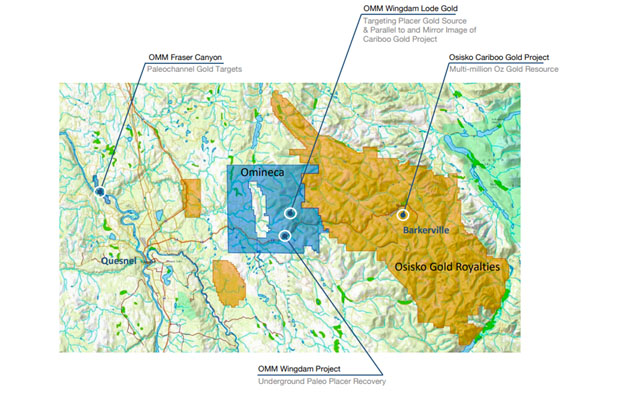

Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCMKTS) is about to re-start the placer gold recovery program that sits 50 meters below Lightning Creek, in the heart of British Columbia's Cariboo District, home of a major gold rush in the 1860s. The company is simultaneously beginning exploration to search for the hard rock source of all that gold.

"It's technically challenging to mine the alluvial gold under Lightning Creek, and over the 100+ year history of the project, people's attempts to mine it failed because it's a wet, unconsolidated mining scenario that most of the placer miners in the region just didn't know how to deal with," Omineca CEO Tom MacNeill told Streetwise Reports.

But Omineca has found the solution for mining the alluvial gold on its Wingdam property, and partner KR Investment/HCC Mining and Demolition is about to begin to mine the first 300-meter section.

The company has about 98 million shares outstanding, with around 75% in the hands of management and insiders. "Typically placer projects aren't a good fit for a publicly traded company, and so that's one of the reasons why share structure is so tight," MacNeill said. "CVG Gold, a private company, held the project and did a reverse takeover into Omineca. 49 North and other parties were comfortable investing in the private company to do the bulk sample of this very prospective project. That's why 49 North has such a large shareholding in it and why there are some large individual shareholdings. The reason we went into a public company is because it was time to start developing the hard rock exploration program."

Industry observers have homed in on Omineca.

Chris Temple wrote in The National Investor on June 20, "Omineca is truly unique.With not one but two major projects for a small company such as it is—the underground bulk sample-gold recovery via its partner HCC and now the aggressive hard rock exploration in its own right—Omineca's potential is mind-boggling if even just one of these gambits is a success. If both are, this company could be one of those once-in-a-generation wealth builders for those who get in before the (hoped-for) fireworks start."

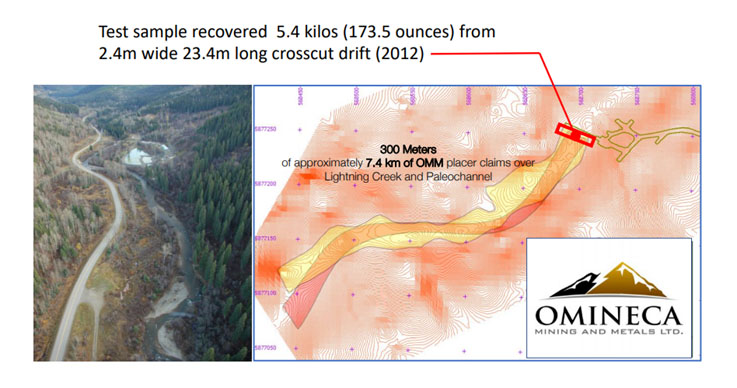

Jay Taylor wrote on June 12 in J. Taylor's Gold, Energy and Tech Stocks, "There is no guarantee of success, but if grades are similar to those achieved in 2012 it could be hugely profitable for both companies. Taking the 173.5 ounces recovered over the 23.4-meter channel width by a 2.4-meter slice across the conglomerate channel. . .Omineca would receive 86.75 ounces of gold. At current gold prices of ~C$2,330 per ounce, that amounts to a value of around C$202,000. After subtracting the C$850, Omineca would be left with $1,480 per ounce, or $128,390 for its 50% share of production over a slice of conglomerate real estate cutting a swath 2.4 meters wide extending across the 23.4-meter conglomerate channel."

How did Omineca find a solution to mining Wingdam when others failed?

