8.1 |

6.1 |

Minerals |

Labrador Iron Ore Royalty |

$1,646,720,000 |

9.1 |

9.5 |

Iron Ore |

Osisko Gold Royalty |

$2,741,788,160 |

10.8 |

10.3 |

Precious Metals |

Royal Gold |

$7,970,305,536 |

16.0 |

12.8 |

Precious Metals |

Maverix Metals |

$903,300,544 |

21.8 |

17.7 |

Precious Metals |

Franco Nevada |

$35,296,989,184 |

38.0 |

29.6 |

Precious Metals |

Vox Royalty Corp |

$85,493,448 |

47.5 |

14.2 |

Precious Metals |

EMX Royalty Corp |

$312,891,968 |

54.9 |

- |

Precious Metals |

Nomad Royalty Corp |

$723,743,104 |

86.5 |

13.0 |

Precious Metals |

Metalla Royalty & Streaming |

$414,756,512 |

106.3 |

59.3 |

Precious Metals |

Orogen Royalties |

$62,311,720 |

339.1 |

- |

Precious Metals |

Uranium Royalty Corp. |

$4,832,714 |

- |

- |

Uranium |

Data from Bloomberg, TMX, and company websites; *Estimates from Bloomberg |

||||

Only one company in the list had no 2020 revenue, Uranium Royalty Corp. Five of the companies didn't have estimates for 2021 revenues—SIR Royalty Income Fund, Timia Capital, Dorchester Minerals, EMX Royalty Corp, Orogen Royalties and Uranium Royalty Corp.

The price to revenue comparison demonstrates how the market values these companies. It's clear that investors consider revenue from precious metals production more valuable than other sources.

This table should give us a good starting place to evaluate royalty companies for our portfolio.

--Matt Badiali

Matt Badiali is a geologist and independent financial analyst. He spent fifteen years researching and writing about great investments inside the natural resources sectors. He can be reached at www.mattbadiali.net.

[NLINSERT]Streetwise Reports Disclosure:

1) Matt Badiali: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Vox Royalty. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Altius Minerals, EMX Royalty Corp., Orogen Royalties, Royal Gold, Metalla Royalty and Streaming, Vox Royalty, Osisko Gold Royalties and Franco-Nevada, companies mentioned in this article.