It goes back to Tom MacNeill, who is a third generation miner. He has 35 years of experience in mining and mining finance and is the founder, president and CEO of 49 North, a resource investment and development company headquartered in Saskatchewan. His father, Bill MacNeill, was the Founder and CEO of Claude Resources whose Seabee Gold Operation has been operating in Saskatchewan since 1992, making it the longest running, most successful gold project in Saskatchewan history. SSR Mining purchased the company in 2016.

The Saskatchewan connections have proven useful because miners in that province are adept at using freeze mining technology.

"Freeze mining, although it wasn't invented in Saskatchewan, has been propagated there more than anywhere in the world," MacNeill explained. "Saskatchewan has the largest potash mining industry in the world. To go a kilometer deep down to the potash you have to go through some of the same unconsolidated, wet, gravelly type material, so miners started freezing back in the 1960s as a way to sink shafts into potash mines. Then in the 1990s and 2000s, mines in Saskatchewan started using freeze mining for uranium mining."

Tom MacNeill's brother Ken MacNeill, CEO of Star Diamond Corp., used freeze mining to sink a shaft in Saskatchewan for diamond exploration. "And the technical people on the Star Diamond project brought this project to me, and we tested freeze mining."

MacNeill explained freeze mining: "If you picture any mining operation, if the ground is unstable, you're going to have trouble mining it. To deal with that you drill some holes into the ore body, run pipes into it that have a return feature so a cold brine solution can go in and then return out the middle of the pipe. Just like freezing ice in a hockey rink, it freezes the ground and once the ground is frozen, it is some of the most competent rock in the world. So it's a simple procedure. Once you've mined out the area of interest, you backfill it: you put in crushed rock and a little bit of cement grout, let it thaw and you're done. We proved all of this technology in 2012. And we had tremendous success with it."

Omineca does not have a compliant 43-101 resource calculation on the alluvial gold at Wingdam. "We are working with a resource calculation that was done in 1986 by Wright Engineers, some of the preeminent engineers in the world, but it doesn't fit the current requirements under 43-101 standards. We didn't feel compelled to spend $10 million to re-drill historical holes deciding rather to just start bulk sampling it," MacNeill said.

The test bulk sample in 2012 used a crosscut tunnel 2.4 meters wide and 24 meters long, and extracted 5.4 kilos (173 troy ounces) of raw placer gold, 13.64 grams per tonne across the entire 23.5 meter drift. Then the gold market collapsed.

"By October of 2012, the peak of the gold market was behind us and in Canadian dollar terms gold went down $600 in the first part of 2013. We decided to slow walk this thing and keep our powder dry; we essentially put the project on the shelf, using the treasury in the company and some other small financings for all of the technical work that was necessary on the placer project: the mining, engineering, the costing and getting everything done. And all of that internal work is what we did over the quiet period in the market," MacNeill explained.

With the rise in the price of gold over the last year, the company decided to re-start the project, and structured a deal with privately held HCC Mining and Demolition. "They will bring their own equipment, their own expertise, their own engineering group, their own in-house personnel, all of the necessary things to initiate the operation, and will cover all the costs of excavation and mining," MacNeill said. "We have a fixed contract with them. We split the gold they mine 50/50; they keep half the gold, and on our half of the gold they will bill us CA$850 for every ounce that they deliver to us."

The arrangement will begin with 300 meters of bulk sample under Lightning Creek. "And then if that works out well they will just continue mining. Once HCC starts mining we'll be able to say every week that this is how much we got and this is how much they billed us," MacNeill said.

HCC plans to start work at the end of June or early July, and the company expects the first gold will be mined by September.

"We've got over 15 km of potential paleoplacer; we don't know if there's gold's the entire length, but we know it's prospective for it," MacNeill said. "We have an immediate area of interest of 2.4 km, and we're very comfortable that it is prospective for gold all the way through that 2.4 km because operators several miles downstream of us have operations that are liberating gold closer to surface, albeit lower grade, but it looks just like our gold."

MacNeill sees this as a material handling project. "We don't talk in terms of how much gold we can produce, but we know that we can do probably about a cross cut every day or two. And to put that into context, there are 125 cross cuts in the first 300 meters. So we expect this operation would last between five and eight years for the initial 2.4 kilometers. People are going to see the output as it happens because we know one of the trail of breadcrumbs we've left is we recovered 173 ounces of gold from the initial one cross cut. We're going to do 125 more of those."

The alluvial gold under Lightning Creek is just one half of Omineca's project. The other is finding the hard rock source of all that placer gold. "The reason that's been a hard nut to crack is because some of the erosion that put all of this gold into the creek beds was glacial and that left a great deal of till on top of the bedrock gold sources. Geophysical techniques have caught up so that we can go looking for the hard rock source of this gold using geophysics and geochemistry in ways that didn't exist 100 years ago," MacNeill explained.

When the company did the bulk sample in 2012, a lot of that gold was proximate gold, MacNeill explained. "It has a very rough, jagged appearance, characteristics of gold that has not moved very far from its source because as gold is eroded off the mountainsides and gets dragged down rivers for miles and miles and miles, it gets bounced along in the river gravels. And those river gravels flatten it out and round it off. In the last 30 years people have come up with specific ways of determining how far from source you are by looking at the gold grain morphology. And when we looked at some of it, not all of it, but some of that gold came from a very near source; we're presuming less than 100 meters away."

Omineca is looking for multiple sources of the gold. "We're looking very close; we've done airborne magnetics and we've got airborne SkyTEM (Transient ElectroMagnetic) surveys over the immediate area of interest. We have people out in the field doing sampling to isolate our targets," MacNeill stated. "We're very confident given the geophysics. So the electromagnetics and the magnetics that we've interpreted, and the structural controls that we're modeling in the field right now, we're very confident that we should be able to explore for and find a very nearby lode source of gold for part of this paleoplacer. The SkyTEM surveys show there's a massive signature right where it should be."

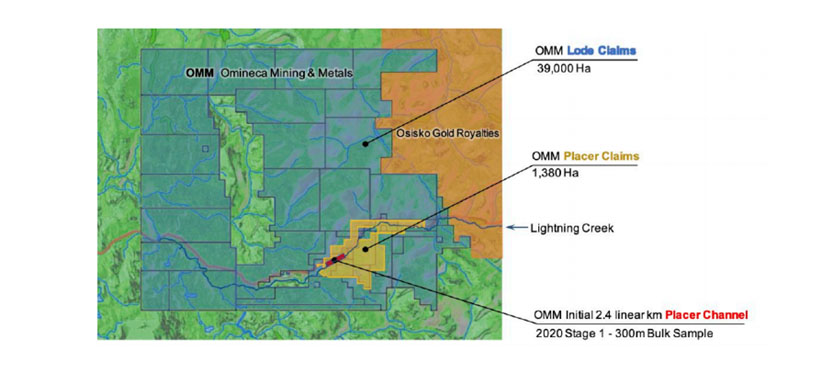

In line with this belief, Omineca has staked 39,000 hectares and dramatically expanded its hard rock exploration land position in January. "We did this because of what we learned about the geophysics and how we believe we have a direct analog to what Osisko has just on the other side of the geological terrain (Cariboo Gold Project, Barkerville). When people ask questions about the geology, we just point them to Osisko because we have the same structural controls. We have the same bedrock geology; we have the same type of hosted gold. We also have some of the highest grade placer gold in North American history, which they had back in the day. And during the gold rush period, ours remained unmined because it was technically challenging to get to it. Barkerville's high-grade gold was near surface so people could just dig out pits and mine it 100 years ago," MacNeill said.

Omineca is targeting up to an initial 27 drill holes this year and is waiting for the permits from the British Columbia government. "We went out for a small financing that was well over subscribed. So we've got the money in the bank. We're cautiously optimistic that we should have permits sometime early summer," MacNeill explained. The financing raised about CAD$1.56 million.

If Omineca starts drilling at the beginning of July, it expects it would begin releasing assay results in September.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Omineca Mining and Metals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Omineca Mining and Metals. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Metals, a company mentioned in this article.

Additional disclosures:

The National Investor is published and is e-mailed to subscribers from [email protected]. The Editor/Publisher, Christopher L. Temple may be personally addressed at this address, or at our physical address, which is: National Investor Publishing, P.O. Box 1257, Saint Augustine, FL 32085. The Internet web site can be accessed at https://nationalinvestor.com/. Subscription Rates: $275 for 1 year, $475 for two years for "full service" membership (twice-monthly newsletter, Special Reports and between-issues e-mail alerts and commentaries.) Trial Rate: $75 for a one-time, 3-month full-service trial. Current sample may be obtained upon request (for first-time inquirers ONLY.) The information contained herein is conscientiously compiled and is correct and accurate to the best of the Editor’s knowledge. Commentary, opinion, suggestions and recommendations are of a general nature that are collectively deemed to be of potential interest and value to readers/investors. Opinions that are expressed herein are subject to change without notice, though our best efforts will be made to convey such changed opinions to then-current paid subscribers. We take due care to properly represent and to transcribe accurately any quotes, attributions or comments of others. No opinions or recommendations can be guaranteed. The Editor may have positions in some securities discussed. Subscribers are encouraged to investigate any situation or recommendation further before investing. The Editor receives no undisclosed kickbacks, fees, commissions, gratuities, honoraria or other emoluments from any companies, brokers or vendors discussed herein in exchange for his recommendation of them. All rights reserved. Copying or redistributing this proprietary information by any means without prior written permission is prohibited. No Offers being made to sell securities: within the above context, we, in part, make suggestions to readers/investors regarding markets, sectors, stocks and other financial investments. These are to be deemed informational in purpose. None of the content of this newsletter is to be considered as an offer to sell or a solicitation of an offer to buy any security. Readers/investors should be aware that the securities, investments and/or strategies mentioned herein, if any, contain varying degrees of risk for loss of principal. Investors are advised to seek the counsel of a competent financial adviser or other professional for utilizing these or any other investment strategies or purchasing or selling any securities mentioned. Chris Temple is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

Notice regarding forward-looking statements: certain statements and commentary in this publication may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 or other applicable laws in the U.S. or Canada. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of a particular company or industry to be materially different from what may be suggested herein. We caution readers/investors that any forward-looking statements made herein are not guarantees of any future performance, and that actual results may differ materially from those in forward-looking statements made herein.

Copyright issues or unintentional/inadvertent infringement: In compiling information for this publication the Editor regularly uses, quotes or mentions research, graphics content or other material of others, whether supplied directly or indirectly. Additionally he makes use of the vast amount of such information available on the Internet or in the public domain. Proper care is exercised to not improperly use information protected by copyright, to use information without prior permission, to use information or work intended for a specific audience or to use others' information or work of a proprietary nature that was not intended to be already publicly disseminated. If you believe that your work has been used or copied in such a manner as to represent a copyright infringement, please notify the Editor at the contact information above so that the situation can be promptly addressed and resolved.

Additional disclosure: Omineca Mining & Metals was formally recommended to paid subscribers/Members of The National Investor in March, 2019. Neither this nor any company recommended by Chris Temple pay for such recommendations, which the Editor makes based on his own research, opinions, due diligence, best efforts, etc. In some cases, following a recommendation to subscribers/Members, companies will work with National Investor Publishing in regard to media placement and added advertising/distribution of Editor’s recommendation of the company. In the case of Omineca, the company has paid to National Investor Publishing a total of approximately US$7,500.00 prior to and concurrent with this particular report for the company’s profile being included in a separate, Gold-centric Special Issue, for this particular individual Profile of the Company and for reprint rights/rights to separately distribute the same as it sees fit. This is simply an advertising/editorial service provided to Omineca by National Investor Publishing. National Investor Publishing does not engage in investor relations, brokerage, investment advisory or any similar, regulated activity in conjunction with the publishing of this Special Report. As of the date of this Special Report, the Editor owns securities of Omineca.

Disclosures from J Taylor's Hotline, June 12, 2020

The opinions expressed in this message are those of Jay Taylor only and they do not necessarily represent the opinions of Taylor Hard Money Advisors, Inc., the publisher of J Taylor's Gold, Energy & Tech Stocks. The management of THMA may, from time to time, buy and sell shares of the companies recommended in J Taylor's Gold, Energy & Tech Stocks newsletter and in this Hotline message. No statement or expression of any opinion contained either in this Hotline or in J Taylor's Gold, Energy & Tech Stocks newsletter constitutes an offer to buy or sell the securities mentioned herein.

Companies are selected for presentation in J Taylor's Gold, Energy & Tech Stocks strictly on their merits as perceived by Taylor Hard Money Advisors, Inc. No fee is charged to the company for inclusion. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein.